- Global growth prospects restrained by persistent weak labour productivity growth

- Services trade as a potential source of global growth

- Growth moderation in India amid a contraction of investment activity

Global issues

Global economy restrained by weak productivity growth

The world economy has slowed markedly since the global financial crisis. As highlighted in the World Economic Situation and Prospects Update as of mid-2016, world gross product has expanded at an average annual rate of 2.6 per cent since 2010, much slower than the average growth rate of 3.4 per cent observed between 2000 and 2007. The prolonged period of slow global growth has been characterized by a marked slowdown in labour productivity growth in the majority of developed economies. Many large developing economies and economies in transition have also experienced a significant slowdown in labour productivity growth, including Brazil, China, the Russian Federation and South Africa. Given that this protracted period of weak productivity growth may have longer-term implications, an assessment of the factors driving this slowdown may offer some insights into the outlook for the global economy.

Gross domestic product (GDP) growth can be decomposed into the contributions from growth in labour inputs and the contributions from growth in labour productivity. In terms of welfare, the contribution of labour productivity to GDP growth is particularly important. Changes to labour inputs are largely driven by demographic developments, although they may also reflect shifts in labour force participation, the average number of hours worked and shifts in the unemployment rate. If GDP growth is driven entirely by a rise in labour input from an expansion of the population, income per capita remains stagnant. Therefore, in order to raise average incomes in the economy, labour productivity growth is essential.

Gross domestic product (GDP) growth can be decomposed into the contributions from growth in labour inputs and the contributions from growth in labour productivity. In terms of welfare, the contribution of labour productivity to GDP growth is particularly important. Changes to labour inputs are largely driven by demographic developments, although they may also reflect shifts in labour force participation, the average number of hours worked and shifts in the unemployment rate. If GDP growth is driven entirely by a rise in labour input from an expansion of the population, income per capita remains stagnant. Therefore, in order to raise average incomes in the economy, labour productivity growth is essential.

Labour productivity can be further decomposed into capital deepening and total factor productivity (TFP) growth. Capital deepening refers to the increase in the capital intensity of production, and is defined here as the rise in the volume of productive capital stock per hour of labour input. The productive capital stock includes physical assets such as machinery and equipment, non-residential structures and infrastructure, and intellectual property assets. TFP measures the relationship between output of the economy and the inputs (capital and labour) involved in production. Rather than focusing exclusively on labour productivity, TFP measures the joint influences of technological change, efficiency improvements, the skills of the workforce, returns to scale, reallocation of resources and other factors that drive economic growth, after allowing for any expansion of capital and labour inputs.

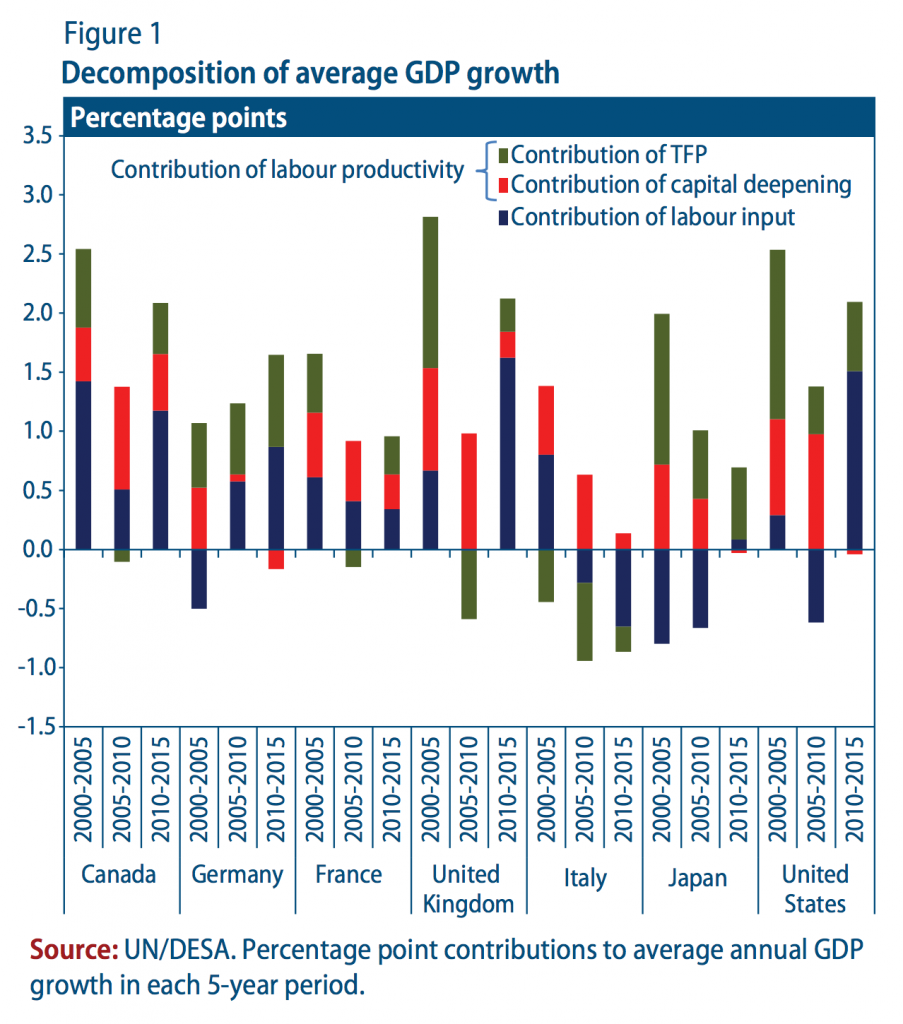

Figure 1 decomposes average GDP growth in the largest developed economies into the contributions from labour input, capital deepening and TFP growth, comparing three 5-year periods. Except in Italy, average GDP growth since 2010 has increased compared to the period of 2005-2010. However, this has been largely driven by a rise in labour input, as employment recovered towards pre-crisis levels. Labour productivity growth, by contrast, has remained weak, especially when compared to the pre-crisis period of 2000-2005, where labour productivity growth averaged 1-2 per cent per annum in these countries. Italy remains an exception, due to significant structural changes in its labour market.1

When decomposed further, the slowdown in labour productivity growth in the largest developed economies was primarily driven by the very low rate of capital deepening. Germany, Japan and the United States of America have, in fact, undergone a period of ?capital shallowing? since 2010, as the volume of productive capital stock per hour of labour input has actually declined. This is indicative of the collapse in investment growth in the developed economies post-crisis, which has allowed the existing capital stock to atrophy. Capital deepening and TFP growth are closely interconnected. Investment in new capital can affect factors such as the rate of innovation, labour force skills and the quality of infrastructure. These in turn drive the technological change and efficiency improvements underpinning TFP growth in the medium term.

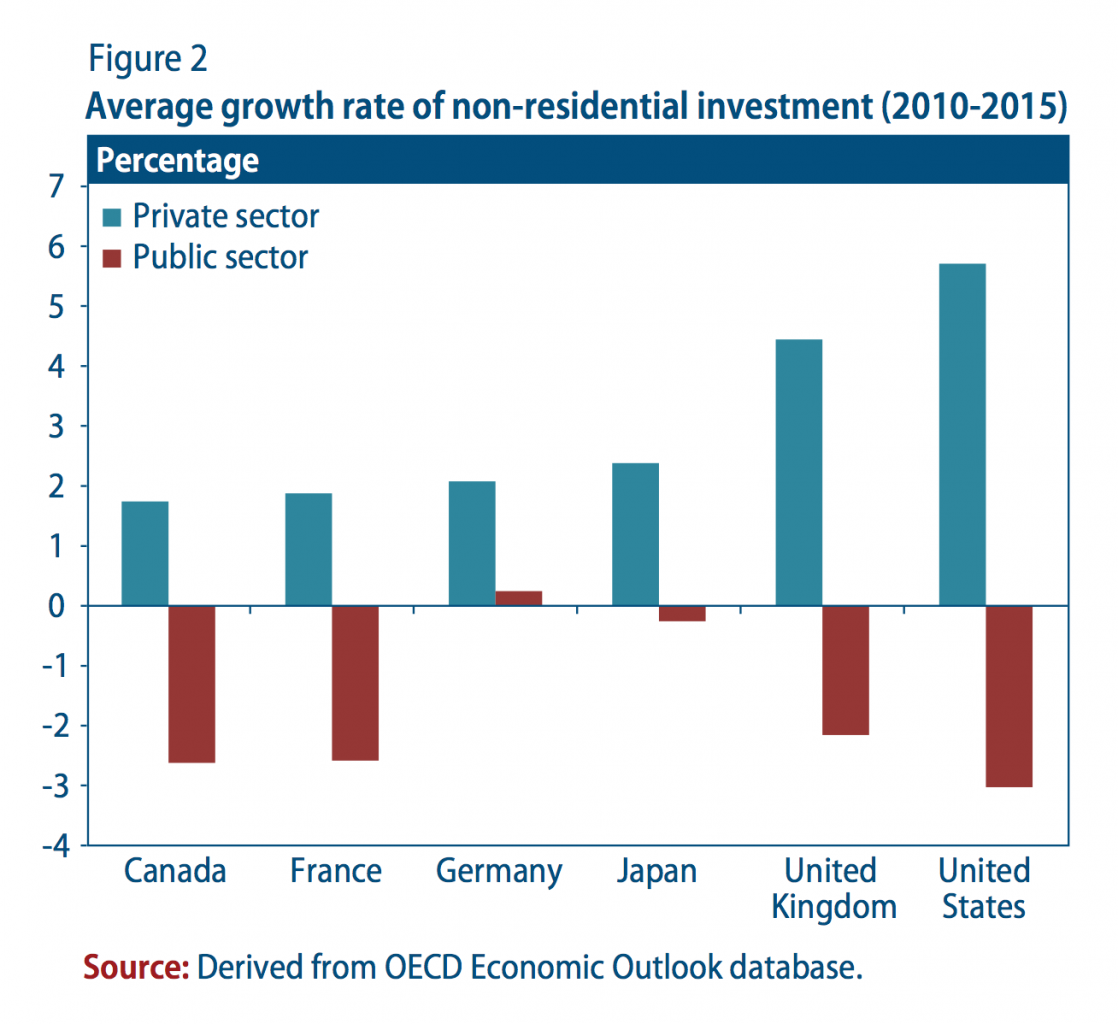

The widespread slowdown in capital deepening reflects the low rate of both private and public investment. In some cases, private investment has been constrained by a lack of access to finance, especially for small and medium-sized firms, amid weak global demand. Steep cuts in public sector investment (figure 2) largely reflect fiscal adjustment policies that have been implemented in many developed economies. The most recent figures for 2016 point to further declines in private non-residential investment in Canada, Japan, the United Kingdom of Great Britain and Northern Ireland and the United States of America. In the absence of concerted policy efforts to revive productive investment, this suggests that the extended period of weak productivity and global growth can be expected to linger for several more years.

The widespread slowdown in capital deepening reflects the low rate of both private and public investment. In some cases, private investment has been constrained by a lack of access to finance, especially for small and medium-sized firms, amid weak global demand. Steep cuts in public sector investment (figure 2) largely reflect fiscal adjustment policies that have been implemented in many developed economies. The most recent figures for 2016 point to further declines in private non-residential investment in Canada, Japan, the United Kingdom of Great Britain and Northern Ireland and the United States of America. In the absence of concerted policy efforts to revive productive investment, this suggests that the extended period of weak productivity and global growth can be expected to linger for several more years.

The relative resilience of global services trade and its potential as a source of growth

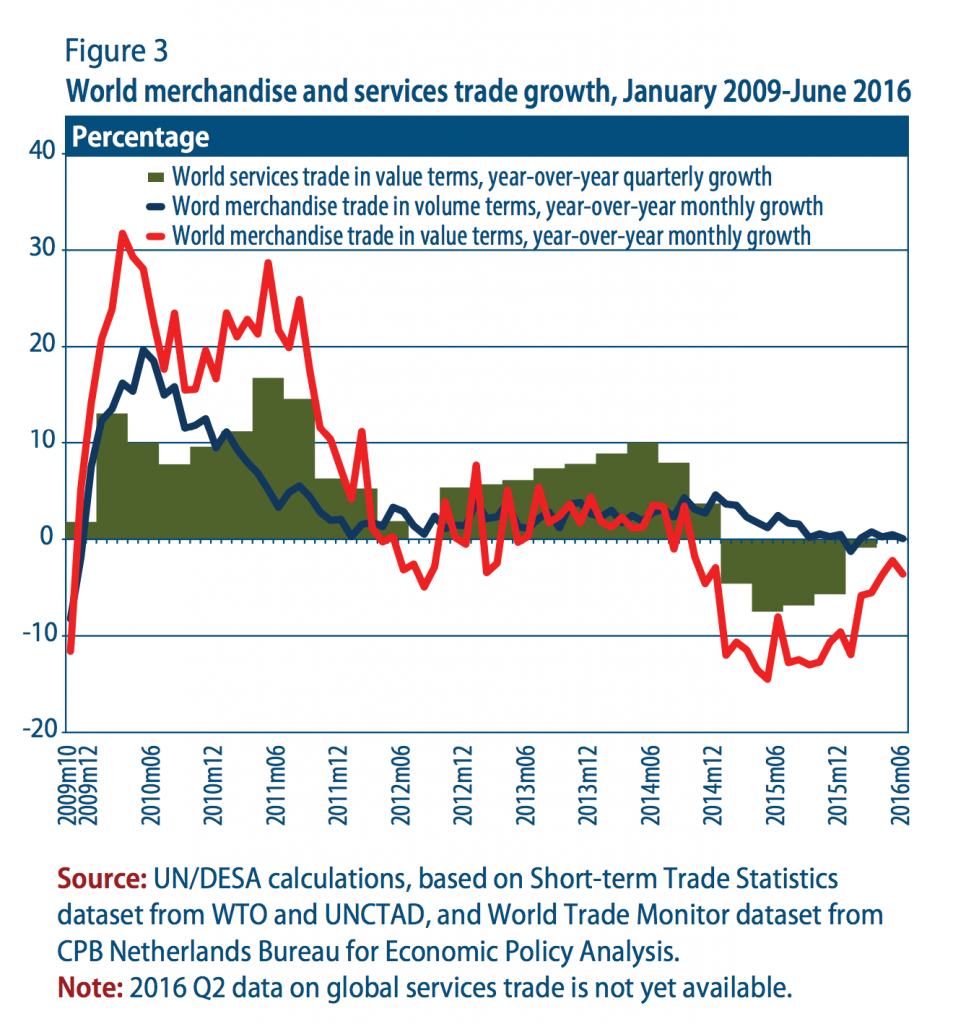

Global trade activity remained tepid in the first half of 2016, as merchandise trade growth in volume terms has stagnated since end-2015 (figure 3). In value terms, the pace of decline in world merchandise trade has slowed from its 2015 trough. However, this largely reflects an improvement in commodity prices since the first quarter of this year. The current lacklustre dynamics of global merchandise trade is attributed to a combination of cyclical and structural factors, as highlighted in the World Economic Situation and Prospects 2016 report. Developed economies have recently seen a modest improvement in their merchandise import volumes, with the main beneficiaries being exporters in Africa, Central and Eastern European economies, Japan, and the Middle East. Collectively, developing economies saw some uptick in export volume growth in the first quarter of 2016, but it subsequently slowed, driven by developing Asia and Latin America and the Caribbean, regions that have been adversely affected by the global trade stagnation.

In recent years, global trade in services has displayed greater resilience than merchandise trade. Services trade in value terms has consistently performed better than merchandise trade since 2012. Nonetheless, since early 2015, quarterly global services trade values have contracted on an annual basis. This, however, can be partly attributed to the strong US dollar, which saw its monthly effective exchange rate appreciate by 12 per cent on average in 2015. Indeed, physical data on air passengers and freight indicates that in volume terms services have performed relatively well (travel and transport accounts for around 45 per cent of global services trade). Traditional trade statistics that record gross flows has put the share of services in total global trade at around 20 per cent. These measures, however, suffer from double-counting issues as intermediate goods are often repeatedly traded across borders. Instead, data on trade in value-added suggests that service sectors in fact account for about 50 per cent of world exports. The levels are typically higher for developed economies, but are also significant for large developing economies, such as Brazil (49 per cent), China (42 per cent) and India (58 per cent).

The relative resilience of services trade and its significant share in global trade in value-added highlight its potential as a source of growth. Such potential is not only underpinned by the significant size of services trade among global economic activities, but also its possible role in supporting productivity growth, which has slowed down considerably in recent years, as discussed above. Services?ranging from telecommunications to finance, and from transportation to construction?can play a crucial role in supporting other economic activities, through reducing transaction costs, disseminating knowledge and information, and facilitating resource allocation. Furthermore, firm-level analyses have shown that liberalization of the services sector can improve productivity, owing to the increased availability of reliable, sophisticated service providers for the manufacturing sector and the exit of less productive firms. The impact should be even more pronounced in developing countries as their service sectors are typically less advanced when compared to the developed economies.

In order to facilitate global services trade, the high level of costs needs to be addressed. Empirical research shows that services trade costs are significantly higher than merchandise trade costs across a wide range of countries.2 In this regard, services trade agreements could play a key role in lowering these costs. However, the fundamental differences between merchandise and services introduce specific challenges. Compared to merchandise trade, services trade barriers are more likely in the form of ?behind-the-border? measures, such as discriminatory regulations that impose more restrictive requirements on foreign services. These measures come in many different forms and are typically more difficult to monitor than other trade barriers. Some of them also serve legitimate regulatory purposes, which are permissible under World Trade Organization rules under clearly defined conditions. The challenge hereby would be to make sure that the measures are set at levels that achieve legitimate objectives without imposing unnecessary restrictions on trade. At the domestic level, complementary policies that facilitate the process of adjusting to service sectors liberalization must be in place to ensure that the domestic economy can reap the full benefits. These include policies that ensure the opening-up does not lead to a mere transfer of monopoly rents to foreign firms; social policies that provide a social safety net, especially for those who are most adversely affected; and labour market and education policies that equip the labour force with commensurate skills to work in the service sectors.

In order to facilitate global services trade, the high level of costs needs to be addressed. Empirical research shows that services trade costs are significantly higher than merchandise trade costs across a wide range of countries.2 In this regard, services trade agreements could play a key role in lowering these costs. However, the fundamental differences between merchandise and services introduce specific challenges. Compared to merchandise trade, services trade barriers are more likely in the form of ?behind-the-border? measures, such as discriminatory regulations that impose more restrictive requirements on foreign services. These measures come in many different forms and are typically more difficult to monitor than other trade barriers. Some of them also serve legitimate regulatory purposes, which are permissible under World Trade Organization rules under clearly defined conditions. The challenge hereby would be to make sure that the measures are set at levels that achieve legitimate objectives without imposing unnecessary restrictions on trade. At the domestic level, complementary policies that facilitate the process of adjusting to service sectors liberalization must be in place to ensure that the domestic economy can reap the full benefits. These include policies that ensure the opening-up does not lead to a mere transfer of monopoly rents to foreign firms; social policies that provide a social safety net, especially for those who are most adversely affected; and labour market and education policies that equip the labour force with commensurate skills to work in the service sectors.

Developed economies: scope for fiscal loosening

Several of the large developed economies have initiated a move away from the tight fiscal austerity programmes that have been in place, for the most part, since 2010, towards a more expansive fiscal stance. As emphasized in the World Economic Situation and Prospects Update as of mid-2016, developed countries have relied primarily on monetary policy to support their economies since 2010. A more balanced policy mix?supported by more robust fiscal policy stances and coordinated among the largest economies?could provide a much needed impetus to the global economy.

Several developed economies have announced pro-growth fiscal measures in 2016. Australia introduced tax cuts for small and medium-sized businesses, and preserved the investment budget for the national innovation and research agenda. Canada announced a programme of large infrastructure investments over the next five years. Meanwhile, Japan postponed a planned hike in the rate of VAT and announced a significant expansion of public works spending; and the United Kingdom has abandoned plans to balance the fiscal deficit by 2020, given the negative impact on growth prospects of the economic uncertainty surrounding the decision to withdraw from the European Union (EU). While the United States has played an active role in G20 meetings in promoting the use of fiscal tools to support the global economic recovery, in practice, government spending in the United States has contracted sharply since 2010. No concrete change in the direction of domestic policy can be expected before the United States presidential election in November 2016. Nonetheless, a clear shift away from severe fiscal austerity is underway in many developed economies, which should allow for a more balanced policy mix to support the global economy going forward.

Economies in transition:

mixed signals for the Russian economy

Growth in the Commonwealth of Independent States (CIS) showed signs of improvement in the second quarter of 2016. In the Russian Federation, GDP contracted at a slower pace of 0.6 per cent (year on year), following a 1.2 per cent decline in the first quarter. This was mainly attributed to a recovery in manufacturing and agricultural output. Stronger demand for electricity also indicated increased capacity utilization. Forward-looking economic indicators, however, signal mixed trends. While the latest purchasing managers? indices indicate an expansion for both the manufacturing and services sectors, consumer demand has continued to dwindle in line with shrinking real disposable incomes. In Ukraine, GDP increased by 1.3 per cent in the second quarter. This was largely owing to the robust performance of the metallurgy sector, which was in turn supported by higher global steel prices. However, the economy faces numerous risks. Bilateral trade between Ukraine and the Russian Federation contracted by 42 per cent in the first half of 2016. In addition, many important exports to the EU have been constrained by quotas, despite the recently concluded free trade agreement. The continued delay of the next Extended Fund Facility loan tranche from the International Monetary Fund (IMF) is posing challenges for public finances.

Weak consumer price inflation in the CIS prompted monetary policy loosening by a few central banks in the region. In August, Armenia cut its policy rate by 25 basis points following deflation in the previous month. In Belarus, the policy rate was reduced by 200 basis points. In Kazakhstan, however, the lifting price controls on diesel spurred inflation, which stood at 17.6 per cent in August, with potential second round effects.

In South-Eastern Europe, growth in Serbia slowed to 1.8 per cent in the second quarter, following a strong 3.5 per cent expansion in the previous quarter. In the former Yugoslav Republic of Macedonia, the Government in August proposed budget amendments to accommodate additional spending in response to floods earlier in the month.

Developing Economies

Africa: security concerns continue to weigh on

North Africa?s tourism sector

The tourism industry in several North African countries remains on a deteriorating trend, given elevated security threats and social unrest in the region. Most recent year-to-date figures for 2016 show that tourist arrivals into Egypt and Tunisia declined at an annual pace of 50 per cent and 25 per cent, respectively. Meanwhile, despite relative domestic stability, visitor arrivals into Morocco contracted by almost 3 per cent in the first half of this year.

The weakening tourism sector poses an additional risk to the already challenging growth and development outlook for North Africa. Based on international balance-of-payment statistics, tourism receipts constitute 11?18 per cent of total exports of these economies, reflecting its direct importance as a source of foreign exchange earnings. In Egypt, the sharp decline in tourism revenue has contributed to a severe foreign currency shortage. This prompted Egyptian authorities to arrange for a $12 billion loan programme with the IMF in August. The decline in tourist arrivals has had adverse effects on the food and beverage, accommodation and retail trade industries in particular. In addition, the contraction in the tourism sector has affected job creation, amid double-digit unemployment rates in these economies. Diminished business opportunities, particularly for small and medium-sized enterprises, also further constrain income prospects.

Beyond the North African region, several other major tourist destinations in Africa are also facing rising headwinds. The recent introduction of a tax on tourism services in the United Republic of Tanzania poses a risk to the industry?s competitiveness. For Kenya and South Africa, ongoing political uncertainty may weigh on tourism growth.

Developing East Asia: producer prices show signs of recovery across the region

Developing East Asia is showing signs of emerging from the two-year stretch of producer price deflation. While producer prices in most of the region continue to contract, the pace of decline moderated in most countries in the first half of 2016. The broad-based improvement in producer prices can be attributed to some recovery in commodity prices, and China?s producer prices, which has experienced producer-price deflation for the last 53 months?the longest span since 1996 when data became available. There is a significant correlation between China?s producer prices and the rest of the region that has been rising since early 2000s, reflecting intricate production linkages through the global value chain.

The easing of producer price deflation is encouraging, given its positive implications for corporate profits and investment incentives. It should also boost employment and wages, benefitting consumer demand. However, there are downside risks to producer price developments, particularly given uncertainties of commodity prices and China?s progress in addressing industrial overcapacity.

South Asia: slower growth in India

India?s GDP growth moderated to 7.1 per cent in the second quar?ter of 2016, its slowest pace in more than a year. The slower-than-expected expansion in economic activity was attributed to a contraction in gross fixed capital formation by 3.1 per cent and slower growth in private consumption, which expanded by 7.0 per cent. Subdued private investment activity may prompt the Reserve Bank of India to further reduce interest rates later this year. However, additional monetary easing can be expected to have only a limited impact on investment activity. Structural factors, such as banking fragilities and weak corporate balance sheets, will continue to constrain investment demand. The recovery of private investment remains crucial for the Indian economy in boosting its medium-term growth prospects.

Despite the moderation in quarterly growth, India remains one of the fastest-growing emerging economies and prospects for the second half of 2016 remain largely positive. In particular, private consumption is expected to regain momentum. Prospects for rural income and the agriculture sector are favourable due to monsoon rains. In addition, more than 10 million federal government employees and pensioners will benefit from a rise in salaries and benefits resulting in a $13 billion payout in the coming months.

Western Asia: Lebanon faces challenging economic conditions

Lebanon?s growth prospects have deteriorated visibly in recent months. Economic activity is being adversely affected by spillovers from regional conflicts, significant political turmoil and domestic security challenges. In particular, the conflicts in the Syrian Arab Republic and Republic of Iraq have significantly impacted investment, consumption and international trade flows. Preliminary data for the first half of 2016 showed that merchandise exports declined by about 11 per cent on an annual basis, as exports confront increasing transportation and insurance costs. The rising trade deficit, alongside declining capital inflows, particularly foreign direct investment, has led to a worsening of the country?s external position. Meanwhile, the challenging political situation, with no clear plans for presidency and parliamentary elections, is also impairing the implementation of reforms. The fiscal position remains fragile, amid high debt servicing requirements and a relatively low tax base. Against this backdrop, the Lebanese economy is expected to decelerate further in 2016, after posting an estimated modest GDP growth of 1.4 per cent in 2015.

Latin America and the Caribbean: Chile and Mexico register weak growth in the second quarter

Recent data underscore the ongoing economic weakness across Latin America. While GDP in Argentina, Brazil and Venezuela (Bolivarian Republic of) continues to contract, other large economies also face considerable headwinds. In the second quarter of 2016, both the Chilean and the Mexican economies contracted from the previous three months in seasonally-adjusted terms. On an annual basis, Chile?s growth slowed to 1.5 per cent, amid a significant drop in mining output. Weak consumer and business confidence, rising unemployment and persistently low copper prices continued to weigh on domestic demand in Chile. The unemployment rate rose to 6.9 per cent in June, the highest level since November 2011. Private investment also remained weak, with the ratio of real gross fixed capital formation to GDP falling to a multi-year low of 23.1 per cent. Mexico?s GDP grew by 2.5 per cent in the second quarter. Growth, however, was constrained by low oil prices and weak industrial production in the United States. Macroeconomic conditions remain stable in Mexico, with consumer price inflation at 2.6 per cent and unemployment at 4.0 per cent. However, labour productivity, both in the manufacturing sector and in commerce, has stagnated over the past few years.

Welcome to the United Nations

Welcome to the United Nations