12 October 2015 Summary

- Global trade flows drops in value terms amid persistently weak commodity prices and stronger US dollar

- Budget cuts and increasing fiscal strains in many commodity-exporting developing countries

Global issues

Widening gap between values and volumes in global trade

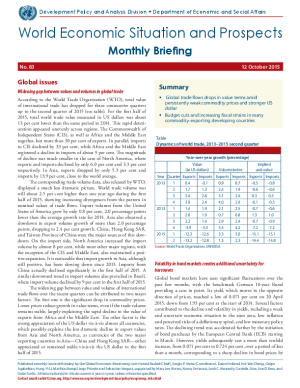

According to the World Trade Organization (WTO), total value of international trade has dropped for three consecutive quarters up to the second quarter of 2015 (see table). For the first half of 2015, total world trade value measured in US dollars was about 13 per cent lower than the same period in 2014. This rapid deterioration appeared unevenly across regions. The Commonwealth of Independent States (CIS), as well as Africa and the Middle East together, lost more than 30 per cent of exports. In parallel, imports to CIS declined by 33 per cent, while Africa and the Middle East registered a decline in imports of about 9 per cent. The magnitude of decline was much smaller in the case of North America, where exports and imports declined by only 6.0 per cent and 3.3 per cent respectively. In Asia, exports dropped by only 5.3 per cent and imports by 13.9 per cent, close to the world average.

The corresponding trade volume data, also released by WTO, displayed a much less dramatic picture. World trade volume was still about 2.5 per cent higher than one year ago during the first half of 2015, showing increasing divergences from the pattern in nominal values of trade flows. Export volumes from the United States of America grew by only 0.8 per cent, 2.0 percentage points lower than the average growth rate for 2014. Asia also observed a slowdown in export volume growth of more than 2.0 percentage points, dropping to 2.4 per cent growth. China, Hong Kong SAR, and Taiwan Province of China were the major sources of this slowdown. On the import side, North America increased the import volume by almost 8 per cent, while most other major regions, with the exception of the CIS and Middle East, also maintained a positive expansion. It is noticeable that import growth in Asia, although still positive, has been slowing down since 2013. Imports from China actually declined significantly in the first half of 2015. A similar downward trend in import volumes also prevailed in Brazil, where import volume declined by 9 per cent in the first half of 2015.

The widening gap between value and volume of international trade flows over the recent quarters can be attributed to two major factors. The first one is the significant drop in commodity prices. Lower prices reduce growth in value terms, even if the trade volume remains stable, largely explaining the rapid decline in the value of exports from Africa and the Middle East. The other factor is the strong appreciation of the US dollar vis-?-vis almost all currencies, which possibly explains the less dramatic decline in export values from Asia and North America, as currencies of the two major exporting countries in Asia?China and Hong Kong SAR?either appreciated or remained stable vis-?-vis the US dollar in the first half of 2015.

Volatility in bond markets creates additional uncertainty for borrowers

Global bond markets have seen significant fluctuations over the past few months, with the benchmark German 10-year Bund providing a case in point. Its yield, which moves in the opposite direction of prices, touched a low of 0.071 per cent on 20 April 2015, down from 1.93 per cent at the start of 2014. Several factors contributed to the decline and volatility in yields, including a weak and uncertain economic situation in the euro area, low inflation and perceived risks of a deflationary spiral, and low monetary policy rates. The declining trend was accelerated further by the initiation of bond purchases by the European Central Bank (ECB) starting in March. However, yields subsequently saw a more than tenfold increase, from 0.071 per cent to 0.724 per cent, over a period of less than a month, corresponding to a sharp decline in bond prices by about 6.0 per cent and implying a dramatic increase in volatility. After some temporary recovery, the sell-off picked up speed again, culminating in a yield of 1.0 per cent in mid-June, then falling to about 0.5 per cent by September. A major trigger for this was the receding risk of deflation in the euro area, with investors demanding higher interest rates for holding bonds. In addition, bond price movements were possibly exacerbated by lower levels of market liquidity, meaning that orders set off relatively larger changes in transaction prices. Such pronounced swings in benchmark bond yields are creating additional uncertainty for corporate, private and sovereign borrowers alike at a time when financial markets already have to deal with the prospect of an increase in the policy interest rate by the United States Federal Reserve (Fed). This complicates financial planning and future investment, and particularly highlights the risk of debtors encountering higher interest rates when refinancing their outstanding debt, with potential adverse effects on growth.

Developed economies

North America: strong dollar may drag growth

On 17 September 2015, the Fed decided to keep its policy rate at the prevailing level. Nevertheless, communication from Fed senior managers since then suggested that the Fed had not completely excluded the possibility for changing its stance by the end of this year. After declining before the Fed meeting, the dollar's external value bounced back and remained close to the highest level since the end of the Great Recession. The rapid and sustained appreciation of the dollar since mid-2014 has been affecting exports of the United States; for the first eight months of this year, nominal exports have declined month-over-month five times. If this trend continues, external trade will drag on growth noticeably over the second half of this year.

Developed Asia: Japanese economy affected by sluggish external demand

In Japan, the export volume declined by more than 2 per cent in August from the average level for the first half of 2015. Industrial production also declined in August, month on month, for the fifth time in the first eight months of 2015, while the ratio of inventory to sales soared in August, indicating the possibility of a further decline in production. Total commercial sales decreased by 1.8 per cent in August, month on month on a seasonally adjusted basis, which is the fourth time out of the first eight months in 2015. These recent developments confirm the serious challenges faced by the Japanese economy, due to both the growth slowdown in Japan's major exporting markets and the higher consumption tax rate introduced in 2014.

In Australia, quarterly gross domestic product (GDP) growth declined to 0.2 per cent in the second quarter of 2015, the lowest level since mid-2013 from the average GDP growth of 0.6 per cent registered during the previous four quarters. A 3.3 per cent drop in total exports largely explains the slowdown. If the rapid increase in public consumption and public fixed investment were excluded, the growth rate would have been even lower. On a positive note, growth in household consumption remained healthy.

Western Europe: deflationary expectations recede

Despite heightened volatility in the European financial markets and a broader deterioration in the global economic outlook, economic prospects in Western Europe remain generally favourable. Euro area inflation dropped below zero in September, which can be attributed to the 8.9 per cent drop in energy prices, while core inflation excluding energy remained stable at 1.0 per cent. If global oil prices do not fall further, the impact of low energy prices on euro area inflation will become more muted by early 2016, and deflation is unlikely to become entrenched in expectations. The unexpected drop in energy prices has boosted household spending and reduced production costs. This has supported solid retail sales and rising confidence indicators, while both intra- and extra-euro area exports have remained strong.

The new EU members: trade surpluses in Central Europe

Despite some variations, the positive growth momentum in the new European Union (EU) member States continued in July and August, supported by both exports and domestic demand. In Poland, industrial production grew robustly in August, by over 5 per cent, thanks to impressive gains in manufacturing output. The external financing capacity of most of these countries has also improved, as many of them, especially in Central Europe, recorded strong trade surpluses and benefited from an increased inflow of EU funds, distributed from remaining funding from the EU 2007-2013 budget.

A low-inflation environment, created by the fall in commodity prices and the Russian food-import ban, continued in August. Annual inflation was zero in Bulgaria and Hungary, and has reached a record low of -1.9 per cent in Romania. Deflation continued to ease in Poland; on an annual basis, prices declined by only 0.6 per cent, although deflation of producer prices accelerated.

The ongoing refugee crisis in Europe poses new challenges for some of the new EU members, as it may lead to disruptions in normal trade flows with the EU-15. Some of the EU-15 countries have threatened to freeze access to EU funding in case of a refusal to agree with the proposed refugee quotas; such development would weigh on investment programmes and adversely impact growth in Central Europe.

Economies in transition

CIS: signs of macroeconomic stabilization in Ukraine

In the Russian Federation, industrial output shrank by 4.3 per cent in August, owing to weak performance of the manufacturing sector, which has not yet benefited from the depreciation of the rouble and from the import substitution effect. The rouble meanwhile showed signs of stabilization. The Ukrainian economy, hit hard by the military conflict in the East and the disruption in trade flows, may have reached a turning point, as the exchange rate and foreign reserves show signs of stabilization and private capital outflows have moderated. In August, following the disbursement of IMF funds, official reserves increased. Month-on-month inflation was negative at -0.8 per cent. At the end of August, the National Bank of Ukraine cut its main policy rate from 30 per cent to 27 per cent; in September the country started restructuring its foreign public debt. In Belarus, GDP declined by 3.5 per cent in January-August, in part because of the lost competitiveness against the background of a narrowing wage gap with the Russian Federation. In Armenia, strong agricultural production (and the opening of a copper mine) pushed the second quarter GDP growth to 5.1 per cent. Meanwhile, Uzbekistan reported 8.1 per cent growth in the first half of 2015, with a strong rise in the services sector and construction.

Many CIS currencies remain under pressure from lower export revenues or contraction in remittances. In Moldova, the central bank had to increase its policy rate in early September, as the currency deprecation contributed to 12.2 per cent inflation in August. Despite that move, currency depreciation continued. In late September, the central bank of Georgia tightened its monetary policy by lifting the interest rate by 100 basis points. In mid-September, the National Bank of Kazakhstan spent almost $500 million to support the national currency, despite a previous decision to move its monetary policy to an inflation-targeting regime with very limited market intervention.

South-Eastern Europe: Europe's refugee crisis leads to trade disruptions

In August and September, the ongoing refugee crisis led to episodes of disruption in freight transport between Serbia and the EU, as Croatia and Hungary?which host the major transit routes for Serbia's external trade?intensified border controls. This may present risks for the Serbian economy, whose exports benefited from lower production costs in the first half of 2015. In the former Yugoslav Republic of Macedonia, GDP increased by 2.6 per cent in the second quarter. Inflation in the region remains contained: in Serbia, it accelerated to 2.1 per cent in August, as the impact of lower oil product prices was offset by higher food and electricity prices. Inflation is still below the lower bound of the tolerance band of the National Bank of Serbia, which continued its monetary easing in September, cutting the policy rate further by 50 basis points to 5 per cent.

Developing economies

Africa: South Africa sees some improvement in its trade performance

In South Africa, the current-account deficit decreased in the first half of 2015 to 3.6 per cent of GDP from 5.5 per cent in the previous year. A major driver for this was an improvement in the trade balance, with exports growing sharply, taking advantage of a weak rand, despite weaker demand and lower prices for commodities. These trade figures also reflect stronger sectoral performances. Manufacturing expanded by 5.6 per cent in July, the fastest growth rate in ten months, underpinned by stronger export demand for motor vehicles. The mining sector grew at the same pace, although the basis for comparison was affected by last year's extensive labour strikes. In Egypt, the current-account deficit widened sharply in the fiscal year ending in June 2015 owing to lower oil export revenues and lower grants from Gulf Arab donors. In the monetary policy area, the Bank of Ghana increased its policy interest rate by 100 basis points to 25 per cent in view of high inflation, continued pressure on the currency and the looming interest rate increase in the United States.

East Asia: the majority of central banks in East Asia keep policy rates on hold

With the exception of monetary authorities in China and Taiwan Province of China, central banks in developing East Asia have put policy interest rates on hold in recent months despite underperformances of their economies and an overall low-inflation environment. Average inflation in the first eight months has been significantly lower than the 2014 average for all systematically important economies in the region with the exception of Indonesia. Indonesia, Thailand, and the Republic of Korea have maintained their policy rates for 7, 5 and 4 months, respectively. Other major central banks in the region have also kept the policy rates steady throughout the year. The impending rate hike by the Fed and the expected disruption to global capital flows have been common considerations in keeping the policy rates generally unchanged.

Conversely, China cut its benchmark one-year lending rate by 25 basis points on 26 August and Taiwan Province of China cut its benchmark discount rate by 12.5 basis points on 24 September, with a view to improving lending conditions and boosting growth. Currency depreciation has become a growing concern for economies in the region, particularly to those that have higher foreign credit exposure. Several East Asian currencies have already depreciated to multi-year lows against the US dollar during the first nine months of 2015, despite the resilience they displayed in the beginning of the year. In particular, Indonesian rupiah and Malaysian ringgit have depreciated by over 15 per cent.

South Asia: significant revisions of Sri Lanka's GDP growth after change in base year

Sri Lanka's economy grew by 6.7 per cent in the second quarter of 2015 on the back of a strong expansion in the service sector, in particular finance, insurance and real estate activities. First-quarter growth was revised down from a previously estimated 6.0 per cent to 4.4 per cent. The national statistical authorities recently released a new GDP series, moving the base year from 2002 to 2010 and including additional data sources. The adjustments have lifted the 2010 level of GDP (and GDP per capita) by 14.4 per cent, while also significantly changing the production structure (away from agricultural and industrial activities towards services) and the country's recent growth trajectory. Annual GDP growth in 2012 is pushed up to 9.1 per cent under the new series (from 6.4 per cent under the old series), whereas growth in 2013 and 2014 is lowered to 3.4 per cent (from 7.2 per cent) and 4.5 per cent (from 7.4 per cent), respectively.

The Reserve Bank of India cut its main policy rate more than expected in September, lowering the repo rate by 50 basis points to 6.75 per cent. The move comes after a further decline in inflation and amid concerns over a slowdown in economic activity. Year-on-year consumer price inflation dropped below 4 per cent in July and August and food inflation pressures are expected to remain contained despite insufficient monsoon rains.

Western Asia: oil-exporting economies overhaul fiscal budgets

In Iraq, oil production has been on the rise this year, reaching over 4 million barrels per day in July 2015, about 30 per cent more than last year's average production. Despite higher production, low oil prices are limiting the Government's revenues and its ability to control the widening budget deficit. The Government is now expecting a budget deficit of $22 billion for 2015, corresponding to 11 per cent of GDP, based on an average oil price of $56 per barrel. This month, as an attempt to limit expenses, the Iraqi Government has decided to cut funding to the oil sector and has issued $2 billion of Eurobonds in order to help finance its deficit. Similarly, Kuwait's Government is expected to redefine its ambitious development plan, by cutting capital spending, rather than wages and subsidies, after recording a fiscal deficit of 5.2 per cent of GDP for the fiscal year April 2014/March 2015?the first budget deficit in a decade.

Anticipating low oil prices and an additional deficit for the current fiscal year, Kuwait's Government announced plans to issue bonds denominated in Kuwaiti dinars by the end of the year. In addition, several members of the Gulf Cooperation Council began taking concrete steps this month to negotiate and implement new revenue-raising measures to increase non-oil government income, such as a value-added tax and new corporation taxes.

Latin America and the Caribbean: fiscal balances under pressure

The sharp decline in commodity prices and the consequent economic slowdown in the region are deteriorating the fiscal position of several economies, mainly through a significant reduction in public revenues. Consequently, in recent months a number of countries have announced public budget adjustments for 2015 and 2016, including relatively large spending cuts and, in some cases, tax increases. In Brazil, the Government announced spending cuts and tax increases of about $16.5 billion (more than 1 per cent of GDP), in an attempt to reduce the fiscal deficit and reach a primary budget surplus over 0.7 per cent of GDP in 2016. The spending cuts are mainly on health and housing programmes, infrastructure and agricultural subsidies, while the increase in taxes encompasses the reintroduction of a financial transaction tax. In Mexico, the public budget bill for 2016?which still must be approved by the Congress?proposes several spending cuts, aimed at reducing the fiscal deficit by 0.5 per cent of GDP. This adds to a previous reduction in expenditures announced last January of about 0.7 per cent of GDP. In Ecuador, spending cuts accumulated 2.2 per cent of GDP in 2015, while spending and investment postponements in Colombia reach $2.4 billion, about 3.0 per cent of the public budget. Furthermore, in order to maintain the fiscal discipline in 2016, the Colombian Congress recently approved an austere budget bill, which includes a sharp reduction on administrative expenditures. Given these recent developments, the region seems to be entering a period of procyclical fiscal tightening.

Welcome to the United Nations

Welcome to the United Nations