Download the World Economic Situation and Prospects Monthly Briefing No. 76

March 2015 Summary

- ??Central banks in developed and emerging economies ease monetary policy

- Agreement reached to extend Greece's bailout programme through June

- Inflation pressures increasing in CIS economies, while easing in many other emerging economies

Central banks in developed and emerging economies continue to ease monetary policy

Against the backdrop of subdued growth and downward pressure on inflation, many central banks across the globe have further eased monetary policy in recent months. While the United States Federal Reserve (Fed) is projected to start the process of normalizing interest rates in the near future, most other monetary authorities are still moving in the opposite direction. In January 2015, the European Central Bank (ECB) announced a large-scale bond-buying programme in a bid to revive its sluggish economy and counter deflation. The Bank of Japan has kept its massive monetary stimulus programme unchanged since October 2014, but could take additional easing measures in the course of 2015 as inflation falls short of the 2 per cent target. Among other developed economies, the monetary authorities of Australia, Canada, Denmark, Norway, Sweden and Switzerland have all lowered their benchmark policy rates in the past few months. The Central Bank of Sweden, which was among the first to raise rates after the global financial crisis, also announced a programme of government bond purchases while joining the ECB, Denmark, and Switzerland in imposing negative interest rates. In several emerging economies, including China, India, Indonesia, Israel, Pakistan and Turkey, policy rates have also been cut since the start of the year as monetary authorities responded to notable declines in inflation. From a global perspective, these cuts in interest rates and the extensive use of unconventional monetary policy measures in developed economies have raised a number of concerns. First, fears of competitive devaluations have emerged because the easing measures tend to weaken the domestic currencies. Second, ultra-low interest rates and abundant global liquidity could fuel asset price bubbles and lead to misallocation of resources. And third, a growing divergence between the monetary policy stance in the United States of America and other major economies could result in disruptive adjustment processes on international financial markets, including significant capital flow reversals, higher asset price volatility and a broad-based repricing of risks.

Greece's bailout negotiations: agreement on an extension, but only through June

The new political leadership of Greece has engaged in protracted negotiations with the European Commission on the terms of the country's bailout programme, worth about ?240 billion in soft loans. The European Union (EU) and the International Monetary Fund (IMF) have been providing financial assistance to Greece since May 2010 against the backdrop of a sharp deterioration in the balance of payments, while the ECB has been providing liquidity support to Greek banks. However, the adherence to fiscal austerity (a key condition of the bailout) and the reduction in the country's primary fiscal balance to about 1 per cent of gross domestic product (GDP) by 2014 has imposed a heavy toll on the economy; GDP declined by about 25 per cent, while the unemployment rate currently stands at over 25 per cent. Together with the erosion of real wages, high unemployment severely constrained aggregate demand, thereby curbing growth. On the other hand, lower labor costs failed to attract significant foreign investment.

The recent tough negotiations have created a feeling of uncertainty in Greece, which has led to a massive withdrawal of corporate and household deposits. Beginning 11 February, the ECB suspended acceptance of Greek government bonds for its refinancing operations. At the end of February, the new Government of Greece agreed de facto to comply with the broad terms of the bailout programme, which has been extended by four months by the euro area finance ministers, despite the skeptical attitude of the ECB and the IMF. The extended programme offers some budget flexibility in 2015. In turn, the Government committed itself to a list of reforms, while living up to its promise of providing humanitarian relief. It promised to crack down on domestic corruption, tax evasion and smuggling of fuel; to limit sales tax exemptions; to address the shadow economy; and not to reverse privatizations. However, the four-month extension means that in June, when the country faces massive external debt repayments, the entire negotiations have to start all over.

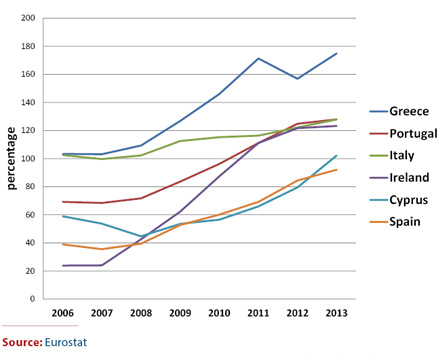

At the end of 2014, the public debt-to-GDP ratio for Greece stood at approximately 175 per cent, much higher than in other peripheral euro area countries (see figure). The maturity of most of this debt has been extended by the EU and the IMF, and interest payments have been lowered or postponed, mitigating the near-term risks. Nevertheless, with the long-term growth prospects subdued by low investment and poor demographic trends, this debt still remains a heavy burden on the economy.

Although it is unlikely that the parties will fail to eventually find a long-term solution to the Greek sovereign debt crisis, the possibility that a lack of timely bailout disbursements could force Greece to abandon the euro cannot be completely discounted. The consequences of such a move could be detrimental for both Greece and the euro area, as it might put the credibility of the entire monetary union at stake. The Greek banking system would fall under enormous stress: The benefits of devaluation would be offset by higher import costs, affecting many sectors of the economy and resulting in higher inflation. Abandoning the euro would deter foreign investors in the short term. The Balkan countries, where Greek banks have a heavy presence, would face instability in the financial sector.

Developed economies

North America: GDP growth in Q4 of 2014 slower than expected, but more balanced

The United States Bureau of Economic Analysis has revised its GDP estimate for the fourth quarter of 2014. The annualized growth rate has been revised down from 2.6 per cent to 2.2 per cent. This downward adjustment was mainly caused by the significantly lower estimate of inventory changes. In the previous estimate, inventory change contributed 0.8 per cent out of the 2.6 per cent of GDP growth; for the new estimate, that contribution was revised to 0.1 per cent out of the 2.2 per cent. Private consumption and net exports were also revised down. On the other hand, the growth rate for business fixed investment has been revised upward from 1.9 per cent to 4.8 per cent. The situation in the labour market has continuously sustained its upward trend, with an accelerating speed of recovery in payroll employment since 2014. The payroll employment in early 2015 has become about 2 per cent higher than the peak level before the great recession. Labour participation for most age groups has bottomed out in 2014 already.

Developed Asia: export growth led a tepid recovery in Japan

According to the Japanese statistical authority, economic output resumed growth during the last quarter of 2014. The first estimate showed that GDP grew at the annualized rate of 2.2 per cent from the previous quarter. GDP for that quarter was still 0.4 per cent lower than one year ago, but has improved notably over the 1.3 per cent drop in the third quarter. This lower-than-expected rate of recovery was broad-based, as all categories of final demand, with the exception of residential investment, have expanded. In particular, the export of goods and services has sustained growing dynamics and expanded at an annualized rate of 11.4 per cent over the fourth quarter of 2014. Net exports contributed to GDP growth, increasing by 0.9 percentage points. Correspondingly, the trade deficit has dropped to the lowest level of the last six quarters. At an annualized growth rate of 1.1 per cent, recovery in private consumption was less vigorous; its level was still about 2.5 per cent lower than one year ago. Monthly statistics indicate that recovery continued in early 2015. Growth in export volume and industrial production has accelerated further. However, the inflation rate, net of effects from the consumption tax rate hike, is still far below the target set by the Bank of Japan.

Western Europe: sovereign debt crisis temporarily quelled, but continues to pose a risk to the fragile recovery

Tense negotiations throughout the first 3 weeks of February between the new Greek Government and the Eurogroup of Finance Ministers acted as a stark reminder that the European sovereign debt crisis has yet to be fully resolved. While it was encouraging to observe a few signs of financial market contagion to other economies as the risk premium on Greek government debt widened between September 2014 and February 2015, another flare-up of tensions could derail the fragile economic recovery in Europe. Following a temporary agreement reached on 20 February, Greek 10-year government bond yields have receded by more than 100 basis points. But as the end to the temporary agreement approaches in June (see global section), financial tensions may re-emerge. The risks are higher in countries such as France and Italy, where persistently weak housing markets continue to weigh on the economy and bank balance sheets.

The recovery in Europe, led by Germany and the United Kingdom of Great Britain and Northern Ireland, is gradually becoming more broadly based, including a notable rebound in Spain. The upturn is supported by low oil prices, weaker currencies, expansive monetary stimulus programmes and declining consumer prices. The EU recorded inflation of -0.5 per cent in January, with 23 of 28 member States reporting a year-on-year drop in the price level. While prolonged deflation poses a risk of becoming entrenched in expectations and wage settlements, a temporary drop in prices should support real incomes, household demand and external competitiveness in the near term.

The new EU members: deflation deepens in January

Lower prices of crude oil and energy and lower transport costs (as well as the excess food supply created by the Russian food import ban) continued to exert downward pressure on consumer prices in the new EU members. Deflation, which was observed in the final quarter of 2014 in several countries of the region, deepened further in January. Consumer prices declined on an annual basis by 1.4 per cent in Hungary, 1.4 per cent in Lithuania, 1.3 per cent in Poland and 0.4 per cent in Slovakia. Although key policy rates are already at record-low levels in countries with flexible currencies, further interest rate cuts during the first quarter are quite possible.

In addition to using the interest rate channel of monetary policy, the Hungarian National Bank announced in mid-February that its Funding for Growth scheme aimed at providing cheap credit to small and medium-sized businesses will be extended until December 2015, with additional funds worth $1.9 billion (an equivalent of 1.6 per cent of GDP) to be disbursed to commercial banks starting in March.

Economies in transition

CIS: Azerbaijan devalues the currency

A peace deal achieved in Minsk on 12 February gave hope of ending the military conflict in east Ukraine. However, as violence continued, the Ukrainian currency plunged further against the dollar in late February, losing over 50 per cent of its value since the beginning of the year, despite the 550 basis points policy rate increase by the National Bank of Ukraine (to 19.5 per cent) earlier in the month. As the country's foreign-exchange reserves dropped in February to another critical low of less than a month of import coverage, access to the $17.5 billion loan, newly approved by the IMF, remains critical. The conflict took a heavy toll on the economy; the Ukrainian GDP declined by 15.2 per cent year on year in the final quarter of 2014. As lower oil prices clouded the outlook for the Russian economy, Moody's agency downgraded the Russian sovereign debt rating in February to junk status, also citing the conflict in Ukraine and the weaker currency.

Inflationary pressures in the CIS area remain strong following the depreciation of most of the currencies, even for countries whose main import partner is the EU. In January, inflation in the Russian Federation hit 15.0 per cent year on year, while in Ukraine, consumer prices grew by 3.1 per cent month on month. The Central Bank of Armenia raised interest rates by 100 basis points in early February, citing high inflationary expectations, although the currency has stabilized after its sharp fluctuations in December. Against the backdrop of lower oil prices, the Central Bank of Azerbaijan in mid-February announced a change in its exchange-rate policy by abandoning the peg to a dollar and pegging the currency to a euro-dollar basket. The central bank has spent about $1 billion since the beginning of 2015 in order to maintain the peg, as many depositors converted their savings to dollars. Later in the month, the central bank devalued the currency versus the dollar by 33.5 per cent. The weaker currency will facilitate achieving fiscal targets, but may create difficulties for borrowers who took dollar-denominated loans, and increase the commercial banks' ratio of foreign liabilities to total assets.

South-Eastern Europe: new IMF program for Serbia

In late February, the IMF approved a new stand-by arrangement for Serbia, worth about ?1.17 billion. The arrangement is precautionary, meaning that funds will be drawn only in the case of serious balance-of-payments needs. The accompanying economic programme, agreed with the IMF, focuses on strengthening public finances and increasing stability of the financial sector. In late January, the Bank of Albania cut its key policy rate to a record low level of 2 per cent, as consumer price inflation was far below the target range.

Developing economies

Africa: the situation in Libya is deteriorating

The situation in Libya continues to deteriorate as there are now two competing governments?the internationally recognized elected government operating in the east and the Islamist-backed government in control of Tripoli. This has continued to put pressure on government operations and oil production. Oil production was down to only 200,000 barrels per day (bpd) in mid-February, well below the post-revolutionary peak of around 1.5 million bpd in mid-2013. Oil exports were even lower, estimated at only 70-80 thousand bpd. This has had considerable impact on government revenues, which were down by almost two thirds between 2013 and 2014, exacerbated by the fall in oil prices. Foreign reserves have also fallen, by 15 per cent between January and September last year. The competing governments have also limited some functions and payments, such as the Price Stabilization Fund and wheat imports. Wheat reserves for subsidized flour are only expected to last

until April.

In South Africa, the economy expanded by 1.5 per cent last year, down from 2.2 per cent in 2013. The slowdown was caused by a number of factors, including an extended mining strike, persisting power shortages and constrained consumer spending. The mining sector, which constitutes about 7.6 per cent of GDP, contracted by 1.5 per cent during 2014. This also underpinned the increase in the trade deficit by 33.5 per cent in 2014, despite the positive impact on competitiveness stemming from the depreciation of the rand.

East Asia: inflation in the region remains subdued

Inflation remains subdued across East Asia, as most economies registered lower year-on-year inflation in January, compared to the month before and the 2014 annual average. Taiwan Province of China and Thailand fell into deflation territory, with consumer price index (CPI) changes of -0.9 per cent and -0.4 per cent year on year, respectively. Singapore has witnessed deflation for three consecutive months, with consumer prices falling by 0.4 per cent in January. Within the CPI basket, fuel and utilities and private road transportation experienced the sharpest fall from one year ago. Overall, government estimates show prices of direct oil-related items dropped by 13.6 per cent in January.

On 17 February, Bank Indonesia (BI) cut its benchmark policy rate from 7.75 to 7.5 per cent?the first cut since 2012, as inflation is expected to slow down in 2015. CPI inflation came in at 6.96 per cent year on year in January, down from 8.36 per cent in December 2014. BI considers the rate cut as consistent with its efforts in reducing the current-account deficit to a more

sustainable level.

On 1 March, People's Bank of China (PBoC) cut both its benchmark one-year deposit rate and lending rate by 25 basis points to 2.5 per cent and 5.35 per cent respectively. PBoC cites upward influence of tepid inflation on real interest rates as a reason behind its decision. On 5 February, PBoC also slashed the required reserve ratio by 50 basis points. These moves came after preliminary PBoC data showed new credit creation in China fell by 4.96 per cent in 2014. Growth of trust loans, a main pillar of the country's expanding shadow banking sector, slowed down in 2014, accounting for only 3.1 per cent of all new credit creation, down from 10.6 per cent

in 2013.

South Asia: statistical revisions boost GDP growth in India

In India, statistical revisions have significantly raised the GDP growth estimates for the past two years. The national statistical authorities moved the base year from 2004/05 to 2011/12, while also incorporating conceptual changes, based on international guidelines, and improvements in survey techniques. According to the new calculations, India's GDP grew by 6.9 per cent in the fiscal year 2013/14, compared to a previous estimate of only 4.7 per cent. For the period March-December 2014, growth is now estimated at 7.4 per cent, well above earlier estimates of about 5.5 per cent. The authorities attribute these upward revisions in growth largely to improved measurement of manufacturing and service

sector activities.

In Pakistan, economic activity was weaker than expected in the third quarter of 2014 as the agricultural sector and large-scale manufacturing posted subdued growth. However, preliminary estimates indicate some improvement in the final quarter of the year, in part owing to the sharp decline in oil prices. The country is expected to receive a $518 million loan tranche in March under the IMF $6.6 billion Extended Fund Facility programme as economic reforms are on track and the Government has exceeded the

targets set.

Western Asia: new interest-rate cut by the Central Bank of Turkey

In February, the Central Bank of Turkey cut its key interest rate, the one-week repurchase lending rate, by 25 basis points, to 7.5 per cent. This is the second cut in two months, amid disinflationary effects of lower oil prices. The stabilization of credit growth rates at sustainable levels and a narrowing of Turkey's large current-account deficit also support the central bank's decision. A major concern, however, is that renewed lira weakness in late January and early February could offset the disinflationary effects of lower oil prices. In the months ahead, the Central Bank of Turkey's decision regarding further interest rate cuts will depend on the monetary policy decision of the Fed and the availability of global liquidity. According to data released by the Central Bureau of Statistics on 16 February, Israel's real GDP growth expanded by 2.6 per cent in 2014. The economy had slowed down in the third quarter owing to the conflict in the Gaza strip in July and August. However, the negative impact of the conflict was short lived; during the final quarter of 2014, investment rebounded strongly, by 8.7 per cent. In addition, public and private expenditure rebounded in the aftermath of the conflict. Exports of goods and services also performed well, increasing by 7.3 per cent, despite weak tourist arrivals.

Latin America and the Caribbean: strong growth in some smaller southern economies expected in 2015

Although economic activity in the region continues to be weak, due to the mediocre performance of large economies in South America, some smaller southern economies are expected to grow robustly in 2015. For instance, after a disappointing performance in 2014, the Peruvian economy is expected to resume a stronger growth trajectory and to expand by 4.9 per cent in 2015, driven by the recovery of investment demand, resilient private consumption and a sizeable fiscal stimulus, including tax cuts and large public investments. Given that the inflation outlook remains favourable, accommodative monetary policy will also support economic activity. Meanwhile, Paraguay's economy is expected to continue on a relatively firm growth path and to expand by 4.6 per cent in 2015. Economic activity will be driven by a significant pickup in exports and the continuing expansion of private demand, supported by favourable trends on employment and real wages, along with further support from conditional cash transfers and other anti-poverty programmes. Finally, the economy of the Plurinational State of Bolivia is expected to expand by 4.8 per cent in 2015, a slightly slower pace than in previous years. In particular, robust private consumption (supported by public transfers and subsidies)

and reasonably vigorous investment demand (helped by large

public spending in infrastructure) will continue to sustain

economic activity.

Welcome to the United Nations

Welcome to the United Nations