Introduction

Introduction

The automotive industry plays a crucial role in the global economy, accounting for around 3 per cent of the world’s GDP. It has been a key driver of innovation, value creation, economic growth, and employment, particularly in developed economies like Germany, Japan, the Republic of Korea, and the United States. In recent years, the sector has faced intense scrutiny due to its contribution to climate change through greenhouse gas (GHG) emissions from transportation, which accounts for approximately 16 per cent of global emissions. Partly in response, electric vehicles (EVs) have become increasingly important although their potential to contribute to emissions reduction could remain unrealized if the electricity used to power them is generated from fossil fuels. Of late, the burgeoning EV market is facing broader trade and geopolitical tensions, characterized by an escalating rivalry between the world’s major economic powers. Concerns over the competitiveness of domestic industries, automotive jobs, and environmental protection have triggered major policy responses, particularly in developed economies. The resulting policy measures have ramifications along the entire EV supply chain, including critical minerals, processing infrastructure, batteries and battery components.

Recent trends in automotive industry and the EV segment

Recent trends in automotive industry and the EV segment

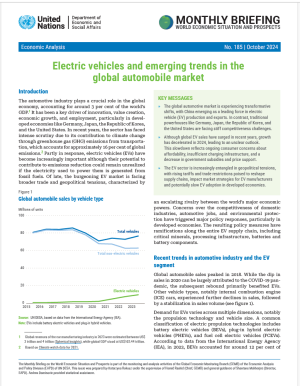

Global automobile sales peaked in 2018. While the dip in sales in 2020 can be largely attributed to the COVID-19 pandemic, the subsequent rebound primarily benefited EVs. Other vehicle types, notably internal combustion engine (ICE) cars, experienced further declines in sales, followed by a stabilization in sales volume (see figure 1).

Demand for EVs varies across multiple dimensions, notably the propulsion technology and vehicle size. A common classification of electric propulsion technologies includes battery electric vehicles (BEVs), plug-in hybrid electric vehicles (PHEVs), and fuel cell electric vehicles (FCEVs). According to data from the International Energy Agency (IEA), in 2023, BEVs accounted for around 12 per cent of global new car sales, PHEVs for 6 per cent and FCEV for a minor fraction, while ICE car sales still made up 82 per cent of global car sales. Liu et al (2023) recount findings of several studies indicating that consumer sentiment towards EVs depends on various factors, such as the purchase price and total cost of ownership, the availability of subsidies, vehicle reliability, the density of the charging infrastructure (critical for BEVs), as well as location and desired driving range. In terms of EV size, Chinese consumers tend to favor smaller cars, whereas American customers generally prefer larger vehicles (IEA, 2024), and European consumer preferences fall in between.

In response to the ongoing efforts to mitigate climate change by reducing emissions, the EV segment of the automotive market has witnessed remarkable growth over the past few years (see figure 2). An important factor for growing EV adoption has been increasing affordability, which varies by region. Car Edge (2024) estimates that the average EV price in the United States has fallen by around 20 per cent between mid-2023 and mid-2024. According to S&P Global Mobility (2024) the average manufacturer’s suggested retail price (MSRP) premium for battery electric vehicles (BEVs) compared to non-BEV vehicles is 24 per cent in Western Europe and 37 per cent in the United States. By contrast, in China the average suggested retail price for BEVs is 7 per cent lower than for non-BEV vehicles. Moreover, technological progress in batteries and other EV components, coupled with supportive government policies like price subsidies, and a growing density of charging infrastructure have driven strong consumer demand and sales growth. The growth momentum has been most dynamic in China, followed by Europe and the United States. According to IEA (2024), this trend is likely to continue and accelerate, given the scope of CO2 reduction commitments by countries around the world. The “Stated Policies” scenario, which is based on existing policies and measures, projects that the stock of EVs will increase from 45 million in 2023 to 250 million in 2030, with an average annual growth rate of 23 per cent from 2023 to 2035.

In response to the ongoing efforts to mitigate climate change by reducing emissions, the EV segment of the automotive market has witnessed remarkable growth over the past few years (see figure 2). An important factor for growing EV adoption has been increasing affordability, which varies by region. Car Edge (2024) estimates that the average EV price in the United States has fallen by around 20 per cent between mid-2023 and mid-2024. According to S&P Global Mobility (2024) the average manufacturer’s suggested retail price (MSRP) premium for battery electric vehicles (BEVs) compared to non-BEV vehicles is 24 per cent in Western Europe and 37 per cent in the United States. By contrast, in China the average suggested retail price for BEVs is 7 per cent lower than for non-BEV vehicles. Moreover, technological progress in batteries and other EV components, coupled with supportive government policies like price subsidies, and a growing density of charging infrastructure have driven strong consumer demand and sales growth. The growth momentum has been most dynamic in China, followed by Europe and the United States. According to IEA (2024), this trend is likely to continue and accelerate, given the scope of CO2 reduction commitments by countries around the world. The “Stated Policies” scenario, which is based on existing policies and measures, projects that the stock of EVs will increase from 45 million in 2023 to 250 million in 2030, with an average annual growth rate of 23 per cent from 2023 to 2035.

However, recent data show that the pace of growth in EV sales has decelerated in 2024 (figure 3) as headwinds in several key markets have intensified. The trend varies across regions and the outlook remains unclear, with analysts indicating that the slowdown could span over the next 12–18 months, or that a rebound may occur in 2025. Several factors are behind the current slowdown. First, according to S&P Global Mobility (2024), affordability remains the top concern among consumers, as expressed by 48 per cent of 7,500 survey respondents. According to Bank of America (2024), the rate of electric vehicle penetration in the United States premium automobile market is double that of the mass market, with EVs accounting for 14 per cent of premium car sales compared to 7 per cent for the mass market. Secondly, insufficient availability of charging infrastructure in many countries poses a fundamental challenge, discouraging the use of EVs beyond city boundaries and limiting their appeal. Installation of further charging and hydrogen refueling stations was listed by the European Automobile Manufacturers’ Association (ACEA) as the number one condition to support continued rollout of EVs in Europe, following the continent’s sales slump in recent months (ACEA, 2024). Thirdly, lower-than-expected resale values are impacting EV capital costs (Goldman Sachs, 2024). According to a recent study using a sample of 1.6 million used cars (1–5 years old) sold in August 2023 and 2024, used EV values dropped 25 per cent in the past year compared to a 4 per cent decline for gasoline-powered cars (iseecars.com, 2024). This steeper depreciation undermines EVs’ investment appeal and signals their inability to retain value in the used car market comparable to gasoline vehicles (Butts, 2024). Finally, concerns have emerged regarding the performance and reliability of EVs, with 80 per cent more issues being reported in the US compared to gasoline vehicles (Picchi, 2023), while sales in the Republic of Korea have taken a hit following a recent large-scale EV fire.

However, recent data show that the pace of growth in EV sales has decelerated in 2024 (figure 3) as headwinds in several key markets have intensified. The trend varies across regions and the outlook remains unclear, with analysts indicating that the slowdown could span over the next 12–18 months, or that a rebound may occur in 2025. Several factors are behind the current slowdown. First, according to S&P Global Mobility (2024), affordability remains the top concern among consumers, as expressed by 48 per cent of 7,500 survey respondents. According to Bank of America (2024), the rate of electric vehicle penetration in the United States premium automobile market is double that of the mass market, with EVs accounting for 14 per cent of premium car sales compared to 7 per cent for the mass market. Secondly, insufficient availability of charging infrastructure in many countries poses a fundamental challenge, discouraging the use of EVs beyond city boundaries and limiting their appeal. Installation of further charging and hydrogen refueling stations was listed by the European Automobile Manufacturers’ Association (ACEA) as the number one condition to support continued rollout of EVs in Europe, following the continent’s sales slump in recent months (ACEA, 2024). Thirdly, lower-than-expected resale values are impacting EV capital costs (Goldman Sachs, 2024). According to a recent study using a sample of 1.6 million used cars (1–5 years old) sold in August 2023 and 2024, used EV values dropped 25 per cent in the past year compared to a 4 per cent decline for gasoline-powered cars (iseecars.com, 2024). This steeper depreciation undermines EVs’ investment appeal and signals their inability to retain value in the used car market comparable to gasoline vehicles (Butts, 2024). Finally, concerns have emerged regarding the performance and reliability of EVs, with 80 per cent more issues being reported in the US compared to gasoline vehicles (Picchi, 2023), while sales in the Republic of Korea have taken a hit following a recent large-scale EV fire.

While globally EV sales are still rising – albeit at a lower rate than in the past few years – the European market has recently experienced a decline (figure 4). In August 2024, registrations of BEVs dropped by 43.9 per cent to 92,627 units (compared to 165,204 the same period last year), while Europe’s two biggest markets for BEVs saw sharp declines from a year ago (ACEA (2024)): Germany (-68.8 per cent) and France (-33.1 per cent). Several factors may have triggered the decline. In December 2023, Germany phased out its EV subsidy for consumers, causing EV sales to fall throughout 2024. According to McKinsey (2024), high purchase price, insufficient driving range and concerns about battery lifetime top European consumers’ concerns over EVs. In addition, due to the phased structure of the EU’s emission reduction schedules for cars, recent analysis suggests that the downturn in 2024 may partly be due to the car manufacturers’ decision to frontload sales of high-end, high-margin vehicles, putting off the launch of smaller, more affordable EVs to end-2024 and 2025 (Transport & Environment, 2024). Overall, total passenger vehicle sales have been on a downward trajectory in Europe, signaling broader changes in mobility patterns across the continent, notably through significant continued use of public transport and micro-mobility solutions.

In contrast, the EV market in China continues to grow at a rapid pace. Although the expiration of sales tax exemptions for EVs with a range of less than 200 kilometers weighed on the market in June 2024, sales recovered quickly in July thanks to the government subsidy for trading in an old vehicle to purchase a new EV (Xinhua, 2024). In August 2024, a record-breaking number of more than 1 million EVs were sold in China, corresponding to a 33 per cent year-over-year growth (CAAM, 2024), bringing the overall sales volume for the first 8 months of 2024 to around 7 million EVs. As elsewhere in the world, government support has been critical for the establishment of the EV sector in China, which is an important component of energy transition and pollution reduction efforts. Kennedy (2024) estimates that the Chinese government’s cumulative support for the EV sector totaled $230.9 billion during 2009 through 2023. Going forward, the strength of China’s domestic demand, the scope of government incentives and access to export markets are expected to shape the overall outlook of the EV sector.

While globally EV sales are still rising – albeit at a lower rate than in the past few years – the European market has recently experienced a decline (figure 4). In August 2024, registrations of BEVs dropped by 43.9 per cent to 92,627 units (compared to 165,204 the same period last year), while Europe’s two biggest markets for BEVs saw sharp declines from a year ago (ACEA (2024)): Germany (-68.8 per cent) and France (-33.1 per cent). Several factors may have triggered the decline. In December 2023, Germany phased out its EV subsidy for consumers, causing EV sales to fall throughout 2024. According to McKinsey (2024), high purchase price, insufficient driving range and concerns about battery lifetime top European consumers’ concerns over EVs. In addition, due to the phased structure of the EU’s emission reduction schedules for cars, recent analysis suggests that the downturn in 2024 may partly be due to the car manufacturers’ decision to frontload sales of high-end, high-margin vehicles, putting off the launch of smaller, more affordable EVs to end-2024 and 2025 (Transport & Environment, 2024). Overall, total passenger vehicle sales have been on a downward trajectory in Europe, signaling broader changes in mobility patterns across the continent, notably through significant continued use of public transport and micro-mobility solutions.

In contrast, the EV market in China continues to grow at a rapid pace. Although the expiration of sales tax exemptions for EVs with a range of less than 200 kilometers weighed on the market in June 2024, sales recovered quickly in July thanks to the government subsidy for trading in an old vehicle to purchase a new EV (Xinhua, 2024). In August 2024, a record-breaking number of more than 1 million EVs were sold in China, corresponding to a 33 per cent year-over-year growth (CAAM, 2024), bringing the overall sales volume for the first 8 months of 2024 to around 7 million EVs. As elsewhere in the world, government support has been critical for the establishment of the EV sector in China, which is an important component of energy transition and pollution reduction efforts. Kennedy (2024) estimates that the Chinese government’s cumulative support for the EV sector totaled $230.9 billion during 2009 through 2023. Going forward, the strength of China’s domestic demand, the scope of government incentives and access to export markets are expected to shape the overall outlook of the EV sector.

Changing trade patterns in electric vehicles

As the sales dynamics of EVs evolve, the structure of supply and global trade patterns are undergoing significant transformations. As depicted in figure 5, in 2018, the United States was the world’s largest exporter of BEVs (passenger cars), accounting for over 30 per cent of global exports in value terms. However, by 2022, its share had plummeted to less than 7 per cent. In contrast, Germany’s share grew substantially from 17 per cent to over 30 per cent during the same period, while China experienced a remarkable surge, capturing over 20 per cent of the value of exports in 2022, up from only 1 per cent in 2018. Other important actors include the Republic of Korea (9 per cent of global exports), Belgium (8 per cent) and Spain (4 per cent); the remaining 20 per cent of exports originate from the rest of the world. These massive shifts in export shares reflect the rapidly evolving landscape of the BEV industry, where traditional automotive powerhouses like Japan, Germany, the Republic of Korea or the United States are facing intense competition from emerging players, most notably China. It is worthwhile to also note that China, the second largest importer of BEVs in 2018, dropped out of the top 10 importer countries in 2023, as local producers captured a larger market share, supported by the establishment of the Tesla Gigafactory in 2019. Norway was a clear early adopter in 2018, and in September 2024, the number of EVs in Norway exceeded the number of ICE cars. The increasing importance of the United Kingdom and the United States as BEV importers reflects a growing ambition to scale up electrification efforts. The rising share of the rest of the world as importer countries of EVs partly reflects growing demand for EVs in developing countries. In terms of recent bilateral trade flows, it is worthwhile to note that the United States relies heavily on imports from Germany and the Republic of Korea, rather than from China, to fulfil its demand. These changing trade patterns underscore the need for carmakers and governments to adapt their strategies to remain competitive in the global BEV market. Mazzocco and Sebastian (2023) highlight two critical factors that have contributed to China’s success as an EV exporter: the growing capabilities of the Chinese EV automakers and China’s global importance as an EV manufacturing hub. While the joint venture requirement for foreign investors helped stimulate the domestic capacity of the car industry, technological advances have been attained also through dedicated research and development (R&D) efforts in areas such as battery efficiency, design and digital interfaces. The cost advantages gained through its lead position within the battery industry allow it to offer competitive prices, while a dedicated effort at improving styling, design, and connected-vehicle features has increased consumer appeal, particularly in the domestic market. For example, BYD successfully transitioned from producing smartphone batteries in the 1990s to EV batteries, and full EV production. Currently, BYD ranks first in China for patented technologies, owning or filing nearly 30,000 patents (Reid, 2023). Western carmakers have acknowledged the growing competitiveness of Chinese electric vehicle companies, as exemplified by Volkswagen’s acquisition of a stake in the Chinese EV startup Xpeng. This deal allowed Volkswagen to gain access to Xpeng’s expertise in areas like EV software and autonomous driving technologies (Waldersee, 2023).

China is a key EV manufacturing hub for both Chinese firms and international actors. Scale and network effects as well as supportive business environment make manufacturing EVs in China very cost efficient. The value chain and production capabilities have also driven large price reductions on Chinese-made EV batteries, with costs of lithium iron phosphate (LFP) battery cells falling by 51 per cent to $53 per kilowatt-hour over the last year (Gupta, 2024). In 2023, China’s export of lithium-ion batteries constituted 56 per cent of global exports, signaling a large dependence of global EV manufacturers on EV parts and components’ imports from China. The joint venture requirement for foreign production of EVs was phased out in 2018. Hetzner (2024) reports that Tesla, the first foreign car manufacturer allowed to build a wholly owned plant in China, manufactures more than half of cars built globally in Shanghai, with around a third of its volume destined for export. Western carmakers continue to cooperate with Chinese partners in the EV sector and are aiming to expand EV production in China.

Mazzocco and Sebastian (2023) highlight two critical factors that have contributed to China’s success as an EV exporter: the growing capabilities of the Chinese EV automakers and China’s global importance as an EV manufacturing hub. While the joint venture requirement for foreign investors helped stimulate the domestic capacity of the car industry, technological advances have been attained also through dedicated research and development (R&D) efforts in areas such as battery efficiency, design and digital interfaces. The cost advantages gained through its lead position within the battery industry allow it to offer competitive prices, while a dedicated effort at improving styling, design, and connected-vehicle features has increased consumer appeal, particularly in the domestic market. For example, BYD successfully transitioned from producing smartphone batteries in the 1990s to EV batteries, and full EV production. Currently, BYD ranks first in China for patented technologies, owning or filing nearly 30,000 patents (Reid, 2023). Western carmakers have acknowledged the growing competitiveness of Chinese electric vehicle companies, as exemplified by Volkswagen’s acquisition of a stake in the Chinese EV startup Xpeng. This deal allowed Volkswagen to gain access to Xpeng’s expertise in areas like EV software and autonomous driving technologies (Waldersee, 2023).

China is a key EV manufacturing hub for both Chinese firms and international actors. Scale and network effects as well as supportive business environment make manufacturing EVs in China very cost efficient. The value chain and production capabilities have also driven large price reductions on Chinese-made EV batteries, with costs of lithium iron phosphate (LFP) battery cells falling by 51 per cent to $53 per kilowatt-hour over the last year (Gupta, 2024). In 2023, China’s export of lithium-ion batteries constituted 56 per cent of global exports, signaling a large dependence of global EV manufacturers on EV parts and components’ imports from China. The joint venture requirement for foreign production of EVs was phased out in 2018. Hetzner (2024) reports that Tesla, the first foreign car manufacturer allowed to build a wholly owned plant in China, manufactures more than half of cars built globally in Shanghai, with around a third of its volume destined for export. Western carmakers continue to cooperate with Chinese partners in the EV sector and are aiming to expand EV production in China.

Welcome to the United Nations

Welcome to the United Nations