- Argentina re-enters international capital markets after 15 years

- Deflationary trends remain a concern in euro area and Japan

- GDP growth in China in line with government target, but United States and Republic of Korea fall short of expectations

Global issues

Argentina?s debt agreement underscores need for a multilateral approach to sovereign debt restructuring

Fifteen years after defaulting on its debt, Argentina returned to international capital markets in mid-April, issuing $16.5 billion in sovereign bonds. The sale, which included 3-year, 5-year, 10-year and 30-year bonds, was four times oversubscribed; however, Argentina had to settle for hefty coupon rates from 6.25 to 7.62 per cent, given the below-investment-grade status of its bond issue. About 55 per cent of the proceeds from the recent debt issue would be used to pay the so-called hold-out creditors from the Argentine default in 2001. This group of investors, which mainly consists of US-based hedge funds, refused to participate in two rounds of debt restructuring in 2005 and 2010, when a vast majority of bondholders (around 93 per cent) accepted the Argentinian Government?s offer. Since Argentina?s bonds did not include a collective action clause (CAC) that would have forced minority investors to accept the deal agreed by a super-majority, a small group of creditors could hold out and demand full repayment, resulting in a long-lasting legal battle with the Government. In February 2016, Argentina?s new Government finally reached an agreement in principle with the main hold-out creditors. The agreement foresees payment of about 75 per cent of the full amount outstanding, including principal, interest and

legal fees.

While the resolution of the legal dispute eased Argentina?s return to the international capital market, it sets a costly precedent for sovereign issuers and the demonstrated success of a hold-out strategy could further complicate future sovereign debt restructuring processes. The hold-outs, which had bought many of the bonds at a steep discount, are expected to make enormous returns on their investment. On the other hand, Argentina would need to improve its macroeconomic performance and boost growth to ensure that it can service its costly new debt. While the inclusion of CACs has become a standard market practice for issuances of sovereign bonds in the past decade, a sizeable portion of all outstanding sovereign debt has no CACs attached. Moreover, since existing CACs only apply to a specific issue and not to the entire outstanding debt of a sovereign, they cannot completely mitigate the hold-out problem (see International Monetary Fund, 2014, Strengthening the Contractual Framework to Address Collective Action Problems in Sovereign Debt Restructuring). The recent deal, and the Argentinian experience as a whole, underscores the need to establish a multilateral legal framework for sovereign debt restructuring processes, building on the nine basic principles that were adopted by the United Nations General Assembly in September 2015 (A/RES/69/319), particularly the principle related to restructuring as enunciated in the resolution: ?Majority restructuring implies that sovereign debt restructuring agreements that are approved by a qualified majority of the creditors of a State are not to be affected, jeopardized or otherwise impeded by other States or a non-representative minority of creditors, who must respect the decisions adopted by the majority of the creditors. States should be encouraged to include collective action clauses in their sovereign debt to be issued.?

Monetary policy decisions

The European Central Bank (ECB), Bank of Japan (BoJ) and the United States Federal Reserve (Fed) all kept their monetary policy stances unchanged in April. This follows the 25 basis point rise in interest rates by the Fed in December 2015, and cuts of 5-20 basis points on key policy rates by the ECB and BoJ since last December, which widened the differential on nominal policy rates in the United States of America vis-?-vis the euro area and Japan. Elsewhere in the world, central banks in Albania, Belarus, Georgia, Hungary, India, Republic of Moldova, Uganda and Ukraine cut policy rates in April, whereas Mozambique and Namibia increased interest rates for the second time this year, reflecting diverging global inflationary pressures.

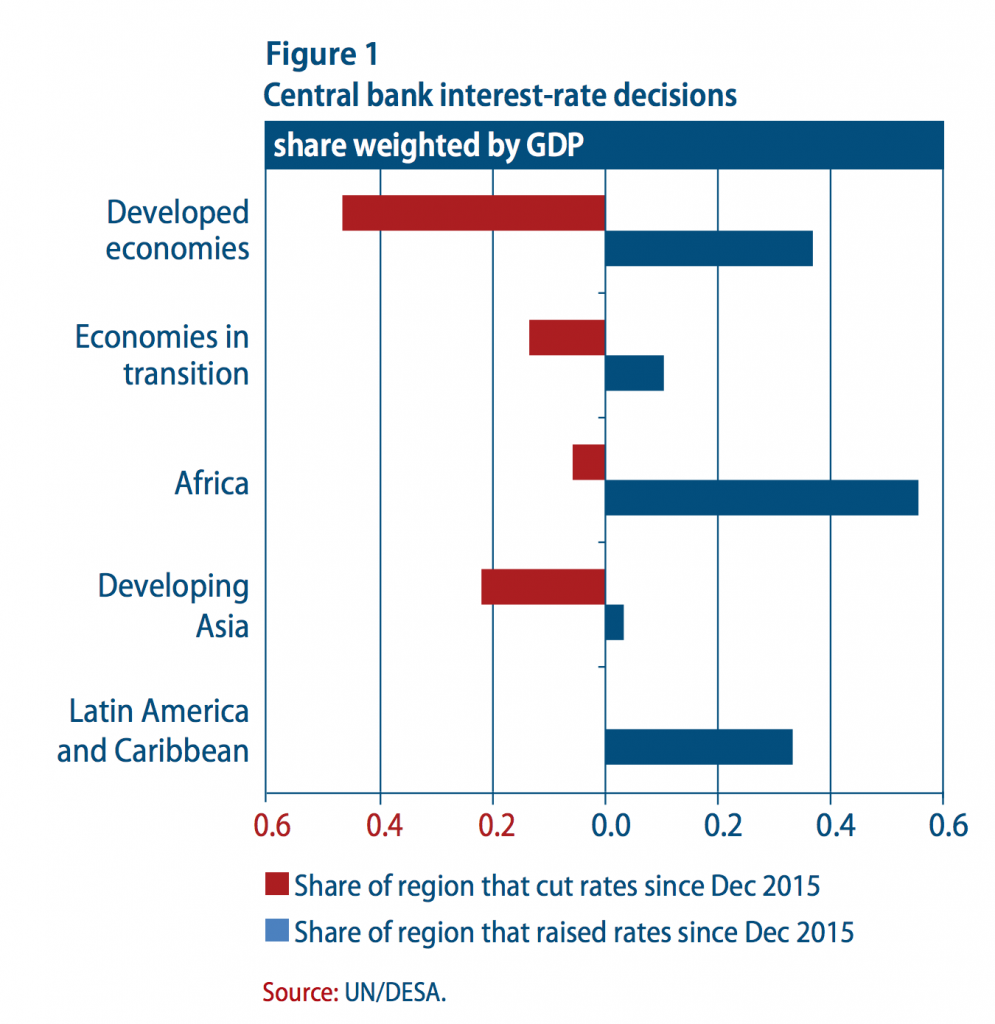

Figure 1 illustrates the global divergence in policy rate decisions since December 2015, when the Fed introduced its first interest-rate rise since 2006. There has been a clear tendency towards tightening in Africa and Latin America and the Caribbean, despite deteriorating economic prospects in these regions. Currency depreciations, and in some cases food price spikes, have increased inflationary pressures, prompting procyclical monetary tightening in several countries, and further dampening prospects for growth this year. In many cases (Angola, Azerbaijan, Egypt, Kazakhstan, Mexico, Namibia, South Africa, Sri Lanka), recent interest-rate increases followed sharp exchange-rate depreciations, and the rates of return for international investors have declined despite higher domestic interest rates. This leaves countries exposed to capital withdrawal, as investors seek higher rates of return elsewhere. Foreign direct investment flows to Africa and Latin America declined in 2015, adding pressure to financing constraints in the region. Available finance is particularly tight in commodity-exporting countries, which have also experienced a sharp fall in commodity-related government revenue. This puts at risk essential investment projects needed to revive productivity and support development.

Given the unexpectedly weak out-turn for gross domestic product (GDP) growth in the United States in the first quarter of the year, the Fed is expected to remain cautious, postponing further interest-rate rises until the latter part of 2016. The re-emergence of deflationary pressures in the euro area and Japan (see discussion below) may prompt the ECB and BoJ to push rates deeper into negative territory in the coming months. However, additional monetary stimulus measures on their own are proving insufficient to stimulate the economy and reach the inflation target. Credit conditions have loosened slightly, while bank lending interest rates and government bond yields have declined since negative policy rates were introduced in the euro area and Japan. However, to some extent the decline in bond yields reflects a global shift towards safer assets. The negative spreads on 5-year and 10-year government bonds yields between the United States and the euro area and Japan have remained broadly stable or slightly narrowed in recent months, despite the widening differential on policy rates. At the same time, both the euro and the yen have appreciated against the dollar since December, exacerbating deflationary pressures, and limiting scope for net trade to support the economy. A more balanced policy mix that complements the loose monetary stance with a more expansive fiscal stance would allow a more rapid economic revival.

Growth momentum dissipates in the United States

The advance estimate for GDP growth in the United States in the first quarter of the year proved weaker than anticipated, indicating annualized growth of just 0.5 per cent. Although this figure will undergo two further revisions before it is finalized, economic momentum in the United States is revealing new signs of weakness. Despite strong jobs growth and low inflation, household spending failed to keep pace with real personal disposable income in early 2016. Spending on durable goods was particularly weak. Business investment contracted sharply for the second consecutive quarter, while exports also declined. The sharp decline in exports of capital goods is indicative of feeble global investment growth that holds back a broader revival of the global economy. Housing investment, on the other hand, continued to expand rapidly in the United States, albeit from a low base, while the ratio of housing investment to GDP remains depressed relative to historical levels.

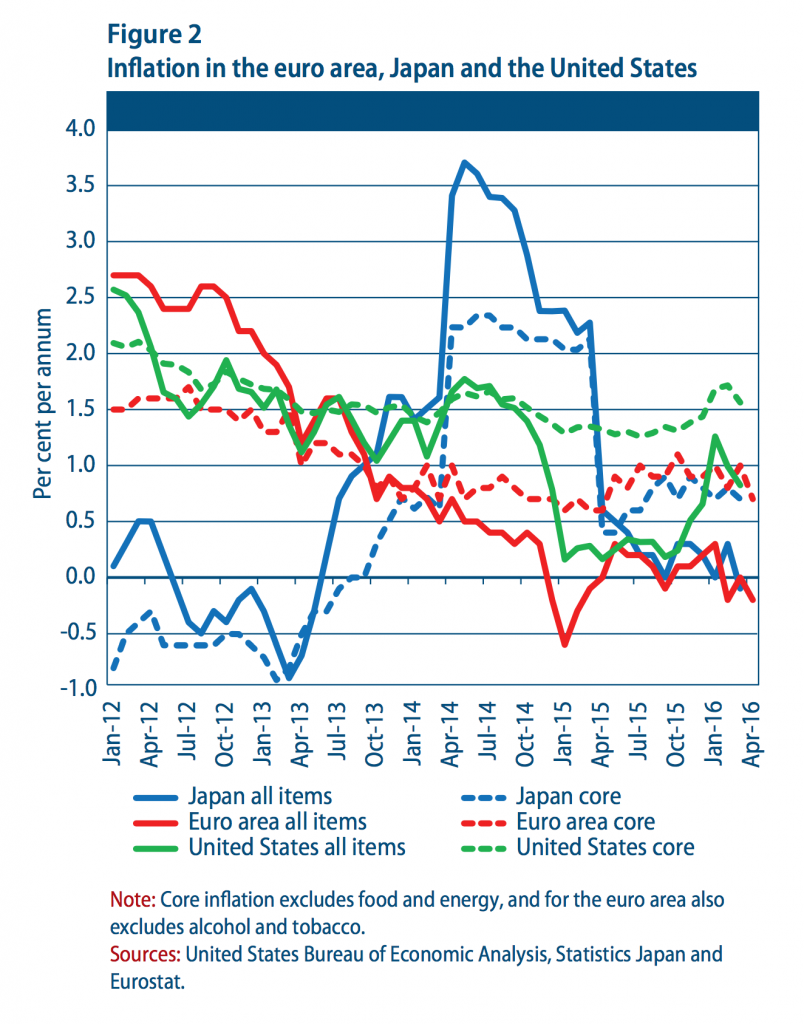

The decline in business investment and household spending on durable goods in the quarter immediately following the Fed?s first interest-rate rise in nearly a decade will make the Fed cautious regarding the pace of the policy normalization process going forward. Inflationary pressures remain relatively benign, with core inflation, which excludes food and energy prices, at 1.6 per cent in March (figure 2). Provided inflation remains stable once the impact of last year?s oil price drop passes through in August, the Fed is likely to make only one additional interest-rate rise before the end of 2016.

Japan holds monetary policy steady despite

renewed deflation

Headline inflation in Japan dipped below zero in March 2016 for the first time in nearly three years (figure 2). While this is largely a reflection of low energy prices and the low price of imported goods, core inflation, at 0.7 per cent, remains well below the 2.0 per cent target of the BoJ. Thus far, the additional monetary easing measures announced in January, which included the introduction of a negative policy rate, have had little observable impact on inflation. While the Bank of Japan?s Senior Loan Officer Opinion Survey indicates some easing of credit conditions and increased demand for loans from both firms and households, the economic situation in Japan remains feeble.

Industrial production in the first quarter of 2016 was more than 3 per cent lower than a year ago, reflecting sluggishness in most major demand components. Two years after the consumption tax rate hike in April 2014, household consumption has not been able to regain the level observed in 2012 and 2013.

The yen has appreciated by more than 8 per cent since the additional monetary easing measures were announced on 29 January, which will continue to restrain export growth and imported inflation this year, and prospects for reaching the inflation target of 2 per cent are slight.

Deflation tendency persists in Europe

Europe continues to exhibit weak inflation, with the euro area as a whole registering deflation in both February and April 2016 (figure 2). These weak price dynamics reflect a confluence of factors. Unemployment remains high in several countries, averaging 10.2 per cent in the euro area and 8.8 per cent in the European Union as a whole. This hampers the prospects for any solid wage growth that is needed to boost demand. Average headline inflation in the euro area has remained below 1 per cent since late 2013. While low energy prices have acted as a clear drag on headline inflation for the last 18 months, core inflation has also remained below 1.0 per cent for the most part, dropping to 0.7 per cent in April. The prolonged period of low inflation increasingly risks becoming entrenched in expectations. Wary of second-round effects on wage and price setting, the ECB may introduce additional easing measures if wage growth stalls or core inflation fails to accelerate.

Economies in transition: monetary easing in the

CIS continues

A moderate comeback in oil prices in April facilitated further recovery in several currencies in the Commonwealth of Independent States (CIS)?currencies which may have been undervalued following their precipitous depreciations in 2015 and early 2016. Together with base-year effects, this contributed to moderating inflation in the CIS. However, the near-term outlook for the region still remains marred by uncertainty, especially after the failure to reach an agreement on freezing oil production levels among the major oil-exporters. In April, Moody?s rating agency downgraded Kazakhstan?s sovereign debt rating to the lowest investment grade level.

While GDP in the Russian Federation may have stabilized during the first quarter, the Belarus economy, which is strongly exposed to the Russian economy, recorded a contraction in GDP of 3.6 per cent in the first quarter, with a pronounced decline in industrial output. In Ukraine, stabilization of the political situation in April may facilitate disbursement of the much-needed second tranche of the IMF loan and unlock further financial assistance. However, to comply with loan conditions, the Government unified natural gas tariffs for customers in April; as a result, most households will face higher prices.

Slowing inflation prompted several monetary easing moves in April, although the Bank of Russia decided to keep rates on hold. The National Bank of the Republic of Belarus cut its key policy rate by a total of 300 basis points to 22 per cent, aiming to reduce the risk premium in the price of credit; the National Bank of Georgia reduced its refinancing rate by 50 basis points to 7.5 per cent; the National Bank of Moldova cut the base rate by 200 basis points to 15 per cent; while the National Bank of Ukraine cut its policy rate by 300 basis points to 19 per cent.

In South-Eastern Europe, Albania reported GDP growth of 2.2 per cent in the fourth quarter of 2015, which signals a slowdown. Despite a noticeable increase in manufacturing output and construction, the economy, which is a net oil exporter, is affected by low commodity prices. As February inflation dropped to near-zero levels, the central bank cut its benchmark interest rate by 25 basis points in April, to 1.5 per cent.

China?s first quarter growth within targeted range

The Chinese economy registered 6.7 per cent year-over-year growth in the first quarter of 2016, staying within the Government?s annual target range of 6.5-7.0 per cent. The economy was supported by a rebound in industrial production and fixed investment, and continues to be driven by the tertiary sector, which now accounts for over 55 per cent of economic output. Among the service sectors, real estate services experienced the strongest year-over-year growth of 9.1 per cent, significantly up from the 2.0 per cent recorded in the first quarter of 2015. However, this was not coupled with accelerated construction growth, reflecting the high housing inventory outside the top-tier cities. The first quarter growth was at least partly supported by rapid credit expansion, predominately in the form of bank loans and corporate bonds. Corporate bond issuance in the first quarter was 224 per cent higher than a year earlier. The acceleration of credit growth in the first quarter adds to concerns regarding rapidly-rising corporate debt, and is likely to abate later this year.

Republic of Korea?s economy registered a weak 2.7 per cent year-over-year growth in the first quarter of the year?below the Government?s annual target of 3.1 per cent. Export performance continues to be frail, driven by the slowing Chinese economy and increased external competition. Domestic demand is the main impetus of the economy, but there are signs of weakness in both capital investment and private consumption. Construction and government consumption strengthened, on the back of the government?s frontloading of expenditure into the first quarter.

Economic growth is revitalizing in the Islamic

Republic of Iran

After posting meagre GDP growth of 0.9 per cent last year, the economic outlook for the Islamic Republic of Iran has visibly improved in 2016, driven by a strong rise in exports and investment demand, and by a gradual pickup in private consumption. In particular, the lifting of international sanctions last January is encouraging trade and investment flows and a revival of the oil sector. In recent months, oil exports have surged noticeably, and oil production is expected to reach pre-sanction levels by June 2016. Meanwhile, the fiscal policy stance continues to be relatively tight, but it will provide some support to economic activity by expanding capital expenditures and by implementing several initiatives to upgrade the country?s inadequate infrastructure. In addition, the existence of large unexploited natural gas reserves and privatization plans in some manufacturing sectors such as in the automotive industry could also encourage significant new investments. In particular, the Islamic Republic of Iran requires not only immense financial resources to fill the gap left by several years of underinvestment, but also enhanced efforts to strengthen its technological capabilities in order to improve its medium-term growth prospects.

Saudi Arabia unveils a comprehensive plan to

transform its economy

The Government of Saudi Arabia revealed an ambitious and comprehensive package of economic and social policies named Saudi Vision 2030. The long-term objective of the plan is to strengthen the country?s competitiveness and significantly reduce its heavy dependence on oil. Saudi Vision 2030 encompasses several regulatory, budgetary and other policy changes, including measures to improve the efficiency of the public sector, an overhaul of military spending, the announcement of several infrastructure projects, policies to encourage female labour participation, and plans to expand the privatization programme, including the sale of up to 5.0 per cent of the shares of the oil super-giant Saudi Arabian Oil Company. Given the size of the state-owned company, this partial privatization could allow Saudi Arabia to massively recapitalize its sovereign wealth funds, another aspect of the economic plan. However, several details on the execution and implementation remain to be seen. But clearly, reducing the high oil-dependency entails major medium-term challenges for the country, such as building and strengthening the technological base and productive capabilities in other sectors of the economy. The program was unveiled as Saudi Arabia?s economy continues to adjust to the sharp decline in oil prices, with significant pressures on fiscal accounts and major reforms in order to maintain fiscal sustainability. GDP growth is expected to slow to just 1.0 per cent in 2016, down from 3.4 per cent in 2015.

Central America?s economies are expected to

see robust growth

While economic activity in South America is projected to contract for a second year in a row, the prospects for Central America are generally more favourable. Annual growth in the six Central American economies?Costa Rica, El Salvador, Guatemala, Honduras, Nicaragua and Panama?averaged 4.2 per cent in 2015 and a similar rate of expansion is expected for 2016 and 2017. In sharp contrast to most South American economies, the Central American countries have seen their terms of trade improve over the past two years. As net oil importers, they have benefited from the sharp drop in oil prices, while the prices of most of the major export goods, including textiles, electronics, gold, bananas and sugar, held up well. Another positive factor for Central America has been the favourable performance of the US economy, which has supported exports, remittances and tourism. On the domestic front, low inflation and accommodative monetary conditions have helped consumption and investment demand. In the first quarter of 2016, average consumer price inflation ranged from -0.4 per cent in Costa Rica to 4.3 per cent in Guatemala. The weak inflationary pressures largely reflect the decline in energy prices, high degrees of dollarization?El Salvador and Panama are fully dollarized?and generally stable currencies as some economies are not deeply integrated into the global financial system.

Welcome to the United Nations

Welcome to the United Nations