- World gross product projected to expand by just 2.4 per cent in 2016

- Forthcoming referendum on EU membership has increased financial market volatility in the United Kingdom

- Ongoing fiscal adjustment in Africa, the CIS, Latin America and Western Asia continues to constrain prospects

Global issues

Global growth outlook remains bleak; little prospect for turnaround in 2016

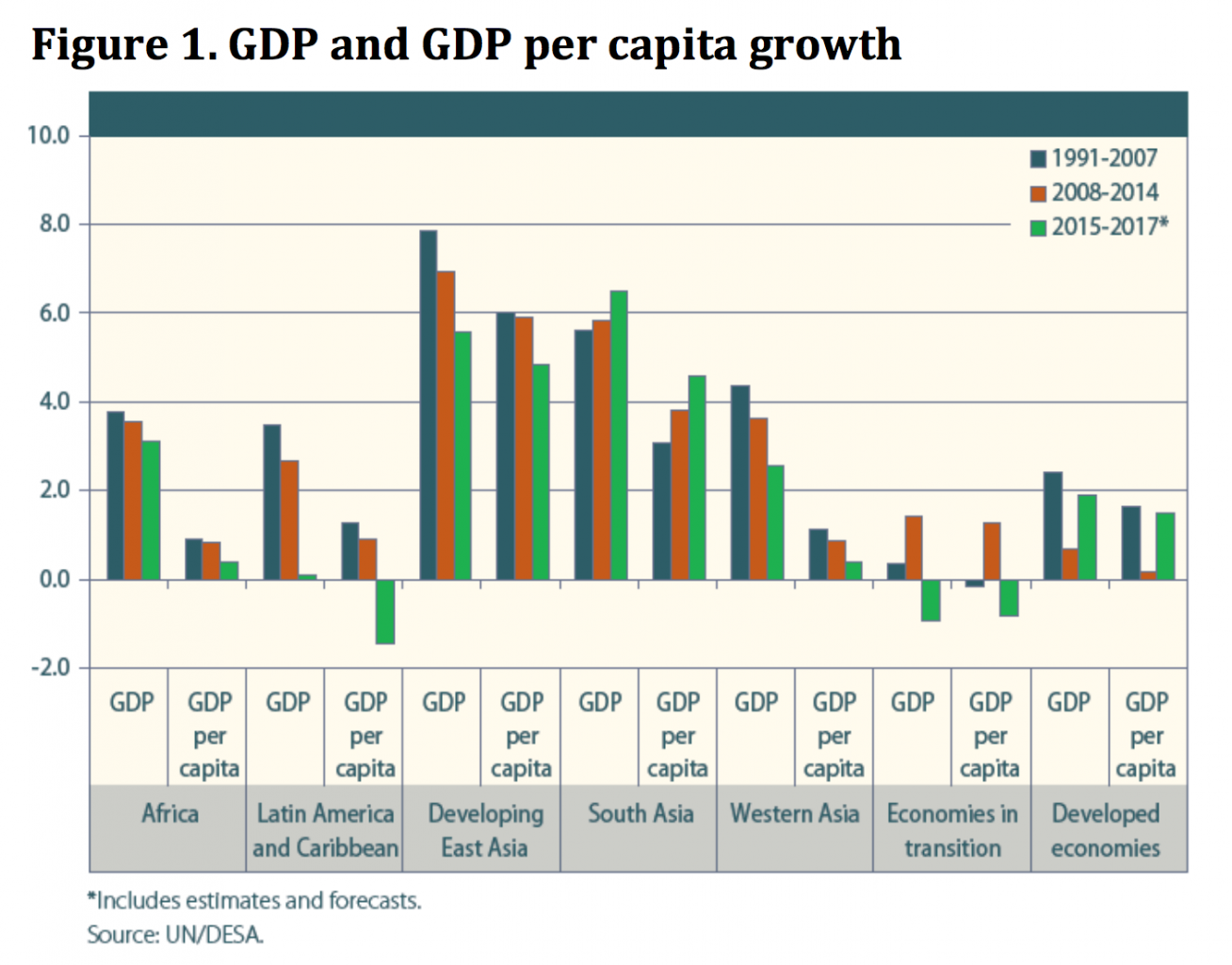

Growth in the world economy continues to be lacklustre, as highlighted in the World Economic Situation and Prospects Update as of mid-2016(figure 1). In the report, world gross product is projected to expand by just 2.4 per cent in 2016, the same rate as in 2015, marking a downward revision of 0.5 percentage points to the forecasts reported in December 2015. In recent months, global manufacturing activity appears to have stagnated while international trade flows remain weak. In May, oil prices exceeded $50 dollar per barrel for the first time since last November, following supply disruptions in countries such as Canada, Nigeria and Libya. Nevertheless, a sustained recovery in oil prices remains uncertain. Amid modest global demand, the oil market remains oversupplied with record-level oil production in the Russian Federation and Saudi Arabia, and a faster-than-expected expansion in oil production by the Islamic Republic of Iran.

Low commodity prices, mounting fiscal and current-account imbalances and policy tightening continue to restrain prospects for many commodity-exporting economies in Africa, the Commonwealth of Independent States (CIS) and Latin America and the Caribbean. This has been compounded by severe weather-related shocks, political challenges and large capital outflows in many developing regions.

Aggregate demand in the developed economies remains subdued, constrained by structural weaknesses, including sluggish investment growth, high indebtedness and persistent slack in the labour market. Nevertheless, a divergence in policy stances between these economies was observed in May.

The United States Federal Reserve indicated that it could lift policy rates in the coming months. In contrast, given weak domestic demand, the Japanese Government delayed a consumption tax increase. Meanwhile, the European Central Bank (ECB) maintained its highly accommodative monetary policy stance.

The United Kingdom's referendum on EU membership

Citizens in the United Kingdom of Great Britain and Northern Ireland will vote in a referendum on 23 June 2016 whether or not to remain a member of the European Union (EU). This will be the second time that the question of EU membership will be put to a popular vote since the United Kingdom became a member of the EU in 1973. A first referendum held in 1975 produced the approval of continued EU membership by 67 per cent of voters. Addressing public concerns regarding the direction of EU integration, the referendum follows from a campaign commitment made by the current Government back in 2013, pledging that if they won the 2015 election they would seek to renegotiate the United Kingdom?s relationship with the EU and then give the people of the United Kingdom the simple choice between staying in the EU under those terms or leaving the EU. The Government of the United Kingdom reached a renegotiated agreement with the other EU member States at the beginning of this year, addressing the first part of this pledge. The adjusted terms address issues such as immigration, and particularly rules on when foreigners can receive social benefit payments in the United Kingdom; clarification of monetary and exchange-rate independence of the United Kingdom; protection of the United Kingdom?s financial services industry from eurozone regulations; and a formal exemption from the EU?s effort to pursue ?ever closer union?.

The result of the referendum will carry significant weight in multiple dimensions, and this analysis maps out some of the economic issues that are linked to this outturn. The analysis is complicated by the considerable degree of uncertainty regarding the final policy arrangements under the scenarios-both in the case of a vote to leave the EU and in the case of a decision to remain. Exiting the EU would require the rearrangement and reconstitution of the international economic relations of the United Kingdom in many respects, including, for example, the negotiation of new trade agreements. The details of these alternative arrangements could take several different forms, as discussed below. At the same time, reforms introduced as part of the next stage of the EU single market will change the existing trading arrangements within the EU in areas such as services, energy markets, the digital economy and external agreements with non-EU countries.

Despite these uncertainties, it is possible to pinpoint a number of economic implications of the referendum. First, the anticipation of the referendum itself has already had a noticeable impact in financial markets. Sterling has depreciated by nearly 5 per cent against the euro since the start of the year, despite a further round of monetary easing by the European Central Bank, suggesting that investors are demanding a premium to hold United Kingdom assets. Option-implied volatilities of sterling and the FTSE index?which capture the cost of insuring portfolio and business activities against exchange-rate or equity market volatility?have increased noticeably since the start of the year.1 This rise in uncertainty in the run-up to the referendum may also be holding back business investment, which contracted in both the final quarter of 2015 and the first quarter of 2016.

While the risk premium associated with anticipation of the referendum can be expected to dissipate swiftly after the result is known, in the event of a vote to leave the EU, a considerable degree of uncertainty would remain regarding the future terms of the United Kingdom?s relationships with the EU and the rest of the world. The United Kingdom and the EU are highly integrated through trade, investment and labour mobility and the outcome of these negotiations will have a significant impact on many business and employment relationships. In the short-term, existing law and regulation would remain in place, until the final terms of a withdrawal from the EU are agreed. Potential models for these terms include membership of the European Economic Area (like Norway), a negotiated bilateral agreement (like Canada, Switzerland or Turkey), or no special agreement, in which case trade partnerships would be governed under WTO agreements. Negotiations over the final terms are generally expected to take a minimum of two years, suggesting a protracted period of economic uncertainty, which could have a significant and lasting impact on investment.

The outcome of the referendum and any pursuant negotiations will determine several key factors that will affect the overall economic outlook. These include: the level of tariff and non-tariff barriers to trade; the level of net fiscal transfers to the EU; regulation in certain markets; and legislation on labour mobility and migration. The level of barriers to trade will depend heavily on the terms agreed under an exit scenario and also on the extent of reforms introduced as part of the next stage of the EU single market. In the event of an increase in trade barriers, trade volumes would be expected to fall. Trade barriers may also affect the location decision of foreign firms, as survey evidence indicates that access to the European market is an important input into the location decision of foreign firms based in the United Kingdom. Trade and foreign direct investment (FDI) encourage technological diffusion across borders, meaning that a rise in trade barriers could also adversely affect productivity growth.

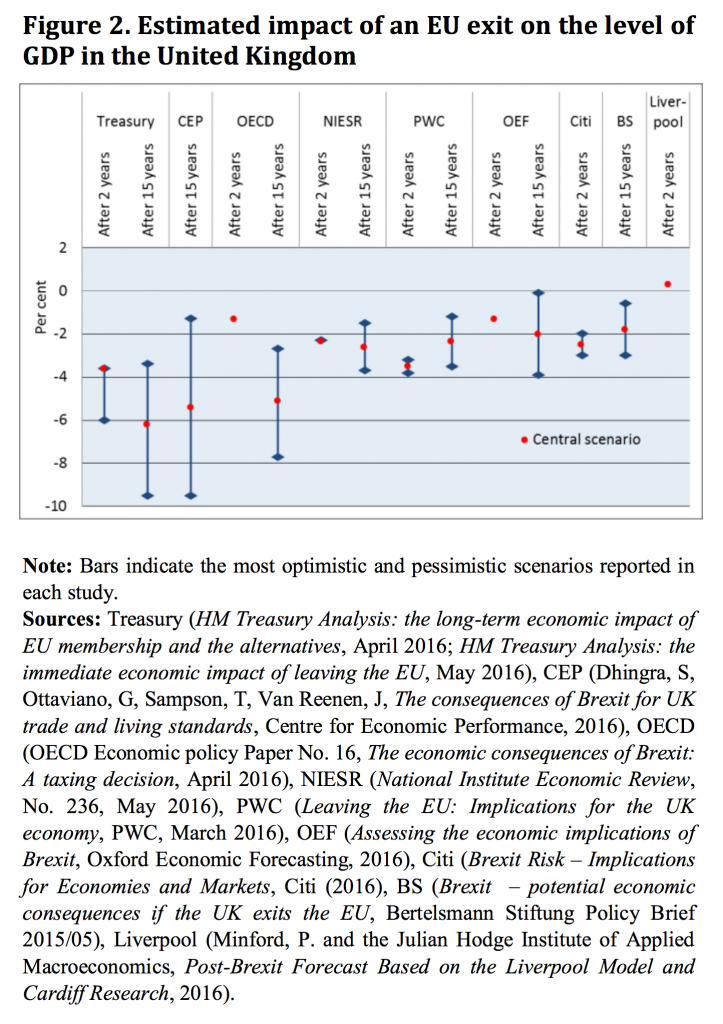

Estimates of the impact of a decision to leave the EU on the United Kingdom economy have yielded wide-ranging results (figure 2). The United Kingdom Treasury?s estimates can be viewed as a lower boundary, suggesting that the level of output in the United Kingdom could be as much as 9.5 per cent lower by 2030 if the referendum leads to a withdrawal from the EU compared to a scenario of remaining in the EU. The vast majority of modelling studies expect that the level of gross domestic product (GDP) in the United Kingdom will be lower in the event of an EU exit, as losses of trade, FDI and investment tend to outweigh positive impacts from lower levels of regulation and savings on contributions to the EU budget. One exception is the study based on the Liverpool Model. The primary argument in this study is that withdrawal from the EU allows the removal of non-tariff barriers to trade, particularly in agriculture and manufacturing sectors. Several other studies also highlight the different sectoral sensitivities to EU membership, identifying, for example, the financial services sector as particularly vulnerable.2

Estimates of the impact of a decision to leave the EU on the United Kingdom economy have yielded wide-ranging results (figure 2). The United Kingdom Treasury?s estimates can be viewed as a lower boundary, suggesting that the level of output in the United Kingdom could be as much as 9.5 per cent lower by 2030 if the referendum leads to a withdrawal from the EU compared to a scenario of remaining in the EU. The vast majority of modelling studies expect that the level of gross domestic product (GDP) in the United Kingdom will be lower in the event of an EU exit, as losses of trade, FDI and investment tend to outweigh positive impacts from lower levels of regulation and savings on contributions to the EU budget. One exception is the study based on the Liverpool Model. The primary argument in this study is that withdrawal from the EU allows the removal of non-tariff barriers to trade, particularly in agriculture and manufacturing sectors. Several other studies also highlight the different sectoral sensitivities to EU membership, identifying, for example, the financial services sector as particularly vulnerable.2

The economic issues that are tied to the outcome of the referendum are magnified further by the nexus between the economic and political dimension of the referendum. In the political realm, recent developments such as the migration crisis in Europe have already strengthened voices across the EU that question the principle of ever increasing integration. This is further evidenced by the outcome of various recent elections within the EU. In case of a United Kingdom?s vote in favour of an exit from the EU, stronger calls for more decentralization and a stronger role for nation-states could quickly follow in other countries and regions in the EU. Along this trajectory, maybe the most fundamental economic fallout of a United Kingdom?s exit from the EU would be the cataclysmic role it could play in accelerating the demise of the core principles of the EU, namely freedom of movement for people and goods and a coordinated and standardized approach in numerous policy areas.

Japan: tax hike delayed again

On 1 June, as anticipated in the World Economic Situation and Prospects Update as of mid-2016, the Japanese Government decided to further postpone the consumption tax hike (from 8 per cent to 10 per cent) from April 2017 to October 2019. The Government will also propose a supplementary budget to support growth. This policy shift is considered to be critical to prevent economic contraction from happening again. While the previous consumption tax rate hike in April 2014 increased consumption tax revenue by almost 50 per cent in that fiscal year, it triggered a sharp decline in private consumption, resulting in an economic recession. The subsequent recovery has been sluggish and uneven. The level of total private consumption remains more than 2 per cent lower than in 2013. Weak nominal wage growth and the long-term trend of population decline have also dragged on consumption.

Economies in transition: diverging trends

Over the last six months, economic forecasts for the CIS region have been revised downward against the backdrop of lower international energy prices, the contractionary impact of tighter fiscal policies, and domestic political uncertainties. The aggregate GDP of the CIS and Georgia is expected to contract by 1.3 per cent in 2016, returning to modest growth of 1.1 per cent in 2017. The Russian economy is forecast to shrink by 1.9 per cent in 2016 owing to fiscal tightening and further declines in private consumption and invest?ment, while international sanctions continue. Suspension of the free trade agreement with Ukraine by the Russian Federation constrains Ukraine?s near-term growth, which is expected to stagnate in 2016. Generally low growth rates are projected for the smaller CIS economies in 2016, which saw a significant contraction in remittances from the Russian Federation in 2015. This has also affected employment opportunities for migrant workers from the Caucasus and Central Asia. However, if the recent recovery in the oil price to around $50 per barrel is sustained, this may enable a turnaround in the Russian Federation and other oil-exporting countries in 2016. Given the strong intraregional linkages, a recovery in the Russian Federation would lift growth across much of the region.

Prospects for South-Eastern Europe remain more favour?able, supported by stronger demand from the EU and low energy prices. Regional GDP growth is projected to accelerate to 2.3 per cent in 2016 and 2.6 per cent in 2017. In the first quarter, the Serbian economy expanded by 3.5 per cent. Inflation in the region should remain at low levels, providing an opportunity to relax monetary policy in countries with flexible currencies. In early May, Albania further reduced its policy rate, reaching a new record low. Labour market conditions in general have im?proved.

Governments in the region are facing the dilemma of pursuing fiscal consolidation while stimulating growth. Medium-term prospects are also constrained by infra?structure and energy bottlenecks, low labour force participation, nascent financial markets and a challenging business environment. Europe?s migrant crisis compounds the challenges for the region.

Africa: growing fiscal vulnerabilities pose risk to growth outlook

Persistently low global commodity prices have intensified fiscal pressures in many African countries. This poses a growing challenge for policymakers in their efforts to achieve a balance between preserving fiscal sustainability while supporting slowing economic growth.

Weakening public finances have prompted authorities across the continent to announce budget cuts or fiscal reform measures. Angola and the Democratic Republic of the Congo plan to cut public expenditure in the 2016 fiscal year by approximately 20 per cent and 30 per cent respectively, while South Africa aims to reduce its budget deficit to 2.4 per cent of GDP over the next three years, from 3.9 per cent in 2015. In Nigeria, fuel subsidies were removed, resulting in a 70 per cent increase in retail petrol prices. For the Nigerian economy, the need to consolidate fiscal spending is particularly critical, as revenue has also been affected by sharp disruptions to crude oil production following renewed unrest in the Niger Delta. Meanwhile, a few countries, including Angola and Zambia, are seeking financial assistance from the International Monetary Fund, amid deterioration in their external and fiscal positions.

Fiscal vulnerabilities pose an increasing risk to the growth outlook for Africa. Cutbacks or delays in much needed infrastructure investment, such as in the energy and health sectors, will weigh on the progress of economic and social development. This highlights the urgent need for policymakers to accelerate economic diversification efforts and to seek new sources of Government revenue in order to ensure stronger and more sustainable growth prospects.

Notwithstanding fiscal issues, downside risks remain high, arising from prolonged drought conditions, currency volatility, security concerns and the recent outbreak of yellow fever.

Developing East Asia: the region expects modest deceleration in growth

The developing economies of East Asia are projected to see only a modest deceleration in growth this year. Domestic demand?particularly private consumption?will remain the engine of growth for most countries. Despite the stabilization or depreciation of most of the region?s major currencies since early or mid-2015, exports continued to decline in early 2016. Investment remains generally weak. Countries that are projected to benefit from the Trans-Pacific Partnership might step up investment, but the direct effect of the trade agreement during the forecast period is uncertain given the domestic political hurdles that countries face regarding ratification of the deal. The establishment of the ASEAN Economic Community at the end of 2015 and the introduction of other regional economic integration measures could also entice additional private investment. Inflation has been subdued across the region, with some economies facing deflationary pressure. For the region as a whole, GDP growth is projected to average 5.5-5.6 per cent during 2016-2017. China is projected to grow by 6.4-6.5 per cent over the same period, in line with the Government target. The risk of a more substantial slowdown of the Chinese economy remains a regional and global concern.

Fiscal policy is expected to play a more prominent role in boosting growth, although there are concerns regarding striking the balance between fis?cal discipline and flexibility in several countries. Room for further monetary loosening still exists for many economies. However, this may entail risks in relation to capital outflow and the rising level of household and corporate leverage.

South Asia: growth outlook improves, but challenges persist

Despite weak global growth, South Asia is expected to remain the fastest-growing developing region, led by India. Regional GDP growth is expected to accelerate from 6.1 per cent in 2015 to 6.6 and 6.8 per cent in 2016 and 2017, respectively. GDP growth in India is projected to reach 7.4-7.5 per cent during 2016-2017. Private consumption is projected to remain vigorous in Bangladesh and India, and to pick up gradually in the Islamic Republic of Iran and Pakistan. Investment demand is also projected to strengthen in some countries. For instance, in the Islamic Republic of Iran, the lifting of economic sanctions is revitalizing the oil sector. Meanwhile, investment demand in India is projected to rise gradually owing to domestic reforms, rising capital inflows and public infrastructure investments. However, private investment growth will be somewhat constrained by wobbling manufacturing output, stressed corporate balance sheets and banking system fragilities. In Pakistan, investment demand will remain relatively robust, supported by Chinese investments under the China-Pakistan Economic Corridor. Further cuts in policy interest rates in recent months in India and Pakistan will provide additional support to economic activity. However, the economic situation in smaller economies, such as Afghanistan and Nepal, is more challenging due to country-specific factors.

Despite the generally favourable outlook, regional growth will remain below its potential. Policymakers should renew efforts to tackle structural challenges such as energy shortages, infrastructure and connectivity gaps, and feeble fiscal revenues. Broadening the tax base can significantly contribute to addressing large infrastructure needs and building fiscal space for effective countercyclical policies.

Western Asia: economic growth slows

In recent years, the economic outlook in the countries of the Cooperation Council for the Arab States of the Gulf (GCC) has deteriorated noticeably. On average, GDP growth in GCC countries is expected to fall to a meagre 1.6 per cent in 2016, less than half the growth pace during 2013-2015. The decline in oil prices has imposed significant macroeconomic adjustments on GCC countries, slowing down domestic demand and weakening fiscal accounts. Countries such as Bahrain, Oman and Saudi Arabia will experience a sharp deceleration in economic growth, while economic activity in Kuwait is expected to remain constrained. Also, unemployment rates will remain relatively high, especially among the youth. Against this backdrop, GCC countries are moving into fiscal austerity and implementing major tax and subsidy reforms. In addition, countries like Saudi Arabia are undertaking medium-term structural reforms in order to diversify their economies and improve productivity.

Meanwhile, growth in Turkey is projected to expand at a moderate pace. Private consumption is expected to rise, while investment demand remains subdued. Fiscal and monetary policies will likely continue to be relatively tight. Turkey?s economy faces significant downside risks from political uncertainties and security concerns. The economy also remains vulnerable to sudden stop of capital flows and high exchange-rate volatility. Meanwhile, the economic outlook remains perilous in Iraq, the Syrian Arab Republic and Yemen, due to military conflicts and geopolitical turmoil. Overall, GDP growth in Western Asia is expected to slow from 2.8 per cent in 2015 to 2.4 per cent in 2016.

Latin America and the Caribbean: overall regional outlook is bleak, but bright spots exist

The short-term outlook for Latin America and the Caribbean is bleak in the face of significant internal and external headwinds. As Brazil and the Bolivarian Republic of Venezuela remain mired in deep recessions, the region's GDP is projected to contract by 0.8 per cent in 2016, virtually the same rate as in 2015. This would mark the first time since the debt crisis in 1982-83 that regional output falls for two consecutive years. Many economies, especially in South America, have been hit hard by lower commodity prices and large capital outflows. In some cases, the slowdown in economic activity has been further exacerbated by tighter monetary and fiscal policies as Governments and central banks have been responding to rising inflation and increased fiscal pressures. While the overall outlook for the region is not favourable, there are some bright spots, including Bolivia, the Dominican Republic, Nicaragua, Panama and Peru. In Bolivia, full-year growth in 2015 was stronger than generally expected, with GDP expanding by 4.9 per cent following robust private and public consumption. A few green shoots have begun to appear in Brazil. Although GDP contracted for a fifth consecutive quarter in the first quarter of 2016, the decline was less severe than expected (0.3 per cent quarter-on-quarter and 5.4 per cent year-on-year). At the same time, business and consumer confidence have picked up as the new Government took power in early May. A key question is how the Government's planned fiscal adjustment programme, which will likely include both short-term and structural measures, will impact macroeconomic conditions and growth.

Welcome to the United Nations

Welcome to the United Nations