- WTO?s Eleventh Ministerial Conference to be held against a backdrop of major challenges to the multilateral trading system

- Rising financial imbalances prompt policy responses in China and the Republic of Korea

- Higher oil and metal prices driving South America?s economic recovery

Global issues

WTO Ministerial Conference: Strengthening the multilateral trading system at a time of major challenges

The Eleventh Ministerial Conference (MC11), the highest decision-making body of the World Trade Organization (WTO), will be held from 10?13 December in Buenos Aires, Argentina. The meeting, which brings together all 164 members of the WTO, comes at a time when the multilateral trading system faces major challenges. The Doha Round, which was launched in 2001 and had placed development at the centre of the agenda?hence, it?s semi-official name Doha Development Agenda?has not been completed. While the Round is officially still ongoing, the Tenth Ministerial Declaration (MC10) held in Nairobi, Kenya in 2015, acknowledged divergent views among members on its future. Many members, in particular developing countries, reaffirmed their full commitment to conclude the Doha Development Agenda. Others, including the United States of America and the European Union (EU), have instead proposed to abandon the Doha Development Agenda and move on to new issues and approaches to achieve meaningful outcomes in multilateral negotiations.

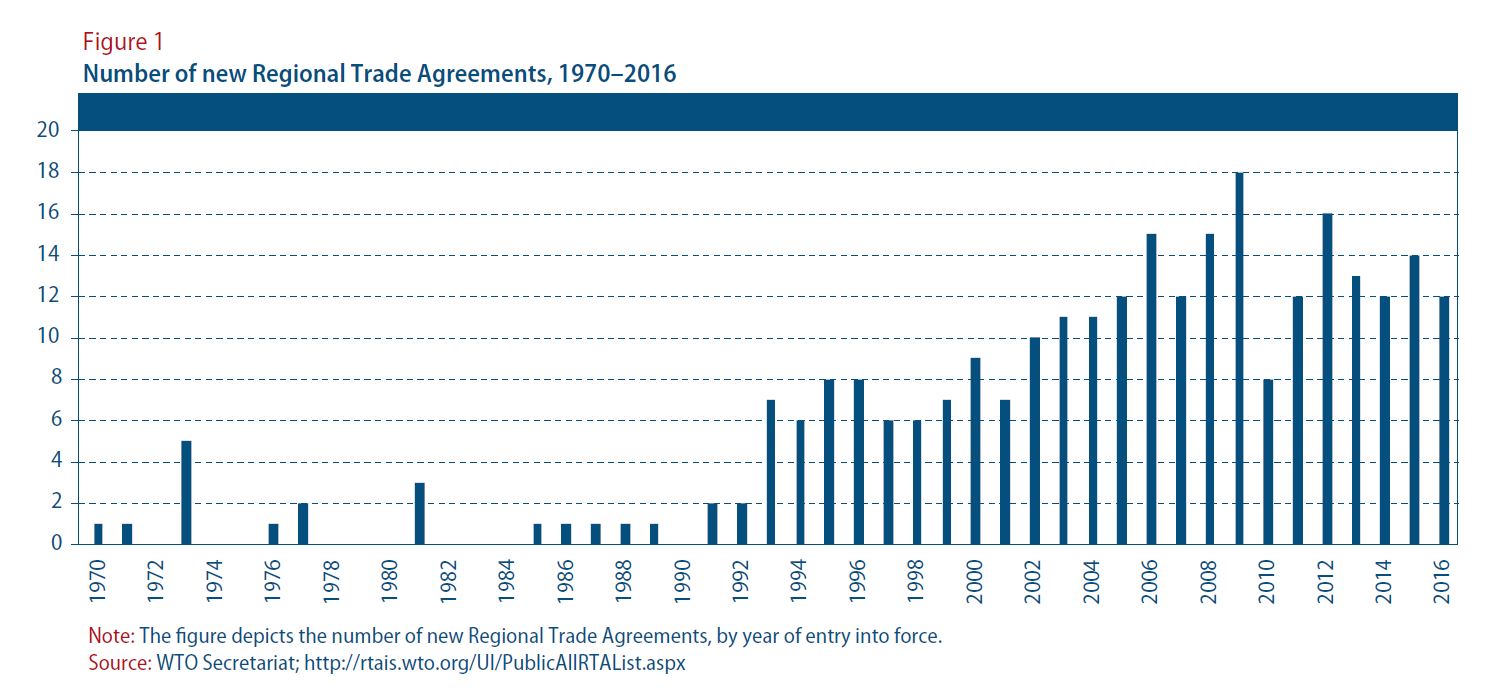

The failure to conclude a new round of multilateral trade negotiations is one of the factors that has led countries to increasingly pursue bilateral and regional trade agreements (see figure 1). The proliferation of these deals?and especially of mega-regional trade agreements between countries or blocs of countries ?is viewed by some as a threat to the WTO-led multilateral trading system. Overlapping trade agreements give rise to an increasingly complex network of different trade regulations, while undermining the WTO?s non-discrimination principles. Concerns have especially been expressed about the consequences for developing countries that are outside the mega-regional trade agreements, particularly the least developed countries (LDCs). In the Ministerial Declaration of MC10, WTO Member States ?reaffirm[ed] the need to ensure that Regional Trade Agreements (RTAs) remain complementary to, not a substitute for, the multilateral trading system.? As argued by the WTO Secretariat, many fundamental issues can only be tackled in an efficient manner in the multilateral context.

The role of the WTO is further complicated by growing popular discontent with globalization and trade liberalization in parts of the world. An additional factor shaping the prospects for negotiations is the scepticism expressed by some large countries regarding multilateral trade agreements. For example, the current Administration of the United States has indicated a clear preference for bilateral deals over multilateral deals.

In view of these challenges, much is at stake at MC11. The conference presents an opportunity to reaffirm the centrality of the WTO in international cooperation. A successful conference outcome would enhance the relevance and effectiveness of the multilateral trading system, while also supporting development around the globe. The WTO?s work agenda covers a broad range of issues, but several subjects have been identified as priorities for action at MC11. Some of them are long-standing issues or follow-ups from decisions taken two years ago in Nairobi. On many of these issues, however, the positions of Member States remain relatively far apart. This has raised the question as to whether meaningful outcomes can be achieved.

First, rules on agriculture continue to be a fundamental issue that could also help to unlock other parts of the negotiation agenda. The focus here is on several areas: (a) Domestic support: Several groups of countries, including the LDCs, have advocated a substantial reduction in trade-distorting agricultural subsidies. (b) Public stockholding for food security purposes: Such programmes, which are used by many developing countries, are considered to distort trade when they involve purchases from farmers at prices fixed by governments. In Nairobi, the interim ?peace clause? agreed upon at MC9 in Bali in 2013 was reaffirmed. According to this clause, members refrain from initiating legal disputes that challenge such programmes. WTO Member States now face the task of finding a permanent solution to the issue. (c) Cotton: A majority of members support a meaningful and specific outcome in addressing the issue of domestic support for cotton. At MC10, WTO Members adopted a decision that prohibited export subsidies for cotton and called for a further reduction in domestic support. The so-called Cotton-4 countries ?Benin, Burkina Faso, Chad and Mali?have stressed the importance of an effective implementation of these decisions, while calling for a progressive phasing-out of all forms of trade-distorting domestic support.

Second, Member States aim at strengthening the WTO?s regulation of fisheries subsidies. Currently, various proposals are being discussed regarding the prohibition of certain forms of fisheries subsidies that contribute to overcapacity and overfishing.

Third, e-commerce is among the WTO?s thematic priorities for MC11. Several groups of countries, including the EU, aim to launch negotiations on an e-commerce treaty in Buenos Aires. Some developing countries, however, have pushed back on the idea of new WTO rules governing e-commerce. They fear that rules that ensure the free flow of data or prohibit requirements to hold data locally would severely constrain domestic policy space. For example, the new set of rules could make it harder for domestic players in the digital industry to compete with transnational corporations.

Fourth, there is a significant divergence in views about the domestic regulation for trade in services. The discussions focus on domestic regulation disciplines to ensure that licensing, qualification requirements and procedures, and technical standards do not constitute unnecessary barriers to trade. Some Member States fear that further WTO disciplines could undermine the regulatory sovereignty of countries. A group of 25 members, led by Australia and the EU, has tried to revive the negotiation by promoting a discussion on a subset of less controversial trade-facilitating elements within the broader agenda on domestic regulations.

A fifth priority area is the development dimension of the multilateral trading system, including new approaches to special and differential treatment for developing countries and LDCs. It is often argued that the existing WTO regulations are too restrictive for developing countries (in particular LDCs) or not in line with their development needs.

As indicated in SDG 17, a universal, rules-based, open, non-discriminatory and equitable multilateral trading system is a cornerstone of the global partnership for sustainable development. At MC11, Member States have the opportunity to respond to the current challenges and help ensure that the global trading system is truly inclusive.

Developed economies

Japan: Supplementary budget of 2.9 trillion yen planned

The Japanese Government is planning to introduce a supplementary budget of 2.9 trillion yen ($25 billion) for fiscal year (FY) 2017. The fiscal package will focus on two recent initiatives led by the Government in the area of productivity growth and human resource development. Given its focus on supply-side issues, the impact of the new package on domestic demand is not expected to be as immediate as last year?s supplementary budget. The previous supplementary budget totalled 6 trillion yen, including expenditure on public works. Consumer confidence and business sentiments continued to improve despite rising geopolitical tensions in the Korean Peninsula. In the third quarter of 2017, GDP grew at 2.1 per cent compared to the same period last year, reflecting a steady economic expansion in Japan.

Europe: Economic growth gains further momentum

Economic activity in Europe remains relatively strong and is showing signs of a stronger acceleration. Growth increased to 2.5 per cent year-on-year in both the EU and the euro area in the third quarter, from 2.4 per cent and 2.3 per cent, respectively, in the second quarter. Both domestic and external demand drove growth, keeping a broad-based economic expansion in the region on track. There are also signs that the continued dynamic performance in the large economies in the region such as Germany, France and Spain is feeding through into EU-wide positive growth impulses. This strong growth picture is in line with the broader trend in labour markets. Unemployment has been declining throughout the region and while unemployment levels, especially among youth, remain a problem in various countries, countries such as Germany are experiencing full employment and even a shortage in job seekers.

Romania, Latvia, the Czech Republic and Poland registered the highest year-on-year growth rates in the EU in the third quarter, of 8.6 per cent, 6.2 per cent and, for the latter two, 5.0 per cent, respectively. The exceptional growth in Romania was mostly driven by booming domestic demand. Growth is unlikely to be sustained at this level, as higher inflation is likely to lead to monetary tightening, while the stronger currency and a weaker fiscal stimulus will moderate growth. The robust growth in Latvia observed in the third quarter reflects a massive expansion in construction.

Economies in transition

Commonwealth of Independent States: The Russian Federation continues to cooperate with OPEC on oil production cuts

Growth in the Russian Federation moderated in the third quarter, expanding by only 1.8 per cent, after an impressive 2.5 per cent growth in the second quarter. Private consumption, which accounted for around 52 per cent of GDP in 2016, remains the key driver of economic growth. However, retail sales?an important indicator of household spending?expanded by only 3 per cent in October 2017. Although real wages are growing thanks to slowing inflation, average real disposable income is contracting because of increasing debt payments and the freezing of certain social payments. On the positive side, investment in the third quarter increased by about 4 per cent, albeit relative to very low levels in the previous year. In late November, the Government of the Russian Federation, along with a number of other countries, including Azerbaijan and Kazakhstan, agreed to extend the OPEC-led oil production cuts until the end of 2018. Since the Russian budget for 2018 is based on an oil price assumption of $40 per barrel, the current oil price is favourable for the economy. On the other hand, an excessive currency appreciation, which may be caused by a higher oil price, would be damaging to the economy. In the third quarter, Ukraine also maintained its positive growth trend, with the economy expanding at 2.1 per cent, mostly driven by domestic demand.

In South-Eastern Europe, investment is increasing, especially in infrastructure. In November, the construction of a railway link to Central Europe, funded by China, began in Serbia, within the framework of the ?Belt and Road? initiative. A number of new investment agreements were also signed during the latest ?16 plus 1? summit of Central European countries and China, held in Hungary. In late November, Bosnia and Herzegovina obtained a ?750 million loan from China to expand its power generation facilities. While these additional funds provide a welcomed upgrade to the region?s infrastructure, they are also adding to public debt in the region.

Developing economies

Africa: Third quarter GDP in several economies support a cautiously optimistic outlook for the region

Several large African economies released robust third quarter GDP figures, indicating that a solid recovery is underway. The economic expansion in Egypt accelerated in the third quarter, with real GDP growing by 5.2 per cent compared to the same period last year. An improvement in the foreign exchange situation will add further support to the economy. On 28 November, the Central Bank of Egypt lifted foreign exchange restrictions for importers that have been in place since 2012. The central bank?s foreign reserves stood at $36.7 billion in October, surpassing the previous peak registered in 2010.

Meanwhile, the increase in oil prices is supporting the economic recovery in Nigeria, and the economy has exited recession. In the third quarter of 2017, the GDP growth rate stood at 1.4 per cent on a year-on-year basis. The level of foreign reserves at the Central Bank of Nigeria has grown by 42 per cent over the last 12 months, indicating a stabilization in foreign exchange conditions.

Upon exiting recession earlier this year, South Africa?s real GDP growth recovered to 0.8 per cent in the third quarter on a year-on-year basis. The recovery in household consumption has contributed to the continued economic expansion, but fixed investment and public expenditure spending remains weak.

The Tunisian economy expanded by 2.1 per cent in the third quarter of 2017, compared to the same period last year. However, a further expansion in domestic demand may be hampered by foreign exchange constraints. Rising oil prices have already contributed to a deterioration in the terms of trade, which would be exacerbated by a devaluation of the national currency.

East Asia: Rising concerns over financial imbalances prompt policy responses in the region

In November, the Republic of Korea?s central bank raised its key policy rate by 25 basis points to 1.5 per cent, marking the first rate hike by a major East Asian central bank since 2015. The Bank of Korea?s shift towards a less accommodative policy stance was motivated by a solid growth outlook and concerns over a build-up of financial imbalances. Fuelled by low borrowing costs and speculative activity, house prices in the large cities have risen rapidly following the global financial crisis. The country?s household debt-to-GDP ratio, at close to 90 per cent, is also one of the highest in the region. Nevertheless, while an increase in interest rates will curb new borrowing, it also increases the debt service cost for existing borrowers with variable-rate loans. Prior to raising interest rates, the authorities had earlier this year implemented a range of macroprudential measures in efforts to cool the property market and rein in debt. These measures include reducing the loan-to-value ratio and raising the tax on capital gains.

In response to rising domestic financial risks, policymakers in China have also intensified their usage of macroprudential and regulatory policies. In November, new guidelines were issued with regard to the sale of wealth management products, which has thus far been largely unregulated. The Chinese authorities also announced limits on the ability of State-owned enterprises to participate in public-private partnership projects. This move was not only aimed at lowering the debt levels of these firms, but also at boosting private investment growth.

South Asia: Stronger growth in Pakistan, but a widening current account deficit poses risks

The economy of Pakistan has gained momentum since early 2017, with GDP growth climbing to 5.3 per cent in FY2017, the strongest growth in more than a decade. Economic activity has been underpinned mainly by robust private consumption and rising investment, which is benefiting from the China-Pakistan Economic Corridor and other large infrastructure initiatives. Furthermore, sound macroeconomic policies have also supported economic and financial stability in recent years, including relatively low and stable inflation, currently hovering around 4.0 per cent. Against this backdrop, the prospects for the Pakistan economy are largely favourable, with growth expected to remain above 5.0 per cent in the near term.

Nevertheless, incipient macroeconomic imbalances also pose some risks. For one, the current account deficit has increased visibly in recent months. In the first quarter of FY2018, the current account deficit surged to more than $5 billion (4.4 per cent of GDP), after posting $2.3 billion in the same period of FY2017. Given limited exchange rate flexibility, this has led to a decline in international reserves by more than 20 per cent since early 2017. In addition, the difficulties arising from these trends could be compounded if the fiscal deficit were expected to rise in the near term. A further widening of these imbalances could certainly complicate Pakistan?s macroeconomic policy management in the short term, while also affecting the economy?s overall resilience to external and domestic shocks.

Western Asia: Reforms in Saudi Arabia tap potential of highly-educated female labour force

Beginning in June 2018, Saudi women will be eligible to obtain driver?s licenses, according to a royal decree released on 26 September. The new measure is indicative of the robust reforms ongoing in Saudi Arabia. A positive economic impact is expected in both the short and long term. Since the new measure enables Saudi women to travel privately and independently, it is expected to create employment opportunities for Saudi women. The lack of viable transportation for commuting has long been one of the major obstacles for Saudi female job seekers, as well as for potential employers. The Saudi female labour force has grown by 82 per cent over the last decade as the labour participation rate has risen from 12.2 per cent in 2007 to 17.4 per cent in the second quarter of 2017. At the same time, the female unemployment rate has increased to a significantly higher level than the male unemployment rate. As of the second quarter of 2017, the unemployment rate among Saudi nationals (excluding foreign workers/residents) stood at 12.8 per cent. While the male unemployment rate stood at 7.4 per cent, the female unemployment rate stood at 33.1 per cent. Most unemployed Saudis are young first-time job seekers. Whereas 22 per cent of unemployed Saudi men are university graduates, 74 per cent of unemployed Saudi women are university degree holders. Mobilizing the untapped and highly-educated female labour force represents an important opportunity to progress towards sustainable economic development in Saudi Arabia.

Latin America and the Caribbean: Higher oil and metal prices supporting South America?s economic recovery

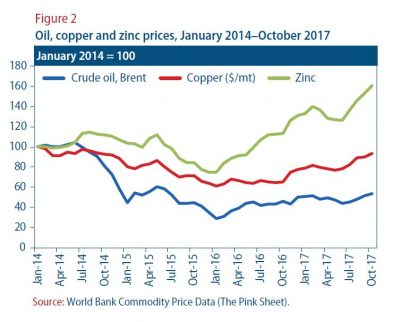

Recent data show that a broad-based recovery is underway in South America. In almost all economies, GDP growth strengthened and unemployment rates declined in the third quarter of 2017. The upturn in economic activity is supported by higher prices of some of the subregion?s main export commodities, including oil, copper and zinc. Brent crude oil prices have recovered from below $30 a barrel at the start of 2016 to about $60 in November 2017 (figure 2). This increase benefits the subregion?s hard-hit oil producers, including Argentina, Brazil, Colombia, Ecuador and the Bolivarian Republic of Venezuela. In Colombia, value added in the oil and gas extraction sector rose in the second and third quarter of 2017, following a severe contraction in 2016. Copper prices have increased by more than 40 per cent over the past twelve months on the back of temporary supply disruptions, robust construction and automotive demand in China, and expectations that growth of electric vehicles will boost future demand. Meanwhile, zinc prices have more than doubled since early 2016, reaching the highest level in ten years. The strong rebound in copper and zinc prices has helped boost the economic outlook for Chile (the world?s largest copper producer) and Peru (the second-largest producer of both copper and zinc). Both countries are projected to see a marked acceleration in growth over the coming year.

Recent data show that a broad-based recovery is underway in South America. In almost all economies, GDP growth strengthened and unemployment rates declined in the third quarter of 2017. The upturn in economic activity is supported by higher prices of some of the subregion?s main export commodities, including oil, copper and zinc. Brent crude oil prices have recovered from below $30 a barrel at the start of 2016 to about $60 in November 2017 (figure 2). This increase benefits the subregion?s hard-hit oil producers, including Argentina, Brazil, Colombia, Ecuador and the Bolivarian Republic of Venezuela. In Colombia, value added in the oil and gas extraction sector rose in the second and third quarter of 2017, following a severe contraction in 2016. Copper prices have increased by more than 40 per cent over the past twelve months on the back of temporary supply disruptions, robust construction and automotive demand in China, and expectations that growth of electric vehicles will boost future demand. Meanwhile, zinc prices have more than doubled since early 2016, reaching the highest level in ten years. The strong rebound in copper and zinc prices has helped boost the economic outlook for Chile (the world?s largest copper producer) and Peru (the second-largest producer of both copper and zinc). Both countries are projected to see a marked acceleration in growth over the coming year.

Welcome to the United Nations

Welcome to the United Nations