The pandemic crisis will worsen global inequality

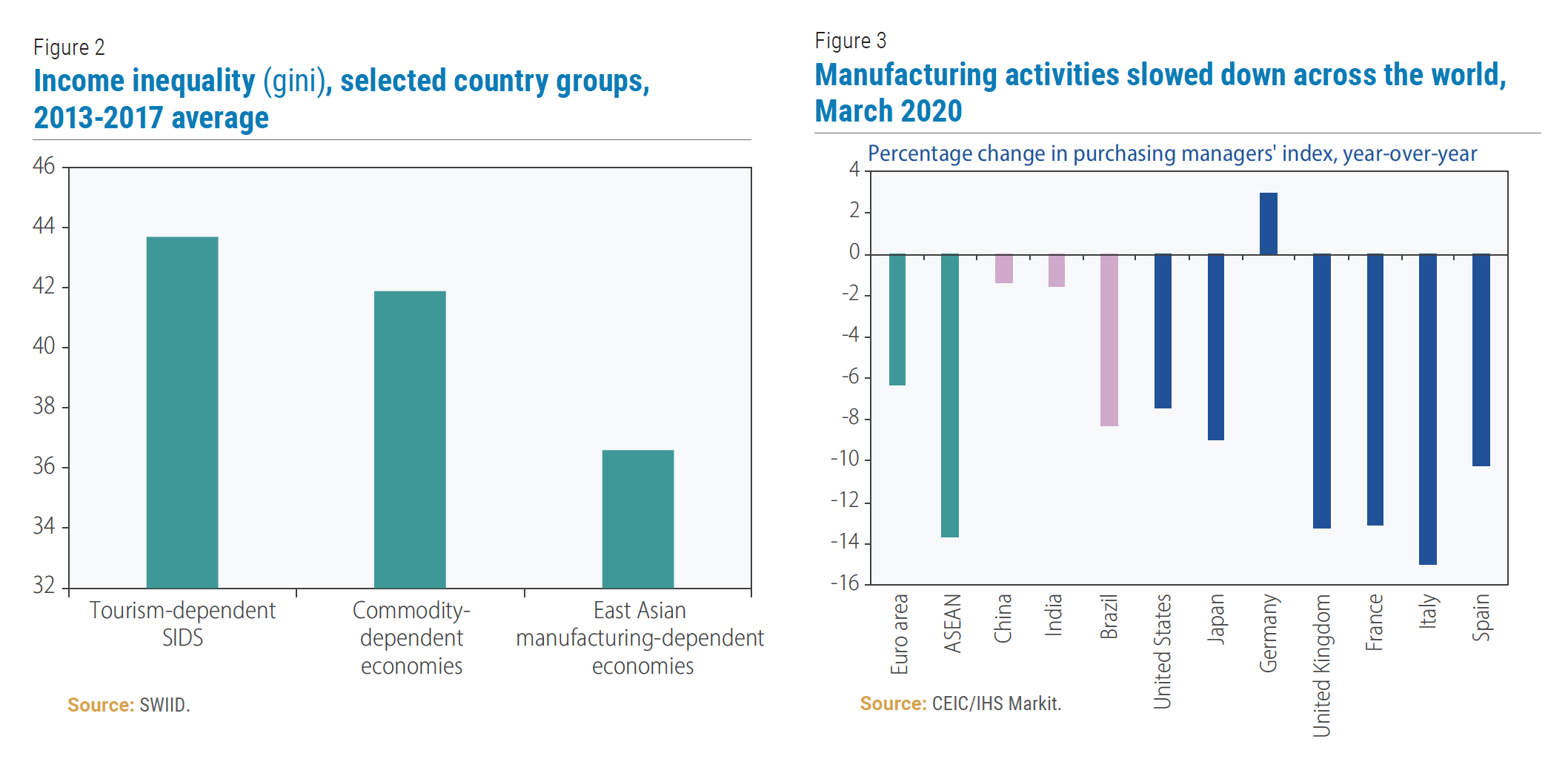

The COVID-19 pandemic is wreaking havoc on the global eco??nomy, unleashing the worst economic downturn since the Great Depression. Since the April 2020 Monthly Briefing on the World Economic Situation and Prospects, the global death toll of the pandemic has increased by more than 330 per cent, while the number of confirmed cases rose by over 210 per cent. COVID-19 is now the most severe health crisis since the Spanish Flu of 1918. The epicenter of the pandemic shifted from Europe to the United States during the past month, with the latter now accounting for nearly one third of confirmed cases and a quarter of the death toll globally. The share of confirmed cases in the rest of the world reached 25 per cent, marginally increasing by 3.3 percentage point during the past three weeks (Figure 1). Since the World Health Organization declared COVID-19 as a global pandemic on 11 March 2020, nearly 80 per cent of global population has come under stay-home orders, lockdowns and quarantines, inflicting increasingly severe direct and indirect economic impacts.

The COVID-19 pandemic is wreaking havoc on the global eco??nomy, unleashing the worst economic downturn since the Great Depression. Since the April 2020 Monthly Briefing on the World Economic Situation and Prospects, the global death toll of the pandemic has increased by more than 330 per cent, while the number of confirmed cases rose by over 210 per cent. COVID-19 is now the most severe health crisis since the Spanish Flu of 1918. The epicenter of the pandemic shifted from Europe to the United States during the past month, with the latter now accounting for nearly one third of confirmed cases and a quarter of the death toll globally. The share of confirmed cases in the rest of the world reached 25 per cent, marginally increasing by 3.3 percentage point during the past three weeks (Figure 1). Since the World Health Organization declared COVID-19 as a global pandemic on 11 March 2020, nearly 80 per cent of global population has come under stay-home orders, lockdowns and quarantines, inflicting increasingly severe direct and indirect economic impacts.

This Monthly Briefing discusses the impacts of the pan?demic on a few key sectors in the global economy: labor-intensive tourism in developing economies, particularly in Small Island Developing States (SIDS), manufacturing sector in East Asia, and commodity-dependent economies in Africa and Latin America. The pandemic will inevitably worsen both within and between country inequality, as it will put at risk millions of relatively high-paying manufacturing and tourism related jobs, depress wage earnings, and reduce government transfers and spending on social protection. The limited fiscal space?particularly in countries dependent on tourism and commodities exports?will constrain the abilities of governments to fight the pandemic and prevent massive jobs and income losses. Developing countries facing severe economic impacts will need substantial international support to avoid sharp increases in inequality.

This Monthly Briefing discusses the impacts of the pan?demic on a few key sectors in the global economy: labor-intensive tourism in developing economies, particularly in Small Island Developing States (SIDS), manufacturing sector in East Asia, and commodity-dependent economies in Africa and Latin America. The pandemic will inevitably worsen both within and between country inequality, as it will put at risk millions of relatively high-paying manufacturing and tourism related jobs, depress wage earnings, and reduce government transfers and spending on social protection. The limited fiscal space?particularly in countries dependent on tourism and commodities exports?will constrain the abilities of governments to fight the pandemic and prevent massive jobs and income losses. Developing countries facing severe economic impacts will need substantial international support to avoid sharp increases in inequality.

The two crises: different causes, similar outcomes

The current pandemic crisis is reminiscent of the Great Recession in 2009 although origin and causes of the two crises are funda?mentally different. The Great Recession began with foreclosures and bankruptcies with households defaulting on mortgage payments, which cascaded to a banking crisis. As bankruptcies increased and liquidity and credit dried up, unemployment skyrocketed and a Great Recession followed in 2009. This time, economic activities contracted sharply and almost simultaneously, as stay-at-home orders and then partial and complete lockdowns forced businesses to close in most developed economies. Rising unemployment, the loss of wage income, and falling business revenues are depressing aggregate demand, which may soon lead to sharp increases in bankruptcies. Rising business bankruptcies?if not prevented?will adversely affect the balance sheet of banks and reduce the flow of liquidity and credit, which will further reduce aggregate demand in the global economy.

The global financial crisis disproportionately hurt lower income households in developed economies, as millions lost jobs and their most important asset, homes. In the United States alone, two million manufacturing jobs were lost during 2008?2009, which never came back. Homeownership in the United States is lower today than it was in 1970s. The loss of income and wealth among households at the bottom of the income distribution resulted in sharp increases in wealth inequality in the largest economies. During the boom years before the Great Recession, wealth share of the top 10 per cent increased, while the bottom 90 per cent saw their fortunes taking a hit. The crisis exacerbated this existing trend?the wealth share of top ten per cent of households increased further, from 69.8 per cent in 2007 to 74.2 per cent in 2010, in the United States, and from 55.8 per cent to 62.8 per cent in China during the same period. While benefits of an economic boom mostly accrue at the top, the pain and losses from a crisis typically trickle down, with the poor and the most vulnerable in societies suffering the most. The inequality impact of the current crisis will likely be more pronounced both in scope and magnitude. Low income households will face the prospects of both income losses and rising health care costs at the same time, which will deplete their savings and other assets.

The sudden decline in economic activities due to the pande?mic-induced lockdowns is affecting different sectors differently. The impacts are also asymmetric across different country groups, and depend on their economic structures. Labour-intensive service sector jobs are most directly hit by lockdowns. Retail trade, restaurants and hospitality, sports and recreations and transportation became the first casualties, as the pandemic containment measures largely shut down economic activities in these sectors, which employ millions of low-skilled workers. The pandemic's impact hurts the low-skilled, low-wage workers both in formal and informal sectors the most, who are least able to withstand an economic shock.

The COVID-19 pandemic is also affecting millions of manufacturing, tourism and mining jobs simultaneously, which will drastically affect people at the bottom of the income distribution who work in these sectors. A significant number of these jobs are in developing countries, accounting for about one in four jobs in Africa, Asia and Latin America. While many developing countries weathered the Great Recession with minimum job losses, the employment impact of the current crisis is already significantly more severe. China, for example, grew by 9.4 per cent in 2009, experiencing almost no increase in the unemployment rate. According to most forecasts, China is projected to grow by less than 2 per cent in 2020. Most developing countries are expected to experience sharp contractions in economic growth in 2020, significantly more severe than what they experienced in 2009.

Tourism reeling in an unprecedented crisis

Amid growing travel restrictions worldwide, tourism is one of the hardest-hit sectors on a global scale. The World Tourism Organization projected a 20 to 30 per cent decline in international tourist arrivals in 2020 with high downside risk, a significantly worse contraction than the 4 per cent decline experienced in 2009. The International Air Transport Association estimates a 38 per cent drop in passenger traffic in 2020 compared to the 2019 levels, which translates to $252 billion in lost passenger revenue.

A prolonged slump in international travel would be very costly for tourism-dependent economies. Thailand, for example, is among the top-five developing country tourism destinations for tourists from the United States, France, Germany, Italy and United Kingdom. China, Egypt and Turkey are also among top five tourism destinations for most of these countries. If Europe and the United States remain in deep recession, tourism sectors in Thailand, China or Egypt will face a deep and prolonged contraction. The economic impact will be more severe for small island developing countries where tourism accounts for a significantly larger share of GDP.

A prolonged slump in international travel would be very costly for tourism-dependent economies. Thailand, for example, is among the top-five developing country tourism destinations for tourists from the United States, France, Germany, Italy and United Kingdom. China, Egypt and Turkey are also among top five tourism destinations for most of these countries. If Europe and the United States remain in deep recession, tourism sectors in Thailand, China or Egypt will face a deep and prolonged contraction. The economic impact will be more severe for small island developing countries where tourism accounts for a significantly larger share of GDP.

For small island developing economies, tourism is a key driver of jobs and economic growth and also the main source of foreign exchange earnings. The collapse in tourist arrivals not only directly affects income and employment in sectors directly related to travel such as airlines, ground transport, hotels, but also affects agriculture, transport and construction through indirect and induced effects. Less tourist arrivals often mean less demand for agricultural products, hurting the farmers who supply fresh produce to hotels and restaurants catering to tourists.

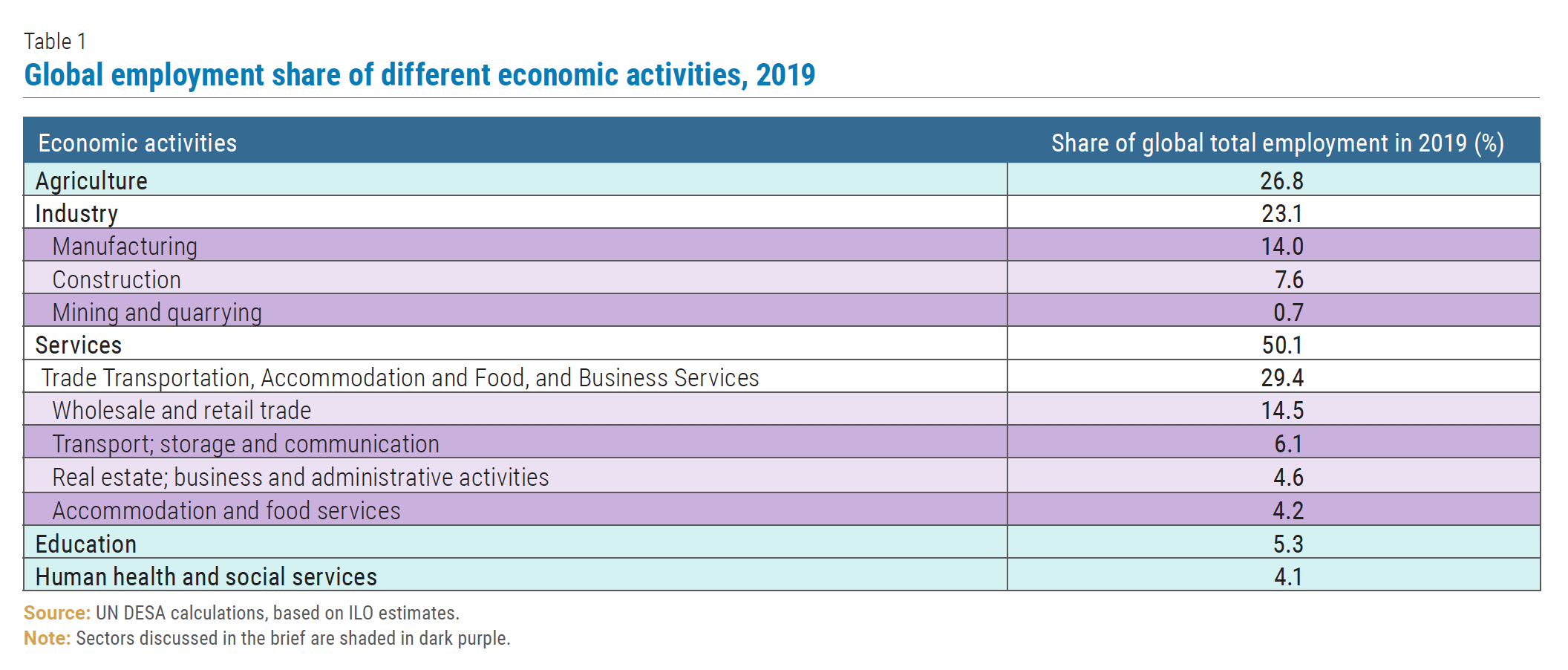

Tourism?spanning transportation, accommodation and food services?supports an estimated 300 million people (Table 1), often low-skilled employees, many working as tour guides, drivers, waiters, bartenders, entertainers, lifeguards, shopkeepers and retailers. As most of these jobs require close physical proximity and close interactions with their clients, tourism will remain under watch as a potential channel for transmitting the spread of the pandemic. Even if economies recover, it is highly unlikely that global tourism will rebound any time soon, as many governments will try to discourage?if not restrict outright?international travel in the near term to minimize the risk of a return of the pandemic. For example, Argentina has announced on 27 April its decision to extend the ban on all international flights to and from the country until 1 September 2020 as a preemptive measure for containing the pandemic.

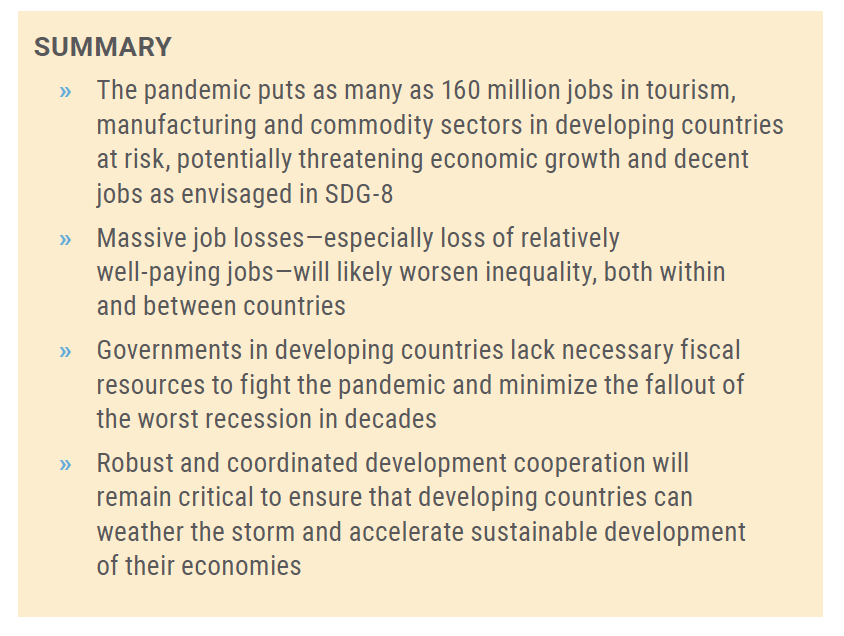

The collapse of tourism would have catastrophic distributional consequences in tourism-dependent economies, which have, on average, one of the highest levels of income inequality among different country groups. Loss of employment and income?combined with limited opportunities to find jobs in other sectors of the economy?will lead to higher levels of income inequality in most tourism-dependent countries. The impact would be larger in economies where inequality is already high, such as in small island developed economies with stubbornly high levels of income inequality (Figure 2).

Manufacturing facing sharp contraction

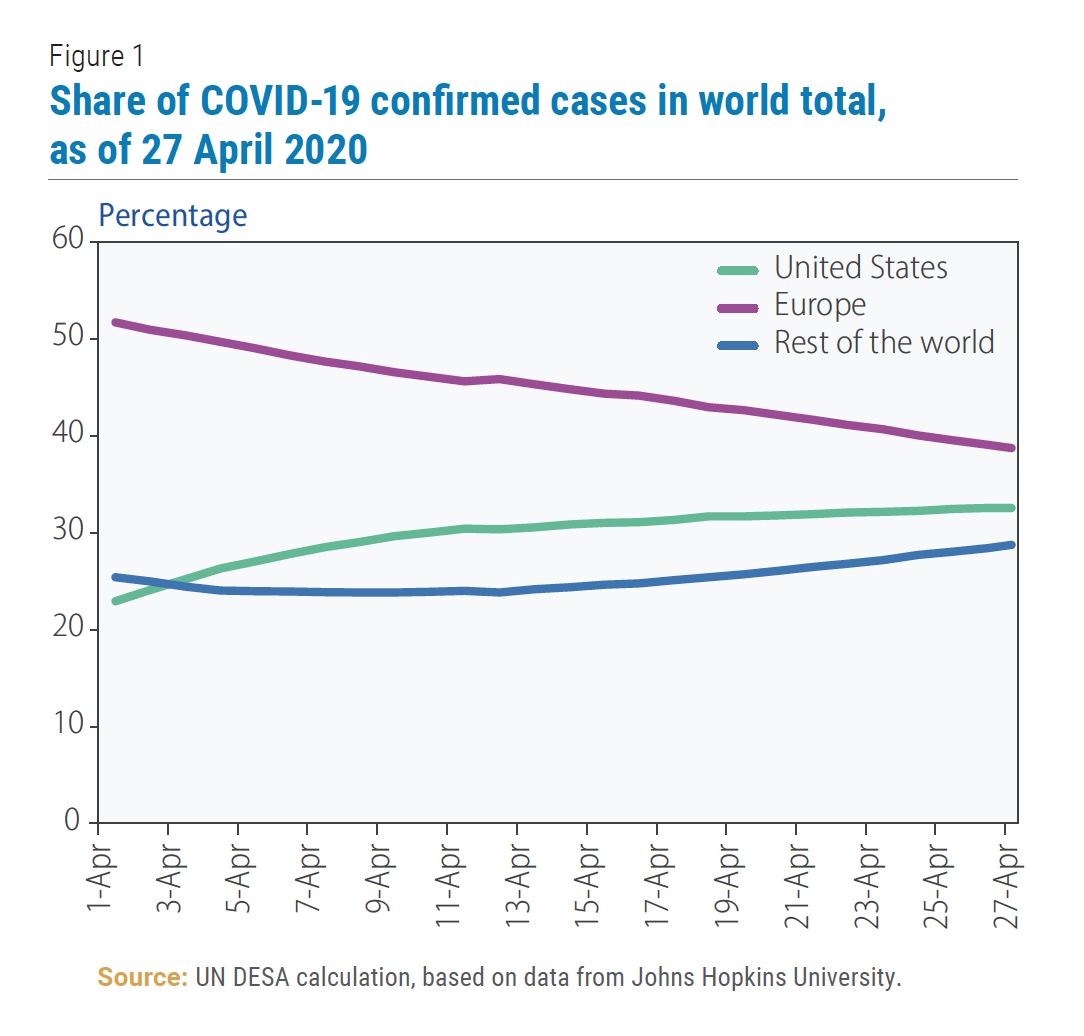

The COVID-19 pandemic is taking a major toll on global manufacturing, driven in large part by the disruptions to global supply chains. Early evidence from China suggests that the initial effect of the pandemic on manufacturing activities is comparable to the impact of the global financial crisis. The stalling of the manufacturing sector would have significant employment effects as the sector accounts for over 460 million jobs worldwide (Table 1). As the pandemic continues to spread and partial or total lockdowns are introduced, manufacturing activities are slowing down around the world, with many economies experiencing a severe contraction of their manufacturing sectors in March (Figure 3).

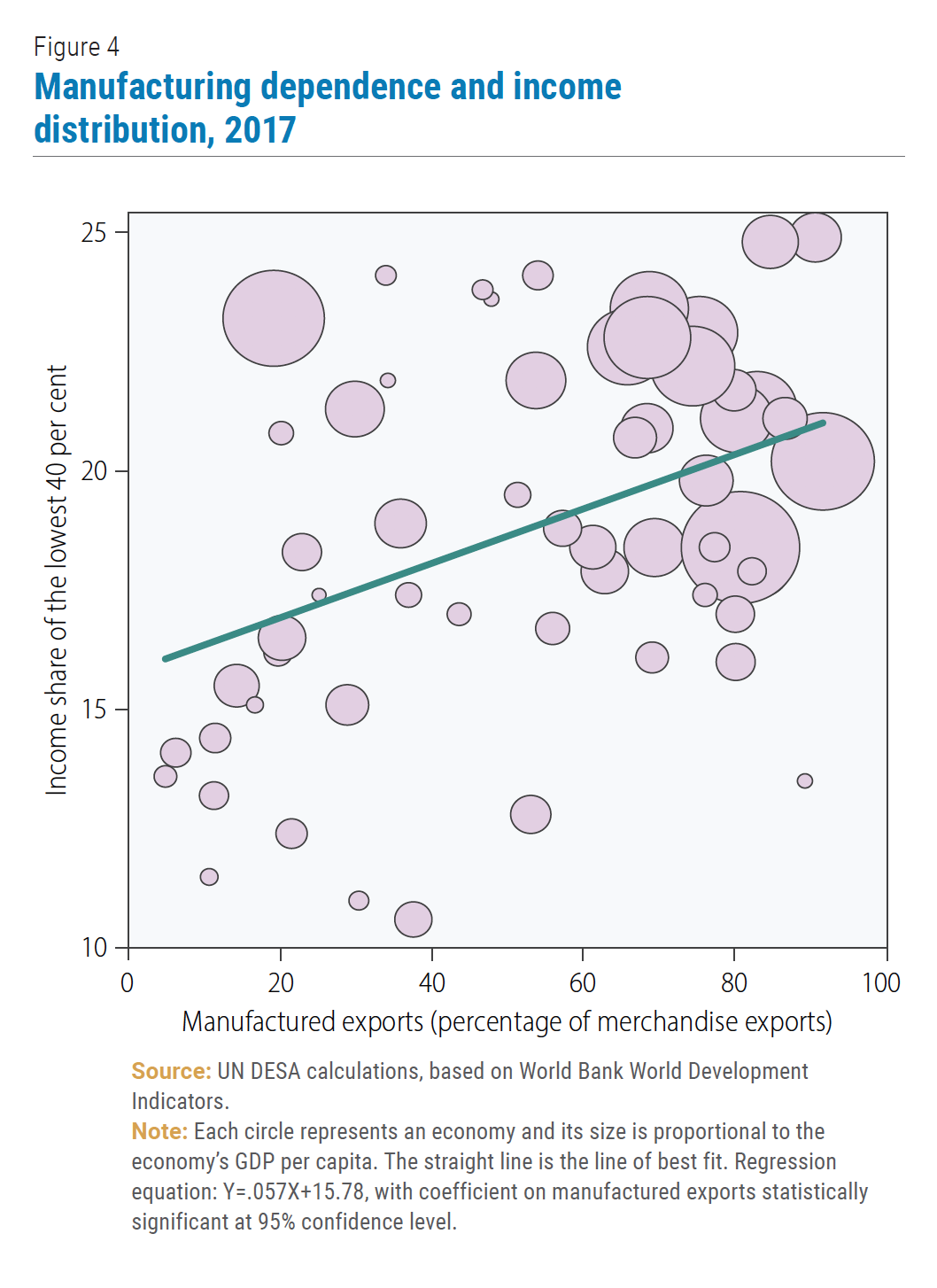

Manufacturing has been the key driver of rising living standards in East Asian economies. China?s emergence as the global manufacturing hub helped to lift nearly 800 million people out of extreme poverty during the past three decades. Manufacturing and global value chains connect global demand and supply and allow equalization of factor prices, particularly wages, leading to great convergence in wages and living standards. The higher share of manufacturing in merchandise exports of countries is closely correlated to a higher share of income for the bottom 40 per cent of the population in these economies (Figure 4). It is no surprise that East Asian manufacturing-dependent economies have relatively low levels of income inequality.

Global manufacturing was already taking a hit due to lin???gering trade tensions in 2019. A prolonged economic crisis?reducing global demand for manufacturing, especially for durable goods?could destroy millions of manufacturing jobs worldwide, particularly in manufacturing-dependent economies, and stall or reverse the process of reducing inequality within and between countries.

Global manufacturing was already taking a hit due to lin???gering trade tensions in 2019. A prolonged economic crisis?reducing global demand for manufacturing, especially for durable goods?could destroy millions of manufacturing jobs worldwide, particularly in manufacturing-dependent economies, and stall or reverse the process of reducing inequality within and between countries.

Commodities bracing prolonged price slump

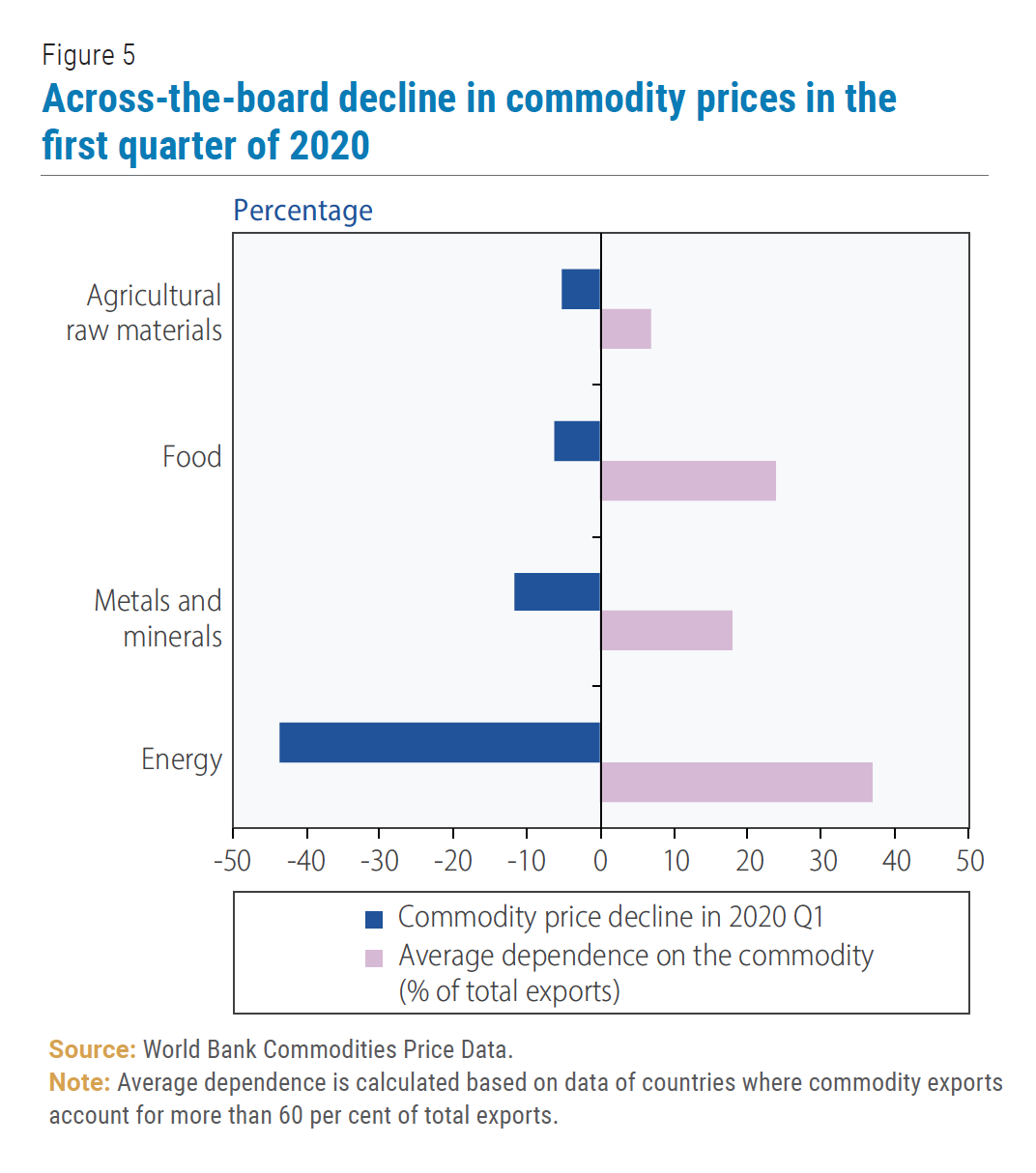

Commodity-dependent countries are also facing the brunt of the pandemic. The unprecedented nosedive of benchmark US oil prices into the negative territory during the second half of April, owing to minimal demand and insufficient storage capacity, rattled commodity and financial markets worldwide. Not just oil but prices of all commodities have declined across the board during the first three months of 2020 (Figure 5). Even if the pandemic is contained, commodity prices are unlikely to rebound quickly as stockpiles of commodities are accumulating. Economic activities will also take time to fully recover as countries remain cautious in terms of reopening their economies, fearing the emergence of a second wave of the pandemic should containment measures be eased too quickly.

The commodities sector ? particularly mining and quarrying activities?is relatively less labour-intensive than the tourism or manufacturing sectors. Less than 1 per cent of global workers ? around 21 million ? are employed in mining and quarrying (Table 1). This does not mean falling commodity prices will not have negative distributional consequences.

Unsurprisingly, commodity-dependent economies typically experience high levels of income and wealth inequality, which are often exacerbated as falling commodity prices significantly reduce government revenue, constraining transfer programmes ? direct income support and indirect subsidies ? aimed at helping households at the bottom of income distribution. Amid falling trade and fiscal revenues and tightening fiscal conditions, these transfer programmes may experience severe setbacks and exacerbate inequality.

Unsurprisingly, commodity-dependent economies typically experience high levels of income and wealth inequality, which are often exacerbated as falling commodity prices significantly reduce government revenue, constraining transfer programmes ? direct income support and indirect subsidies ? aimed at helping households at the bottom of income distribution. Amid falling trade and fiscal revenues and tightening fiscal conditions, these transfer programmes may experience severe setbacks and exacerbate inequality.

Global trade unraveling

Global trade will take a nose dive this year, driven by falling manufacturing, commodities and tourism flows. Global trade contracted by 20 per cent during the Great Recession in 2009. Disruptions in global supply chains and falling manufacturing activities downstream are reducing demand for intermediate goods and commodities upstream. Such spillover effect will be significant as close to 50 per cent of global trade involve importation of intermediate goods and raw materials, including minerals and metals. China, for example, imported nearly $2.1 trillion from the rest of the world in 2018, with intermediate inputs, metals and minerals accounting for more than 45 per cent of total imports. A 20 per cent decline in Chinese imports from the rest of the world could reduce global demand for oil, metals and minerals by over $100 billion?a large demand-side shock for Brazil, Chile or South Africa that rely heavily on Chinese demand.

The slowdown in global demand for manufacturing and commodities will have second order effects on trade-related services, including shipping services, financial services, ground transportation, tourism and travel. Domestic service sector value-added, for example, accounts for nearly 28 per cent of the value of Chinese manufacturing exports. Trade and business-related tourism, which accounts for about 20 per cent of global tourism spending, will likely experience a sharp decline owing to the contraction of global trade of manufacturing and commodities. There will also be significant longer-term effects, as good hospitality facilities such as hotels and restaurants contribute to the success of a country. A prolonged decline in tourism flows would slow the maintenance and upgrading of hotels and tourist facilities, which are key to attracting foreign businesses and investments, further depressing trade and investment flows.

Stakes are too high to allow increasing inequality

The global slowdown in tourism, manufacturing and commodities exports will put one in five jobs in these sectors ? as many as 160 million jobs ? at high risk should economic value added in these sectors fall by 20 per cent this year. Massive job losses will exacerbate income inequality, as many of these jobs ? especially in manufacturing, tourism and mining and mineral sectors ? typically offer substantially higher wages than jobs in retail trade or informal sector jobs, and thus derail global efforts to reduce inequality, as envisaged in SDG-10 (Reduce inequality within and among countries). It will also reduce productivity growth and hinder the realization of SDG-8 (Promoting decent work and inclusive, sustainable economic growth). Countries with low levels of inequality, on average, experience faster economic growth. If productivity growth remains subdued amid rising inequality, this will constrain the recovery of global growth in the post-COVID-19 period. Anemic global growth during the next decade will signi?ficantly undermine the prospects of realizing the 2030 Agenda for Sustainable Development.

Governments in developed economies are implementing large fiscal and monetary measures ? averaging over 10 per cent of GDP ? to fight the pandemic, sustain aggregate demand and prevent a deep recession. In contrast, fiscal stimulus packages in developing countries have been significantly smaller, ranging between 1 and 2 per cent of their GDP. These fiscal measures will fall significantly short to minimize the fallout of falling export revenue, which are likely to experience a double-digit contraction this year.

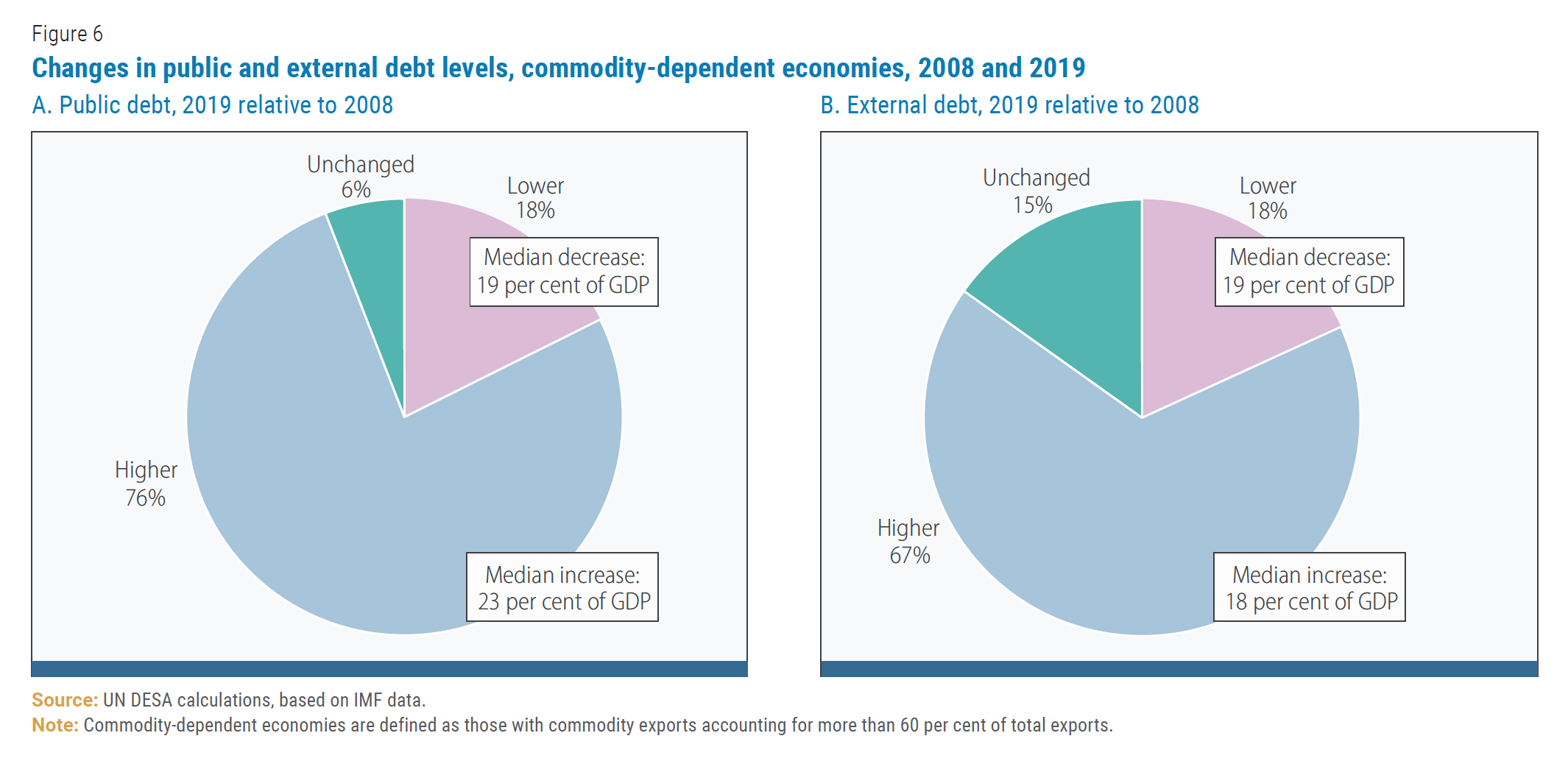

Most governments in developing countries face stiffer fiscal constraints to rolling out stimulus packages to soften the blow of the current crisis, compared to their situation in the last global financial crisis. When compared to the beginning of the global financial crisis, more countries are now grappling with higher fiscal deficits, and many are also struggling with higher levels of public debt and external debt. In particular, commodity export-dependent economies stand out, as the median increase in external debt (as a percentage of GDP) during the past decade was 18 percentage points (Figure 6), compared to a 2.6 percentage points increase in other countries.

Most governments in developing countries face stiffer fiscal constraints to rolling out stimulus packages to soften the blow of the current crisis, compared to their situation in the last global financial crisis. When compared to the beginning of the global financial crisis, more countries are now grappling with higher fiscal deficits, and many are also struggling with higher levels of public debt and external debt. In particular, commodity export-dependent economies stand out, as the median increase in external debt (as a percentage of GDP) during the past decade was 18 percentage points (Figure 6), compared to a 2.6 percentage points increase in other countries.

East Asian manufacturing economies learned from the experience of the Asian Financial Crisis in 1997. Their bitter experience two decades earlier encouraged them to keep deficits low, limit the growth of public debt and accumulate large amount of foreign exchange reserves. Collectively, they hold nearly 40 per cent of official reserves worldwide, offering them a significant financial cushion to survive a global recession. Other economies, especially commodity-dependent economies, are less well prepared to confront the crisis with necessary fiscal measures. Following the global financial crisis and during the boom years, commodity exporters racked up public debt, borrowing extensively from the international capital market.

During a recession, international capital becomes scarce and highly indebted countries are often left on their own to ensure liquidity and credit, while servicing their debt to external borrowers. Commodity- and tourism-dependent economies will need a lifeline of international support ? especially credit ? to weather the storm and minimize its adverse impacts, including on rising inequality. Further increases in inequality will add fuel to growing social discontent in many developing countries, undermining stability and threatening democracy, even as these countries confront the worst economic crisis in decades.

Shrinking job prospects, inadequate or non-existent social protection and limited capacities for increasing government support, especially in many commodity-dependent African economies, will also intensify migration pressures. Millions of youth in these countries facing a bleak economic future will flee their countries looking for better economic fortune elsewhere. The pandemic crisis can lead to a larger migration crisis for Europe, which will impede its own recovery from the current crisis.

Developed economies dealing with the impacts of the crisis within their own borders will unlikely be in a position to significantly? expand their official development assistance (ODA). In fact, ODA flows will likely shrink significantly this year, which will undermine their sustainable development efforts.

While development partners consider debt restructuring, moratorium and relief for many of these economies, it is impe?rative that commodity and tourism dependent economies receive additional credit and liquidity support from international financial institutions, including the International Monetary Fund, the World Bank and regional development banks. It is also an opportunity for other multilateral institutions to expand their credit support to countries that will be hardest hit by the crisis. These economies need international financial support as soon as possible ? not three months from now ? to avoid the costly impact of rising income and wealth inequality, which will severely curb their hope for achieving sustainable development.

Welcome to the United Nations

Welcome to the United Nations