- The Bank of Japan announces decision to cap 10-year bond yields to address deflation and restore profitability and growth

- United States household incomes rise sharply in 2015

- The Nigerian economy contracts at a faster pace amid significant macroeconomic challenges

Global issues

The Bank of Japan announces decision to cap 10-year bond yields to address deflation and restore profitability and growth

On 21 September, the Bank of Japan (BoJ) announced a new set of unconventional monetary policy measures aimed at boosting inflation and reviving growth. The BoJ?s new monetary policy strategy consists of two components. The first is a ?quantitative and qualitative monetary easing with yield curve control? framework to anchor ten-year Japanese government bond yields near the current level of 0 per cent. The second component is an explicit commitment to increase the monetary base until inflation overshoots the 2 per cent target.

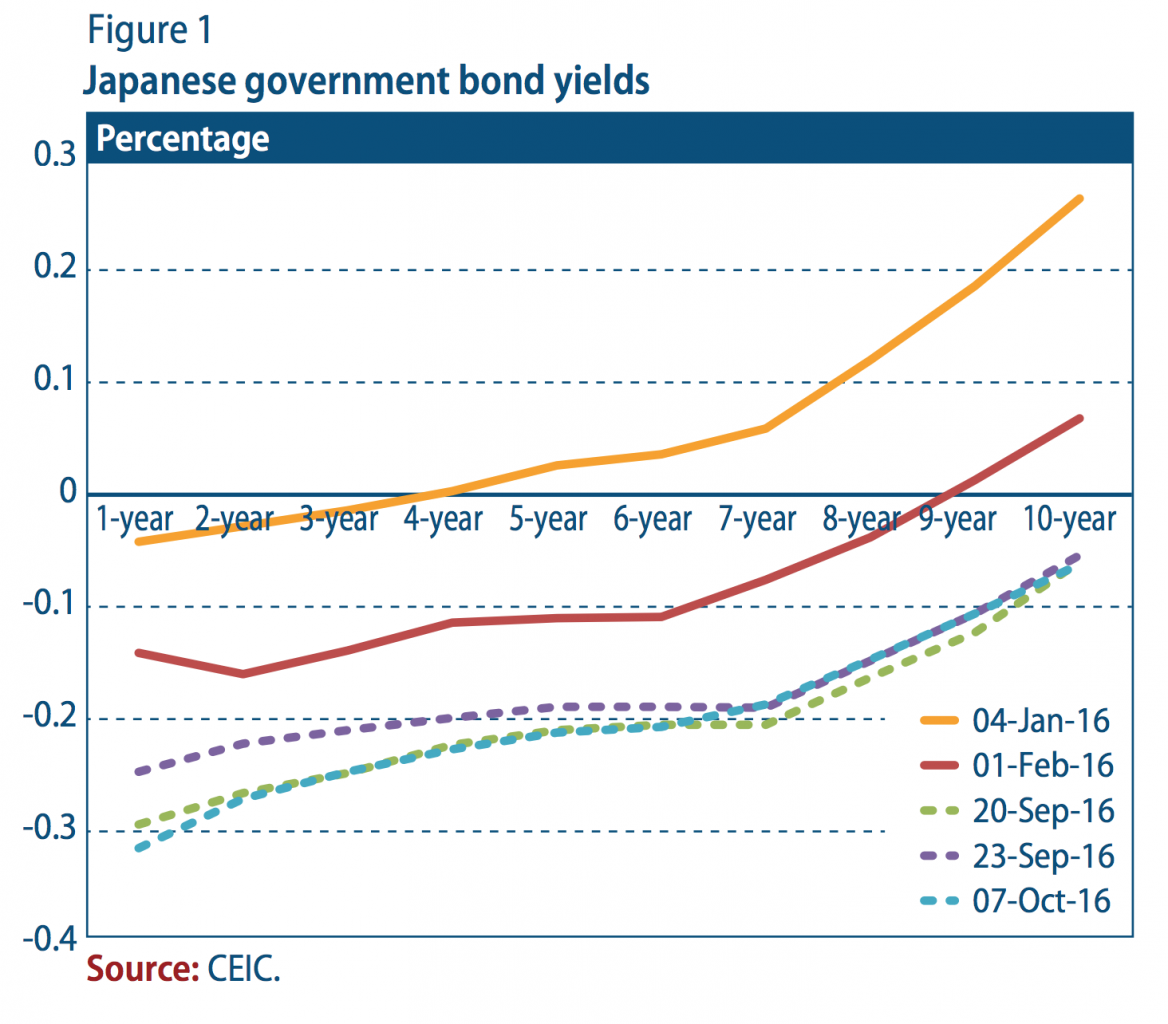

Both of these measures are intended to complement the BoJ existing quantitative and qualitative easing measures and the negative interest rate policy. The decision to target the yield curve aims to address the flattening of the yield curve (figure 1), which has been apparent since the introduction of negative interest rates in late January this year. The flattening of the yield curve represents a sharper decline for longer maturities, with significant pass-through to lending rates, which has had adverse effects on the profitability of the Japanese financial institutions. The objective is clearly to enforce a floor, while ensuring positive yields for longer-term maturities.

Both of these measures are intended to complement the BoJ existing quantitative and qualitative easing measures and the negative interest rate policy. The decision to target the yield curve aims to address the flattening of the yield curve (figure 1), which has been apparent since the introduction of negative interest rates in late January this year. The flattening of the yield curve represents a sharper decline for longer maturities, with significant pass-through to lending rates, which has had adverse effects on the profitability of the Japanese financial institutions. The objective is clearly to enforce a floor, while ensuring positive yields for longer-term maturities.

Financial markets initially reacted positively to the BoJ announcement, which demonstrated the central bank?s ability and willingness to expand its policy toolkit to tackle deflation. Japanese equities rose by about 2 per cent while the yen depreciated by 1 per cent against the US dollar. The initial reaction, however, may prove short-lived, as a high level of uncertainty persists regarding these new and untested strategies.

The yield-curve targeting is likely to affect the existing BoJ policies of quantitative and qualitative easing. Instead of expanding the monetary base at a fixed annual pace of 80 trillion yen, the BoJ is now expected to vary asset purchases in the short term to maintain a stable yield on 10-year government bonds. This also means the BoJ would be expected to intervene in the market more frequently and sell assets?which would reverse quantitative easing?to ensure that the yield remains at the target level. While the BoJ?s focus on buying assets with shorter maturities and allowing a steeper yield curve could improve banks? profitability, it is also viewed as a form of monetary tightening because longer-term rates would now likely hit higher levels. Allowing long-term interest rate to rise could, however, be a sensible strategy, given the country?s aging population and the greater adverse impact of depressed long-term rates on household spending.

The measure also signifies a shift from quantity-targeting to price-targeting. This may help the BoJ to address the issue of shrinking numbers of assets across all maturities that it can purchase, which has resulted in excessively flat yield curves. The shift away from quantity-targeting could also help to mitigate the potential destabilizing impact on the market should BoJ decide to taper its bond purchases in the future. However, the success of the new measure would largely depend on BoJ?s credibility with the market.

The measure also signifies a shift from quantity-targeting to price-targeting. This may help the BoJ to address the issue of shrinking numbers of assets across all maturities that it can purchase, which has resulted in excessively flat yield curves. The shift away from quantity-targeting could also help to mitigate the potential destabilizing impact on the market should BoJ decide to taper its bond purchases in the future. However, the success of the new measure would largely depend on BoJ?s credibility with the market.

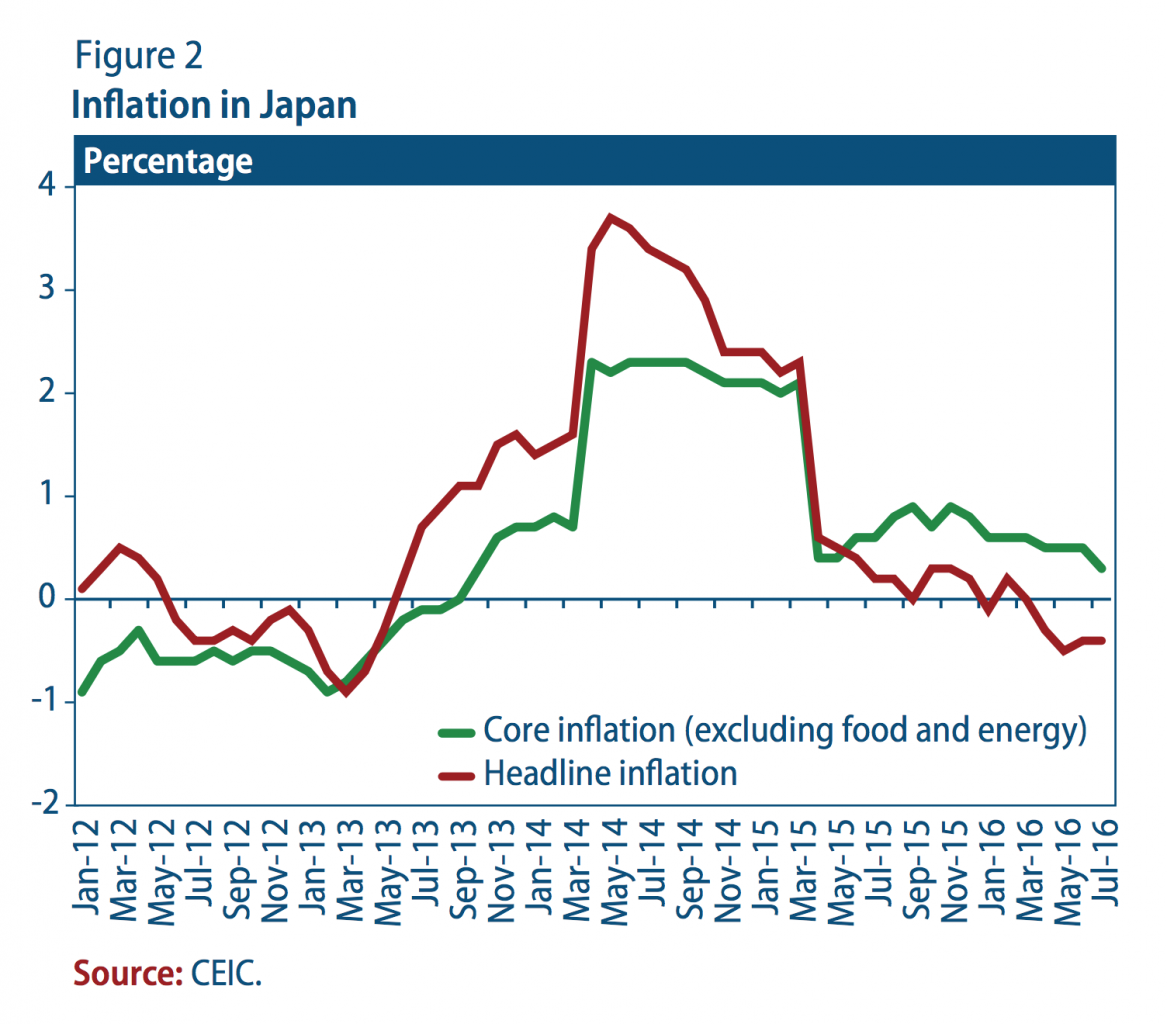

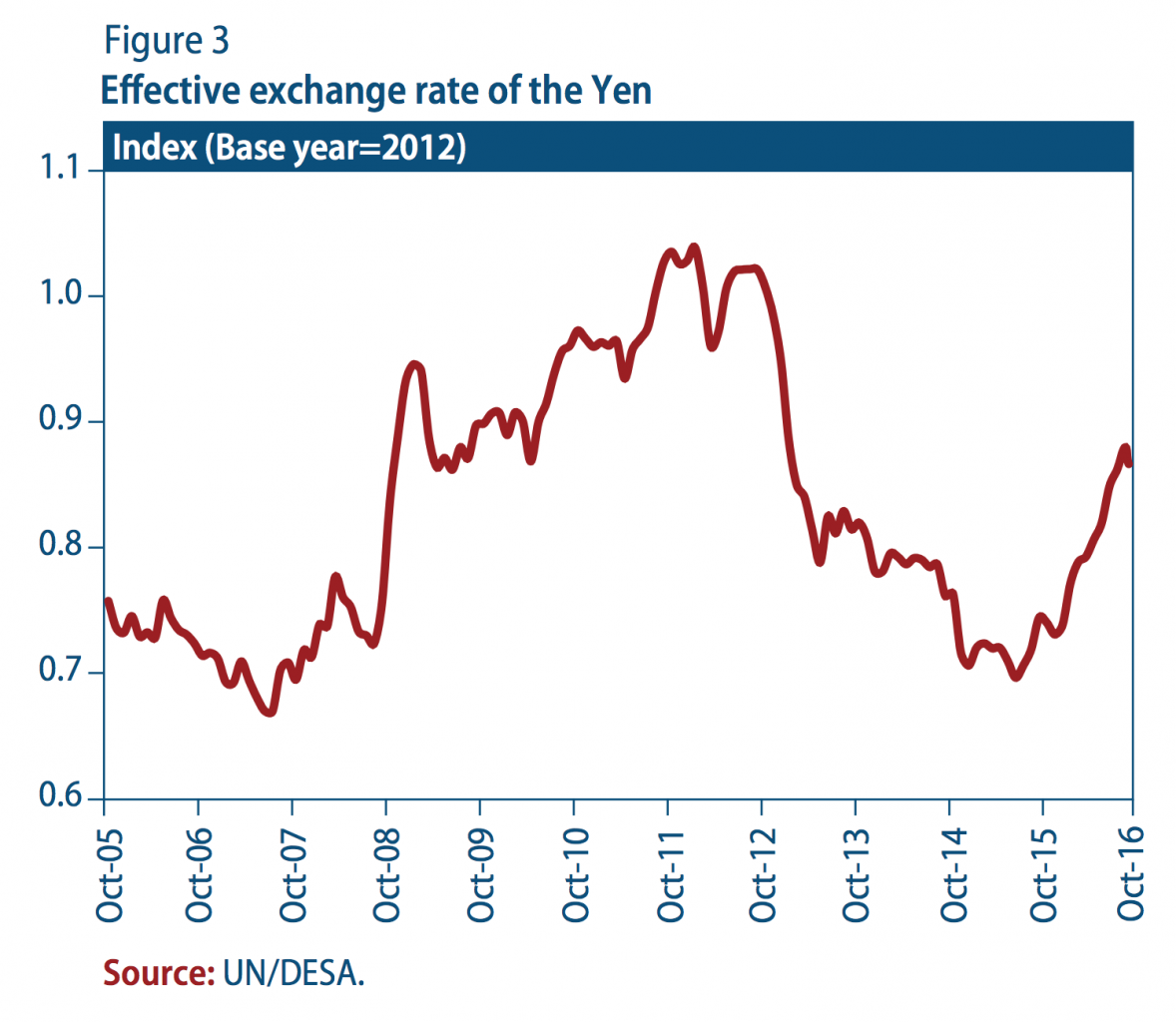

The new policy framework?s effectiveness will also depend on its interaction with fiscal policy, as alluded to in the BoJ?s official statement. Given the structural challenges that the Japanese economy faces, monetary policy on its own would fall short in stimulating and sustaining growth without coordinated support on the fiscal and structural fronts. Despite the implementation of a series of monetary easing measures over the past few years, deflationary pressures in Japan have remained high, amid prolonged weak domestic demand (figure 2). In addition, the persistent strength of the yen (figure 3) has weighed on Japanese exports, further constraining Japan?s growth prospects. The BoJ?s introduction of its new monetary policy framework came after the Japanese Government announced a new fiscal stimulus package in August, including 4.6 trillion yen of additional spending for the current fiscal year. An accommodative monetary stance can increase the effectiveness of fiscal policy. It offsets any upward pressure on interest rates that would typically be associated with a fiscal stimulus, which in turn could crowd out private investment.

The BoJ maintains that there is further room for additional easing under the new policy framework, as it can introduce further cuts in either the short-term policy interest rate or the target level of the long-term interest rate. Furthermore, the BoJ also noted that an expansion or acceleration of asset purchases are still potential policy options going forward.

Developed economies

United States: household incomes rise sharply

According to the latest Current Population Survey conducted by the U.S. Census Bureau, median household income in the United States of America increased at its fastest rate on record in 2015. Nonetheless, given the steep falls in median income following the financial crisis, the level of median income remained 1.6 per cent below its pre-crisis level in real terms. It is difficult to directly reconcile the sharp rise in median household income with the evolution of average hourly earnings of private sector employees, which have been rising at a steady, but unimpressive, rate of about 0.5 per cent per annum. However, the developments in median household income are more closely aligned with other labour market indicators. The unemployment rate dropped from 6.6 per cent at the start of 2014, stabilizing at about 5.0 per cent by end-2015 and maintaining solid job gains, for the most part, in 2016. It is also consistent with the recent strength of household spending growth. Household consumption increased by 2.6 per cent in the first 7 months of 2016 relative to a year earlier, and has been the sustaining force behind otherwise lacklustre gross domestic product (GDP) growth in recent quarters.

The apparent lack of wage pressures, despite the low unemployment rate, has been one of several factors that explains the cautious approach of the United States Federal Reserve (Fed) to increasing the interest rate. The new information on median household income growth, while not a determining factor in itself, increases the probability of an interest rate rise in the United States in the coming months. At its September meeting, the assessments of the members of the Federal Open Market Committee continued to point to at least one 25-basis-point rise in interest rates before the end of 2016. This accords with the Fed Fund futures market, which places the probability of an interest rate rise by the end of 2016 at just over 50 per cent.1

Europe: challenging labour market conditions, low inflation and stronger domestic demand

A number of national data releases in the past month illustrate the broader economic trends in the region: challenging labour market conditions, low inflation and stronger domestic demand. In France, the number of jobseekers increased by 1.6 per cent to more than 3.5 million. While this number is usually relatively volatile, the current level is higher than at the beginning of the year and close to the recent peak number of jobseekers registered in the fourth quarter of 2015. Drivers of the recent increase in the number of unemployed include more subdued conditions in the services sector?notably the hotel and restaurant sector?in the wake of recent terror attacks, which comes on top of more structural challenges such as taxes and regulations that can hinder the creation and development of small and medium-sized firms. In Austria, inflation remained at 0.6 per cent in August, dragged down by low energy prices. However, the low level of inflation continues to reflect the sharp drop in energy prices last year, which will have a diminishing effect on the year-on-year change in the consumer price level in the coming months. The economy of the Netherlands has expanded by 0.6 per cent quarter on quarter in the second quarter. As in a number of other countries in the region, domestic demand was a major driver in this regard, especially in the form of improvements in the real estate market and business investment.

Economies in transition

CIS: another round of monetary easing

In response to weakening inflationary pressures and stabilizing currencies in the CIS, several central banks further loosened their monetary policy stance in September. The central bank of the Russian Federation reduced its key policy rate by 50 basis points to 10 per cent as August inflation moderated to 6.9 per cent. Aggregate demand has been weighed down by a slower-than-anticipated rise in nominal wages and the Government?s decision to limit indexation of pensions. An increase in the oil price caused by the September OPEC decision to cut production has led to an appreciation of the Russian rouble, which should further restrain inflationary pressures. Nevertheless, as inflation still far exceeds the target, further policy moves are likely to be cautious. Policy interest rates were also cut in Armenia (by 50 basis points to 6.75 per cent), Georgia (not a CIS member, by 25 basis points to 6.5 per cent), Moldova (by 50 basis points to 9.5 per cent, bringing the cumulative 2016 cut to 1000 basis points) and Ukraine (by 50 basis points to 15.0 per cent). In contrast, Azerbaijan increased its policy rate from 9.5 per cent to 15.0 per cent to counteract depreciation pressures.

In September, the Standard and Poor?s rating agency upgraded its outlook for the Russian sovereign credit rating to stable from negative, citing moderation of the external risks. The outlook for major Russian companies has also been upgraded. In Ukraine, the second quarter GDP growth was revised up to 1.4 per cent on a year-on-year basis, mainly driven by a recovery in private investment, which grew by 17.6 per cent. Following a significant delay, the International Monetary Fund (IMF) eventually approved a $1.0 billion tranche for Ukraine as a part of the $17.2 billion bailout programme. Among the smaller CIS economies, the Armenian GDP grew by 2.8 per cent in January-June despite its strong dependence on the Russian economy; in Moldova, growth accelerated to 1.8 per cent in the second quarter.

In South-Eastern Europe, in the former Yugoslav Republic of Macedonia, GDP expanded by 2.2 per cent in the second quarter. While growth remains on a weaker trajectory compared with 2015, a 9.2 per cent expansion in investment marks a positive development.

Developing Economies

Africa: Nigerian economy contracts at a faster pace amid significant macroeconomic challenges

Recent economic indicators point towards a weaker growth outlook for Nigeria. In the second quarter, real GDP contracted at a faster pace of 2.1 per cent on a year-on-year basis, mainly due to a sharper decline in mining output. In particular, crude oil production decreased further, following prolonged militant attacks on critical oil and gas infrastructure in the Niger Delta. With the exception of the agriculture sector, growth in non-oil sectors has remained weak, constrained by foreign currency shortages, accelerating inflation and a weak banking system.

Exacerbated by low oil prices, the collapse in oil-related revenue has resulted in a worsening of Nigeria?s fiscal position. In the first half of 2016, government revenue fell 55 per cent short of its target, prompting the Nigerian authorities to seek financial assistance from bilateral sources and international organizations. In September, the African Development Bank tentatively agreed to extend an initial loan of $1 billion to Nigeria, aimed at addressing its urgent budget shortfall and to support key infrastructure development projects. Nevertheless, the Nigerian economy faces strong headwinds to growth. Rising inflation, high-exchange rate uncertainty and elevated security threats will continue to weigh negatively on its investment and growth prospects.

East Asia: Bank Indonesia cuts rate, while many others face limited room for further easing

Bank Indonesia (BI) cuts its new benchmark 7-day reverse repo rate by 25 basis points to 5 per cent in September. It is the fifth time that BI has cut its policy rate in 2016 (including the previous benchmark policy rate?the ?BI rate?) and a total of 125 basis points have been cut so far this year. The cut came amid BI?s expectation that growth would slow down in the third quarter. The current low inflationary environment and decreasing current-account deficit would allow BI to pursue further monetary easing if needed.

While Indonesia still has relatively more monetary space, policy rates in many other economies in the region are either approaching or have already reached the lowest levels since the Global Financial Crisis. Even though most economies still have some?albeit limited?room for rate cuts, many remain wary of the prospects of capital outflows, as the region saw its largest annual net capital outflow in 2015 since at least 2000. Uncertainty about the region?s economic prospects drove investors towards safer assets outside the region and lower rates could further accelerate capital outflows. Many central banks in the region are also concerned about the high levels of household and corporate debts, as loose monetary conditions following the financial crisis had encouraged corporations and households to increase leverage. Uncertainties surrounding the Fed?s decision on the Federal Fund Rate also prompt the region?s central banks to take a more prudent approach in setting their respective policy rates.

South Asia: the recovery in Nepal gains momentum; Sri Lanka's economy stabilizes after severe turbulences by early 2016

After a devastating earthquake in 2015, the economic outlook in Nepal has gradually improved throughout 2016, driven by stronger investment demand and supportive private consumption. Agricultural output, which accounts for one third of the economy, is also improving after a normal monsoon season. Monetary policy has remained moderately accommodative and the Government is expected to prioritize infrastructure investments and reconstruction efforts, with the challenge of improving budget performance. In contrast, remittances have recently shown signs of weaknesses, especially from migrants in the countries of the Cooperation Council for the Arab States of the Gulf (GCC) and Malaysia. If this trend continues, it could potentially depress private consumption. Meanwhile, the outlook for the Sri Lankan economy has stabilized in recent months, after serious balance of payment and debt turbulences in early 2016, including a large decline in international reserves and a significant depreciation of the rupee. In recent months, external pressures have eased and preliminary data suggest GDP growth has slightly revived, with tourism and construction activities showing dynamism. While fiscal consolidation, coupled with a tight monetary stance, may help to contain external risks, it will also impede major improvements in economic activity. In recent months, Sri Lanka received a three-year Extended Fund Facility of $1.5 billion from the IMF to support the reform agenda, which should provide some contribution to improving public finance.

Western Asia: Saudi Arabia's central bank increased its efforts to support the banking system

The economy of Saudi Arabia is experiencing a noticeable slowdown and significant macroeconomic adjustments, following the sharp decline in oil prices. Saudi Arabia?s central bank announced the injection of $5.3 billion into the banking system as time deposits, amid a visible deterioration in liquidity conditions and a deceleration in credit growth in recent months. Also, the central bank introduced 7- and 28-day re-purchase agreements, in addition to the existing re-purchase agreements with one-day maturity. These measures seek to support the banking sector and alleviate tightening monetary and financial conditions, complementing a series of moves implemented throughout 2016 that has had only limited effects. Borrowing costs have substantially increased in recent months, with interbank interest rates reaching the highest levels since 2009. It remains unclear, however, to what extent the large government financing needs might crowd out financial resources available for the private sector. Before the end of the year, Saudi Arabia is expected to sell its first international bond of about $10 billion to finance its large budget deficit, which reached a record high of about 15 per cent in 2015. Overall, tightening monetary conditions, coupled with a series of significant spending and subsidies cuts and tax increases, are further undermining economic activity. In 2016, GDP growth is expected to fall to its lowest level since the financial crisis.

Latin America and the Caribbean: declining inflation provides room for monetary easing

While the South American economy is projected to contract for a second consecutive year in 2016, there are signs of a mild recovery in 2017. In several countries, most notably Brazil, Colombia and Peru, consumer and business confidence indicators have improved. At the same time, inflation has started to moderate owing to stronger domestic currencies, a diminishing impact of El Ni?o on food prices, and weaker domestic demand. Portfolio capital inflows and asset prices have increased since the beginning of the year. This reflects a stabilizing of commodity prices and the search for yield among investors prompted by a slower-than-expected pace of monetary tightening in the United States and additional easing measures in other developed economies. The combination of reduced inflationary pressures and more benign financial market conditions has created room for central banks to ease monetary policy and support economic activity. In Argentina, the benchmark policy rate has already been lowered from 38.0 per cent in April to 26.75 per cent in September and further easing is expected over the coming year. Brazil?s central bank has signaled its intention to start reducing the policy rate from its current level of 14.25 per cent. Given elevated unemployment and planned fiscal tightening in most countries, supportive monetary policies will remain critical for a recovery in 2017.

Welcome to the United Nations

Welcome to the United Nations