Introduction and overview

Introduction and overview

The COVID-19 pandemic and the ensuing global recession are undermining fiscal and external balances in many countries. But even before the pandemic, financing emerged as one of the key challenges to Sustainable Development Goals (SDG) achievement. In their voluntary national reviews at the 2019 High-level Political Forum, many countries identified financing gaps as the major obstacle they are confronted with.

Developments in the last 8 months have only exacerbated this task. Confronted with significant spending needs for the immediate crisis response and investments in recovery, and a parallel and major drop in access to a wide range of financing sources, countries see their prospects for timely achievement of the SDGs imperiled. Many risks identified before the crisis—e.g. around sovereign debt sustainability—are now materializing. Fiscal and balance of payments constraints hamper countries’ ability to make urgently needed investments in COVID-19 response and recovery. They provide a stark reminder that sustainable development strategies and associated financing policies must be risk-informed and long-term oriented.

In the Addis Ababa Action Agenda, UN Member States introduced the concept of integrated national financing frameworks (INFFs) to help countries better align their financing policies with long-term development strategies and plans. In the current context, INFFs can play a twofold role in supporting the crisis response. First, while a full implementation of an INFF will take time, some elements can support immediate response—e.g. a rapid assessment of the COVID-19 impact on the financing landscape or a rapid review of support options from the international community. Second, as countries review and reformulate national development plans from a post- COVID baseline, INFFs can be a valuable tool in helping formulate a comprehensive strategy for recovery and prepare for future risks—one that is aligned with the SDGs, the Paris Agreement, and that is sustainably financed.

What are INFFs?

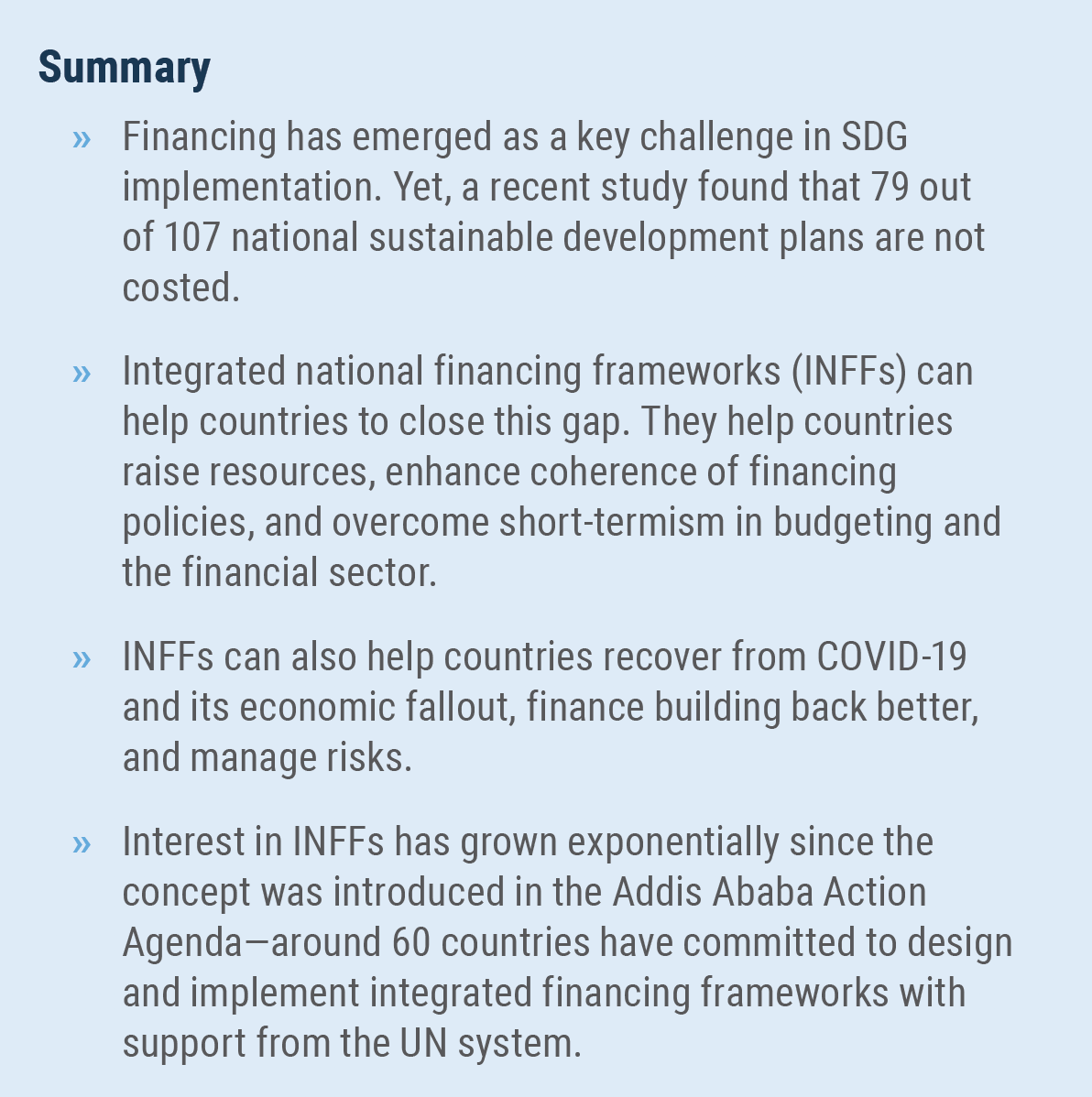

Integrated financing frameworks are a country-owned planning and delivery tool that provides a framework for financing sustainable development at the national level. They bring together the full range of financing sources— public finance and tax, aid, borrowing, and private investments, to support national sustainable development strategies or plans. To this end, they align existing financing policies and approaches and lay out a strategy to increase investment, manage risks, and achieve sustainable development. In short, they help countries operationalize the Addis Ababa Action Agenda, within the context of multilateral action to support the international enabling environment. The 2019 Financing for Sustainable Development Report by the Inter-agency Task Force on Financing for Development spelled out what such frameworks can look like. Based on this report, 16 countries are pioneering the design and implementation of INFFs. Around 60 countries are now working with UN Country Teams, UNDP and other UN system agencies to take INFFs forward, with financial support from the Joint SDG Fund (see Figure 1). In parallel, the IATF is further developing the INFF methodology and publishing guidance material.

Why INFFs?

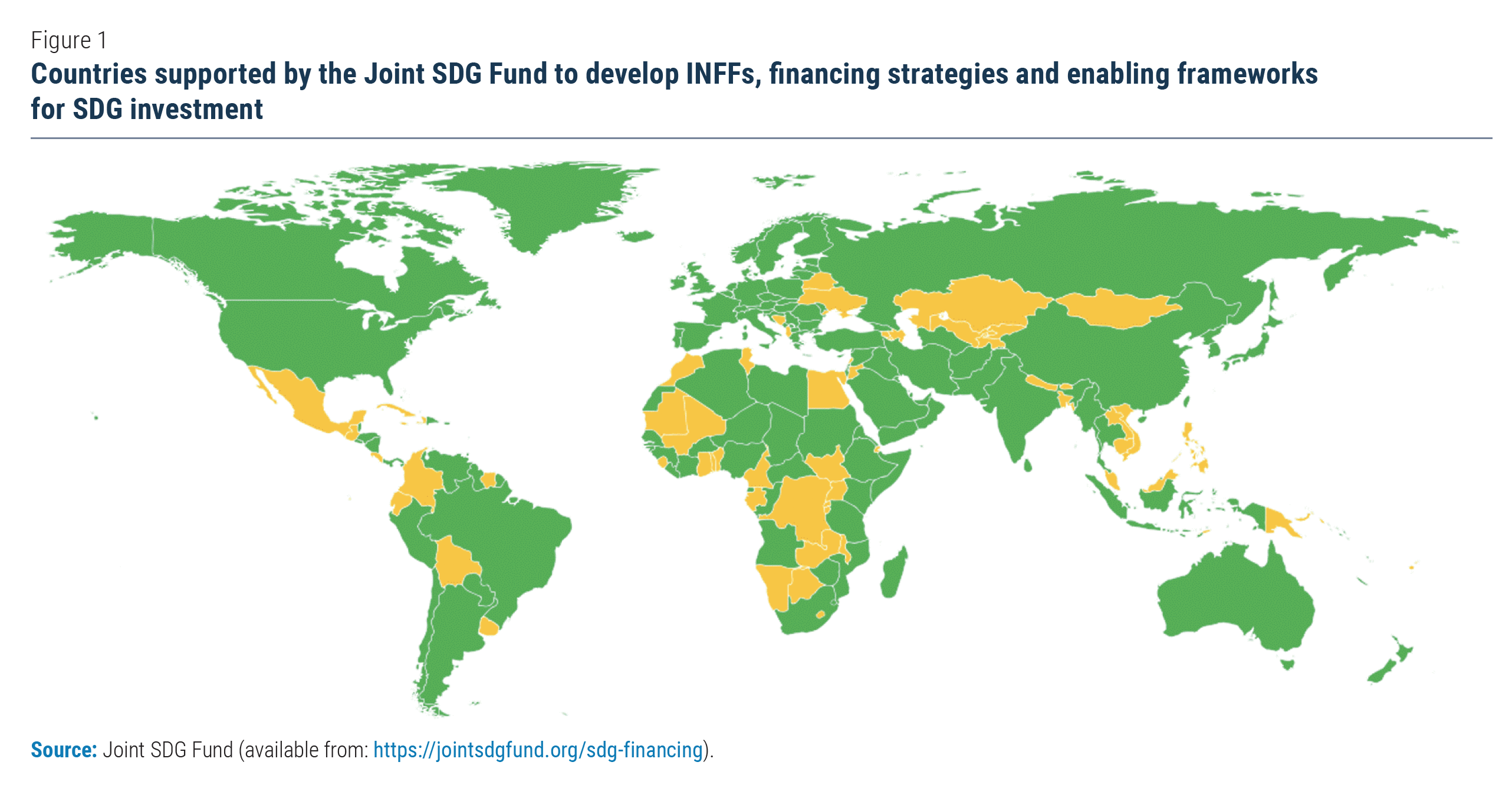

The majority of national sustainable development strategies and plans do not spell out in detail how they will be financed—one study found that 79 out of 107 national plans are not costed. Such plans risk remaining a vision rather than a vehicle for change. While most countries have financing policies and strategic approaches for specific areas in place, these policies typically are not brought together in a coherent strategy, nor fully aligned with national sustainable development priorities and the SDGs (see Figure 2 for the role of a financing strategy). An integrated financing framework helps countries to bridge this gap and enhance alignment of all financing policies with long-term priorities, with a view to:

An integrated financing framework helps countries to bridge this gap and enhance alignment of all financing policies with long-term priorities, with a view to:

» Raise resources for investment in sustainable development, and manage an increasingly complex financing landscape;

» Align financing with long-term priorities by helping overcome incrementalism in public budgets and short-termism in financial markets;

» Enhance coherence of different financing policies, scanning for inconsistencies in policies that have developed over time or been adopted in an ad-hoc fashion; and

» Translate priorities into action.

National actions alone will of course not suffice to finance implementation of the 2030 Agenda. The COVID-19 pandemic has underlined the need for international cooperation and support. Integrated financing frameworks can also guide partner coordination and policy asks of the international community, even if improving the global enabling environment ultimately requires multilateral action.How can countries implement integrated financing frameworks?

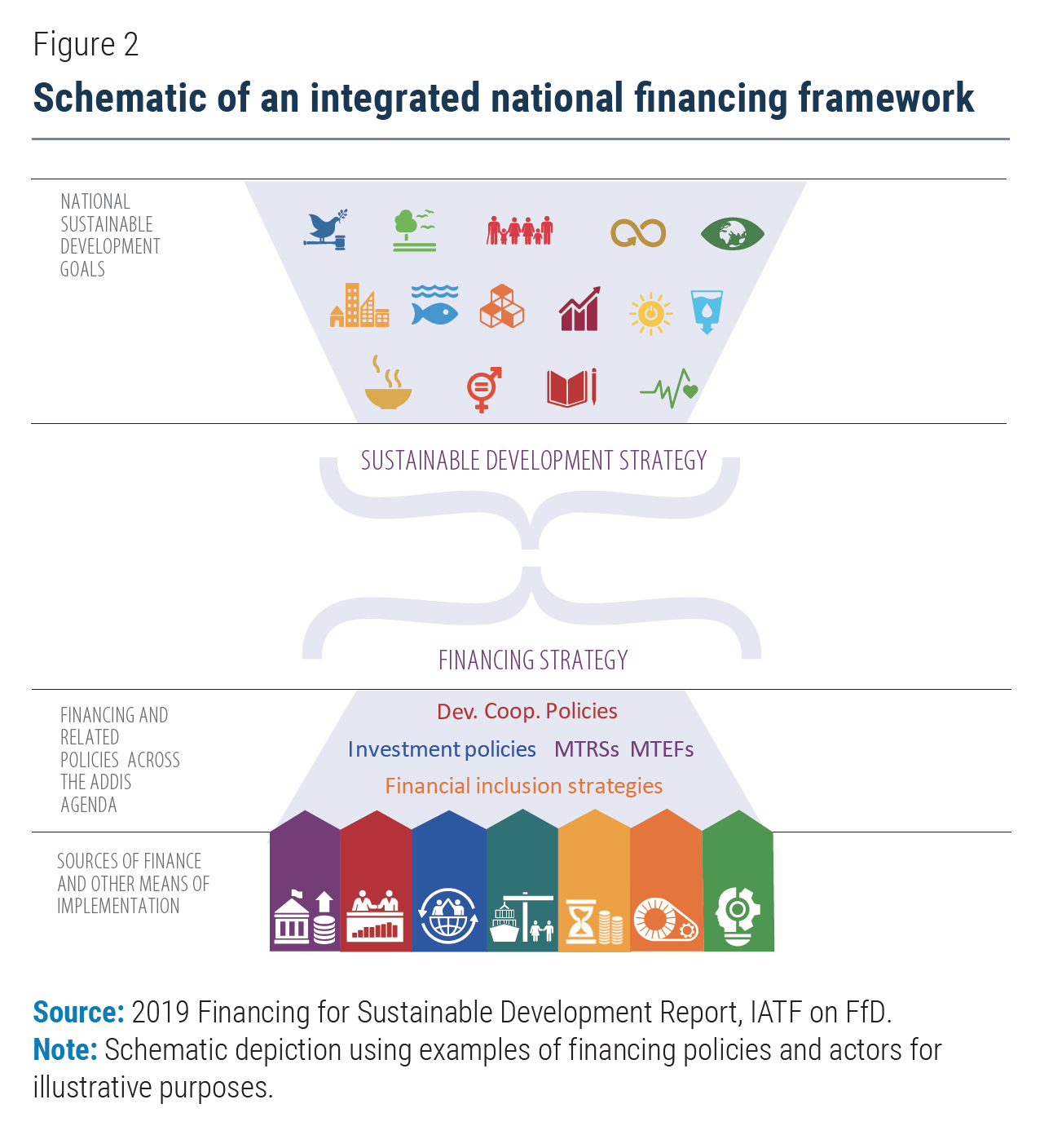

Countries do not need to start from scratch—almost all countries have policies and institutional arrangements on financing in place. An INFF builds on these existing arrangements, and seeks to identify and close gaps, overcome incoherencies, and exploit unused opportunities. INFF design and implementation therefore typically starts with an inception phase, which pulls together existing information. It then operationalizes four building blocks: i) assessment and diagnostics; ii) the financing strategy; iii) monitoring and review; and iv) governance and coordination. The inception phase typically includes a scoping exercise to assess the current state of sustainable finance, identification of an institutional home for the INFF process, and key stakeholders and relevant institutions. It concludes with the development of an “INFF roadmap” for next steps. There is both a technical and a political dimension to the inception phase. At the political level, the inception phase should convert initial interest by the government to develop an INFF into sustained commitment across government, and lay the groundwork for national ownership of the INFF. National governments should be in the lead throughout the process, including mobilizing technical expertise from within the government to carry out the scoping exercise. UNDP’s Development Finance Assessments are a key tool to carry out an INFF inception phase. The assessment and diagnostics building block includes: i) a financing needs assessment; ii) a financing landscape assessment, iii) a risk assessment, and iv) a binding constraints diagnostic.

Analysis from the financing needs and landscape assessments creates a baseline understanding of financing gaps, both at aggregate levels and for specific SDG priorities. It also highlights opportunities countries might have to raise new financing or better align existing financing to sustainable development objectives. Risk and binding constraints analyses go beyond this to support further understanding of potential impediments to financing sustainable development effectively over time.

Financing needs assessments estimate the cost of implementing national development priorities. They can be undertaken at various level (e.g. programmatic, sectoral or more aggregate levels) and with different time horizons (short- to long-term needs); the scope of financing needs assessments depends on what countries wish to cost. This also guides the choice of the right costing methodology. Top-down and modelling approaches are best suited for costing exercises aimed at informing strategic planning and long-term target setting (e.g. to establish an estimate of overall financing requirements for a national development plan). Bottom-up and historical trendsbased approaches, which estimate cost at the activity-level and require more detailed knowledge of individual inputs or interventions, are best suited for operational planning purposes and short- to medium-term budgeting.

Financing landscape assessments explore the country’s current financing envelope (the ‘supply side’). The goal is to broaden the envelope while maximising investment in sustainable development. By examining trends in volumes and use of financing, the analysis sheds light on key challenges and opportunities. Together with findings from the financing needs assessment (the ‘demand side’), it can be used to develop resource mobilization targets, as a first step toward linking planning and financing processes.

The risk assessment identifies major risks that may be impeding financing from flowing in the country, as well as weaknesses in the country’s financing in the face of shocks and crises. The COVID-19 pandemic has highlighted that development and development financing are only sustainable if they are risk-informed. Along with the growing frequency and intensity of climate-related disasters, it has also reminded us that when shocks occur, they can cause major disruptions and set-backs to development progress. The binding constraints diagnostic complements the risk assessment in furthering the analysis of the major bottlenecks to financing sustainable development. It helps policymakers identify problem areas and their root causes. It also includes analysis of how feasible and desirable removing identified constraints is. In so doing binding constraints diagnostics help shape the focus of the financing strategy and sequencing of policy action.

The financing strategy is at the heart of the INFF. It matches financing policy actions to sustainable development priorities. Taking assessments as a starting point, it matches key opportunities and constraints to financing policies, and identifies policy action in the following areas:

The assessment and diagnostics building block includes: i) a financing needs assessment; ii) a financing landscape assessment, iii) a risk assessment, and iv) a binding constraints diagnostic.

Analysis from the financing needs and landscape assessments creates a baseline understanding of financing gaps, both at aggregate levels and for specific SDG priorities. It also highlights opportunities countries might have to raise new financing or better align existing financing to sustainable development objectives. Risk and binding constraints analyses go beyond this to support further understanding of potential impediments to financing sustainable development effectively over time.

Financing needs assessments estimate the cost of implementing national development priorities. They can be undertaken at various level (e.g. programmatic, sectoral or more aggregate levels) and with different time horizons (short- to long-term needs); the scope of financing needs assessments depends on what countries wish to cost. This also guides the choice of the right costing methodology. Top-down and modelling approaches are best suited for costing exercises aimed at informing strategic planning and long-term target setting (e.g. to establish an estimate of overall financing requirements for a national development plan). Bottom-up and historical trendsbased approaches, which estimate cost at the activity-level and require more detailed knowledge of individual inputs or interventions, are best suited for operational planning purposes and short- to medium-term budgeting.

Financing landscape assessments explore the country’s current financing envelope (the ‘supply side’). The goal is to broaden the envelope while maximising investment in sustainable development. By examining trends in volumes and use of financing, the analysis sheds light on key challenges and opportunities. Together with findings from the financing needs assessment (the ‘demand side’), it can be used to develop resource mobilization targets, as a first step toward linking planning and financing processes.

The risk assessment identifies major risks that may be impeding financing from flowing in the country, as well as weaknesses in the country’s financing in the face of shocks and crises. The COVID-19 pandemic has highlighted that development and development financing are only sustainable if they are risk-informed. Along with the growing frequency and intensity of climate-related disasters, it has also reminded us that when shocks occur, they can cause major disruptions and set-backs to development progress. The binding constraints diagnostic complements the risk assessment in furthering the analysis of the major bottlenecks to financing sustainable development. It helps policymakers identify problem areas and their root causes. It also includes analysis of how feasible and desirable removing identified constraints is. In so doing binding constraints diagnostics help shape the focus of the financing strategy and sequencing of policy action.

The financing strategy is at the heart of the INFF. It matches financing policy actions to sustainable development priorities. Taking assessments as a starting point, it matches key opportunities and constraints to financing policies, and identifies policy action in the following areas:

» Public finance, with a focus on integrating planning and public budgeting processes;

» Private finance and investment, aligning policy and regulatory frameworks for private finance with sustainable development;

» Macro- and systemic issues, including debt sustainability, macro-economic and macro-prudential policies, and other issues related to financial market stability;

» Cross-cutting issues, such as the public-private partnerships or sector-specific policy issues;

Actions need to be focused and carefully sequenced, taking capacity and political economy constraints into account. Policy measures would also undergo a ‘coherence check’, to ensure that they are (i) fully aligned with national long-term priorities and the SDGs, e.g. on issues such as leave-no-one-behind and climate action; that they (ii) avoid unintended trade-offs or enable synergies and win-wins; and (iii) that they are risk-informed. In the current context, financing strategies could be a particularly useful tool to help reconcile large financing needs for recovery. They can help identify medium-term financing gaps and solutions, including when debt relief may be needed, and thus inform comprehensive and longterm approaches that avoid austerity and development set-backs in the short run. Monitoring the impact of different financing flows and policies provides the basis for informed policy making, facilitates learning, adaptation of policies to enhance their impact, and can help mitigate risks. This includes monitoring progress across different areas of financing, tracking volumes and impact (for example of national budgets and their impact on SDGs, and on private finance and investment). It also entails strengthening the coherence of existing monitoring systems, with a view to close gaps, and address misalignments, e.g. in the use of indicators by national authorities and development partners. Third, it would help review the value of the financing strategy itself, e.g. in increasing mobilization of additional financing and strengthening coordination among financing actors. An integrated financing framework needs strong political backing and broad-based country ownership. This lesson emerges consistently from experiences with sustainable development strategies and financing policy reform efforts. This calls for high-level governance and coordination: government leadership and engagement of all stakeholders, building on existing coordination mechanisms. Beyond coordination and coherence, INFF governance should also be inclusive—ensuring broad-based participation, dialogue and ownership by relevant stakeholders, both within and beyond government, transparency, and accountability. Welcome to the United Nations

Welcome to the United Nations