- UK vote to leave the EU adds significant uncertainty to the global economy

- Prolonged weak global growth poses a challenge to sustainable development

- India further liberalizes its FDI regime

Global issues

The outcome of the United Kingdom referendum on EU membership

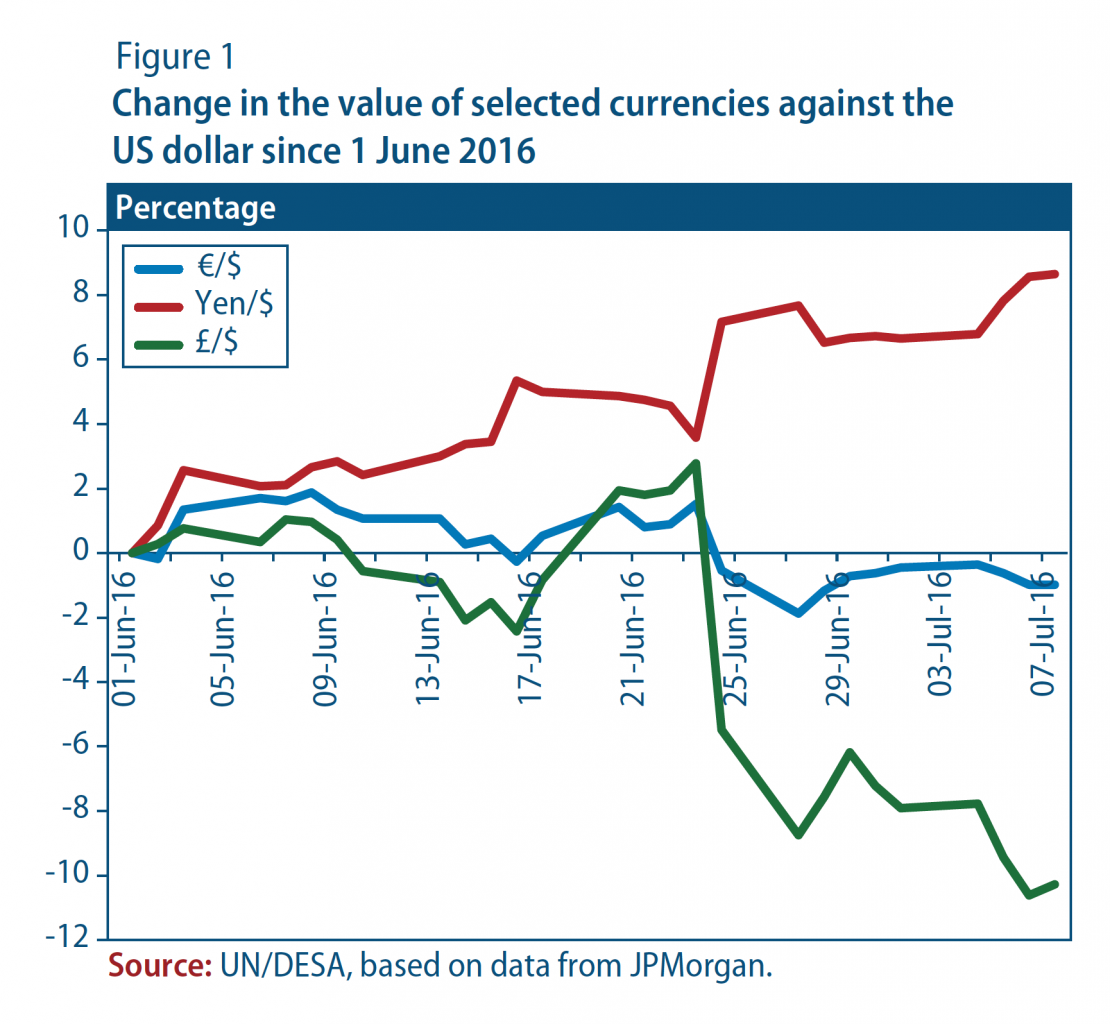

In a closely contested referendum on 23 June, the citizens of the United Kingdom of Great Britain and Northern Ireland voted to leave the European Union (EU). The largely unexpected result sent shock waves through financial markets. A number of currencies experienced sharp declines, led by the 11 per cent fall of the British pound against the US dollar in the two trading days following the referendum (figure 1), while some currencies such as the Japanese yen appreciated. Equities fell by almost double-digit percentages in some European bourses before regaining some ground in the subsequent days. The yield on safe-haven bonds declined further from their already low levels, accompanied by an increase in spreads for riskier bonds.

The uncertainty and commensurate market reactions largely stem from the lack of clarity about the future direction for the United Kingdom and the EU. The formal negotiations over the United Kingdom?s withdrawal from the EU and their future relationship can only start once the United Kingdom submits a formal notification of its exit to the EU; but whether and when this notification will take place is still unclear. Several regions of the United Kingdom, including Scotland, voted in favour of staying in the EU. There are concerns that Scotland may try to block the United Kingdom?s exit from the EU or hold another referendum to steer independence from the United Kingdom.

The continued high degree of political and economic uncertainty is likely to result in prolonged financial market volatility. While the drastic fall in the pound may lend some support to the United Kingdom?s exports, it will also increase upward pressure on import prices and inflation. The United Kingdom is running a current-account deficit of 5.2 per cent of gross domestic product (GDP), creating additional risks, including further currency depreciation, particularly in the case of large capital outflows. There is also the risk of a significant contraction in the United Kingdom?s real estate market, as prospective buyers assess alternatives in the EU and institutional investors mark down holdings in the United Kingdom. Across all sectors, firms are likely to delay new investments or divert investments away to other EU countries in order to retain access to the EU common market. This might apply, for example, to the automotive sector: United Kingdom car manufacturers export 80 per cent of their output, and 50 per cent of United Kingdom car exports go to the EU. A relocation of existing business operations from the United Kingdom to the EU may also be likely, notably in the sizeable financial sector, where financial entities have used the United Kingdom as a gateway to the EU, especially in regulatory terms. These developments are likely to set in immediately, as businesses seek to reduce uncertainty in their operations. Taken together, this has created a significant likelihood that economic activity both in the United Kingdom and the EU will see a pronounced slowdown in the near term.1 Given these prospects, the Bank of England (BoE) has hinted at the possibility of further monetary policy easing in the coming months. BoE has recently instructed banks to reduce their capital buffers and increase credit to the private sector.

The United Kingdom referendum has also created uncertainty regarding labour migration, which may affect labour market conditions and private consumption, notably in the new EU countries. The United Kingdom was among the first countries in the EU to open its labour market during 2004-2007 to the citizens of the new EU member States. In 2014, over 654,000 Poles, 100,000 Lithuanians and 79,000 Hungarians were estimated to be living in the United Kingdom. It is not clear whether the residence rights of these workers will be affected as the United Kingdom exits the EU. However, possible restrictions on new arrivals and a return of some of the earlier migrants to their home country may increase domestic labour market pressures in Eastern Europe and the Baltics, unless most of these migrants relocate to another EU country. In many Eastern European economies, remittances?while being lower as a share of GDP than, for example, in the CIS region?still constitute an important family support. These remittances are now also buffeted by a weaker pound, resulting in lower purchasing power in the respective home countries.

Prolonged weak global growth poses a challenge to the achievement of the Sustainable Development Goals

The global economy continues to underperform almost eight years after the financial crisis. Between 2010 and 2016, world gross product grew at an average annual rate of 2.6 per cent, much lower than the average of 3.4 per cent observed between 2000 and 2007. Given persistent, strong headwinds in the global economic, financial and policy landscape, a strong growth turnaround in the near term is unlikely. Against this backdrop, the prolonged period of weak global growth poses a significant challenge to the achievement of the Sustainable Development Goals. This was the central focus of a recent panel discussion on ?The State of the World Economy and its Implications for the 2030 Agenda? that the Development Policy and Analysis Division, organized on 14 June 2016. Amid increasingly constrained monetary and fiscal space, jump-starting global growth will require timely, effective and well-targeted policy measures, the panel discussion concluded. To do so, policymakers need to identify and understand the main transmission channels through which slower economic growth can affect progress on achieving development goals.

In general, slower economic growth adversely affects household balance sheets, as economies continue to face weak job creation or downward pressure on real wages. Labour market conditions remain fragile in many regions, with elevated long-term unemployment and youth unemployment rates, poor job quality, and high job insecurity. This environment demands more concerted poverty eradication efforts. The past two decades have been characterized by a significant decline in poverty rates worldwide.2 In recent years, however, there has been a visible slowdown in poverty reduction in Africa, Latin America and South Asia, with a high risk of reversal in poverty reduction trends in many economies. As lower household income is often associated with higher levels of indebtedness, these developments will restrict the capacities of households to invest in long-term assets, spend on nutrition, health care and education and prevent destitution and poverty. This will hinder progress on human capital development and productivity growth, which are critical imperatives for long-term sustainable development. An increase in poverty rates will also likely be accompanied by rising inequality. High inequality, in turn, has a negative feedback on growth as increased concentration of wealth can lead to a more inefficient allocation of resources and depress aggregate demand. In addition, high inequality undermines sustainable development and risks triggering political and social unrest.

For the corporate sector, sluggish demand conditions compounded by high uncertainty in the global environment have reduced incentives for firms to invest in productive capital. In spite of easy global monetary conditions, capital investment growth has failed to rebound after the global financial crisis and has markedly slowed down since 2014. The protracted period of weak investment can partly explain the slowdown in productivity growth across economies. Insufficient investments in enabling infrastructure, such as public utilities, transportation, and renewable energy will undermine growth and sustainable development prospects. Given the mutually reinforcing linkages between investment and productivity growth, failure to reverse the current trends will also depress productive capacities and growth potentials of the corporate sector in many economies.

Meanwhile, bank balance sheets in many economies have been affected by slower economic growth through deterioration in loan performance. Banks face strong headwinds from increasing corporate sector risks, large and volatile capital flows and, in some developed economies, negative interest rates. The ongoing vulnerabilities and instability in the financial system pose challenges to financing for development. As commercial banks continue to show high levels of risk aversion, development banks can play a crucial role in effectively mobilizing financial resources for productive investments and in ensuring continued access to credit for small and medium-sized enterprises.

On the fiscal front, weak economic growth has affected government revenue, resulting in a worsening of fiscal positions in many economies. For the commodity-dependent developing economies, the growing strains on public finances have been particularly evident in the collapse in commodity prices. Amid intensified pressures for fiscal consolidation, revenue growth may undermine Governments? capacities and political will to implement countercyclical fiscal policies and pursue development objectives. In efforts to preserve fiscal sustainability, there is a growing risk that countries will resort to cutting social protection expenditures, such as the provision of income support, health care and education. Cutbacks or delays in crucial infrastructure investments will worsen existing structural bottlenecks and constrain productivity growth, further impeding the realization of sustainable development. According to the Organization for Economic Cooperation and Development (OECD) Development Assistance Committee, development aid, excluding funds spent on refugees, increased by only a modest 1.7 per cent in 2015. However, if fiscal pressures should increase in the OECD economies, these flows may experience sharp declines going forward, worsening development prospects of the least developed countries that are dependent on external development assistance.

The challenging economic environment risks generating a vicious cycle of weak economic growth and deteriorating sustainable development prospects. While short-term vulnerabilities need to be addressed, it is equally important for policymakers to remain focused on advancing the sustainable development agenda. There is, therefore, an urgent need for a more balanced policy mix in the global economy, one that extends beyond the current overdependence on monetary policy. This includes a more supportive role for the public sector, through scaling up productive investments?particularly in infrastructure, but also in social sectors?including in social protection. The growing complexity and interlinkages between economic sectors and across countries also call for more effective policy coordination in order to maximize the positive spillover effects of various policy interventions, both at the domestic and international levels.

United States: prospects for 2016 interest-rate rise decline

At its meeting on 14-15 June 2016, the Federal Open Market Committee (FOMC) of the United States Federal Reserve (Fed) voted to maintain its current target range for the federal funds rate. The Committee cited the slowdown in the pace of improvement in the labour market and soft fixed investment growth as reasons for continued caution in the pace of interest rate normalization, while it continued to closely monitor global economic and financial developments.

At the time of its June meeting, the FOMC participants? assessments of appropriate monetary policy pointed to at least one 25-basis-point rise in interest rates before the end of 2016, with the majority of participants expecting a 50-basis-point rise by the end of the year. Since the United Kingdom?s referendum outcome, the prospects for an interest rate rise in the United States this year have diminished significantly. According to the Fed Fund futures market, the probability of an interest rate rise by the end of 2016 currently stands less than 30 per cent, compared to a 74 per cent probability at the beginning of June.3 Uncertainty surrounding the global outlook has increased, requiring the Fed to take a more cautious approach in adjusting its policy rate. The strengthening of the US dollar, which has appreciated by more than 1 per cent in nominal effective terms since the United Kingdom referendum, is also weighing on the Fed?s decision. The stronger exchange rate will put downward pressure on inflation. With core inflation currently standing well below the objective of 2 per cent, the strength of the US dollar can be expected to warrant a more gradual increase in the federal funds rate than anticipated previously.

Japan: strong yen poses challenges to business and Government

Since mid-2015, the yen?s effective exchange rate has been on an upward trend, appreciating by over 15 per cent in the year up to May 2016. The results of the United Kingdom referendum further strengthened this trend, as the yen appreciated by more than 3 per cent against the dollar in the week following the referendum.

The strong yen has weighed on demand for Japanese exports. During the first five months of 2016, export volume was 0.5 per cent lower compared to one year ago. In value terms, exports declined by 9 per cent. This has cut into profits of exporting firms, as reflected in falling equity prices of listed Japanese firms.

A stronger yen also complicates the Bank of Japan?s effort to increase the inflation rate to about 2 per cent. For the first five months of 2016, prices for imported components of domestically demanded goods declined by approximately 20 per cent on an annual basis, with the yen?s appreciation contributing to about one third of this decline.

Economies in transition: monetary easing in the CIS

Following the United Kingdom referendum, some Commonwealth of Independent States (CIS) currencies depreciated and stock markets lost value. Amid continued high uncertainty in the global environment, CIS commodity exporters face the risks of prolonged low commodity prices and sluggish global trade. Although capital inflows into the Russian Federation have largely dried out since 2014, the economy is not insulated from possible global financial shocks. In early July, the EU extended economic sanctions against the Russian Federation for another six months, until end-January 2017. The Government of the Russian Federation, in turn, extended its embargo on food imports from most of the OECD countries until end-2017.

Meanwhile, moderating inflation in the CIS has allowed for further widespread easing of monetary policies. The Central Bank of the Russian Federation reduced its policy rate by 50 basis points to 10.5 per cent in June. The central bank also raised foreign exchange reserve requirements for commercial banks to reduce dollarization of the economy. However, the region?s near-term investment prospects remain bleak, aggravated by banking sector pressures and high macroeconomic uncertainty.

Output trends in the region vary. The Russian Federation?s GDP is estimated to have shrunk by less than 1 per cent during January-May, while the economy of Azerbaijan contracted by 4 per cent in the same period. In contrast, Uzbekistan?s first quarter GDP grew by 7.5 per cent.

South-Eastern Europe may also face risks, stemming from the United Kingdom referendum result, including lower prices of commodities, sluggish demand from the EU, and subdued foreign direct investment (FDI) flows. Countries in the region may need to negotiate new trade deals with the United Kingdom. The ongoing political challenges in the EU are likely to postpone further enlargements (all countries in the region except Bosnia and Herzegovina are EU candidate countries), and the region may see diminished pre-accession assistance.

On the positive side, the weaker euro (to which most of the region?s currencies are pegged) may support the regions? exports to outside the euro area.

Africa: Nigeria removes currency peg

Amid a rapid decline in oil revenue and foreign exchange reserves, the Central Bank of Nigeria removed the naira?s sixteen-month peg to the US dollar in June. The move towards a more flexible exchange rate policy was aimed at alleviating severe foreign currency shortages and reducing price distortions in the economy. Nevertheless, the sharp depreciation of the naira following the announcement has increased risks in the near-term. Alongside the recent removal of fuel subsidies, the significantly weaker exchange rate will exacerbate already elevated inflation, which rose to a six-year high of 16 per cent in May. In addition, the prolonged and heightened currency volatility and financial market uncertainty pose a risk to investment prospects.

Across African countries, a divergence in growth trends was observed in the first quarter of 2016. In Nigeria and South Africa, GDP contracted at an annual pace of 0.4 per cent and 0.2 per cent, respectively, as low commodity prices affected economic activity in these economies. Growth in South Africa was further affected by prolonged drought conditions. In contrast, the Kenyan economy grew at a stronger pace of 5.9 per cent, supported by the tourism sector. Growth in Ghana also strengthened to 4.9 per cent, as improvement in agriculture output and telecommunication services offset weakness in the mining sector.

Developing East Asia: uncertain and uneven impact?of the United Kingdom referendum on the region

While the result of the United Kingdom referendum led to immediate negative reactions in the financial markets in developing East Asia, most of the region?s stock markets and currencies have quickly recovered. In the longer-run, heightened global financial instability resulting from the referendum will have relatively larger impact on the Hong Kong Special Administrative Region of China and Singapore, given their regional financial centre status and large exposure to United Kingdom banks. On the trade side, it is unlikely the referendum will have a strong first-round effect on the region?s economies, given that export to the United Kingdom accounts for less than 1 per cent of the region?s GDP. What is more concerning is the potential second-round trade impact from the possible weakening of the EU economy, which is a top export destination for the region?s many economies. The result of the referendum could also lead policymakers to reassess the prospect of the ASEAN Economic Community (AEC). Established at the end of 2015, a key objective of the AEC is to create a single market, similar to the EU. The current development in the EU adds uncertainty as to how quickly ASEAN would like to pursue further economic integration.

As the external environment is likely to remain weak and the prospect of a rate hike by the world?s major central banks has been considerably weakened by the United Kingdom referendum result, the region?s central banks could further cut policy rates to stimulate domestic demand. The continued low inflation environment across the region mitigates concerns over possible inflationary effects of such monetary easing.

South Asia: India announces further liberalization of FDI

In June, the Government of India unveiled measures to further liberalize FDI in the country. The measures extend across multiple sectors, including defence, pharmaceuticals, civil aviation, retail and e-commerce. After some modifications implemented last November, this new round of reforms continues to pave the way for fully opening all sectors to foreign investors, seeking to boost FDI inflows and accelerate job creation. The reform removes several bureaucratic obstacles, including local sourcing requirements, and relaxes restrictions on foreign ownership, bringing additional sectors to the ?Automatic Approval Route? of the Reserve Bank of India. Sectors such as defence and trading of food products are also now open for partial or full foreign ownership via government approval.

Amid these regulatory changes and robust growth, near-term FDI inflows to India are expected to continue the strong upward trajectory seen in recent years. In the Fiscal Year 2015-2016, net FDI inflows reached a record high of $36 billion. In the current context of subdued global growth, heightened global uncertainty and volatile portfolio flows to emerging economies, FDI inflows provide a stable financing source and an additional cushion to absorb potential shocks. In the medium-term, a key challenge is to channel FDI inflows into productive investments, especially in the manufacturing sector, and to promote technology transfers and skill upgrading of the Indian economy.

Western Asia: despite consolidation efforts, fiscal?deficits are widening further in GCC countries

Against the backdrop of lower oil prices, the countries of the Cooperation Council for the Arab States of the Gulf (GCC) have introduced several measures to address the deterioration of their fiscal accounts. These measures include significant spending and subsidies cuts, tax increases and new debt issuances. In some cases, privatization plans are also underway. Despite these efforts and the availability of large international reserves and sovereign wealth funds, fiscal deficits have surged in most GCC countries. In 2015, Saudi Arabia?s fiscal deficit reached a record high of 15 per cent of GDP, as fiscal revenues declined by more than 35 per cent. In Oman, the fiscal deficit in 2015 reached an estimated 18 per cent of GDP, and preliminary data points to an even further weakening in the first quarter of 2016, with oil revenues plummeting by 48 per cent compared to the first quarter of last year. In Bahrain, Kuwait and Qatar, fiscal deficits are also deteriorating more than previously expected. Consequently, government bond yields and sovereign default swaps have recently increased in several GCC countries.

Given worsening fiscal positions and visible growth slowdowns, the GCC countries may need to introduce additional measures to ensure fiscal sustainability, while supporting growth prospects. In this aspect, policymakers need to strike a delicate balance between the use of sovereign wealth funds, the level and composition of further expenditure cuts, and the introduction of additional direct and indirect taxes to increase non-oil fiscal revenues. The issuance of new debt would also require careful consideration, given its potential impact on local financial markets. For instance, while the Government?s reliance on domestic debt might help to develop local financial markets, it could also crowd-out private investment by constraining the local firms? access to credit.

Latin America and the Caribbean: direct impact from the United Kingdom referendum likely to be limited, but higher global uncertainty adds to challenges

The United Kingdom?s vote to leave the EU adds to the challenges for Latin America and the Caribbean, at a time when many of the region?s economies are facing considerable domestic and international headwinds. After suffering considerable losses immediately after the referendum, asset markets across the region quickly recovered. Given relatively weak trade linkages, the direct impact of slower growth in the United Kingdom on the region is projected to be small. In 2015, shipments to the United Kingdom accounted for only 1 per cent of the region?s total exports. While the United Kingdom is not a major export destination for most South American countries and Mexico, it is relatively more important for several member states of the Commonwealth of Nations, including Belize, Guyana and Jamaica. On the monetary side, the region will be affected by higher global uncertainty and elevated financial volatility. As the most liquid emerging market currency, the Mexican peso is particularly vulnerable to shifts in investor sentiments, as reflected in the increase in downward pressure on the peso following the outcome of the United Kingdom referendum. This prompted the Central Bank of Mexico to raise its policy rate by 50 basis points to 4.25 per cent on June 30, as concerns over rising inflation expectations outweighed those over weaker economic growth.

Welcome to the United Nations

Welcome to the United Nations