Download the World Economic Situation and Prospects Monthly Briefing No. 73

December 2014 Summary

- ?? Further appreciation of the U.S. dollar

- Japan registers technical recession during the third quarter

- Lower inflation rates in many countries across the world as oil prices decline

Global issues

Assessment of the potential impact of heightened geopolitical tensions around Ukraine

The World Economic Situation and Prospects 2015 presents a very subdued outlook for the euro area, where the underlying growth momentum has decelerated to the point that an exogenous event could lead to a return to recession. One of the downside risks identified is an escalation of the geopolitical crisis around Ukraine. To evaluate the potential impact of such a situation, the United Nations World Economic Forecasting Model (WEFM) was used to assess the impact of a simple variant of this worsening of tensions on economic activity.

The assessment of the potential impact is based on three main assumptions. First, if increased sanctions and counter-sanctions continue, a large drop in consumption and investment spending in 2015 can be expected in the Commonwealth of Independent States (CIS) compared to the baseline forecast. This would lead to a decline in the level of gross domestic product (GDP) by close to 5 per cent compared to the baseline forecast for 2015 and 2016. The decline in GDP in conjunction with the sanctions could in turn lead to a decline of close to 12 per cent in the level of imports in 2015 compared to the baseline and a decline of 8 per cent in 2016. Second, in the euro area, the heightened tensions could cause a sharp decline in consumer confidence in 2015, which would linger into 2016 and impact private consumption expenditure. An increase in the risk premium on the user cost of capital could also be expected, which would affect investment spending in both years as well. Third, it is assumed that there are no disruptions to energy supplies.

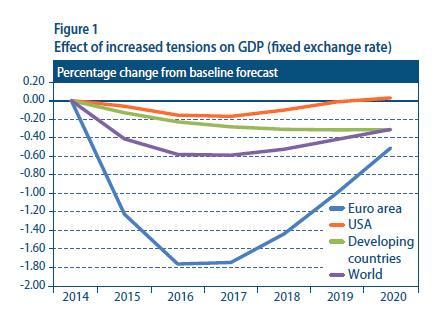

Clearly, in such a scenario, many CIS economies would suffer serious losses, but the spillover effects to the euro area and the rest of the world, depicted in figure 1, would also be significant. GDP in the euro area would decline by 1.2 per cent in 2015 relative to the baseline forecast, creating a return to recession. A cumulative loss of 1.8 per cent in 2016 could be expected, eliminating nearly all of the pickup in activity envisaged in the baseline forecast. But the impact of the crisis would be fairly localized: In the United States of America, GDP would be barely affected in 2015, down by about 0.2 per cent in 2016. Developing countries would lose about 0.1 and 0.2 percentage points in the two years. World GDP would be down by 0.4 per cent in 2015 and 0.6 per cent in 2016 (figure 1). The situation would be compounded by the fact that countercyclical policy space is extremely limited in the developed regions in 2015?2016. Later in the simulation period (2017?2020), however, the baseline forecast assumes a gradual normalization of monetary policy, so there would be room for interest rates to be lowered and output would begin to return to the baseline.

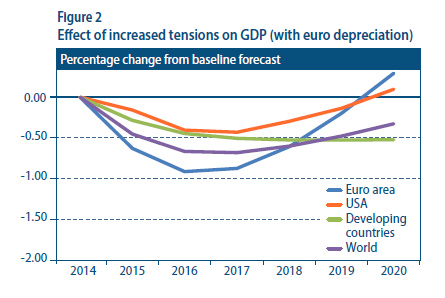

However, the conclusion that the impact of the crisis would be fairly localized rests on the assumption that the euro exchange rate would remain the same as in the baseline. An alternative scenario could be elaborated, assuming that the euro would respond to interest-rate differentials and that heightened tensions would lead to an increase in the risk premium. The increase in the risk premium on the euro would then have an immediate impact on the depreciation of the currency, by about 4 per cent compared to the baseline forecast, while the response to interest-rate differentials would result in a gradual further depreciation in the latter years of the simulation. On the one hand, the depreciation of the euro could have a positive impact on the euro area by boosting net exports, but on the other hand it would have the opposite effect on the rest of the world, due to a reduction in euro area imports.

In this case, GDP in the euro area would decline by 0.6 per cent in 2015 and 0.9 per cent in 2016 relative to the baseline forecast, while the impact on the rest of the world would be more substantial than in the case of a stable euro exchange rate: in the United States GDP would decline by 0.2 per cent in 2015 and 0.4 per cent in 2016, while developing countries would lose about 0.3 and 0.5 percentage points in the two years. Finally, the world GDP would be down by 0.4 per cent in 2015 and 0.7 per cent in 2016 (figure 2).

Developed economies

The United States: further appreciation of the dollar

The appreciation of the U.S. dollar accelerated further in November. On a trade-weighted basis, the value of the dollar has appreciated by 2 per cent from the end of October to the end of November. Although this appreciation was broad-based, there were significant differences across countries. Among developed economies, the Japanese yen depreciated by more than 7.0 per cent, while the euro and sterling depreciated by 0.4 and 2.0 per cent, respectively. Natural resource?exporting countries, such as Australia, Canada, New Zealand and Norway, also observed noticeable depreciation of their currencies. Currencies of major transition economies, such as the Russian Federation and Ukraine, recorded two-digit depreciation figures. Currencies of many developing economies, such as Brazil, Chile, Colombia, Mexico and the Republic of Korea, also recorded significant deprecations.

On November 25, the United States Bureau of Economic Analysis released the second estimation of GDP growth for the third quarter. The annualized quarter-over-quarter growth rate was revised upwards from 3.5 per cent to 3.9 per cent. This revision was mainly caused by the reduced drag of inventory de-stocking. The same report also revised downward the estimates of nominal wage growth for the second and third quarters of 2014. In terms of employment creation, in November, payrolls rose by 321,000, the highest increase since January 2012.

Developed Asia: Japan registers technical recession during the third quarter

Data released in November showed that GDP declined during the third quarter of 2014, by 1.6 per cent at an annualized rate from the previous quarter. Among major expenditure items, private and public consumption and net exports expanded from the previous quarter. The economic contraction was mainly caused by a decline in fixed investment and de-stocking of inventory. Actually, if the inventory level had remained stable, the GDP growth rate would have remained positive. As a result, the Japanese Government decided to postpone the second rise in the consumption tax rate, originally planned to be in force in October 2015.

Additional data revealed a mixed recovery picture for October. On the one hand, retail sales fell by 1.4 per cent nominally from September, after increasing for two consecutive months. On the other hand, industrial output increased in volume by 0.2 per cent from September. The headline inflation rate for Japan and the Tokyo area sustained its weakening trend. The national annual headline inflation rate declined from 3.2 per cent in September to 2.9 per cent in October. For the Tokyo area, the figure has declined from 2.5 per cent in October to 2.1 per cent in November. In both cases, inflation (net of effects from the higher consumption tax) has declined to less than 1 per cent.

Western Europe: growth picks up only marginally, remaining precariously low

Growth picked up marginally in the third quarter of 2014 compared to the second quarter of the year, but remained extremely low. In the euro area, GDP grew by only 0.2 per cent quarter on quarter, while second quarter growth was revised up from 0.0 to 0.1 per cent. In Germany, the drop in activity in the second quarter was not as bad as initially estimated, with growth declining by 0.1 per cent and subsequently rebounding to a positive 0.1 per cent in the third quarter. In France, the second quarter was revised downward, showing a drop of 0.1 per cent, followed by a positive 0.3 per cent growth in the third quarter. In the periphery countries, Italy remained in recession without a single quarter of positive growth since 2011, while Spain continued the rebound that started in the third quarter of 2013, growing by 0.5 per cent. Portugal registered a second consecutive quarter of positive growth and Greece grew by 0.7 per cent (the third positive quarter in a row). Despite this recent positive performance, GDP growth in periphery economies remains well below pre-crisis peaks. Outside of the euro area, the United Kingdom of Great Britain and Northern Ireland maintained its performance, growing by 0.8 per cent, as it also did in the second quarter.

The new EU members: stronger-than-expected third quarter performance in some economies

Several of the new EU member States surprised on the upside with their preliminary third quarter GDP growth figures. Although high-frequency indicators in Poland?the largest economy in the group?pointed to some sluggishness, quarterly growth of 3.4 per cent year on year exceeded expectations. In Hungary, the economy also performed better than expected, with GDP growing by 3.2 per cent year on year, boosted by services. In the Czech Republic, however, growth was sluggish, at 2.4 per cent year on year, and in Croatia the economy contracted year on year for the twelfth consecutive quarter, by 0.5 per cent, as it faces both external and domestic hurdles. For the fourth quarter, signals are mixed. In Poland, new industrial orders remained strong and the manufacturing Purchasing Managers' Index improved in October, while in the Czech Republic economic confidence reached a three-year high in November.

In many of the new EU member States, deflationary developments continued in October, following lower global oil prices, good harvests and the Russian food import ban. Against this background, the National Bank of Romania cut its policy rate in early November to another record low of 2.75 per cent and reduced foreign-currency reserve requirements.

Economies in transition

CIS: interest rate hike in the Russian Federation

The economy of the Russian Federation expanded faster than expected with a rate of 0.8 per cent year on year in the third quarter (a preliminary figure). The main driving force came from the agricultural and industrial sectors. In October, industry grew by 2.9 per cent year on year, reflecting the import substitution effect. However, falling oil prices are posing serious challenges for the Russian economy. The Russian currency depreciated to historic lows against the U.S. dollar and the euro in late November. Earlier, the central bank of the Russian Federation, which had spent significant resources to defend the currency, announced its decision to move to a fully floating regime ahead of the scheduled date (January 2015). However, in response to a further fall of the currency, the central bank intervened in the currency market in December, spending around $5 billion, and increased its policy rate by 100 basis points on December 11th. In Ukraine, the third quarter GDP declined by 5.1 per cent year on year. Continuing outflow of bank deposits was accompanied by a decline in the country's foreign-exchange reserves, as demand for foreign currencies picked up. Inflation in October reached 19.8 per cent year on year, and in mid-November the National Bank of Ukraine increased its key policy rate for the third time this year, by 150 basis points to 14 per cent. In Belarus, real GDP growth picked up to 2.1 per cent year on year in the third quarter, thanks to the stronger industrial output in August and September. Year-on- year inflation, however, exceeded 19 per cent in October.

In early December, the Government of the Russian Federation announced cancellation of the "South Stream" pipeline project, intended to supply Russian gas to the South of Europe. This may have economic implications for a number of countries in the region.

In order to offset the impact of lower oil prices and the slowing oil output, the Government of Kazakhstan announced in November a fiscal stimulus package of $3 billion per year from 2015 to 2017, financed by the country's national wealth fund.

South-Eastern Europe: resumption of interest-rate cuts in Serbia

In Serbia, third quarter GDP declined by 3.6 per cent year on year, and both economic activity and inflation slowed in October. Industrial output dropped by 11.2 per cent year on year, while annual inflation stood at 1.8 per cent in October. The National Bank of Serbia, which earlier put interest-rate cuts on hold, reduced its policy rate in November to 8 per cent. In Bosnia and Herzegovina, industrial output grew by a meagre 0.5 per cent year on year in January-October, although it has been more volatile compared with 2013. Price pressures in the region remain weak; in Montenegro, deflation continued in October, albeit at a more moderate speed.

In late November, the Government of Serbia reached a preliminary deal with the IMF on a 36-month precautionary stand-by agreement worth $1.24 billion, which will cushion the country's reserve position.

Developing economies

Africa: GDP growth is subdued in South Africa, while robust in Nigeria and the United Republic of Tanzania

In South Africa, growth remained subdued in the third quarter, amounting to 1.4 per cent compared to the same quarter in the previous year. Several factors continued to weigh on economic activity, including strikes, energy shortfalls and weak consumer demand in view of high unemployment and high debt levels. Nigeria's economy expanded by 6.2 per cent in the third quarter, with a contraction in the oil sector being offset by expansion in non-oil sectors of the economy such as agriculture. In the United Republic of Tanzania, surging tourism contributed to GDP growing by 7.1 per cent year on year for the first half of 2014, although this is slightly slower than the same period last year. At the same time, the current-account deficit increased to 7.6 per cent of GDP for the year through July. The Central Bank of Egypt announced that it would take steps to contain informal currency activities, as the divergence between the official and informal exchange rates rose from about 5 per cent to above 8 per cent. It also kept interest rates on hold as urban consumer inflation rose from 11.1 per cent in September to 11.8 per cent in October. On a more positive note, the country expects to save about 25 per cent on its fuel subsidies this fiscal year owing to lower oil prices. The Central Bank of South Sudan recently released a set of statistical bulletins covering the period from January 2011 to July 2014 that point to a critical situation for foreign reserves, which were down to only $175 million in July. While reserves rose to $814 million in December 2013 after oil production resumed, recent internal conflicts have reduced these reserves considerably and falling oil prices are likely to put further downward pressure on them.

East Asia: growth in Malaysia and the Philippines lost steam in the third quarter

The Philippine economy experienced a sharp slowdown in the third quarter of 2014. Quarter-on-quarter GDP growth fell to only 0.4 per cent, the slowest pace since the global financial crisis and well below the 1.9 per cent recorded in the previous three months. On a year-on-year basis, growth decelerated from 6.4 per cent in the second quarter to 5.3 per cent in the third, as reduced government spending negatively impacted economic activity. Government final consumption expenditure contracted by 2.6 per cent and public construction spending declined by 6.2 per cent, partly owing to project delays that were caused by new documentation requirements. Economic growth also decelerated in Malaysia amid slower exports and investment. In Thailand, weak exports of goods and services, including a drop in tourism spending, weighed on third-quarter growth. By contrast, economic activity in Hong Kong Special Administrative Region of China expanded faster than expected, with quarter-on-quarter growth reaching a multi-year high of 1.7 per cent. This growth rebound, which was largely driven by stronger private consumption and exports, may not last, however, given domestic and international weaknesses.

The People's Bank of China cut interest rates for the first time in more than two years in a bid to boost economic growth. The authorities reduced the benchmark one-year loan rate by 40 basis points to 5.6 per cent. By cutting nominal interest rates, the authorities also responded to a significant drop in inflation, which has resulted in higher real interest rates.

South Asia: India's growth decelerated in the third quarter owing to weak manufacturing activity

Economic growth in India decelerated in the third quarter of 2014 albeit less severely than feared. GDP grew by 5.3 per cent year on year, down from 5.7 per cent in the second quarter. At the sectoral level, the slowdown can be mainly attributed to stagnant output in the manufacturing industry. Given the weak 2014 monsoon, which ended with rainfall 12 per cent below average (the lowest level in five years), growth in the agricultural sector was stronger than expected at 3.2 per cent. At the expenditure level, growth was supported by a 5.8 per cent increase in private consumption and a surge in government consumption, which rose by 10.1 per cent. This helped partially offset the weakness in investment and external demand. Real exports contracted by 1.6 per cent amid sluggish demand in many developed economies. Pakistan's central bank cut its main policy rate by 50 basis points to 9.5 per cent. The authorities responded to a notable drop in consumer price inflation, which fell to a multi-year low of 5.8 per cent in October. Lower international oil prices, an expected improvement in food production and a reduction in the fiscal deficit will likely further dampen inflationary pressures.

Western Asia: sharp drop in oil prices poses new challenges to some oil exporters

As anticipated, at their last meeting on November 27, OPEC members decided not to cut back on their own oil production. This decision clearly indicates a preference for securing their market share, rather than supporting oil prices. As a result, oil prices have been in a free-fall since then, which will cause serious problems for smaller oil exporters in Western Asia. The consequence of lower oil prices will depend on each country's fiscal breakeven price and the financial reserves accumulated in recent years. Countries such as Bahrain, Iraq and Oman will need to revise their fiscal spending strategies, as their fiscal deficits are expected to reach new highs given lower oil revenues. By contrast, countries such as Kuwait and Qatar enjoy fiscal breakeven prices below current oil prices and will, therefore, have more room to maneuver. For instance, Kuwait's fiscal surplus is expected to remain robust this fiscal year, about 22.2 percent of GDP. Countries such as Saudi Arabia and the United Arab Emirates face breakeven prices that are higher than current oil prices in order to balance their budgets, but they also have accumulated significant financial reserves in recent years, which can be used to cover possible fiscal deficits in 2015. For instance, the central bank of Saudi Arabia possesses net foreign assets exceeding $700 billion, about three times the total public spending budget for 2014.

Latin America and the Caribbean: economic growth in Peru decelerates sharply

After several years of robust growth, Peru's economy has slowed down significantly in 2014. In the third quarter, GDP increased by only 1.8 per cent year on year, accumulating an overall expansion of only 2.8 per cent so far in 2014, less than half the GDP growth of 5.8 per cent in 2013. The economic slowdown has been driven by an abrupt fall in exports and investment. In the first three quarters of 2014, exports and gross fixed capital formation fell by 5.0 and 1.3 per cent, respectively, year on year.

Manufacturing production continues to be highly restrained in the region, particularly in the large economies of South America. In the first nine months of 2014, manufacturing in Brazil shrank by 3.3 per cent year on year, while in Argentina and Peru it fell by 2.7 and 0.1 per cent, respectively. Meanwhile, between January and October of 2014, the manufacturing production index in Chile accumulated an overall variation of -1.1 per cent year on year. Conversely, the manufacturing sector in Mexico has improved in recent months, following strengthening economic conditions in the United States. In September, manufacturing increased by 4.8 per cent year on year, leading to an overall expansion of 3.4 per cent in the first nine months of 2014 year on year.

Welcome to the United Nations

Welcome to the United Nations