14 September 2015 Summary

- Volatility soars in global financial markets

- Concerns over China's economy are mounting

- Stronger-than-expected GDP growth in the U.S., while economic growth slows in many developing countries

Global issues

Financial market volatility heightened sharply

Volatility in global financial markets heightened sharply in August, amid rising concerns about a further slowdown in some major emerging economies, including Brazil, China and the Russian Federation, and the uncertainties about the forthcoming increase in the policy interest rate in the United States of America.

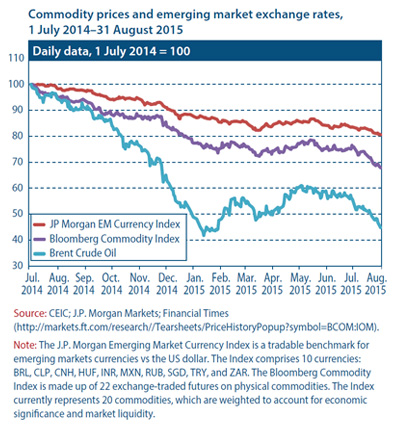

International commodities, particularly crude oil, have seen large price swings over the past month, while the longer-term downward trend remains in place (see figure). Amid concerns over slowing oil consumption growth and signs of abundant supply, the Brent price fell to $42 per barrel on August 24, the lowest level since March 2009 and more than 60 per cent below the level of June 2014 (see figure). Following an upward revision to second-quarter growth in the United States and speculation about production cuts, the Brent price then rebounded to above $50. The prices of industrial metals and several other commodities that are very sensitive to demand from China (such as soybeans and rubber) also weakened considerably before recovering some of their lost ground in late August.

Currencies and equity markets in emerging economies have remained under pressure amid significant declines in portfolio capital inflows. As illustrated in figure 1, the J.P. Morgan Emerging Market Currency Index, which measures the value of 10 major emerging-market currencies against the US dollar, continued to trend downward. The Bloomberg J.P. Morgan Latin America Currency Index dropped in August to its lowest level since November 1992.1 Most East Asian currencies also weakened markedly, with the Indonesian rupiah and the Malaysian ringgit sliding to the lowest levels against the dollar since the Asian financial crisis of 1997-1998. Meanwhile, equity markets in many emerging economies experienced large sell offs, with the equity prices in China plummeting 40 per cent in two months. In many emerging economies, the recent financial market pressures have coincided with a further worsening of short-term economic prospects.

The financial turbulences have also affected stock markets in developed economies. The major indices have dropped by 10 to 20 per cent from the peaks reached in the second quarter of 2015. At the same time, volatility in stock markets and exchange rates among developed countries has soared.

China's exchange-rate regime adjustment and some possible implications

The renminbi dropped 3 per cent against the dollar during 11-13 August, although the exchange rate has since stabilized below 6.4 renminbi to the dollar. The fall in the renminbi was largely a result of the technical adjustment by the People's Bank of China (PBoC) in its mechanism to determine the daily reference rate of the renminbi against the dollar in the interbank foreign-exchange market. According to the new policy regime, the daily reference rate is set based on the previous day's closing rate rather than fixed by the PBoC, thus allowing the market to play a bigger role in determining the exchange rate. The daily trading band around the central reference rate remains 2 per cent. However, as this move followed the release of July data showing weaker growth of retail sales and industrial output and merchandise exports dropping by 8.3 per cent (in value terms), the depreciation of the renminbi is also interpreted by many analysts as a policy to stimulate the economy. The renminbi has maintained a relatively stable exchange rate with the US dollar over the past years; this has led to an appreciation of 15 per cent (in trade-weighted terms) between July 2014 to July 2015 against the currencies of China's trade partners, because the currencies in many other economies depreciated significantly in the same period. The adjustment is also in line with China's bid to get the yuan included in the International Monetary Fund (IMF) basket of reserve currencies, which requires a currency to be "freely usable". The IMF described China's latest exchange-rate regime change as a "welcome step".

The adjustment of the exchange-rate regime in China and the subsequent fall of the renminbi against the dollar may have some global implications. First, there will likely be a direct impact on those trade partners whose export sectors have become increasingly dependent on China. In 2014, merchandise exports to China accounted for 10 per cent of global export values, up from 3.5 per cent in 2000. Some country groups are particularly reliant on exports to China; for example, over 30 per cent of least developed countries' shipments in 2014 went to China. For several economies in Asia and the Pacific, including Australia, Laos, Mongolia and the Republic of Korea, China also accounted for over 30 percent of total merchandise exports. In addition, the currency regime adjustment has implications for countries that compete with China in the global export market. According to the UNCTAD indicator of similarity in merchandise trade structures for 2013, many economies in East and Southeast Asia, such as Malaysia, the Republic of Korea, Taiwan Province of China, Thailand and Viet Nam, had a trade structure relatively similar to that of China. China's move also pushed adjustments further downward for several developing countries' currencies with US dollar pegs. Viet Nam devalued its currency against the dollar by 1 per cent on 19 August and Kazakhstan abandoned the trading band of its currency on 20 August, causing the Kazakhstani tenge to drop by over 20 per cent against the US dollar in a single day. But in case the depreciation of renminbi is just a one-off adjustment, the impact discussed above should be limited.

Developed economies

North America: desynchronized short-term dynamics between the US and Canadian economies

The United States Bureau of Economic Analysis has revised upward the gross domestic product (GDP) growth rate for the second quarter of 2015, from an annualized 2.3 per cent to 3.7 per cent. This upward revision is mainly explained by higher estimates of government expenditures and fixed-capital formation. After plunging more than 7 percent in the first quarter, investment in non-residential structures rallied in the second quarter. Residential investments also stayed on the expansionary track, although slower than the previous two quarters. The pace of construction and transactions of private houses has been on a gradual recovery path for many years, while recent statistics indicate that housing prices have surpassed their pre-crisis peak levels. In Canada, total production increased by 0.5 percent in June 2015 from the previous month, after contracting for five months. Nevertheless, GDP declined by 0.5 per cent in the second quarter, after the 0.8 per cent decline in the previous quarter. In contrast to the United States, business non-residential investment almost mimicked the sharp oil-price plunge in the first quarter, which was the main contributor to the contraction of GDP.

Developed Asia: looming uncertainty in Japan

According to the preliminary estimate, Japanese GDP contracted by 1.6 per cent in the second quarter of 2015. Private consumption and exports, which dropped by 3.0 per cent and 16.5 per cent respectively, were the key driving factors behind this contraction. The drop in private consumption can be attributed to the weak growth of total nominal compensation of employees over the last three quarters. So far, available data for July 2015 shows that private consumption is improving, as retail sales and core household spending did increase from June 2015. However, index levels for both industrial production and employment turned out to be lower than the previous month. The unemployment rate decreased by 0.1 percentage points in July, mainly owing to lower labour force participation. The sustained slowly declining unemployment rate and elevated ratio of job offers to job applicants have not induced improvements in the wage rate yet. During the first six months of 2015, real wages were still lower than one year ago. The export volume did increase slightly in July, but import volume increased more rapidly, raising the net trade deficit.

Western Europe: pockets of fragility persist

European Union (EU) GDP growth remained stable in the second quarter of 2015, at 0.4 per cent quarter on quarter, and the source of growth continued to be fairly broadly based across countries. Nevertheless, the economic rebound in France seen in the first quarter of the year was short lived and Finland remains mired in its fourth consecutive year of recession. In Finland, GDP growth has been hampered by the loss of Nokia, close trade ties with the Russian Federation, and heightened competition from Asia in the paper pulp industry. Spain, on the other hand, has continued to expand rapidly, which has allowed the unemployment rate to recede by more than 2 percentage points compared to a year ago. Nonetheless, more than 22 per cent of the Spanish workforce remains unemployed, which poses a serious European policy challenge. More than half of the unemployed have been out of work for over a year, which puts them at significantly higher risk of longterm disengagement from the labour market.

The Greek economy expanded by a robust 0.8 per cent in the second quarter. However, given the severe political and economic turmoil that ensued, including the three-week closure of Greek banks beginning on 29 June and the imposition of stringent capital controls, much of this apparent rebound will have been reversed in the third quarter of the year. Alexis Tsipras resigned as Greek Prime Minister on 20 August following the controversial bailout agreement with European creditors, and a snap Greek election is scheduled for 20 September. While polls currently favour Syriza, headed by Mr. Tsipras, a splinter party of former Syriza supporters is running on a platform based on withdrawal from the euro area. If the probability of a Greek exit from European Monetary Union gains traction, heightened volatility in Greek financial markets may re-emerge as the election date approaches.

The new EU members: second quarter strong in Central Europe

In the second quarter, most of the new EU members continued to benefit from favourable export demand and lower production cost associated with lower oil prices. In addition to external factors, domestic demand significantly contributed to growth, as improved labour markets bolstered consumer confidence (most notably in the Czech Republic) and low inflation boosted real incomes. Nevertheless, growth slowed down on a quarterly basis in the Czech Republic, Hungary and Poland. In the Czech Republic, second-quarter GDP grew by 4.4 per cent, driven by the flagship automotive industry. In the Baltic States, growth accelerated in Latvia, from 1.9 per cent in the first quarter to 2.7 per cent in the second quarter.

Annual inflation remained near zero in July, and even negative in some cases. Month-on-month consumer prices declined in almost all countries. Lower oil and food prices, exacerbated by the impact of the Russian embargo on food imports, were the major deflationary factors. Despite mounting investor concerns about emerging markets, the currencies and government bonds of the new EU members remained resilient in August; flexible currencies even strengthened versus the US dollar. In August, the Government of Hungary announced its intention to convert consumer foreign currency loans (worth about $1.1 billion in total) into domestic currency loans to protect the holders from exchange-rate fluctuations. In Croatia, outstanding Swiss franc loans will be converted into euro loans.

.

Economies in transition

CIS: Russian and Kazakh currencies slide

The combined effects of lower oil prices and international economic sanctions against the Russian Federation have led to a deeper plunge of GDP in the second quarter, contracting by 4.6 per cent. Although forward-looking indicators had pointed to a possible turnaround in the third quarter, the recent plunge of the Russian rouble to a record low versus the US dollar will create additional challenges. The weaker currency will reduce US dollar expenses in the commodity sector and mitigate financing pressures on indebted companies, but it will also complicate efforts to curb inflation. In Ukraine, the economy was affected by the military conflict and shrank by 14.7 per cent in the second quarter. An agreement has been reached with international creditors in August on restructuring foreign-owned public debt, involving about 20 per cent in write-offs. In Kazakhstan, after the central bank abandoned the currency corridor in late August, the currency depreciated nearly 20 per cent versus the US dollar, to a large extent realigning with the exchange rate of the Russian rouble. This will have inflationary consequences and undermine consumer confidence. Currency also weakened in Belarus.

After 19 years of negotiations to join the World Trade Organization, Kazakhstan signed an accession treaty in late July. The formal ratification process is expected to be completed in 2015. In mid-August, the accession treaty of Kyrgyzstan to the Eurasian Economic Union entered into force. The membership will facilitate labour migration to the Russian Federation. However, the adjustment in external tariffs may lead to higher inflation and curtail re-exports, negatively affecting the economy.

South-Eastern Europe: some countries are caught in the middle of the migrant crisis

The economy of Serbia expanded by a meagre 1.0 per cent in the second quarter, despite 18.6 per cent increase in industrial output in June. Nevertheless, this is a positive development after five consequent quarters of GDP contraction. In Montenegro, the tourism sector, which stagnated in 2014, performed well in the first half of 2015, supported by the weaker euro. Inflation in the region remains subdued. In July, consumer prices declined by 0.7 per cent month on month in the former Yugoslav Republic of Macedonia, and by 0.9 per cent in Serbia, owing to seasonally low food prices. As a result, the National Bank of Serbia cut its key policy rate to 5.5 per cent in mid-August. The former Yugoslav Republic of Macedonia and Serbia became caught in the middle of Europe's migrant crisis, becoming transit countries for migrants, which puts additional burden on public finances.

Developing economies

Africa: a more broad-based slowdown in GDP growth

A number of economies reported weaker economic growth figures. South Africa saw its GDP growth slow to 1.2 per cent in the second quarter, driven by weakness in the manufacturing, agriculture and energy sectors. Nevertheless, for the first half of the year, growth reached 1.6 per cent, the same level as in the previous year. Likewise, growth in Nigeria slowed to 2.4 per cent in the second quarter, with lower oil prices and lower oil output playing a major role. In parallel to this, the number of jobs created fell by almost 70 per cent in the second quarter compared to the previous quarter. In Tunisia, the decline in GDP growth to 0.7 per cent in the second quarter was driven, among other factors, by sharply lower harvest levels, due to drought conditions, and the negative performance of the tourism sector in the wake of terrorist attacks. In the commodity markets, Uganda, the largest coffee exporter in Africa, reported a decline in coffee exports by 7.4 per cent in volume for the 2014-2015 crop year. This decline can be attributed to weaker production caused by adverse weather conditions and lower prices.

East Asia: second quarter growth decelerated in East Asian economies

In line with the overall regional trend, GDP growth in Malaysia and Taiwan Province of China decelerated in the second quarter. GDP growth in Taiwan Province of China decelerated significantly from 3.4 per cent in the first quarter to 0.6 per cent. Exports of goods and services fell by 1.3 per cent, driven by the weak demand for electronic products. Similarly, the export sector of Malaysia contracted in April and May. The trend reversed in June, led by the electrical and electronic sector with 14 per cent year-on-year export growth. Malaysia's GDP growth was 4.9 per cent in the second quarter, down from 5.6 per cent in the first quarter. Both economies are, however, supported by robust private consumption, 4 which rose by 6.4 per cent in Malaysia and 2.8 per cent in Taiwan Province of China.

The Indonesian economy grew in the second quarter at about 4.7 per cent, the same rate as in the first quarter. Exports of goods and services fell by 0.1 per cent. Private consumption?the main driver of the economy?grew by 4.7 per cent, which is lower than the annual averages of the past three years. The delayed execution of the public investment budget also served as a drag on growth. Implementation of the budget should gain pace in the second half of 2015, as the Government seeks to introduce presidential directives that allow senior officials to implement investment faster.

South Asia: India's growth slowed in the second quarter amid weak exports

India remains one of the world's fastest-growing large economies, although GDP growth was slightly lower than expected in the second quarter of 2015 amid continuing weakness in external demand. Gross domestic product expanded by 7.0 per cent year on year, down from 7.5 per cent in the first quarter. Growth was largely driven by private domestic demand, with household consumption increasing by 7.4 per cent. Real exports contracted by 6.5 per cent as external demand weakened, especially from developing countries. The growth slowdown has increased the likelihood that the Reserve Bank of India will further cut its main policy rate in the coming months.

Exports have also remained weak in other South Asian countries, such as the Islamic Republic of Iran, Nepal and Pakistan. In Pakistan, total export earnings (in national currency) declined by 4.6 per cent in the first half of 2015, due to sluggish external demand, continuing energy constraints, and various industry-specific factors. In Nepal, the merchandise trade deficit is projected to further widen significantly in 2015 as a result of the devastating earthquake in April. While export revenues are estimated to fall, import spending will likely be pushed up by reconstruction activities.

Western Asia: sharp depreciation of the Turkish lira

The Turkish lira (TRY) depreciated further in August, as a result of several internal and external factors. On 24 August, the TRY reached an all-time low since 1991, trading at 2.95 TRY per US dollar, representing a depreciation of more than 25 per cent against the dollar since the beginning of 2015. The announcement of new elections and renewed political uncertainty precipitated the recent depreciation trend, in addition to higher global financial volatility. Despite recent good news on the inflation front (i.e., the consumer price index had reached 6.8 per cent in July, the lowest value since May 2013), the depreciation of the TRY may lead to upward pressure on prices and to tighter monetary policy, with negative consequences for economic growth and the already high unemployment rates. Among other diversified economies in the region, the Jordanian Government announced this month a possible new loan of $1.5 billion from the IMF, included in a three year programme aimed at improving the business climate. Although Jordan has considerably improved its overall macroeconomic situation in recent years, employment creation remains a major challenge, especially in the private sector, as it is not keeping up with the pace of new labour market entrants. In Lebanon, the budget deficit increased by more than 26 per cent in the first quarter compared with one year ago. The deficit is now expected to sink deeper than the 6.3 per cent of GDP registered in 2014. A sharp drop in public revenues?mainly due to weaker economic activity, the improvement of which is being hampered by conflicts in the neighbouring Syrian Arabic Republic?more than offset the positive effect of lower oil prices on the expenditure side.

Latin America and the Caribbean: regional exports seriously affected by China's slowdown

The expectation of a further slowdown in China?the third largest export destination for Latin America and the Caribbean, after the United States and the EU?has aggravated the meagre economic situation in the region, especially in South America. In recent months, exports from South American companies to China have already declined markedly and prospects for the second half of 2015 remain bleak. For instance, in the first six months of 2015, Colombian exports to China tumbled by more than 70 per cent, while Brazilian exports fell by almost 20 per cent. Also, in the first seven months of 2015, Uruguayan and Argentinean exports declined by 16 and 15 per cent, respectively. Some Central American countries have also experienced a visible reduction of their exports to China, even though China is not a major trading partner for this subregion. For example, during the first half of 2015, exports from Mexico and Costa Rica decreased by 23 and 19 per cent, respectively.

Considering the region as a whole, almost 80 per cent of the regional exports to China entail only four commodities: soybeans and soybean oil; crude oil; copper and iron ore. This composition and high degree of sectoral concentration of exports makes the region particularly vulnerable to demand swings from China.

Welcome to the United Nations

Welcome to the United Nations