- WESP 2018 highlights that the strengthening global economy is an opportunity to address structural challenges

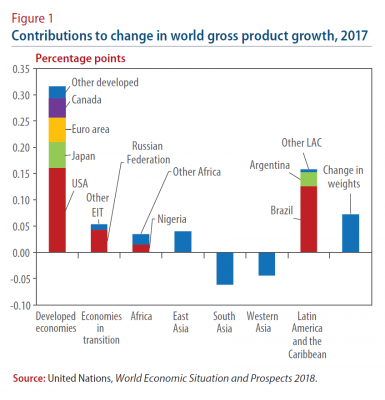

- Several economies in Africa, Latin America and Western Asia still see negligible per capita income growth

- East and South Asia remain world?s most dynamic regions

English: PDF (197 kb), EPUB (262kb)

Global issues

WESP 2018: Stronger global economy offers opportunities?to tackle deep-rooted development issues

According to the World Economic Situation and Prospects (WESP) 2018, launched on 11 December 2017, the world economy has strengthened, as crisis-related fragilities and the adverse effects of recent shocks subside. Investment conditions have improved in many countries. This may encourage the rebound in capital spending needed to revive global productivity growth and to accelerate progress towards the Sustainable Development Goals (SDGs).

The report forecasts steady global economic growth of 3 per cent per annum for 2017, 2018 and 2019. While the global economy is not devoid of risks, what stands out at the current juncture is the synchronized upturn among the major economies, stability in financial market conditions, and the absence of major negative shocks such as commodity price dislocations.

The improvement in global economic conditions offers greater scope for policymakers to shift from a short-term focus that is inevitably part of coping with crises, towards addressing longer-term challenges and eliminating deep-rooted barriers to development. These include reducing inequalities, promoting low-carbon economic growth, and fostering greater economic diversification. Tackling these issues requires long-term strategic planning, and the WESP 2018 stresses that the time to accelerate this process is now, before the next economic crisis hits and diverts attention from these crucial goals.

Global economy has strengthened

At 3 per cent per annum, global economic growth is at its highest rate since 2011, and reflects a significant acceleration compared to growth of just 2.4 per cent in 2016. Roughly two-thirds of the world?s countries saw stronger growth in 2017 than in 2016. Labour market indicators continue to improve in many countries, and world trade has rebounded. The improvement in world trade has been largely driven by rising demand from East Asia. In fact, East and South Asia remain the world?s most dynamic regions, contributing nearly half of global growth.

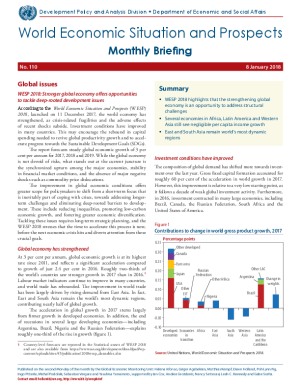

The acceleration in global growth in 2017 stems largely from firmer growth in developed economies. In addition, the end of recessions in several large developing economies?including Argentina, Brazil, Nigeria and the Russian Federation?explains roughly one-third of the rise in growth (figure 1).

Investment conditions have improved

The composition of global demand has shifted more towards investment over the last year. Gross fixed capital formation accounted for roughly 60 per cent of the acceleration in world growth in 2017. However, this improvement is relative to a very low starting point, as it follows a decade of weak global investment activity. Furthermore, in 2016, investment contracted in many large economies, including Brazil, Canada, the Russian Federation, South Africa and the United States of America.

Nonetheless, investment conditions have generally improved, amid stable financial markets, strong credit growth and a more solid macroeconomic outlook. Financing costs remain low and spreads have narrowed in emerging markets, while capital has started flowing back to developing economies. However, elevated policy uncertainty may prevent the rebound from reaching the levels of investment growth needed to make rapid progress towards the SDGs.

Stronger economic activity has not been shared evenly

In 2016, several regions experienced sharp declines in per capita income. Looking ahead, negligible per capita GDP growth is expected in parts of Africa, Latin America and Western Asia over the next few years (figure 2). These regions combined are home to 275 million people living in extreme poverty. Hence, there is an urgent need to foster an environment that will both accelerate medium-term growth prospects and tackle poverty through policies that address inequalities in income and opportunity.

The uneven pace of global growth poses risks for several SDG targets. Very few least developed countries are expected to reach the SDG target for GDP growth of ?at least 7 per cent? in the near term. In many of these countries, growth is constrained by institutional deficiencies, inadequate basic infrastructure, high susceptibility to natural disasters, as well as political instability and security concerns. The WESP 2018 warns that under the current growth trajectory, the target of eradicating poverty by 2030 is likely to remain out of reach, particularly in Africa.

Uncertainties and risks

The key risks highlighted in the WESP 2018 include changes in trade policy and a rise in protectionism, a sudden deterioration in global financial conditions, and rising geopolitical tensions. A deterioration in global financial conditions could be triggered by several factors, including the adjustment of central bank balance sheets in developed economies. Central banks in developed economies are currently operating in largely uncharted territory, with a high risk of policy missteps. This could trigger a spike in risk aversion or a sudden capital withdrawal from developing countries.

Firmer global economy offers opportunities to reorient policy focus

As conditions for more widespread global economic stability and stronger investment solidify, this creates greater scope to reorient policy towards longer-term issues, that will in turn generate stronger investment, higher job creation and more sustainable medium-term economic growth. Key areas emphasized in the WESP 2018 include:

- Promoting economic diversification, especially in countries that remain dependent on a few commodities;

- Stemming the rise in inequality, through a combination of short-term policies to raise living standards among the most deprived, as well as longer-term policies that address inequalities in opportunity;

- Creating a new framework for sustainable finance, shifting away from the current focus on short-term profit towards a target of long-term value creation, in a socially and environmentally responsible manner;

- Tackling institutional deficiencies, including through strengthening legal institutions and administrative capacities, to boost business confidence and reduce country risk perceptions.

Developed economies

United States: Policy changes support short-term growth but may raise inequality

Following an estimated growth of 2.2 per cent in 2017, the United States is forecast to expand at a steady pace of 2.1 per cent in both 2018 and 2019, according to the WESP 2018. These growth figures reflect a significant improvement compared to the 1.5 per cent growth recorded in 2016. The growth acceleration largely stems from shifting business investment dynamics and, to a lesser extent, net trade. Policy changes introduced in the Tax Cuts and Jobs Act, signed into law in December 2017, are expected to contribute roughly 0.1 percentage points to GDP growth in 2018, but will increase the size of the deficit and level of government debt over the medium term. Key policy changes introduced in the new law include income tax cuts for most households, a significant reduction in the rate of corporation tax, and changes to the incentives for individuals to obtain health insurance coverage, which may have repercussions for the global goal of attaining universal health coverage.

Income tax cuts in 2018 will support growth of real personal disposable income, which averaged just 1.1 per cent in 2016?2017. This will help sustain steady household spending and spur a recovery in the household savings rate, which has dropped to one of the lowest levels in the last 75 years. However, after-tax wage inequality is expected to rise, according to estimates of the Joint Committee on Taxation and the Congressional Budget Office, as higher income households will receive larger average tax cuts as a percentage of after-tax income.

A recovery in external demand and expectations for stable domestic demand growth will continue to support a moderate pick-up in investment into 2018. The reduction in the corporation tax rate from a maximum of 35 per cent to a flat rate of 20 per cent (25 per cent for personal services corporations) may encourage capital spending. However, lingering uncertainties regarding future trade relationships and the withdrawal of monetary stimulus may hold back a more robust rebound in investment activity.

Japan: Growth led by rapid expansion of domestic demand

Economic growth in Japan accelerated in 2017, with GDP growth reaching an estimated 1.7 per cent. Growth has been led by a rapid expansion of domestic demand, amid a continued accommodative macroeconomic policy stance. Steady expansion in external demand from Asia and North America also contributed to overall GDP growth. The present growth momentum, however is expected to taper off over 2018 and 2019, as the impact from fiscal stimulus measures eases. GDP is forecast to grow by 1.2 per cent in 2018 and 1.0 per cent in 2019. The main downside risk for the economy in the short run is an abrupt appreciation of the Japanese yen. Since the current exchange rate has been bolstered by the Bank of Japan?s intervention, abandoning its yield curve control measure, for either financial or political reasons, could lead to a rapid appreciation of the domestic currency. This would reduce competitiveness, restrain industrial operating profits and reverse progress towards combating deflation.

Europe: Robust growth but risks from Brexit loom

Economic activity in Europe remains robust, with GDP growth forecast to reach 2.1 per cent in 2018. Household consumption will remain a major contributor to growth, underpinned by rising disposable income, falling unemployment, further upward wage pressure and low interest rates. The expansionary monetary policy stance will also continue to underpin business investment and construction activity. Nevertheless, the European Central Bank?s decision to taper the pace of its asset purchases and eventually cease the expansion of its balance sheet will contribute to the slight downtick in growth to 1.9 per cent in 2019. Ireland and Spain are expected to register the highest growth rates, driven by solid private consumption, fixed investment and external demand. By contrast, growth will remain sluggish in Italy due to weak private consumption and fixed investment. In the United Kingdom of Great Britain and Northern Ireland, growth will suffer from pressures arising from Brexit. The weaker pound sterling has resulted in a rise in import costs and inflation, weighing on domestic demand. Business investment is also suffering from uncertainty surrounding the future framework governing economic relations between the United Kingdom and the European Union (EU). While both sides recently reached a preliminary agreement on the terms of separation, the next negotiation phase poses a major challenge. There is a high probability that reaching a final agreement will be protracted, creating the risk of a hard exit of the United Kingdom from the EU.

Meanwhile, economic growth in the EU members from Eastern Europe and the Baltics exceeded the EU average in 2017, with Romania recording the highest growth in the EU. The robust expansion was mostly driven by booming domestic demand. Private consumption was buoyed by rapid growth in real wages amid record low unemployment. Meanwhile, the rebound in investment, particularly infrastructure, was related to the new EU funding cycle. This pace of expansion, however, is unlikely to be sustained in the medium term. The pick-up in inflation is likely to prompt monetary tightening, while waning fiscal stimulus will reduce support to growth.

Economies in transition

Commonwealth of Independent States: A cyclical upturn in 2017, moderate growth ahead

The pace of economic expansion in the Commonwealth of Independent States (CIS) accelerated in 2017, marked by the return to growth in the Russian Federation. Belarus also exited recession, while growth was strong in Armenia, Kazakhstan, Kyrgyzstan and Uzbekistan. Improved terms of trade, a more supportive external environment and less volatile macroeconomic conditions have contributed to a more favourable economic climate for the region. Following a near growth stagnation in 2016, regional GDP growth is expected to have rebounded to 2.2 per cent in 2017 and is projected to accelerate to around 2.3 per cent in 2018 and 2.4 per cent in 2019. The Central Asian economies are expected to expand faster than other CIS economies, benefiting from stronger remittance inflows, the implementation of the ?Belt and Road? initiative, and fiscal spending on development. Nevertheless, in most of the CIS, projected growth will remain well below pre-crisis rates.

The region continues to face cyclical and structural constraints to growth. International sanctions against the Russian Federation are restricting access to certain technologies and capital markets. The conflict in Ukraine as well as distressed banking sectors are also weighing on growth. In addition, progress towards greater economic diversification in the CIS remains slow.

In South-Eastern Europe, aggregate GDP growth moderated from 2.9 per cent in 2016 to an estimated 2.5 per cent in 2017, due to slower growth in Serbia and the former Yugoslav Republic of Macedonia. Overall growth, however, is expected to accelerate to 3.2 per cent in 2018. Economic activity will be supported by improved economic prospects in the EU and stronger domestic demand, including infrastructure-related investment and private consumption.

Developing economies

Africa: Generally improved policy space though challenges remain

Africa is expected to see a moderate acceleration in growth over the next two years. Aggregate GDP growth is projected to pick up from an estimated 2.6 per cent in 2017 to 3.3 per cent in 2018 and 3.5 per cent in 2019 (excluding Libya). This acceleration is shared by all subregions, although at different rates.

The recovery is supported by a gradual increase in commodity prices and lower inflation, which allow many countries some policy space. In 2017, more central banks in the region loosened their monetary policies compared to the previous year. However, fiscal deficits remain high, particularly among oil and metal exporters, and inflation levels remain above target in several countries, including Ghana, Mozambique, Nigeria and Zambia. Some subregions are still recovering from the commodity price shock of mid-2014, such that, in per capita terms, a decrease in income is anticipated in Central and Southern Africa and negligible income growth is projected for West Africa in 2018.

The outlook is clouded by several external risks, including a sharper-than-expected increase in global interest rates, further downgrades to sovereign ratings, lower export demand and a renewed decline in commodity prices. Domestic risks include an escalation of security concerns, policy uncertainty, and weather-related shocks. Moving forward, policymakers?need to focus on developing fiscal adjustment plans to preserve medium-term fiscal sustainability. These plans should include measures to increase domestic resource mobilization and to reduce over-reliance on commodity revenues through economic diversification. There is also an urgent need to address acute malnutrition, particularly in the conflict-affected areas of northeast Nigeria and South Sudan.

East Asia: Steady growth supported by robust domestic demand

The short-term growth outlook for East Asia remains robust, driven by resilient domestic demand and an improvement in exports. Following growth of 5.9 per cent in 2017, the region is projected to expand at a steady pace of 5.7 per cent in 2018 and 5.6 per cent in 2019. Private consumption will remain the key driver of growth in East Asia, supported by modest inflationary pressures, low interest rates and favourable labour market conditions. Public investment is also likely to remain strong in most countries as governments continue to embark on large infrastructure projects, aimed at alleviating structural bottlenecks. Meanwhile, the ongoing recovery in the region?s exports has been largely driven by growing intraregional demand as well as improved demand from the developed countries.

The East Asian economies, however, face several downside risks, arising mainly from high uncertainty in the external environment. These include a potential sharp escalation in trade protectionism measures by the United States, faster-than-expected monetary policy normalization in the developed countries and rising geopolitical tensions on the Korean Peninsula. On the domestic front, financial sector vulnerabilities, particularly high corporate and household debt, will continue to weigh on investment prospects in several countries. In China, while the focus of economic policies has shifted from high growth to quality of growth, daunting challenges remain in economic restructuring and financial deleveraging, entailing the risk of a larger-than-expected growth slowdown.

South Asia: A favourable short-term outlook with significant medium-term challenges

South Asia?s economic outlook remains steady and largely favourable, driven by robust private consumption and sound macroeconomic policies. Monetary policy stances in the region are moderately accommodative, while fiscal policies maintain a strong focus on infrastructure investment. Against this backdrop, regional GDP growth is expected to strengthen from 6.3 per cent in 2017 to 6.5 per cent in 2018 and 7.0 per cent in 2019. The positive outlook is widespread across the region, with most economies projected to see stronger growth rates in 2018 than in 2017. In India, GDP growth is projected to accelerate from 6.7 per cent in 2017 to 7.2 per cent in 2018 and 7.4 per cent in 2019. Meanwhile, regional inflation is expected to stabilize at relatively low levels.

Beyond the favourable short-term outlook, there are crucial aspects that the region needs to address to unleash its growth potential and to promote a more sustained development path. First, strengthening fiscal accounts is a key challenge for most economies. Low tax revenues and largely rigid public expenditure have contributed to persistent structural fiscal deficits across the region. Improving tax revenues is a critical aspect in building fiscal buffers and strengthening the capacity to implement countercyclical policies. Proactive fiscal policies play a crucial role in stabilizing economic activity and supporting development priorities, including in the social protection, poverty and inequality dimensions. Second, the region needs to tackle large infrastructure gaps, particularly in the areas of energy, sanitation and water access, as well as transportation. Persistent deficits in these areas pose a threat not only to productivity gains and economic growth, but also to poverty alleviation.

Western Asia: Growth to bottom out in 2018

GDP growth for Western Asia slowed to an estimated 1.9 per cent in 2017. A mild recovery is projected, with GDP growth forecast at 2.3 per cent for 2018, and 2.7 per cent for 2019. As oil prices are forecast to recover gradually, GDP growth of the member states of the Cooperation Council for the Arab States of the Gulf (GCC) is forecast to hit its trough in 2018, followed by a gradual acceleration. Weaker growth in GCC economies has had regional repercussions, causing a dip in intraregional resource flows from GCC economies to the region?s oil importing economies, particularly Jordan and Lebanon.

Geopolitical tensions continue to affect economies in the region. The Iraqi economy regained some stability as the security situation improved. However, the Syrian Arab Republic and Yemen continue to face humanitarian crises due to ongoing armed violence.

Meanwhile, growth in the Turkish economy accelerated in 2017, supported by strong domestic and external demand. The present momentum is expected to taper off, with Turkey?s GDP growth forecast to slow to 2.1 per cent in 2018.

Latin America and the Caribbean: Economic recovery projected to strengthen in 2018-2019

Amid favourable global conditions, the economic recovery in Latin America and the Caribbean is set to strengthen in 2018?19. After growing by an estimated 1.0 per cent in 2017, the region?s aggregate GDP is projected to expand by 2.0 per cent in 2018 and 2.5 per cent in 2019. These growth rates would be the strongest that the region has seen since 2013. The recovery will be driven by a broad-based upturn in economic activity in South America as the subregion benefits from higher prices for some of its main export commodities, including oil, copper and zinc. At the same time, private consumption and investment are projected to gain some momentum, supported by low inflation, loose monetary policy and gradually improving labour markets. Average growth in Mexico and Central America is projected to remain steady at about 2.5 per cent in 2018?19, with most economies benefiting from robust demand in the United States and strong remittance inflows. The English-speaking Caribbean economies are projected to see a mild recovery over the next two years, following near-stagnation in 2017. Reconstruction spending and a pickup in private investment are expected support the upturn. Despite the expected improvement, average economic growth in Latin America and the Caribbean will remain much lower than during the commodity boom of the 2000s. A prolonged period of subpar growth would likely pose significant challenges for the region?s progress towards achieving the SDGs.

Welcome to the United Nations

Welcome to the United Nations