- ? The United States of America avoids a fiscal stand-off ?

- Emerging economies brace for net capital outflows for the first time in many years ?

- Third quarter growth in China beats expectations

Global issues

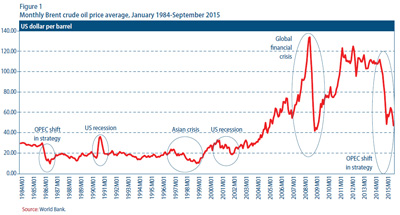

Oil prices expected to remain low in the medium term

In the past week, oil and mineral prices rallied after China cut interest rates for the sixth time in a year. Speculation over the impact of China's monetary stimulus on output growth animated commodity markets, but the price gain was rather short-lived. Given that China remains the main commodity importer at the global level, the market expectations regarding the Chinese growth prospects has had significant impact on commodity price movements in recent months. A Chinese economic boost is generally perceived as good news for commodity markets and the overall global economy. Notwithstanding changing expectations about the Chinese growth rates in both the short and medium term, oil, agricultural and mineral markets remain oversupplied, with inventories at unprecedented levels exerting downward pressure on prices in the short term. Arguably, given the end of the commodity super cycle?which is marked by the expansion and excessive supply capacities at the global level and the market strategies of major oil producers, oil prices are likely to remain low in the medium term regardless of a recovery in demand growth.

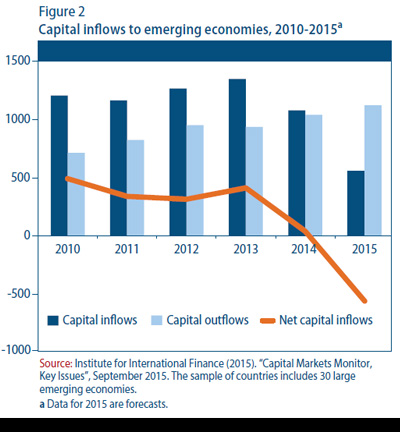

Capital inflows to emerging economies experience sharp declines

Capital inflows to emerging economies and developing countries have declined noticeably in recent months, amid rising domestic economic difficulties, low commodity prices and expectations over the upcoming increase in the US policy rate. Despite a moderate pickup in October, portfolio flows have experienced the sharpest contraction?mainly in equity flows in commodity sectors?across most developing regions, including Brazil, China, Nigeria, the Russian Federation and Thailand. Moreover, during the third quarter, portfolio outflows reached a record high, mostly due to the upsurge in outflows from China after the People's Bank of China announced a surprise devaluation of the renminbi on 11 August, triggering a worldwide sell-off of equities and emerging market currencies. According to Bloomberg, an estimated $142 billion left China in August, increasing from $125 billion in July.

Cross-border lending has also contracted in some large emerging economies in Asia, Europe and Latin America. For instance, cross-border bank lending to China contracted abruptly in recent months, while in the Russian Federation and Ukraine cross-border claims continued to decline, albeit at a slower pace than in 2014. Also, in Brazil, official data through the end of August show a 16 per cent year-on-year contraction in cross-border lending. Foreign direct investments (FDI) have also weakened, particularly in transition economies in Europe and Latin America. Preliminary data also suggest a significant reduction in FDI greenfield projects in countries such as Malaysia, Nigeria, Peru and the Philippines.

Net capital inflows to emerging economies are projected to be negative in 2015, with gross inflows declining to about 550 billion and gross outflows posting a record high of more than 1,000 billion (figure 2). The sharp decline in capital inflows has led to a significant depreciation of domestic currencies across a large number of emerging economies recently, with a few of them also experiencing declines in equity prices and international reserves. The reversal of capital flows to emerging economies is adversely affecting liquidity and credit growth and also reducing monetary policy space to stimulate investment and growth in these economies.

Developed economies

North America: budget and debt ceiling uncertainty mitigated

The legislative and executive branches of the United States Government reached an accord on the federal budget and the debt ceiling on 30 October. This deal paves the way for increasing federal government expenditure by $80 billion over the current and next fiscal years. It also suspends the debt ceiling until 15 March 2017. Although the increment in expenditure is not large, it prevents another shutdown of government operations (the last was in 2013) and also avoids the possibility of a default on US sovereign debts.

According to an advance estimate from the Bureau of Economic Analysis, real gross domestic product (GDP) increased at an annualized rate of 1.5 per cent during the third quarter of 2015, a significant decline from the 3.9 per cent growth during the previous quarter. While both private consumption and private fixed investment expanded robustly, rapid de-stocking of inventory induced the deceleration in GDP growth during the third quarter.

During the 28 October meeting of its policy-setting committee, the United States Federal Reserve (Fed) decided to keep its policy rate unchanged. However, the Fed has adjusted the text of its statement to signal the possibility for the interest rate lift-off in December 2015?the first rate increase in more than nine years. The Fed has also downplayed concerns for developments in the world economy in its statement.

Developed Asia: growth and inflation continue to remain subdued

In its policy-setting meeting on 30 October, the Bank of Japan (BoJ) decided to maintain the current level of its asset purchasing programme, while revising the GDP growth and inflation projections downward. BoJ now expects to reach its target of 2 per cent inflation around the second half of fiscal year 2016, which ends in March 2017, instead of the first half as originally expected.

Price data for September show that both national headline consumer price index (CPI) and CPI excluding fresh food?the benchmark index for BoJ?remained unchanged or reached a slightly lower level from one year ago. Similar price trends prevailed for the October price indices for the Tokyo area.

Other statistics displayed some improvements in September. Export volume sustained the upward trend and reached a level that is 1.6 per cent higher than one year ago. Correspondingly, industrial production reversed the declining trend and increased by 1 per cent from August. Nevertheless, the production level in September remained 0.8 per cent lower year on year basis. Inventories in the manufacturing sector also remain elevated.

Employment remained on a very tepid growth path during 2015, reaching a level that is only 0.6 per cent higher than the employment growth rate registered last year. The labour force expanded at almost the same pace as employment growth and kept the unemployment rate unchanged at 3.4 per cent in September.

Western Europe: sustaining world trade

World trade growth has slowed sharply over the last 12 months, primarily reflecting weaker demand from developing economies and a sharp decline in imports demanded by the Commonwealth of Independent States (CIS). Trade in Western Europe, however, has remained strong for the most part, supported by competitiveness gains relative to the United States and sheltered from the external slowdown by the high level of intraregional trade. The euro has depreciated by roughly 15 per cent against the dollar since mid-2014, and over this period the European Union (EU) trade surplus vis-?-vis the United States has increased by about 0.5 per cent of EU GDP. EU export and import volumes both increased by more than 5 per cent in the first half of 2015 relative to a year earlier. As more than 60 per cent of EU trade is conducted within the region, the strength of demand in the region is largely self-sustaining, with a more limited impact on the rest of the world.

While strong trade growth is fairly broad-based across the EU, some countries are yet to take advantage of the regional revival. Finland, in particular, is highly exposed to the economic sanctions on, and the sharp slowdown, affecting the Russian Federation, and is yet to benefit from stronger intraregional demand. The trade recovery has also eluded Greece, which continues to face significant difficulties in stimulating investment and growth.

The new EU members: Central Europe may feel the consequences of the Volkswagen scandal

The overall economic conditions remained stable in October in most of the new EU members. However, some divergence was observed between consumer and business confidence trends in Central Europe. While consumer sentiment continued to improve as real wages grow and households' balance sheets improve after deleveraging, business confidence in the Czech Republic and Hungary experienced some decline against the backdrop of the Volkswagen scandal as the company has a relatively large manufacturing presence in these economies. September purchasing manager indices (PMI)have weakened in the Czech Republic and Poland as the moderation in the German industrial performance has had a minor spillover effect on Central Europe's industrial output.

Poland experienced the sixteenth consecutive month of deflation in September, with consumer prices declining by 0.8 per cent. Consumer prices also fell in all three Baltic States and inflation returned to negative territory in Hungary. Lower fuel costs contributed to the deflationary trends, keeping inflation much below the official targets.

Economies in transition

CIS: monetary loosening put on hold

The third quarter GDP figure for the Russian Federation has not been released yet, but the pace of economic contraction is expected to moderate. Household expenditure remains weak, especially on non-food items. Retail sales fell by more than 10 per cent in September. On the positive side, the unemployment rate in September declined to 5.2 per cent, from 5.3 per cent a month earlier. However, the share of part-time workers has increased by 40 per cent since January. As inflation remains elevated, at around 16 per cent, and the rouble remains under pressure, the Central Bank in October left its key policy rate unchanged at 11 per cent, despite the widespread expectations of a rate cut. The National Bank of Ukraine has also left its key policy rate unchanged despite signs of stabilization in the economy, as inflation (at 51.9 per cent in September) exceeded expectations because of the lagged effects of earlier sharp currency depreciation and increase in tariffs. Other CIS currencies also remain under pressure. The National Bank of Kazakhstan hiked its policy rate in October by 400 basis points to 16 per cent to bolster the now free-floating currency, while the National Bank of Moldova has kept its rate at 19.5 per cent. High interest rates continue to negatively affect CIS economies through increasing the cost of capital and discouraging investments in the real sector.

South-Eastern Europe: growth accelerates in Bosnia and Herzegovina and Serbia, but from a low base

Economic growth in Serbia accelerated to 2 per cent in the third quarter, from 1 per cent in the previous quarter, despite some industrial slowdown in September. Bosnia and Herzegovina reported a strengthening of growth to 4.4 per cent in the second quarter, thanks in part to base effects. Economic activity in 2014 was disrupted by massive floods. A low-inflation environment continues in the region. In Serbia, for example, consumer prices remained flat in September, bringing annual inflation down to 1.4 per cent. The National Bank of Serbia continued its monetary easing in October, cutting the key policy rate by 50 basis points to 4.5 per cent, as the expectations of a prolonged accommodative monetary stance in Europe mitigate the risk of capital outflows. The ongoing migrant crisis remains a challenge for the region, straining trade links, although spending by the migrants may somewhat add to domestic demand.

Developing economies

Africa: Unemployment in South Africa increases despite solid job creation

In South Africa, unemployment rates increased to 25.5 per cent in the third quarter from 25.0 per cent in the previous quarter against the backdrop of continued low commodity prices. While solid job creation, including in the formal sector, overcame various headwinds, such as slow growth and the difficult conditions in the mining sector, it was still outpaced by the expansion of the labor force. The job gains were mostly in community and social service sectors, while job losses were registered in finance, manufacturing and agriculture. The year- on- year inflation remained subdued and unchanged at 4.5 per cent in September, falling from 4.7 per cent in July. At the same time, South Africa's trade deficit almost halved for the first three quarters, with export growth underpinned by strong vehicle sales outpacing almost flat imports, due to a lower oil import bill. In Nigeria, reduced oil production and the persistent low oil prices continue to strain the fiscal balance of the Government, with capital expenditure slashed by more than 50 per cent during 2015. The recent IMF Article Consultations with Ethiopia?which concluded on 21 September 2015?reported a favorable and robust macroeconomic condition, with growth projected to remain around 8 per cent in 2015. However, the widening current-account deficits, which are estimated at 12.8 per cent of GDP, haves been flagged as a concern, with imports growing faster than exports and capital inflows, including FDI and sovereign borrowing abroad, financing the deficit.

East Asia: third-quarter GDP growth of China and the Republic of Korea beat expectations

China's third quarter GDP growth of 6.9 per cent has beat market expectations. It is led by the service sector's 8.6 per cent growth, followed by the growth in the secondary sector of 5.8 per cent. Growth rates of the two sectors continue to diverge, a trend that began in the third quarter of 2014, and the gap is not expected to narrow in the near future, given excess inventories in the lower-tier cities' property markets and over-capacity in the heavy industries. Despite major stock market corrections during the quarter, the financial sector registered 16.1 per cent growth, the highest among all major sectors. Per capita real disposable income grew by 7.7 per cent in the first three quarters, outpacing real GDP growth, which should continue to support private consumption growth. The Government's announcement of ending the one-child policy at the end of October is a welcome step towards addressing the challenge of a rapidly ageing population. However, it is unclear how effective it will be in boosting the birth rate, given that families are often discouraged from having more than one child because of increases direct and indirect costs associated with raising children, particularly in urban areas.

Early estimates show that the Republic of Korea's economy grew by 2.6 per cent in the third quarter, improving from the previous quarter's 2.2 per cent. Private consumption and fixed investment drove the growth, with construction investment growth seeing significant improvement. Export sector performance has improved marginally, but growth in value terms remained negative at -8.3 per cent in September. There are concerns that the economy could experience a worsening of export competitiveness. Domestically, the manufacturing sector is confronted by inefficiencies in resource allocation and tepid inter-industry labor mobility. Externally, the economy is facing rising competition, particularly from China, in sectors where it had traditionally maintained large market shares.

South Asia: weakness in merchandise trade persists

Across South Asia, the weakness in merchandise trade persisted in the third quarter of 2015. In most countries, the dollar value of exports and imports declined sharply from a year ago. This weakness can be attributed to lower prices of fuel and other commodities, the strong appreciation of the dollar, slowing demand in major trading partners as well as various country-specific factors. In India, merchandise exports fell (in dollar terms) by 15.7 per cent in the July-September quarter from one year ago, while imports dropped by 11.2 per cent for the same period. During January-September, merchandise exports declined to the lowest level since 2010. The sharp drop in the price of oil and other commodities has not only narrowed India's import bill, but has also lowered export receipts, with petroleum accounting for about 20 per cent of total shipments and other commodities making up about 10 per cent. In most South Asian countries, trade deficits have narrowed over the past year, but still remain sizeable. Going forward, South Asia's merchandise exports are expected to recover slightly, supported by a pickup in external demand and the currency depreciations in India, Nepal, Pakistan and Sri Lanka. Unlike other currencies in the region, the Bangladeshi taka has remained stable against the dollar, resulting in a significant real appreciation that has started to impact apparel exports, which account for nearly 80 per cent of country's total export.

Western Asia: despite recent improvements in some diversified economies, GDP growth figures remain relatively weak

In Israel, the newly released data projects a real GDP growth rate of 2.5 per cent for 2015 slightly lower than originally anticipated. This represents a slowdown relative to 2014 and 2013 growth, when GDP grew by 2.6 per cent and 3.3 per cent respectively. Private consumption is expected to rise by 4.1 per cent in 2015, but government consumption is expected to increase by only 2 per cent, as defense spending is projected to decline by about 1 per cent, compared with 2014 when military spending had increased owing to the Israel-Hamas conflict. The export sector, which has been adversely affected by a weakening international demand for diamonds, is also weighing on the economic slowdown. In Jordan, newly released data report an estimated 2.4 per cent growth in the second quarter, increasing from 2 per cent in the first quarter. Most sectors have contributed positively to economic growth , with quarrying contributing more robustly, which has reached nearly 25 per cent in the first half of 2015, driven by higher phosphate production. Based on this new data, GDP growth can now be expected to improve for the year as whole when compared with the 3.1 per cent in 2014, albeit not as high as the 3.8 per cent officially projected for 2015.

Latin America and the Caribbean: visible decline in foreign direct investments

Foreign direct investment (FDI) has visibly declined in Latin America and the Caribbean, owing to the deterioration in domestic economic conditions and low commodity prices. In the first half of 2015, FDI into the region fell by 21 per cent in comparison to the same period in 2014, mainly in natural resources sectors such as oil, mineral and metals in South American economies. The sharpest reductions were observed in Brazil, Colombia and Uruguay. This downward trend has consolidated further in recent months; in Brazil, for example, official data through the end of August show a decline of 33 per cent in FDI year on year. Importantly, the reduction in FDI in the region encompasses not only mergers and acquisitions, but also greenfield projects in countries such as Brazil, the Dominican Republic and Peru. Other countries such as Costa Rica, Mexico, and Panama experienced a more moderate decline or even a slight rise, as FDI inflows into these economies are less concentrated in natural resources sectors. The decline in FDI into the region?which is contemporaneous to the reduction in other types of capital flows, such as portfolio flows?could become a source of external distress, considering the role capital flows had played in financing the current-account deficits in many South American economies in recent years.

Welcome to the United Nations

Welcome to the United Nations