- G20 discuss persistent concerns over supply glut in the global steel market

- China enhances focus on addressing financial risks

- The Bolivarian Republic of Venezuela remains mired in a deep economic crisis

Global issues

G20 address excess capacity in the steel sector

On 7-8 July, the Group of Twenty (G20) leaders convened in Hamburg, Germany to discuss major global economic challenges. The Leaders? Declaration issued at the end of the summit touched on several issues, including the need to reshape globalization to ensure that its benefits are more widely shared. It also emphasized the importance of formulating global solutions to address common global challenges such as terrorism, displacement, poverty, hunger, health threats, job creation, climate change, energy security and inequality. In addition, the Declaration reaffirmed the commitment of its member states to strong, sustainable, balanced and inclusive growth, and included specific reference to an agreement to ?continue to fight protectionism?, which had been absent from the communiqu? released following the meeting of G20 Finance Ministers and Central Bank Governors in March.

The Declaration also highlighted the need to strengthen cooperation to find collective solutions to the problem of excess capacity in certain industrial sectors, especially in the steel industry. Overcapacity in the steel sector has been an issue of growing concern in a number of countries for several years, which prompted the G20 leaders to mandate the establishment of a Global Forum on Steel Excess Capacity at the Hangzhou summit in September 2016, to take collective steps to address market distortions contributing to excess capacity in the sector. The Forum, composed of G20 member states and other steel-producing member states of the Organization for Economic Cooperation and Development (OECD), was formally established in December 2016 and has held four formal sessions so far in 2017.

Global steel production has nearly doubled since 2000. The world?s largest producers of steel include China, India, Japan, the Russian Federation and the United States of America. Production capacity in China, in particular, has increased dramatically over the last decade, outpacing the country?s expansion of demand for steel. As a result, China?s share of world trade in steel has doubled since 2010, reaching 35 per cent. Low global prices and rising steel imports in some jurisdictions have increased trade tensions, leading to a sharp increase in antidumping and countervailing duty cases. As noted in a statement by the European Commission, defensive trade measures can only address the effects of global overcapacity on trade, not its root causes. The G20 member states, therefore, have called for the removal of market-distorting subsidies and other types of government support, to foster a level playing field in the steel industry. According to the agreed timetable, by the end of August, all G20 member states will fulfil their commitments to share information and policies on steel production and government interventions and any other market-distorting measures that impact the sector. Based on these inputs, the Global Forum on Steel Excess Capacity will deliver a substantive report with concrete policy solutions by November 2017.

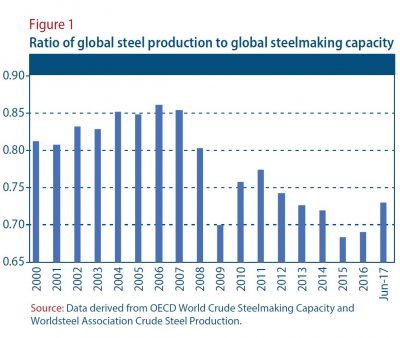

Global capacity utilisation in the steel sector dropped sharply during the global financial crisis, and remains well below levels observed in the years preceding the crisis (figure 1). Dismantling and reconstructing steel mills bears very high financial and environmental costs, which increases incentives to maintain idle productive capacity during downturns, in anticipation of stronger demand in the future. However, global steelmaking capacity has continued to expand rapidly since 2009, outpacing the more subdued revival of demand and production. To some extent this can be attributed to concerted policies in some countries to develop self-sufficiency in the steel sector, to reduce exposure to imports and price fluctuations. Steel is a key intermediate good used by the industrial sector, and a crucial input to development sectors, such as infrastructure and construction, as well as the automotive, energy and defence sectors.

Global capacity utilisation in the steel sector dropped sharply during the global financial crisis, and remains well below levels observed in the years preceding the crisis (figure 1). Dismantling and reconstructing steel mills bears very high financial and environmental costs, which increases incentives to maintain idle productive capacity during downturns, in anticipation of stronger demand in the future. However, global steelmaking capacity has continued to expand rapidly since 2009, outpacing the more subdued revival of demand and production. To some extent this can be attributed to concerted policies in some countries to develop self-sufficiency in the steel sector, to reduce exposure to imports and price fluctuations. Steel is a key intermediate good used by the industrial sector, and a crucial input to development sectors, such as infrastructure and construction, as well as the automotive, energy and defence sectors.

One of the key factors underpinning concerns over excess capacity in the steel market is the job losses suffered in the sector. These losses are widely attributed to unfair trade practices, which have led to a significant rise in import penetration in countries such as Brazil, the United States, and the European Union. While import penetration has clearly been on the rise in these areas, job losses to a large extent reflect longer-term shifts in technology, which have driven strong productivity growth in the steel sector for several decades. According to Worldsteel Association estimates, global employment in the steel industry declined by 50 per cent over the 50 years to 2012, during which time global production of steel rose by nearly 150 per cent. This partly reflects the growing proliferation of production methods based on recycled steel scrap, making steel the world?s most widely recycled material. Lower-skilled workers have suffered the greatest number of job losses in the sector, due to technological innovation in production techniques, which demand a greater share of engineers, computer scientists and higher-skilled production workers.

Over the last 18 months, global steel prices have rebounded, and now stand close to levels observed in early 2014 (figure 2). This may ease some of the pressure on firm profits, and lead to some revival of the steel sector. However, without a return to stronger global investment growth, demand for steel is likely to remain subdued. While large-scale infrastructure programmes, such as that proposed in the United States, have the potential to increase global demand for steel, moves towards import tariffs would have the opposite effect. Neither would provide a lasting solution to the problems of excess capacity in the steel sector, which will need to be tackled through deeper structural change.

Over the last 18 months, global steel prices have rebounded, and now stand close to levels observed in early 2014 (figure 2). This may ease some of the pressure on firm profits, and lead to some revival of the steel sector. However, without a return to stronger global investment growth, demand for steel is likely to remain subdued. While large-scale infrastructure programmes, such as that proposed in the United States, have the potential to increase global demand for steel, moves towards import tariffs would have the opposite effect. Neither would provide a lasting solution to the problems of excess capacity in the steel sector, which will need to be tackled through deeper structural change.

Developed economies

United States: Weak demand for steel impacts jobs

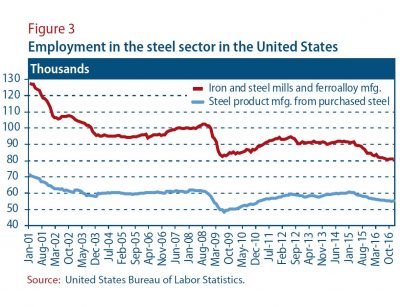

The United States was a driving force behind the establishment of the Global Forum on Steel Excess Capacity, as the global decline in steel prices from mid-2014 put severe pressure on domestic firm profitability, forcing a number of plant closures and layoffs. Figure 3 illustrates employment in steelmaking industries in the United States since 2001. On aggregate, the iron and steel mills and steel manufacturing sectors have lost 15,000 jobs since January 2015. Over the same period, total employment in the United States increased by more than 4 million, highlighting the distinct dynamics of the steel sector relative to the rest of the economy. To a large extent this reflects a decline in demand for steel in the United States, as imports of steel also fell by more than 15 per cent in 2016.

While employment in the steel sector accounts for less than 0.1 per cent of total jobs in the United States, the sensitivity of the sector is clear from its high-profile presence in national and international discourse. The steel sector is explicitly referenced in the Presidential Executive Order of 18 April 2017 on Buy American and Hire American, which requires a preference for the purchase of materials produced in the United States. By end-September, the heads of all government agencies are due to deliver proposals to ensure Federal financial assistance and procurements maximizing the use of materials produced in the United States, including steel. A Presidential Memorandum on Steel Imports and Threats to National Security of April 2017 prioritized an investigation into whether steel imports threaten to impair national security. Should the report?due by early 2018?conclude that steel imports may impair national security, specific actions, including the imposition of tariffs on steel imports, may be imposed.

While employment in the steel sector accounts for less than 0.1 per cent of total jobs in the United States, the sensitivity of the sector is clear from its high-profile presence in national and international discourse. The steel sector is explicitly referenced in the Presidential Executive Order of 18 April 2017 on Buy American and Hire American, which requires a preference for the purchase of materials produced in the United States. By end-September, the heads of all government agencies are due to deliver proposals to ensure Federal financial assistance and procurements maximizing the use of materials produced in the United States, including steel. A Presidential Memorandum on Steel Imports and Threats to National Security of April 2017 prioritized an investigation into whether steel imports threaten to impair national security. Should the report?due by early 2018?conclude that steel imports may impair national security, specific actions, including the imposition of tariffs on steel imports, may be imposed.

Europe: Nascent turn in monetary policy driving bond yields and the euro

The monetary policy stance of the European Central Bank (ECB) remains a major driver of recent financial market movements. So far this year, the ECB has reduced the amount of its monthly asset purchases and adjusted the language in its policy guidance by dropping the reference to possibly lower interest rates. These indications of a reduction in the monetary policy stimulus and some expectations of more pronounced moves by the ECB in this direction have helped to support the strengthening of the euro and underpinned higher yields on euro-area benchmark bonds. Notably, German ten-year bond yields exceeded 0.5 per cent in July, compared to almost -0.2 per cent a year ago.

Several factors have been driving monetary policy expectations. Economic growth has been robust in a number of countries in the euro area, including strong impetus from private consumption. Unemployment has decreased in numerous economies, with some regions experiencing labour market conditions equivalent to full employment and real wages showing solid increases. In addition, indicators of both consumer and business sentiments remain elevated. Meanwhile, inflation has been on an upward trend and remained solid even after a pullback due to the disappearance of one-off effects from oil prices.

In Eastern Europe, the Czech National Bank raised its key policy rate for the first time since 2008, from 0.05 per cent to 0.25 per cent. Among the countries with flexible currencies in Eastern Europe, this marks the first interest rate increase in several years. The Czech Republic?s rate hike was in response to the sustained upward trend in nominal wages and in housing prices, amid a pick-up in inflation and robust short-term macroeconomic indicators.

Economies in transition

Commonwealth of Independent States: United States tightens sanctions against the Russian Federation

In early August, the United States expanded economic sanctions against the Russian Federation, targeting the energy and finance sectors, as well as several state-run companies in the metal, mining and railway sectors. The duration of loans to the sanctioned banks and energy companies was reduced to 14 days and 60 days, respectively. Although many components of the new sanctions package are optional and can only be implemented after consultations with allies of the United States, this decision raised concerns in the European Union (EU). Many of the sanctioned companies are important trade partners of EU companies, particularly in the mechanical engineering industry. Nevertheless, the Russian economy has largely adapted to the prolonged sanctions environment, and the announcement did not materially impact the stock market and exchange rate. According to initial estimates by the central bank, the economy expanded by 1.3-1.5 per cent in the first six months of 2017. Macroeconomic data in June also reaffirm a continued broad-based recovery with a pick-up in indicators of construction, industry and retail sales activity. However, stronger inflationary expectations, driven in part by the late harvest of fruit and vegetables, prevented further monetary loosening.

In South-Eastern Europe, the prospect of EU accession remains an important political and macroeconomic anchor for countries in the region. During the fourth EU-Western Balkans Summit held in July, the EU reiterated its commitment to the region and stressed the need for further regional integration, including the elimination of non-tariff trade barriers and harmonization of business regulations in order to attract investment. The EU also pledged to finalize the Transport Community Treaty with the region, which will fund regional transport infrastructure.

Developing economies

Africa: A challenging period for Egypt?s economic reform

On 13 July, the International Monetary Fund (IMF) approved the disbursement of the second tranche of the Extended Fund Facility (EFF) to Egypt, aimed at alleviating strains in Egypt?s balance of payments. The second tranche amounted to $1.25 billion, bringing the total amount disbursed under the EFF since November 2016 to $4 billion. As part of the agreement with the IMF, the Egyptian Government has continued to pursue economic reform measures, including floating the Egyptian pound, and measures to improve their fiscal position, such as subsidy reforms and the introduction of a value-added tax. Several macroeconomic variables have improved. GDP growth in the first quarter of 2017 reached 3.9 per cent. The central bank?s foreign reserves increased to $31.3 billion at the end of June, which is at 90 percent of the pre-2011 average. However, inflation rose further to 29.8 per cent in June, prompted by the devaluation of the domestic currency and the new value added tax. To safeguard the poor, the Government introduced various social aid programmes, including the use of food ration cards.

Meanwhile, Gabon, the second largest economy in the Central African Economic and Monetary Union, recently entered a new three-year extended arrangement under the EFF. The agreement is aimed at supporting macroeconomic stability, through prudent fiscal policymaking and the maintenance of a sustainable balance of payments position. The immediate disbursement totalled about $98.8 million. Due to the decline in oil prices, the country has experienced a substantial slowdown in economic growth with a large drop in oil revenues, widening fiscal and current account deficits, and increasing debt levels. In June, the IMF also approved tranches of $314 million to Tunisia and $2.3 million to Seychelles under their ongoing EFF programs.

East Asia: China enhances focus on addressing financial risks

Despite high uncertainty in the international environment, recent indicators reinforce the steady growth outlook for China. In the second quarter, the Chinese economy grew at a sustained pace of 6.9 per cent, driven by a stronger-than-expected expansion in both the industrial and services sectors. The improvement in industrial activity was mainly attributed to stronger manufacturing investment, as domestic and external demand improved. Alongside the rebound in producer price inflation, these developments contributed to double-digit growth in industrial profits in the first half of this year. In the services sector, the transport, information technology and business services subsectors grew at a faster pace. However, the pace of expansion in finance and real estate services slowed, reflecting tighter regulation to curb rising risks in these sectors.

In July, the Chinese authorities reiterated their commitment to mitigate growing financial vulnerabilities. Notably, policymakers are prioritizing the deleveraging of state-owned enterprises, including through tighter controls on the acquisition of debt as well as an acceleration of its debt-for-equity swap programme. Amid rapid credit growth and concerns over the build-up of property bubbles, elevated corporate debt constitutes a potential systemic risk for China. The Bank for International Settlements recently showed that China?s corporate debt level of over 160 per cent of GDP was the highest among the major emerging economies in 2016. While efforts to address financial imbalances will contribute to more sustainable medium-term growth in China, the authorities are faced with the policy challenge of ensuring that these measures will not derail the economy?s short-term growth prospects.

South Asia: Lower inflationary pressures provide room for monetary easing

In recent months, lower-than-expected inflation has created more policy space for monetary authorities in the region to support growth. In June, consumer price inflation in India declined to a five-year low of 1.5 per cent, due mainly to a fall in food prices, amid a favourable monsoon season. However, core inflation, which excludes volatile food and fuel costs, also fell below the medium-term target of the Reserve Bank of India (RBI). Amid lower inflationary pressures and relatively slow growth indicators, the RBI cut its key policy rate by 25 basis points to a multi-year low of 6.0 per cent.

In Sri Lanka, headline inflation fell to 4.8 per cent after a visible rise in early 2017, and is expected to ease further in the near term. Coupled with fragile growth indicators, the decline in inflationary pressures suggests that the monetary tightening cycle initiated in early 2016 might be close to an end. Likewise, inflation in Nepal has also continued to decline due to lower food prices. In June, consumer price inflation moderated further to 2.8 per cent. Against this backdrop, the central bank of Nepal established targets on money supply and credit growth for the current fiscal year that are slightly more expansionary than last year. Meanwhile, in Pakistan, inflation fell to 2.9 per cent in July, the lowest level since late 2015.

Western Asia: Saudi Arabia facing deflation

In the first quarter of 2017, Saudi Arabia?s economy contracted by 0.5 per cent on a year-on-year basis. The deterioration in growth was mainly attributed to a 2.3 per cent decline in the oil sector as Saudi Arabia cut its crude oil production under the agreement of the Organization of the Petroleum Exporting Countries (OPEC). The non-oil government sector also shrank by 0.1 percent amid fiscal consolidation efforts, while the non-oil private sector expanded by 0.9 percent. Despite the resilient growth of the non-oil private sector, domestic demand is estimated to have stalled. The general price level in Saudi Arabia has also been on a deflationary trend since early this year. In June, consumer prices declined by 0.4 per cent, due in part to the waning impact of subsidy cuts which drove up prices in 2016. The economy is also exposed to negative wealth effects, given the decline in real estate prices by 9.9 per cent on a year-on-year basis in the first quarter. As Saudi Arabia?s national currency is pegged to the United States dollar, there is limited space for monetary policy to counter these deflationary pressures. In addition, the Government is projected to maintain its fiscal prudence given its strong commitment to economic reform. Hence, deflationary pressures may last through the second half of 2017.

Latin America and the Caribbean: The Bolivarian Republic of Venezuela remains mired in a deep economic crisis

Amid ongoing political turmoil, the Bolivarian Republic of Venezuela remains mired in a deep and prolonged economic crisis. Given the dearth of official data for GDP growth, inflation and other key macroeconomic variables, the true extent of the downturn is difficult to gauge. Latest estimates show that the economy experienced a double-digit contraction last year as private consumption, fixed investment and imports plummeted. The IMF recently revised downwards its GDP growth estimate for 2016 to -18 per cent. With oil prices expected to remain subdued coupled with persistent massive structural imbalances, a further significant contraction in economic activity is projected for 2017. The decline in output has been accompanied by soaring inflation. Among the main factors behind the upward spiral in prices are shortages of consumer goods (partly as a result of widespread government price controls), the monetization of large fiscal deficits and a rapid depreciation of the bolivar in the parallel market. Rampant inflation and a tumbling currency have resulted in an erosion in the purchasing power of households, which in turn has led to a severe decline in private consumption spending. In response, the Government raised the minimum wage in July by 50 per cent?the third hike in 2017, following raises of 50 percent in January and 60 percent in April. These wage hikes are, however, regarded as insufficient to fully offset inflation.

Welcome to the United Nations

Welcome to the United Nations