- According to chapter one of the World Economic Situation and Prospects 2016, only a modest improvement in the world economy is projected for the next two years

- Recessions in the Russian Federation and Ukraine may have reached a turning point

- Unemployment on the rise in a number of South American economies

Global issues

The world economy stumbled in 2015, amid weak aggregate demand, falling commodity prices and financial market volatility

According to chapter one of the World Economic Situation and Prospects 2016, launched on 10 December 2015, the world gross product is projected to grow by a mere 2.4 per cent in 2015. This represents a significant downward revision from the 2.8 per cent forecast six months ago. More than seven years after the global financial crisis, policymakers around the world still face enormous difficulties in stimulating investment and restoring robust and balanced global growth. The world economy has been held back by several major headwinds: persistent macroeconomic uncertainties; low commodity prices and diminished trade flows; rising volatility in exchange rates and capital flows; stagnant investment and productivity growth; and continued disconnect between finance and real sector activities. Only a modest improvement is expected, with global growth reaching 2.9 per cent in 2016 and 3.2 per cent in 2017, supported by generally less restrictive fiscal and still accommodate monetary stances worldwide.

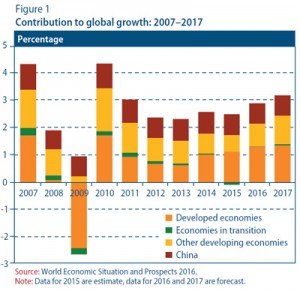

The developed economies are expected to contribute more to global growth

While developing countries, and China in particular, have been the locomotive of global growth since the financial crisis, the pivot of global growth has shifted over the past year towards the developed economies, particularly the United States of America. Economic growth in developed economies as a whole accelerated from 1.7 per cent in 2014 to an estimated 1.9 per cent in 2015, and growth is expected to strengthen further to 2.2 per cent in 2016. Average growth in developing and transition economies, by contrast, slowed in 2015 to its weakest pace since the global financial crisis, amid sharply lower commodity prices, large capital outflows and increased financial market volatility. The slowdown in China and deep recessions in Brazil and the Russian Federation, in particular, have had significant regional spillover effects, through trade, remittances and the global demand for major commodities. The economic slowdown in developing and transition economies is expected to bottom out and growth will gradually recover in the coming two years, but the external environment will continue to be challenging and growth will remain well below its potential. Average growth in developing countries is projected to pick up from an estimated 3.8 per cent in 2015 to 4.3 per cent in 2016 and 4.8 per cent in 2017. In the economies in transition, economic output contracted by 2.8 per cent in 2015 and is forecast to expand by only 0.8 per cent in 2016 and 1.9 per cent in 2017. Economic activity in the least developed countries (LDCs) was also adversely impacted by lower commodity prices and, in some cases, by military conflicts, natural disasters and adverse weather conditions. Average gross domestic product (GDP) growth for this group of countries is expected to recover from 4.5 per cent in 2015 to 5.6 per cent growth in 2016, but achieving the Sustainable Development Goal target of at least 7 per cent GDP growth per annum in LDCs is unlikely to be achieved in the near term.

Given the build-up of debt and leverage in many emerging economies, policymakers need to prepare for a tightening of global financial conditions

In developed economies, central banks played a critical role in supporting growth in the post-crisis period, which led to an unprecedented level of monetary accommodation in recent years. Amid gradually improving economic conditions, the United States Federal Reserve has clearly signalled its intention to begin withdrawing monetary stimulus from the economy, after seven years of near-zero interest rates. Uncertainty persists regarding both the anticipated path of interest-rate increases and the reaction of global financial markets and the real economy to the move, contributing to heightened volatility in commodity, currency, bond and stock markets in recent months. Significant levels of net capital outflows have already occurred in many developing economies in anticipation of the move, and there is a risk that these withdrawals could increase further, drying up liquidity. However, it is expected that financial market volatility will dissipate during the forecast period, with commodity prices stabilizing and policy uncertainty diminished with the onset of monetary policy normalization in the United States.

Challenges for policymakers around the globe are likely to intensify in the short run

Policymakers worldwide will need to make concerted efforts to reduce uncertainty and financial market volatility, striking a delicate balance between their objectives for sustainable economic growth and financial stability. The response to a tightening of global financial conditions will require a variety of policy tools, including macroprudential instruments, targeted monetary measures, and more active fiscal policies. The challenge for developing countries is likely to be more acute, given the difficult trade-offs in the areas of monetary, fiscal and exchange-rate policies. Emerging-market corporate debt has risen sharply over the last decade, with many emerging market firms borrowing in foreign currency to take advantage of low international interest rates. This has left them exposed to exchange-rate risk and rising debt-servicing costs as global financial conditions tighten. Policymakers will need to increasingly rely on macroprudential tools to prevent rapid deleveraging, minimize financial stability risks and, redirect finance to real sector activities.

More targeted, effective and coordinated policy efforts are needed to ensure robust, inclusive and sustainable economic growth

Stimulating inclusive growth in the near term, and fostering longterm sustainable development, requires more effective policy coordination to ensure that the financial sector facilitates and stimulates long-term and productive investment, breaking the vicious cycle of weak aggregate demand, under-investment, low productivity and low growth performance of the global economy. Rather than relying almost exclusively on monetary policy, policymakers would need to pro-actively use fiscal policies to revive investment and growth. Well-designed and targeted labour market strategies can complement fiscal policies to re-invigorate productivity, employment generation and output growth. This will be crucial for achieving the 2030 Sustainable Development Goals.

Developed economies

North America: mild growth in both economies

After two consecutive quarterly declines, the Canadian economy grew at an annualized rate of 2.3 per cent in the third quarter. The most important contributing factor was the 9.4 per cent growth in export volumes, supported by the strong import demand from the United States. Household consumption, residential investment and import dynamics also contributed to the improvement in growth. Non-residential fixed investment continued to decline, although at a more moderate pace.

For the United States, annualized GDP growth for the third quarter has been revised up to 2.1 per cent from the original estimate of 1.5 per cent. The key factor for the upward revision was the lower pace of inventory destocking. The impact of the sharp appreciation of the dollar on international trade still persists. The trade deficit measured at constant prices has been expanding and in the third quarter reached the highest level since the Great Recession.

Japan: Government planning new policy actions

Japan is in the midst of preparing a supplementary budget for the current fiscal year, which ends in March 2016. The Government of Japan has set a target to reduce the primary balance (relative to GDP) by 1 percentage point in next fiscal year.

The monthly statistics for October showed that the labour market remains on an expansionary path. The level of total employment in October was 0.7 per cent higher than one year ago, while the unemployment rate declined to 3.1 per cent, the lowest level since 1995. The improvement in the labour market has not pushed up the wage rate, however. The Government has announced its intention to raise the minimum wage from the current level of 798 yen per hour by 3 per cent annually during the coming years. According to the Government estimate, 5 to 9 per cent of total payroll expense is at minimum wage.

Western Europe: additional monetary easing measures

GDP growth in the European Union (EU) remained steady at 1.9 per cent in the third quarter of 2015. Destocking of inventories in the first half of 2015 suggests that the acceleration in demand exceeded expectations, supporting prospects for solid growth in the coming quarters. The World Economic Situation and Prospects 2016 projects a stable economic expansion of 2.0 per cent in 2016, with a modest acceleration to 2.2 per cent in 2017.

The euro area inflation dipped below zero again in September, against the backdrop of the sharp year-on-year decline in energy prices. If global oil prices do not fall further, the impact of low energy prices on inflation will become more muted by early 2016. Nonetheless, inflation in the euro area is expected to remain below the European Central Bank (ECB) inflation target of below but close to 2 per cent until at least 2018. This has prompted a renewed call for additional monetary easing in the euro area. At its December meeting, the ECB announced that it would extend its quantitative easing programme until at least March 2017, and also cut its deposit interest rate by 10 basis points to -0.3 per cent, leaving other interest rates unchanged. While these measures fell short of market expectations, they nonetheless extend the ultra-loose monetary conditions within the euro area. Similar measures from the central banks of Norway and Sweden are likely to follow.

The new EU members: a mostly encouraging third quarter

The preliminary third quarter figures for year-on-year GDP growth confirm that despite external headwinds emanating from the recent slowdown in the major developing economies, the new EU members remain on track for an acceleration in economic activity. GDP expanded by an impressive 4.5 per cent in the Czech Republic, 3.6 per cent in Poland and 3.6 per cent in Romania. Growth in Bulgaria accelerated to 2.9 per cent, and Croatia recorded the fastest growth since 2008, at 2.8 per cent, thanks to the successful tourism season and exports. However, in Hungary the shrinking agricultural output and the stagnant construction activity slowed growth to 2.4 per cent. The Baltic States, more exposed to the Russian economy, face a more challenging external environment; growth moderated to 2.5 per cent in Latvia, as low prices forced firms to scale back steel production, and picked up to 1.7 per cent in Lithuania.

Monetary stimulus, facilitated by the quantitative easing of the ECB and near-zero or negative inflation, remains an important economic policy tool. As Hungary's Funding for Growth Scheme is to be phased out at the end of 2015, the Hungarian National Bank decided to launch in January 2016 a Growth Supporting Program to increase lending to small and medium businesses. In late November, the Bulgarian National Bank decided to introduce negative interest rates on commercial bank's excess reserves, starting in January 2016.

Economies in transition

Milder pace of contraction in the Russian economy

According to a preliminary estimate, GDP in the Russian Federation declined by 4.1 per cent in the third quarter relative to a year earlier, after having contracted by 4.6 per cent a quarter earlier. The fall in industrial production and investment was also smaller, possibly marking a turning point in the economy; on a monthly basis, GDP increased in October. Nevertheless, private expenditure remains weak and annual inflation remained unchanged. A conservative budget is proposed for 2016, envisaging social spending cuts, a freeze in public sector wages and limited indexation of pensions, which will weigh on private consumption. In Ukraine, the third quarter GDP recorded a year-on-year decline of only 7 per cent (compared to the 14.6 per cent contraction in the second quarter), expanding by 0.7 per cent quarter-on-quarter; consequently, the country has technically exited recession. Against the backdrop of persistently low oil prices, the Government of Kazakhstan decided to launch an ambitious privatization programme, offering shares in about 200 enterprises in order to modernize and diversify the economy.

Inflationary pressures in the Commonwealth of Independent States, fuelled by depreciations, remain strong (for example, in Moldova, October inflation exceeded 13 per cent), warranting prudent monetary policy. In early November, the National Bank of Georgia increased its policy rate by 50 basis points to 7 per cent in response to stronger than anticipated inflation.

In South-Eastern Europe, where economic trends remain positive, inflation, by contrast, is close to zero or negative. In the former Yugoslav Republic of Macedonia consumer prices declined in October by 0.5 per cent. In early November, the Central Bank of Albania cut its benchmark policy rate to a record low level of 1.75 per cent to facilitate credit expansion, as annual inflation remains below the target.

Economic growth in India accelerated in the third quarter of 2015 amid strong investment and manufacturing output. Gross domestic product grew at an annual rate of 7.4 per cent, up from 7.0 per cent in the previous three months. Growth continued to be largely driven by private domestic demand, which has been supported by lower commodity prices, reduced inflationary pressures and more accommodative monetary policy. Since the beginning of the year, the Reserve Bank of India has cut its main policy rates (the repurchase rate) by a total of 125 basis points to 6.75 per cent. The weakness in the external sector persisted, with exports declining by 4.7 per cent and imports falling by 2.8 per cent.

In Nepal, by contrast, the Government sharply lowered its growth projections for the current fiscal year 2015/16 (July 16 2015?July 15 2016) to only 2 per cent. The downward revision reflects the devastating impact of the earthquake in April 2015, but is also related to political unrest over a new constitution and obstructions in the supply of fuel. The Government has warned against rising threats to food security amid declines in the production of paddy and maize and a severe shortage of chemical fertilizers.

Western Asia: labour market challenges intensify amid the Syrian refugee crisis

The newly released unemployment figures for Turkey reflect the region's prevailing labour market challenges. Seasonally adjusted unemployment remained persistently high at 10.4 per cent in the third quarter of 2015 amid solid growth and a weak Turkish lira. The country continues to struggle with a very high youth unemployment rate of 18.5 per cent. These labour market problems reflect the fact that employment growth has not managed to keep up with labour force growth, which also applies to other countries in the region. In Jordan, for example, the unemployment rate was estimated at 13.8 per cent for the third quarter of 2015 compared to 11.4 per cent during the same quarter of 2014. Unemployment remains at a stubbornly high rate of 31.6 per cent for those between 20 and 24 years. The high population growth rates, averaging 2.5 per cent per year during the past decades, have resulted in a rapidly growing labour force today. At the same time, the Syrian refugee crisis puts further pressure on certain countries' labour markets. Up to seven million Syrians have been displaced by the civil war, with most of them fleeing to Turkey (2.2 million), Lebanon (1 million) and Jordan (600,000) according to UNHCR figures from November 2015. This could result in increased labour market challenges including a rise in informal employment, downward pressure on wages of the most vulnerable populations and a possible crowding out of native workers. On the other hand, it could also offer economic benefits in terms of stronger demand.

Latin America and the Caribbean: unemployment is on the rise

The significant economic slowdown is gradually affecting labour markets in the region, particularly in South American economies. As a result, unemployment rates have started to increase, amid relatively slower job creation and decreasing employment rates. For instance, mirroring the severe economic contraction, the unemployment rate in Brazil climbed to 7.9 per cent in October, about 3.2 percentage points above the unemployment rate a year before. In Uruguay, the unemployment rate reached 8.0 per cent in September, well-above the unemployment rate of 6.2 per cent in September 2014. Other countries have seen a more moderate rise in unemployment. For instance, in September unemployment rates in Colombia and Ecuador were 9.0 and 4.3 per cent, respectively, about 0.6 and 0.4 percentage points higher than a year before. Other labour market indicators have also deteriorated in some South American economies recently. For instance, the growth of real wages has visibly decelerated in countries such as Brazil and Uruguay, while job creation has shown signs of weakness as well, particularly regarding salaried work in countries such as Chile and Peru. Moreover, preliminary data also suggest a gradual worsening in the quality of employment, illustrated by an emerging shift from salaried work towards self-employment.

Welcome to the United Nations

Welcome to the United Nations