January Summary

- Limited global financial market reaction to Fed's interest rate move

- IMF includes Chinese renminbi in the SDR basket

- Monetary tightening in Western Asia and Latin America in response to Fed's first rate hike in seven years

Global issues

Beginning normalization of the policy rate by the Fed elicits limited reaction in the financial market

The Federal Open Market Committee (FOMC) of the United States Federal Reserve (Fed) raised the target range for the federal funds rate by 25 basis points on 16 December, a move that had been anticipated by financial markets. The United Nations flagship publication World Economic Situation and Prospects 2016, launched on 10 December 2015, also anticipated the rate increase, which marks the first interest rate move by the Fed since rates were reduced to near-zero levels at the height of the financial crisis in December 2008. Financial conditions in the United States of America remain accommodative after this increase, and the size of the Fed's balance sheet will remain at current levels until normalization of the level of the federal funds rate is well under way.

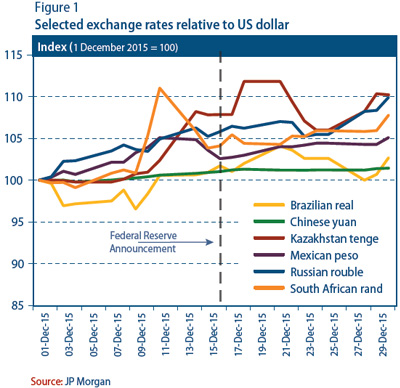

Global financial markets had clearly priced in much of the rise in interest rates, and with few exceptions, the shock to emerging-market exchange rates has been relatively modest since mid-December (figure 1). The United States effective exchange rate appreciated by less than 1 per cent in the second half of December, although it gained 9.7 per cent for the year as a whole. Government bond yields in the developed economies have shifted only marginally, and global equity markets rallied in the immediate aftermath of the FOMC announcement. This marks a stark difference to the market turbulence that accompanied the Fed's announcement in 2013 that it would soon begin tapering its quantitative easing programme, which triggered large capital outflows from developing countries and economies in transition and sharp exchange-rate realignments. However, significant levels of net capital outflows had already occurred in many developing economies and economies in transition in anticipation of the move. Given the uncertainty surrounding the interest-rate path going forward, there remains a risk that capital withdrawals could intensify in 2016. Such a shock may be difficult to absorb in the many developing economies and economies in transition that are already facing an economic slowdown.

The interest rate increase by the Fed entails a rise in debt-servicing costs, both domestically and in the many developing economies and economies in transition that have exchange rates closely linked to the dollar or that hold debt denominated in United States dollars. Several countries increased policy rates in December in line with the United States, including Bahrain, Chile, Colombia, Hong Kong Special Administrative Region of China, Kuwait, Mexico, Peru, Saudi Arabia and United Arab Emirates, while Angola, Egypt and Georgia raised rates by 50 basis points and Mozambique raised interest rates by 150 basis points. Rising interest rates may prove particularly difficult in the fuel-exporting countries, which suffered a sharp deterioration in terms of trade in 2015 and in many cases are tightening fiscal policy to cope with the steep loss in commodity-related revenues.

In determining the timing and size of future increases in the policy rate, the Fed will continue to carefully monitor actual and expected economic conditions relative to its objectives of maximum employment and 2 per cent inflation. It will take into account measures of labour market conditions, indicators of inflation pressures and inflation expectations, and developments in financial markets and in other major economies. Considerable uncertainty, however, persists regarding the magnitude of rate increases over the next 12-24 months.

Developed economies

United States of America: Strong dollar negatively impacted external financial position

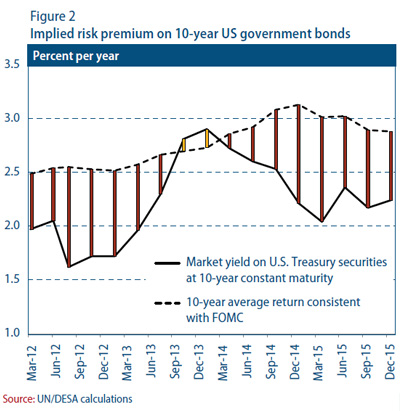

On 16 December 2015, the Fed decided to lift the target range for its policy rate by 25 basis points. While the federal funds rate is likely to remain below levels that are expected to prevail in the longer run, there remains some uncertainty about the pace and sequence of rate increases over the next 12-24 months. The dispersion of interest-rate expectations expressed by the 17 participants of the FOMC in December range from 0.875 to 2.125 per cent by end-2016, indicating the significant degree of uncertainty even within this small group of decision makers. The median forecast is for a cumulative 100 basis point rise in the federal funds rate by end-2016. However, financial market expectations derived from the federal funds futures market point to a cumulative rise of just 50 basis points in 2016. Except for a brief period in late-2013, financial markets have consistently priced in a slower rise in United States policy rates compared to the expectations expressed by the participants of the FOMC, offering a significant negative term premium on the market yields on government bonds since 2012 (figure 2).

Following the Fed's communication strategy, global financial markets had long expected the interest rate rise, which contributed to the strong appreciation of the dollar vis-?-vis almost all major currencies starting in mid-2014. One consequence of this development was the deterioration of the net international investment position (NIIP) for the United States.

According to the United States Bureau of Economic Analysis (BEA), the NIIP reached $7,269.8 billion by the end of the third quarter of 2015, a record high deficit both in absolute terms and relative to gross domestic product (GDP) (40.3% of GDP). For NIIP statistics, both assets and liabilities are measured at the prevailing market prices; the evolution of both asset prices and exchange rates will impact the level of the NIIP. According to the BEA, the deficit in NIIP increased by $526.7 billion over the third quarter of 2015. Of this, only $11.8 billion was caused by net financial transactions while the other $514.9 billion was caused by the revaluation of asset prices and, more importantly, the continuous appreciation of the dollar.

Japan: Fine-tuning monetary policy

On 18 December 2015, the Bank of Japan (BoJ) decided to adjust its monetary easing policy. While maintaining the target of increasing the monetary base by 80 trillion yen per year, the BoJ will, starting from 2016, increase the average remaining maturity of its purchase of Japanese government bonds from 7-10 years to 7-12 years. This move targets a decline in the yields for longer-term government bonds.

On 24 December 2015, the Japanese Cabinet finalized its budget draft for the next fiscal year starting April 2016. While primary expenditure will increase slightly by 0.22 trillion yen, the primary balance deficit is planned to decrease from 13.4 trillion yen (2.7 per cent of GDP) for the current fiscal year to 10.8 trillion yen (2.1 per cent of GDP), supported by more than 2.8 trillion yen in tax revenue.

According to the revised estimate of national accounts, real GDP actually expanded at an annualized rate of 1.0 per cent during the third quarter of 2015 in contrast to the 0.8 per cent contraction originally estimated. Fixed capital formation and inventory change were the main factors behind the upward revision.

Western Europe: Milestone reached in euro area banking union

In June 2012, European Heads of State and Government agreed to create a euro area-wide banking union, in order to enhance the resilience of the financial system and reduce the risks of future financial crises. A milestone on the road to a euro area banking union was reached on 1 January 2016, when the Single Resolution Board became fully operational and took over full responsibility for winding up failing banks. The Single Resolution Mechanism is designed to protect the taxpayer from bailing out banks. It will require a significant share of losses to be borne by creditors, before resorting to a Single Resolution Fund of pooled financial resources for crisis management, provided by banks. While this marks an important step, taxpayer protection is not fully guaranteed, as evidenced by the bailout of Portugal's Banco Internacional do Funchal (Banif) in December, which will require an additional 2.25 billion euro in state aid to cover the funding gap in the resolution costs and consequently, worsen the Portuguese fiscal deficit by 1.3 per cent of GDP. A fully-fledged banking union is not expected to be operational until at least 2024, with a key final hurdle being the establishment of a common deposit insurance scheme in the euro area.

The new EU members: Fed's first step towards policy rate normalization has only temporary impact

Most currencies of the new European Union (EU) members with flexible exchange rates recorded a brief period of depreciation in early December in anticipation of the Fed's move, and because the European Central Bank did not cut policy rates as much as expected. However, they bounced back in a short period of time against the backdrop of favourable growth prospects and the perception that monetary tightening by the Fed will be gradual.

Economies in transition

Another wave of currency depreciations in the Commonwealth of Independent States (CIS)

Although economic activity in the CIS stabilized somewhat during the third quarter and the speed of decline moderated, the economic performance of the Russian Federation weakened in November. The seasonally adjusted GDP contracted by 0.3 per cent month on month after four months of expansion. The budget for 2016 is based on an oil price assumption of 50 dollars per barrel (pb) and incorporates spending from the country's Reserve Fund. As Ukraine's Deep and Comprehensive Free Trade Area agreement with the EU will enter into force in January, the Government of the Russian Federation has decided to suspend its free trade agreement with Ukraine to prevent any re-export of EU products and has introduced an embargo on the import of a range of Ukrainian goods. In response, the Government of Ukraine has introduced reciprocal trade restrictions, which will further reduce the volume of bilateral trade between the Russian Federation and Ukraine.

As oil prices hit new lows in late December, a number of CIS currencies have depreciated further. The Russian rouble hit a near-record low versus the dollar in the last week of December. High currency volatility is adversely affecting economic sentiment and investment plans, although the overall decline in investment in the Russian Federation in 2015 was milder than anticipated. In Kazakhstan, the currency reached another record-low level versus the dollar. The Central Bank of Azerbaijan in December announced a move to free float the currency, abandoning its peg to a basket of the dollar and the euro. Subsequently, the currency lost over 30 per cent in value. This move may put certain commercial banks under pressure, but will mitigate the need to draw from the sovereign wealth fund. The weaker currencies may further spur inflation, delaying the stabilization in consumer prices. In Armenia, however, the Central Bank cut its policy rate by one per cent in December, as inflation eased.

In South-Eastern Europe, Serbia continued to maintain price stability in December, with inflation at 1.6 per cent. The National Bank of Serbia had to intervene in currency markets to stem the currency appreciation emanating from the year-end inflow of remittances.

Developing economies

Africa: Debt-servicing costs are growing in several national budgets

In South Africa, the unexpected appointment of a new finance minister rattled financial markets by raising fears of less fiscal prudence, setting off a further depreciation of the rand. However, the new finance minister was replaced after four days in office, causing the rand to recoup some of its previous losses. In terms of macroeconomic data, South Africa's current-account deficit increased in the third quarter to 5.5 per cent of GDP. While the weaker currency is generally supporting exports, mineral exports are negatively affected by weaker global demand and prices, while on the import side, capital goods and food products were major pillars, with growth in the latter underpinned by drought conditions in the domestic agricultural sector. On the fiscal side, Nigeria's federal Government announced plans to reduce fuel subsidies by increasing fuel prices by 11.5 per cent next year. In Mozambique, the budget deficit is expected to fall to 7.1 per cent of GDP in 2016 from 7.4 per cent in 2015. However, as interest rates are rising, debt-servicing costs will increase from 1.2 per cent of GDP in 2015 to 1.5 per cent in 2016, and the budget plan intends to more than offset this increase through spending cuts in other areas. In Cameroon, the new fiscal policy aims for a balanced budget, against the backdrop of a 13 per cent increase in spending. With the oil sector providing 25 per cent of fiscal revenue, implementing this balanced budget plan remains highly dependent on global oil demand and oil prices. At the same time, debt-servicing constitutes the fastest growing line item in the budget, increasing by 66 per cent compared to last year. Meanwhile, Tunisia's economy emerged from a technical recession in the third quarter of 2015, with GDP growing by 0.1 per cent compared to the second quarter. The continued weak growth picture derives from a stagnant agricultural sector, weaker demand from the EU for the manufacturing sector, shrinking investment in the energy sector and the negative impact of security concerns on tourism.

East Asia: IMF decides to include the Chinese renminbi in the SDR basket

In late November, the International Monetary Fund (IMF) Executive Board decided to include the Chinese renminbi (RMB) in the Special Drawing Rights (SDR) basket, along with the United States dollar, the euro, the Japanese yen and the British pound sterling. The measure will come into effect in October 2016. The authorities concluded that China and the RMB met the two fundamental criteria for inclusion: (i) a large value of exports of goods and services; and (ii) a freely usable currency. The decision reflects China's progress in reforming its monetary and financial system and in moving towards a more open and market-based economy. The inclusion of the RMB is expected to make the SDR basket more representative of the world's major currencies. In December, amid diverging monetary policies and capital outflows from China, the RMB further depreciated against the dollar, falling to the lowest level since mid-2011. In real effective terms, however, the RMB remains close to an all-time high, given its strength against most other emerging market currencies.

In the area of monetary policy, the authorities in Hong Kong Special Administrative Region of China and Taiwan Province of China moved in opposite directions in December. The Hong Kong Monetary Authority, which has pegged the currency to the dollar, followed the Fed's rate hike and raised its base rate from 0.5 to 0.75 per cent. Conversely, the central bank in Taiwan Province of China cut its benchmark rate for the second time in three months in a bid to support its economy, which fell into recession in the third quarter of 2015.

South Asia: Key macroeconomic indicators in Pakistan showed some improvement in 2014/15

According to the State Bank of Pakistan's annual report, several key macroeconomic indicators improved in the fiscal year 2014/15 amid lower global oil prices and a more stable domestic security situation. Pakistan's GDP (at factor cost) increased by 4.2 per cent, the highest rate in seven years, even as long-standing structural constraints persisted. Stronger growth in the service sector and a slight recovery in agricultural output helped offset a slowdown in the industrial sector, which continued to face significant energy shortages. In the wake of the sharp decline in oil and other commodity prices, average consumer price inflation fell from 8.6 per cent in 2013/14 to 4.5 per cent in 2014/15, while both the current-account and fiscal deficits narrowed marginally.

Conversely, in Sri Lanka, economic growth slowed considerably in the third quarter of 2015, largely owing to weaknesses in the service sector. Gross domestic product expanded by 4.8 per cent year on year, down from a revised 6 per cent in the previous three months. As in the region's other economies, external trade in Sri Lanka has remained weak. In the third quarter, merchandise export revenues (in domestic currency) were 5.9 per cent lower than a year ago, while import expenditures were 7.8 per cent lower.

Western Asia: Fiscal balances continue to worsen across the region

The fiscal balances have deteriorated visibly in most Western Asian economies, mainly as a result of the sharp decline in oil prices. In late December, the Brent oil price hovered around $37 pb?far below the IMF projected fiscal break-even prices for the region's oil-exporting economies, which ranged from about $50 pb in Kuwait to about $105 in Bahrain and Saudi Arabia in 2015. Saudi Arabia's Government estimates that the budget deficit in 2015 amounted to $98 billion, equivalent to about 15 per cent of GDP. In the recently unveiled budget for 2016, the Saudi authorities announced significant spending cuts, subsidy reforms (including a rise in petrol prices) and privatization to curb the deficits. In Iraq, the approved budget for 2016 projects a deficit of approximately $20 billion?amounting to about 12 per cent of GDP?based on an oil price forecast of $45 pb. Some of the region's oil-importing economies have also experienced a recent deterioration in their fiscal balances, despite lower importing costs. Lebanon's fiscal deficit increased by 17 per cent year on year to $2.6 billion in the first nine months of 2015, largely because of a sharp drop in revenues.

Latin America and the Caribbean: Monetary policy stances tighten across a number of economies

In recent months, several economies have started to tighten their monetary policy stances. This illustrates the challenges that monetary policy faces in many economies in the region amid subdued growth, accelerating inflation, reduced capital inflows and financial market volatility. For instance, the Central Bank of Chile lifted interest rates by 25 basis points in both October and December to 3.5 per cent, amid above-target inflation and continuing downward pressures on the domestic currency against the dollar. Similarly, the Bank of Mexico raised its policy interest rates for the first time since 2008, increasing them by 25 basis points to 3.25 per cent from an historic low of 3.0 per cent. This decision was spurred by the Fed's move to increase the policy rate in the United States in order to avoid additional depreciation pressures on the peso, already recording record lows against the dollar. The central banks in Peru and Colombia also lifted their policy interest rates by 0.25 percentage points to 3.75 and 5.75 per cent, respectively, to contain the recent upsurge on inflationary pressures. Consumer price inflation in these two countries remains well above the upper limit of the central banks' targets.

Welcome to the United Nations

Welcome to the United Nations