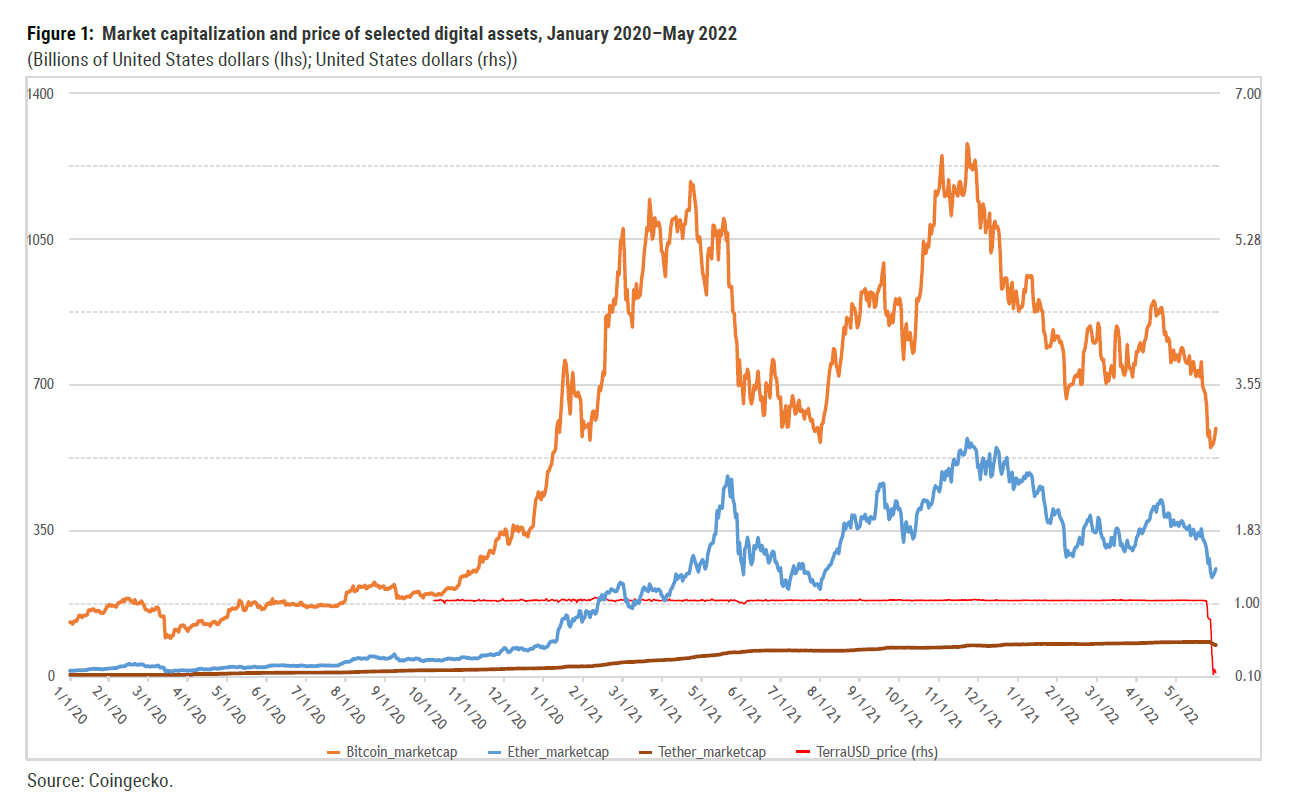

The first weeks of May 2022 have seen a reckoning for cryptoassets (digital tokens such as Bitcoin) and so-called “stablecoins” (which aim to peg their value to a specified asset such as the US dollar). Their combined market capitalization fell from $1.85 trillion to $1.34 trillion between May 1st and May 15th, triggered by the collapse of a major stablecoin. This was down from a peak of over $3 trillion in November 2021. The drop in valuation since late 2021 was over twice as sharp as the drop in other financial market indicators, such as the S&P 500.

Although there have been large swings in the valuation of cryptoassets in the past, the recent expansion of the crypto ecosystem, along with the growing participation of traditional financial institutions, has increased the financial and economic fallout of such swings and heightened financial stability risks. A growing uptake of new trading opportunities, driven in part by a “search for yield” in the low interest rate environment of the past several years, has meant that cryptoassets are no longer on the fringes of the financial system. This means that policy makers and market regulators will have to find ways to avail of the opportunities and manage risks posed by such assets.

This policy brief reviews recent trends, lays out opportunities and risks, and puts forward policy recommendations to reduce risks without unduly stifling innovation. Four main areas for policy action emerge: (i) in the short-term, bring cash- and asset-backed stablecoins under the regulatory umbrella; (ii) in the medium-term, review and update regulations to safeguard financial stability and integrity and harness technology; (iii) strengthen cooperation across sectors and jurisdictions; and (iv) address underlying domestic macroeconomic and structural challenges. As part of their efforts, national authorities should aim to increase the efficiency and inclusiveness of regulated financial services.

The first weeks of May 2022 have seen a reckoning for cryptoassets (digital tokens such as Bitcoin) and so-called “stablecoins” (which aim to peg their value to a specified asset such as the US dollar). Their combined market capitalization fell from $1.85 trillion to $1.34 trillion between May 1st and May 15th, triggered by the collapse of a major stablecoin. This was down from a peak of over $3 trillion in November 2021. The drop in valuation since late 2021 was over twice as sharp as the drop in other financial market indicators, such as the S&P 500.

Although there have been large swings in the valuation of cryptoassets in the past, the recent expansion of the crypto ecosystem, along with the growing participation of traditional financial institutions, has increased the financial and economic fallout of such swings and heightened financial stability risks. A growing uptake of new trading opportunities, driven in part by a “search for yield” in the low interest rate environment of the past several years, has meant that cryptoassets are no longer on the fringes of the financial system. This means that policy makers and market regulators will have to find ways to avail of the opportunities and manage risks posed by such assets.

This policy brief reviews recent trends, lays out opportunities and risks, and puts forward policy recommendations to reduce risks without unduly stifling innovation. Four main areas for policy action emerge: (i) in the short-term, bring cash- and asset-backed stablecoins under the regulatory umbrella; (ii) in the medium-term, review and update regulations to safeguard financial stability and integrity and harness technology; (iii) strengthen cooperation across sectors and jurisdictions; and (iv) address underlying domestic macroeconomic and structural challenges. As part of their efforts, national authorities should aim to increase the efficiency and inclusiveness of regulated financial services.

1. Trends in cryptoassets and stablecoins

Easy global financing conditions during 2020 and most of 2021 spurred the risk appetite of investors who took advantage of increasing trading opportunities and a growing ecosystem of applications for cryptoassets, causing market capitalization to rise 16-fold between January 2020 and its peak in November 2021. Since then, the first cryptoasset, Bitcoin, which still accounts for over 40 per cent of the total market capitalization, lost over three quarters of its valuation. The fast-growing Ether of the Ethereum blockchain, which currently accounts for just under 20 per cent of total market capitalization, lost over 70 per cent (Figure 1). Stablecoins now make up around 12 per cent of the total, with the largest, Tether, accounting for almost half of that. Yet, Tether also experienced a significant selloff during the first two weeks of May 2022 (see section 2).

Welcome to the United Nations

Welcome to the United Nations