July 2013

Summary:

- Global?financial turmoil?amid?expectations?of?tapering?QE?stance

- Significant?capital?outflows?and?sharp?depreciation?of?domestic?currencies?in?developing?countries

- Western?Europe?struggling?to?move?out?from?recession

- Large?emerging?economies?continue?to?face?domestic?vulnerabilities

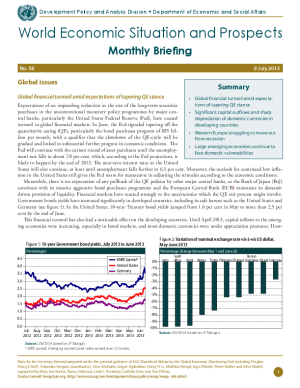

Expectations of an impending reduction in the size of the long-term securities?purchases in the unconventional monetary policy programmes by major central banks, particularly the United States Federal Reserve (Fed), have caused?turmoil in global financial markets. In June, the Fed signaled tapering off the?quantitative easing (QE), particularly the bond purchases program of $85 billion per month, with a qualifier that the slowdown of the QE-cycle will be?gradual and linked to substantial further progress in economic conditions. The?Fed will continue with the current round of asset purchases until the unemployment rate falls to about 7.0 per cent, which, according to the Fed projections, is?likely to happen by the end of 2013. The near-zero interest rates in the United?States will also continue, at least until unemployment falls further to 6.5 per cent. Moreover, the outlook for continued low inflation in the United States still gives the Fed room for manoeuvre in adjusting the stimulus according to the economic conditions.

?

Meanwhile, there is no expectation of any pullback of the QE policies by other major central banks, as the Bank of Japan (BoJ)?continues with its massive aggressive bond purchases programme and the European Central Bank (ECB)?maintains its demand-driven provision of liquidity. Financial markets have reacted strongly to the uncertainties which the QE exit process might involve.?Government bonds yields have increased significantly in developed countries, including in safe havens such as the United States and?Germany.?

?

Download the World Economic Situation and Prospects Monthly Briefing No. 56

Welcome to the United Nations

Welcome to the United Nations