Publications

Displaying 81 - 90 of 304

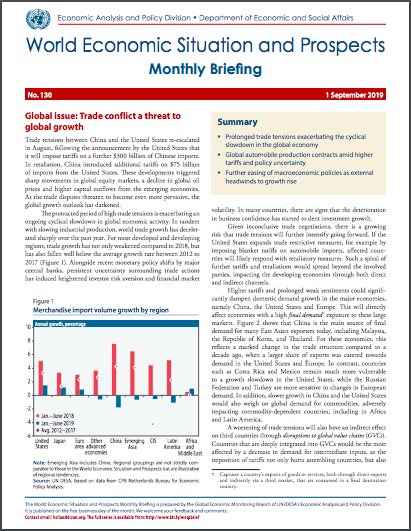

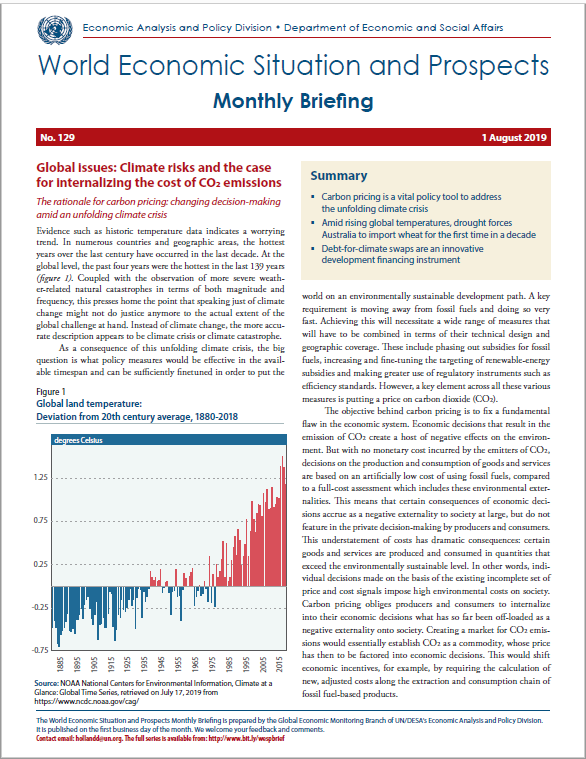

Amid rising global temperatures, drought forces Australia to import wheat for the first time in a decade

Debt-for-climate swaps are an innovative?development financing instrument

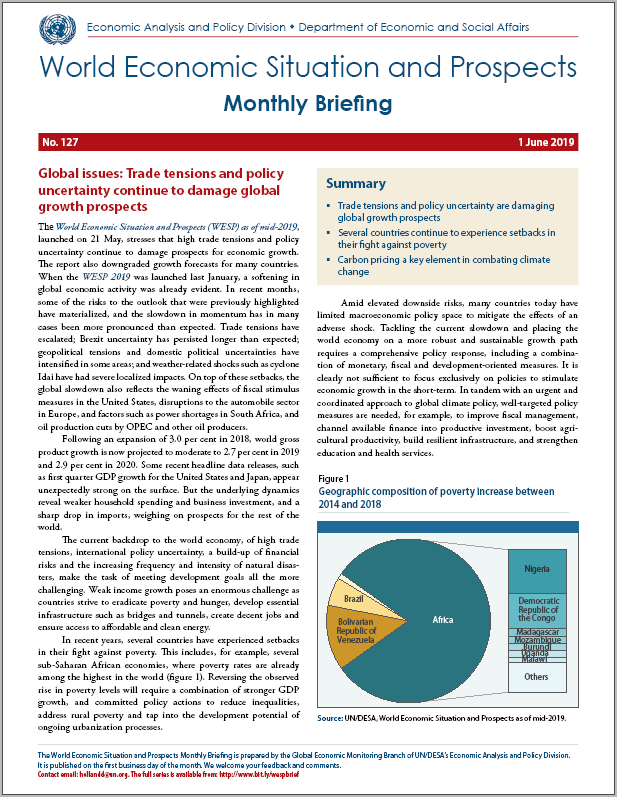

Several countries continue to experience setbacks in their fight against poverty

Carbon pricing a key element in combating climate change

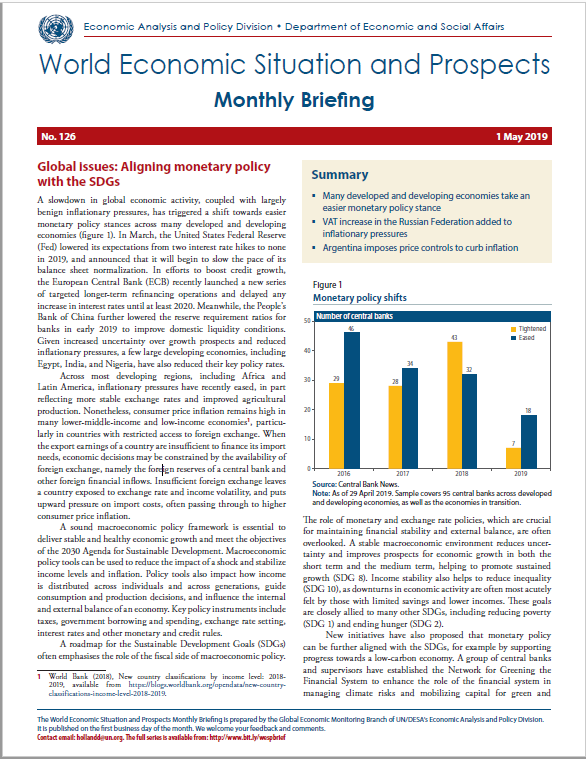

VAT increase in the Russian Federation temporarily adds to inflation

Argentina imposes price controls to curb inflation

In North America, central banks pause interest rate rises despite tight labour markets

Shortage of young workers prompts Japan to relax immigration policies

Welcome to the United Nations

Welcome to the United Nations