- Global growth projected to strengthen to 2.7 per cent in 2017 and 2.9 per cent in 2018

- High food price inflation in several countries raises concerns over worsening food insecurity

- Brazil returns to positive growth in the first quarter

Global issues

Global growth strengthens, but prospects for some of the world?s poorest regions have deteriorated

Global economic growth has strengthened since January, supported by a moderate recovery in trade and investment. According to the World Economic Situation and Prospects as of mid-2017 report (WESP mid-2017), world gross product is expected to expand by 2.7 per cent in 2017 and 2.9 per cent in 2018. Underpinning the recovery is firmer growth in many developed economies. Prospects for many economies in transition have also strengthened. East and South Asia remain the world?s most dynamic regions, benefiting from robust domestic demand and supportive macroeconomic policies.

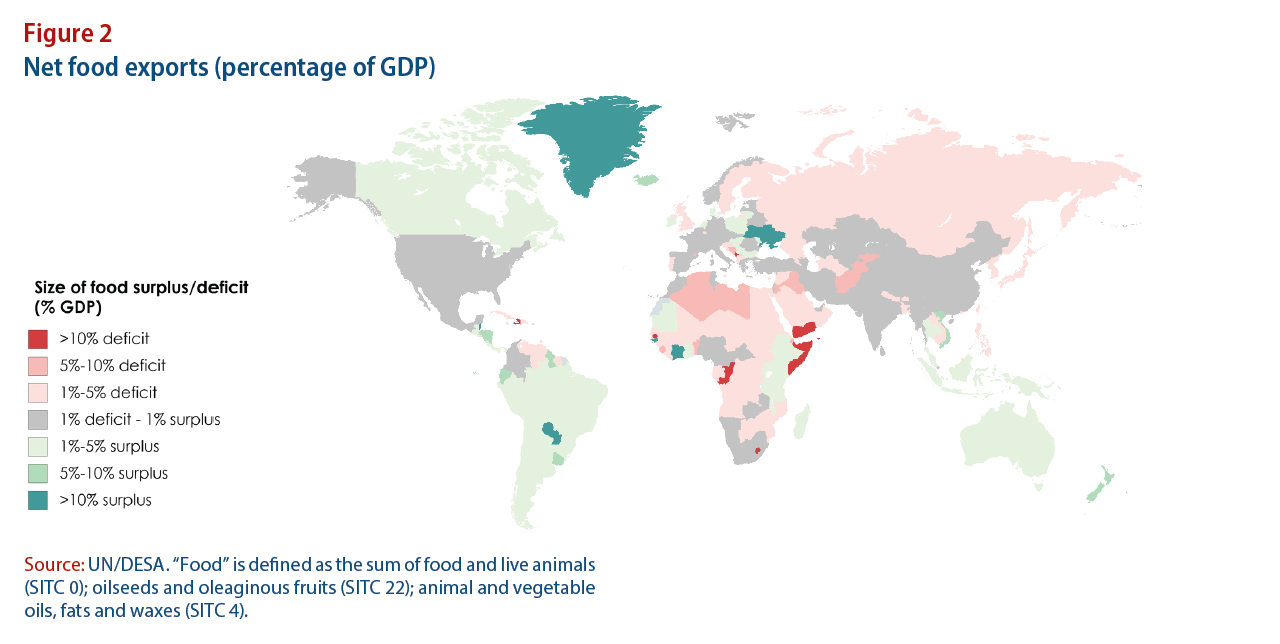

However, the outlook for a few developing regions has deteriorated, with growth remaining well below the levels needed for rapid progress towards achieving the Sustainable Development Goals (SDGs). In Africa, domestic and regional pressures have eclipsed the modest recovery in global commodity prices. Gross domestic product (GDP) per capita declined in Central, Southern and West Africa last year, with negligible per capita growth anticipated in 2017 and 2018 (figure 1). The outlook for several of the least developed countries (LDCs) has also deteriorated. The LDCs as a group are projected to experience average growth of only 4.7 per cent in 2017 and 5.3 per cent in 2018, well below the SDG target of at least 7 per cent GDP growth. Under the current growth trajectory and assuming no changes in income inequality, nearly 35 per cent of the population in the LDCs may remain in extreme poverty by 2030.

On the issue of environmental sustainability, the WESP mid-2017 notes that the level of global carbon emissions has stalled for three consecutive years. However, signs of weakening global commitments, as illustrated by the recent withdrawal of the United States of America from the Paris Agreement, has raised concerns that these positive developments could be reversed.

On the issue of environmental sustainability, the WESP mid-2017 notes that the level of global carbon emissions has stalled for three consecutive years. However, signs of weakening global commitments, as illustrated by the recent withdrawal of the United States of America from the Paris Agreement, has raised concerns that these positive developments could be reversed.

WESP mid-2017 also highlights the heightened uncertainty in the international policy environment as a key downside risk to the global growth outlook. This includes the risk of a resurgence of trade protectionism, with negative implications on trade, investment and growth. In many emerging economies, the corporate sector remains vulnerable to sudden changes in financial conditions and destabilizing capital outflows.

Given pressing global challenges, additional policy efforts are needed to foster an environment that will accelerate medium-term growth and tackle poverty. This includes a combination of shortterm policies to support consumption among the most deprived and longer-term policies, including increasing investment in rural infrastructure, clean energy, healthcare and education.

Rapid escalation in food price inflation impacting nearly thirty countries worldwide

The WESP mid-2017 warns that the outlook for several of the least developed countries and countries where poverty levels remain high have deteriorated, raising concerns over both the short-term and longer-term prospects for addressing poverty and inequality. Of immediate concern, tens of millions face famine or severe food insecurity in parts of Kenya, northeast Nigeria, Somalia, South Sudan and Yemen, where widespread displacement and food supply blockages due to conflict have been compounded by droughts that have destroyed crops and livestock.

Rising food prices have also impacted food security in many other countries. Food price inflation in the first months of 2017 stands at double- or triple-digit levels in nearly 30 countries, two-thirds of which are in Africa. This raises particular concerns in relation to poverty, inequality and social and political stability. High food prices disproportionately impact the poorest households, given that food constitutes a large share of their consumption basket. Those who rely on subsistence farming are particularly at risk where food price spikes are driven by losses in agricultural output. High food prices also have the potential to spark civil unrest and political instability, as observed in many countries during the global food price spikes of 2007-08 and 2011.

At the global level, food price inflation has risen since mid-2016, but remains well below the peaks seen in 2007-08 and 2011. Historically, food price shocks, such as in 2007-08 and in 1972-74, have been associated with a sharp rise in the oil price, which is closely linked to the costs of fertilizers, food transportation and industrial agriculture. However, the current relatively low oil prices suggests a more dominant role for other factors that drive food price inflation, which include:

- Agricultural production, which is sensitive to weather-related shocks and other disasters, including disease, pests and fires; freshwater resources and fisheries are also vulnerable to such shocks;

- Government policy, such as tariffs, subsidies, trade restrictions and agricultural policy, for example in relation to biofuels;

- Exchange rates, especially in countries that are dependent on food imports;

- Conflict situations, which can disrupt food production and distribution.

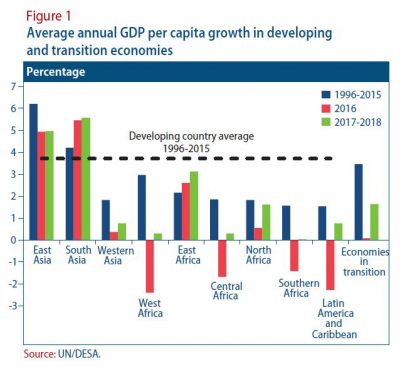

History, geography, demographics and policy choices all play a role in determining whether a country is a net exporter or importer of food. In general, countries in the Americas and Oceania are net food exporters, while much of Asia and large parts of Africa are net food importers ? with notable exceptions such as C?te d?Ivoire, Ethiopia, Ghana, Guinea-Bissau, Madagascar, Malawi, Mauritania, the Seychelles, Uganda, United Republic of Tanzania (figure 2). Many small island States are also net food importers, due to restricted availability of arable land.

Both net importers and net exporters of food are sensitive to developments in agricultural production. In net exporting countries, losses in the agricultural sector reduce farming income, while pushing up prices for food and leading to a heightened risk of food insecurity. Against a backdrop of falling fiscal revenue, governments also face weakening fiscal positions, given the additional costs of providing relief. Countries such as Ethiopia, Madagascar, Malawi, Uganda, United Republic of Tanzania and Zambia, where at least 50 per cent of employment is in agriculture, are particularly exposed to agricultural output losses.

Net food-importing countries are vulnerable to external shocks to food supply, in addition to any domestic disruption to distribution, as well as currency shocks, which impact the price of all imports. For example, currency depreciation in Egypt and Sierra Leone is the main factor driving high food price inflation in these countries. High food price inflation in net food-importers such as Burundi and Rwanda has been associated with trade restrictions and poor harvests in the United Republic of Tanzania and Uganda, where dryness and pests have impacted agricultural production.

The widespread reliance on imported food in Africa poses a longer-term challenge for the continent. Population growth in Africa is projected to continue to outpace that in the rest of the world over the next several decades, pointing to a significant rise in the demand for food. Unlike many other parts of the world, Africa does not have an abundance of arable land, with deserts and jungles restricting the scope to expand agricultural production in many countries. This suggests that most countries will continue to rely heavily on imported food. In order to meet the rising demand and reduce risks of food insecurity, infrastructure improvements to facilitate both water and rail transport are essential.

Developed economies

United States: Growth supported by investment in the mining sector and defense spending

Despite a disappointing start to 2017, the underlying pace of economic growth in the United States remains steady, and on track to record growth of 2.1 per cent in 2017 and 2018, as projected in the WESP mid-2017. While household spending on durable goods has been volatile in recent quarters, residential investment remains strong, and non-residential investment has also seen some revival. Investment in mining exploration, shafts and wells expanded by more than 50 per cent in the first quarter of 2017, which may in part reflect an easing of environmental regulation. Economic activity in 2017 and 2018 is also expected to gain some support from additional government spending, largely in the areas of defense, which will be partly offset by cuts in spending on education, healthcare, environmental protection and development aid.

The Federal Open Market Committee (FOMC) of the United States Federal Reserve is expected to raise interest rates by a further 25 basis points at its meeting on 13-14 June. The move will be largely driven by positive developments in the labour market, with the unemployment rate dropping to 4.3 per cent in May 2017, the lowest level in more than 15 years.

Europe: Unemployment continues to decline

Unemployment remains on a downward trajectory in Europe, falling to 8.0 per cent in the European Union (EU) in March, compared to 8.1 per cent in the previous month and 8.7 per cent in the same period a year ago. Among the EU countries, Greece and Spain continued to register the highest unemployment rates at 23.5 per cent and 18.2 per cent, respectively. In contrast, unemployment stood at less than 5.0 per cent in the United Kingdom, Hungary, Malta, Germany and the Czech Republic. Notably, 23 out of the 28 EU countries showed a decline in their unemployment rates in March. These positive developments in the labour market reinforce the robust growth outlook of the EU economy as a whole, which has been mainly supported by solid private consumption and the European Central Bank?s extremely accommodative policy stance. In the area of international trade, Switzerland saw some recovery in external demand in the first quarter of the year. Exports increased by 2.4 per cent in nominal terms, underpinned by chemical and pharmaceutical exports and stronger demand from Germany, China and the United States. Alongside flat nominal imports, this resulted in a record trade surplus of SFR 10.8 billion.

Meanwhile, growth in many of the EU members from Eastern Europe exceeded expectations in the first quarter. Romania registered the fastest pace of growth in the EU at 5.6 per cent, while Hungary, Poland, Slovenia and the Baltic States also experienced favourable growth during the quarter.

Economies in transition

CIS: Modest growth in the Russian Federation

The Russian Federation registered modest growth of 0.5 per cent in the first quarter of 2017. Although recent macroeconomic trends have been encouraging, the economy still faces several hurdles. Amid shrinking real disposable income and weak household balance sheets, consumer spending indicators worsened in April. Output in the energy sector has also been constrained by the OPEC agreement to reduce oil production. Following the recent announcement to extend the agreement until March 2018, the Russian Federation is expected to cut oil output further in the coming months. Nevertheless, the return to positive investment growth in the first quarter is an encouraging development. In addition, remittances sent from the Russian Federation to the smaller Commonwealth of Independent States (CIS) economies in Central Asia and the Caucasus grew in the first quarter. Remittance flows to Armenia is estimated to have increased by around 15 to 20 per cent, contributing to the economy?s strong first quarter expansion of 6.5 per cent, as private consumption and services growth improved. On the inflation front, faster-than-expected disinflation was recorded in Belarus. In late May, the National Bank of the Republic of Belarus decided to reduce its key policy rate by 100 basis points to 13 per cent.

Despite the modest recovery in oil prices, the banking sectors of the CIS energy exporters have remained under pressure. In May, the International Bank of Azerbaijan (the largest bank in the country) missed a $100 million payment and announced its intention to restructure around $3.3 billion of its debt and deposits. In South-Eastern Europe, Serbia registered disappointing growth of 1.0 per cent in the first quarter. The growth slowdown was to a large extent attributed to the abnormally cold weather and extensive snowfalls that disrupted transport links and hindered activities in the agricultural, construction and retail sectors. As the effects of these temporary factors wane, domestic demand is expected to gain momentum in the coming quarters.

Developing economies

Africa: Nigerian economy contracts further

In the first quarter of 2017, the Nigerian economy contracted by 0.5 per cent on a year-on-year basis, marking the fifth consecutive quarter of contraction in Africa?s largest economy. The deterioration in economic activity was largely due to the fall in oil production compared to the first quarter of 2016. Nevertheless, production was significantly higher than output levels seen in the third quarter of 2016, at the height of militant attacks to oil infrastructure. In contrast, the non-oil sector grew at a stronger pace, driven by the agriculture, information and communication technology, manufacturing and transportation sectors.

Looking ahead, Nigeria?s oil sector may continue to recover, following ongoing peace talks and reports that a damaged pipeline has been fixed after a year-long disruption. However, any resurgence in attacks to pipelines or rise in political instability could derail this recovery, and a rapid turnaround in the Nigerian economy is unlikely. The Governor of the Central Bank of Nigeria projects a continued annual economic contraction up until the third quarter of this year. Meanwhile, due to poor harvests, food stocks are at their lowest with many households in the country already facing food insecurity. Estimates indicate 2.8 million people will be in urgent need of food between June and September. While still at the ?minimal? phase, the food situation could worsen due to ongoing local conflicts or a further depreciation of the domestic currency.

East Asia: Growth outlook remains positive but downside risks have increased

The East Asian region is projected to expand at a steady pace of 5.6 per cent in both 2017 and 2018. Growth will continue to be driven by robust domestic demand, in particular private consumption and public investment. The region will also benefit from a recovery in exports, amid a gradual improvement in global growth.

The region?s positive outlook has been reinforced by the recent release of stronger-than-expected first quarter GDP growth figures in several economies, including China, Hong Kong Special Administrative Region of China, Malaysia, the Republic of Korea, Taiwan Province of China and Thailand. In addition, policymakers in the region have also announced a range of fiscal and pro-growth measures that will provide support to domestic activity going forward. These measures include accelerating infrastructure investment, improving access to finance for small and medium enterprises, and enhancing corporate tax incentives.

Nevertheless, downside risks to the region?s growth outlook have increased. The shifting policy direction in the United States and in parts of Europe poses a risk of a significantly more restrictive global trade environment. This could adversely affect East Asia?s overall growth prospects, given the region?s high trade openness and deep integration in global and regional value chains. In addition, a sharper-than-expected growth slowdown in China will have large spillovers to the region through trade, financial and investment channels. For several economies, high private sector debt continues to pose a risk to financial stability and growth.

South Asia: Favourable growth outlook supported by domestic demand and sound macroeconomic policies

South Asia is projected to grow by 6.7 per cent in 2017 and 7.1 per cent in 2018, buoyed by vigorous private consumption, domestic reforms and supportive macroeconomic policies. Despite temporary disruptions arising from the demonetization policy, economic conditions in India remain robust, with GDP growth projected to rise to 7.3 and 7.9 per cent in 2017 and 2018, respectively. However, stressed bank and corporate balance sheets will constrain investment activity in the near term. Growth in the Islamic Republic of Iran is strengthening, on the back of rising oil production and exports, as well as higher private investment. Meanwhile, economic growth in Nepal and Maldives is expected to gain momentum, while Bangladesh, Bhutan and Pakistan are projected to maintain a moderately robust growth path. Regional inflation reached a multidecade low last year and is projected to remain generally stable, providing space for accommodative monetary policy in most economies. Sri Lanka, however, is an exception, as inflationary pressures coupled with stubbornly high credit expansion have resulted in a tighter monetary stance.

In most economies, fiscal policy has remained moderately tight, but with some flexibility to boost public infrastructure. A key challenge is to improve fiscal revenues and the capacity to implement counter-cyclical policies, which require a broadening of the tax base and improved tax compliance. Given the large infrastructure gaps, public investments should crowd-in private investments in areas such as energy, transport and water/sanitation. Domestic reform setbacks, heightened political instability and a sudden tightening of global financing conditions, however, pose downside risks. In addition, a surge in inflation can rapidly force a tighter monetary stance, dampening private consumption. The favourable regional outlook will be conducive for further improvements in the labour market and gains in poverty reduction.

Western Asia: Cautious optimism despite ongoing geopolitical tensions

According to the WESP mid-2017, Western Asia is forecast to see aggregate growth of 2.1 per cent in 2017 and 2.9 per cent in 2018. For 2017, this represents a downward revision since January, due to weaker prospects in Turkey and a projected decline in crude oil production under the OPEC-led agreement, which was recently extended into 2018. Turkey continues to face balance of payments pressures which have had negative spillover effects on domestic demand. In view of higher oil prices, however, cautious optimism emerged among the member states of the Gulf Cooperation Council (GCC), namely Bahrain, Kuwait, Oman, Qatar, Saudi Arabia and the United Arab Emirates. The broad money stock growth has been recovering in these countries after a significant plunge last year, indicating a moderate domestic demand expansion, amid stable financing costs. For Jordan and Lebanon, the growth outlook remains subdued due to weak domestic demand prospects. Both countries experienced rising inflation as the terms-of-trade advantage of weak commodity prices dissipated. Israel will continue to see robust growth, driven by a stable expansion of domestic demand and low inflation, despite a tightening labour market. Meanwhile, Iraq, Syria and Yemen continue to face humanitarian crises and dire economic situations.

Latin America and the Caribbean: Modest regional recovery expected for 2017 and 2018 amid return to positive annual growth in Argentina and Brazil

After two years of negative GDP growth, Latin America and the Caribbean will see a modest economic recovery in 2017 and 2018. Regional growth is forecast at 1.1 per cent in 2017 and 2.5 per cent in 2018, following a deeper-than-expected contraction of 1.3 per cent in 2016. The moderate regional recovery is expected to be supported by a return to positive annual growth in Argentina and Brazil. In the first quarter of 2017, the Brazilian economy grew by 1.0 per cent compared to the previous three months ? the first quarterly expansion since late 2014. Economic activity was boosted by a surge in agricultural production, which increased by 13.4 per cent on the back of a record harvest of soybeans, one of the country?s main exports. In view of heightened political uncertainty and declining investment, however, Brazil?s recovery remains fragile, with only a marginally positive growth projected for 2017. Meanwhile, Mexico?s economy continues to show resilience to higher interest rates and uncertainty over trade and migration policies in the United States. In the first quarter of 2017, GDP increased by 2.8 per cent on a year-on-year basis, as persistent growth in private consumption and exports offset weak public and private investment.

?

Welcome to the United Nations

Welcome to the United Nations