Download the World Economic Situation and Prospects Monthly Briefing No. 78

May 2015 Summary

- U.S. dollar softens against a wide range of currencies

- East Asian exports weaker than expected during the first quarter

- Labour market in Brazil starts to deteriorate, after several years of falling unemployment rates

Global issues

U.S. dollar exchange rate softens against many currencies

After about one year of continuous strong appreciation, the U.S. dollar has experienced a noticeable depreciation since mid-March 2015. Over the span of the seven weeks until the end of April, it depreciated by about 3 per cent.1 Out of a basket of 48 currencies, the U.S. dollar depreciated against 34 currencies, and significantly in some cases. For example, the Russian ruble gained 17.3 per cent against the U.S. dollar, the Colombian peso 11.3 per cent, and the Norwegian krone 8.8 per cent. On the other hand, the U.S. dollar further appreciated against a few currencies, like the Turkish lira (1.7 per cent), the Argentinian peso (1.4 per cent), and the Peruvian sol (1.1 per cent).

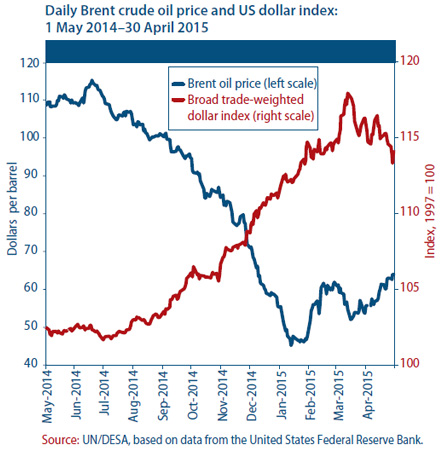

The recent depreciation of the U.S. dollar can be explained by the expectation that the United States Federal Reserve may postpone the timing to raise its policy rate. This perception was also reinforced by the weak economic performance during the first quarter of 2015. The depreciation is also coincident with the firming up of international crude oil prices since mid-March. The Brent oil price, for instance, has increased from $52 per barrel on 15 March to $63.9 per barrel on 30 April. Although the causal relationship is difficult to determine, the U.S. dollar and oil prices tend to be negatively correlated. That was observed, for instance, between mid-2014 to early 2015 (see figure 1), when oil prices trended down and the U.S. dollar appreciated strongly.

Employment gap difficult to close

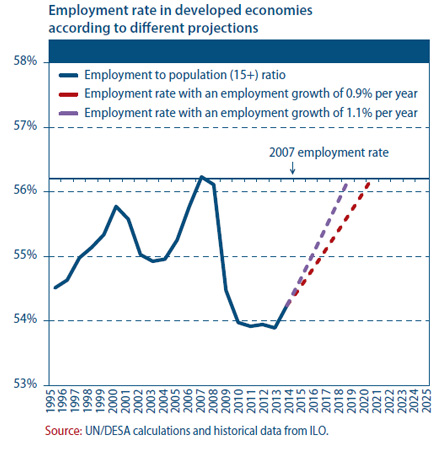

So far, developed economies have not expanded fast enough to recover the jobs lost during the Great Recession. Although unemployment rates may have trended down, from historically high levels, the number of persons actively searching for a job is also much lower. Thus, given lower labour force participation, the unemployment rate cannot accurately assess labour market improvements. A complementary indicator is the employment rate, given by the employment-to-population ratio.

The employment rate for developed economies?measured here as the share of the population aged 15 and older that is employed?was 54.2 per cent in 2014, two percentage points below its pre-crisis level of 2007 (see figure 2). There are long-term and cyclical factors explaining this gap. Retirement in the baby boom generation has introduced a long-term demographic factor to the employment picture, leading to an acceleration in the numberof retirees per active worker. But even taking into account that long-term factor, the negative impact of the Great Recession on employment growth and on the abrupt fall of the employment rate is undeniable, as shown in figure 2. The employment rate decreased from 56.2 per cent in 2007 to 54.0 per cent in 2010.

If the goal is to return to the pre-crisis employment rate,2 at the current pace of employment growth (0.9 per cent observed in 2014), and taking into consideration population growth, it wouldtake six more years, until 2021, to reach that rate. In case employment growth accelerates rapidly to the same rate observed prior to the crisis?1.1 per cent per year?the pre-crisis employment rate could be reached in four years, by 2019 (see figure 2). This is unlikely, however, as according to Global Economic Monitoring Unit's economic forecast, the employment growth rate is not expected to accelerate in 2015 and 2016 for developed economies as a whole.

\

Developed economies

North America: setback in U.S. economy

In the United States of America, economic growth decelerated in the first quarter of 2015, as it did 2014. The first estimate from the Bureau of Economic Analysis showed that gross domestic product (GDP) expanded from the previous quarter at an annualized rate of 0.2 per cent only. This slowdown was mainly caused by the rapid decline in the fixed investment in structures and the export of goods. The former decreased by more than 23 per cent from the previous quarter, which may be explained by the severe winter weather and reduced digging activity for oil and gas wells. The latter decreased by more than 13 per cent, due to the wide-range appreciation of the U.S. dollar, which began in mid-2014, and to the disruption of the Western Coast port operation during the first two months of 2015. Growth in private consumption also slowed down to 1.9 per cent from 4.4 per cent in the previous quarter. The purchasing power gained from a lower gasoline price did not have a positive impact on other consumption categories; households chose to hoard those windfalls, pushing the saving rate to the highest level since 2012.

Developed Asia: longer horizon for inflation target for Japan

Two years after introducing a quantitative and qualitative monetary easing policy, the Bank of Japan has now pushed back the date for reaching the 2 per cent inflation target from "in and around" fiscal year 2015 (i.e., April 2015 to March 2016) to the first half of fiscal year 2016. Recent data shows that year-over-year headline inflation in the Tokyo area declined to 0.8 percent in April from 2.3 per cent in March; a similar pattern also prevails for core inflation. The base effect is expected to generate the same type of deceleration in the national inflation measurement for April, to be released by the end of May.

After the rapid drop in February, industrial production and export volume basically remain flat in March. However, import volume dropped by more than 10 per cent in March alone, reaching the lowest level since January 2013. Weak growth in production activity also caused employment to decline by 0.2 per cent. Nevertheless, a lower labour participation ratio was enough to drive the unemployment rate down to 3.4 per cent in March. Labour market conditions have not been able to drive up the wage rate; in March, average cash earnings for workers increased by only 0.1 per cent from one year ago.

On 4 May, the Reserve Bank of Australia (RBA) lowered its policy rate by 25 basis points to 2.0 per cent, the lowest level on record. The RBA easing policy is expected to "reinforce recent encouraging trends in household demand".

Western Europe: a change of fiscal stance in Western Europe?

The aggregate government deficit of the European Union (EU) fell below 3 per cent of GDP last year for the first time since 2008, having reached 7 per cent of GDP at the height of the financial crisis. The sharp correction in the deficit reflects stringent austerity programmes introduced across the EU, especially in those euro area countries forced to resort to bail-out programmes when the crisis over European sovereign debt erupted in 2010.

The crisis in Greece remains ongoing amid tense negotiations between the Greek Government and the Eurogroup over conditions attached to further financial assistance, which is essential to ensuring that Greece can meet debt obligations over the next few months. However, Ireland, Portugal and Spain have all successfully exited their financial assistance programmes. While they remain subject to Excessive Deficit Procedures along with eight other EU countries, the pressure to consolidate in most countries has eased significantly. The Irish economy expanded by 4.8 per cent last year, making it the fastest growing EU economy. As strong growth boosts tax revenues, the Government is considering expansionary budgets beginning in 2016, reversing some of the austerity measures imposed to comply with bail-out conditions. This is one of the first signs of a change in fiscal policy stance in the EU.

The new EU members: small interest-rate cut in Hungary

Available data for the first quarter of 2015 show sustained positive trends in the new EU member States. Industrial output continues to expand, retail sales are strengthening and unemployment rates remain on a downward trend. Business and consumer confidence are strong, especially in Central Europe. Growth in the first quarter, however, was moderate in Latvia, at 2.1 per cent.

Improvements in labour markets were notable in the Czech Republic, where the March unemployment rate declined by 1.1 percentage points compared to the previous year, to around 7 per cent. In Croatia, which has the highest unemployment in the region, the rate fell to a three-year low of 18.3 per cent in February.

The Hungarian National Bank continued its interest-rate cutting cycle in April, reducing its key policy rate by 15 basis points to another record low of 1.8 per cent. The economy had experienced another month of deflation in March, with prices declining by 0.6 per cent on an annual basis. Despite higher fuel costs, which contributed to a moderation in deflation, and more vibrant domestic demand, inflation in the region is expected to remain subdued in the near term, due to a second round of weaker commodity prices.

Economies in transition

CIS: further relaxation of monetary policy in the Russian Federation

According to preliminary estimates, the economy of the Russian Federation contracted by 2 per cent in the first quarter; this is a more moderate decline than had been expected. Inflation reached 16.9 per cent in March and possibly passed its peak. In April, the rouble recovered quite remarkably from its precipitous fall in the early months of 2015, thanks to strengthening oil prices, moderation in capital outflows and the lighter external debt repayments schedule. Against this background, in late April, the central bank cut its policy rate for the third time in 2015, by 150 basis points to 12.5 per cent. In Ukraine, the economy was severely hit by the continuing military tension in its eastern region, fiscal tightening required by the IMF agreement, and low prices for the key export commodities. Industrial output plunged by 21.4 per cent in the first quarter; inflation reached an alarming 45.8 per cent in March. In early April, domestic natural gas tariffs were raised fourfold, which will further add to inflationary pressures. Restructuring external debt of the country remains the key to receiving significant levels of financial support. The economy of Belarus, strongly exposed to the economies of the Russian Federation and Ukraine, contracted by 2 per cent in the first quarter. The smaller Commonwealth of Independent States (CIS) economies are also affected by the weaker economy of the Russian Federation, especially the sectors that attract migrant labour, such as construction. In Armenia, the dollar value of remittances was 50 per cent lower in February. In contrast to most of the CIS, the economy of Turkmenistan grew by 10.3 per cent in the first quarter, as public expenditure remains strong.

South-Eastern Europe: GDP shrinks in Serbia

In Serbia, GDP shrank in the first quarter by 1.9 per cent, while inflation accelerated to 1.9 per cent in March. This level of inflation is still below the target tolerance band, and the National Bank of Serbia cut its policy rate in mid-April by 50 basis points to 7 per cent.

Deflation continued in March in parts of the region, but at a slower pace; in the former Yugoslav Republic of Macedonia prices declined by 0.3 per cent on an annual basis. Since most of the region's currencies are formally or informally pegged to the euro, the strengthening of the U.S. dollar since late 2014, in which some imports are denominated, will ease deflationary pressures.

Developing economies

Africa: agriculture is propelling growth in Uganda and Morocco

Uganda's GDP grew by 4 per cent in the fourth quarter of 2014, up from 2.3 per cent in the same period the previous year, driven by expansion in the agricultural sector. Core inflation also rose in Uganda from 3.3 per cent in February to 3.7 per cent in March, leading the central bank to raise its benchmark lending rate from 11 to 12 per cent. The central bank expects inflation to continue rising, to almost 8 per cent by mid-2016, driven by currency depreciation and real output growth above potential.

In Morocco, first-quarter GDP growth rose to 4.4 per cent, a significant jump from only 1.8 per cent growth in the fourth quarter of 2014. Agriculture was a key driver of growth here as well, with above average rainfall contributing to a 12.3 per cent expansion in agricultural output. The relatively robust figure is partly a function of lower growth last year, which saw considerably lower rainfall and output.

In South Africa, sectoral data for February suggest a strong economic performance. Retail sales expanded by 4.2 per cent, the biggest increase in more than a year, underpinned by lower inflation and no major labour strikes so far this year. Similarly, mining showed a strong performance with an expansion by 7.5 per cent, although this is partly due to the recovery from the negative impact of big strikes last year. By contrast, the manufacturing sector contracted slightly in February at a rate of 0.5 per cent in view of continued electricity shortages.

East Asia: exports weaker than expected across the region

The economy of Republic of Korea grew by 2.4 per cent in the first quarter, largely driven by investment and government spending. Export of goods contracted by 1.2 per cent. The underperforming export sector is a common trend in the region, where many monitored economies recorded weaker-than-expected export data (in nominal value terms) in the first quarter of 2015. This can be principally attributed to weaker demand from China and lower commodity prices. Relatively strong exchange rates in tradeweighted terms may have also dampened exports for some economies. Among economies with monthly data available, only China, Hong Kong Special Administrative Region of China, and Viet Nam experienced growth for merchandise exports over the first 2 months of 2015, driven by the electronics sector.

China registered a 7 per cent GDP growth in the first quarter. The financial sector witnessed the fastest growth at 15.9 per cent, while the property sector grew at the slowest pace at 2.0 per cent. This development reflects the bullish run of the Chinese stock market since late 2014, with the Shanghai Stock Exchange Composite Index almost doubling during the 6 months up to the end of April 2015?the sharpest surge in 5 years. The housing market continues its struggle, as official statistics show that new house prices in 50 of the 70 surveyed cities experienced month-onmonth declines in March. Prices should receive support from recent government measures introduced to prop up the market, but strong stock market performance continues to drive speculative capital away and weighs down on property prices.

South Asia: earthquake in Nepal devastates the domestic economy

The massive earthquake that hit Nepal in late April has had a devastating impact on the domestic economy. Transport and energy infrastructure are likely to have suffered severe damages, potentially holding back economic activity for an extended period of time. The tourism sector, which contributes significantly to GDP and employment, is expected to take a short-term hit. The medium-term economic impact will, to a large extent, depend on the capacity to effectively manage the incoming aid flows and implement the reconstruction program.

China and Pakistan agreed to further expand and strengthen their economic ties, signing 51 agreements and memorandums of understanding in April. At the center of the cooperation is the China-Pakistan Economic Corridor (CPEC), which is expected to create a network of roads, railways and oil and gas pipelines linking the two countries. The total value of the mega-project is estimated at $46 billion. The corridor would give China access to the Indian Ocean, providing it with a shorter and cheaper route for trade with South Asia, Western Asia and Africa. Pakistan's economy is expected to benefit from the project in multiple ways: In the short run, China's investment in transport and energy infrastructure in Pakistan is expected to boost growth and create more employment opportunities. In the longer run, it is expected to help curb the energy crisis and make the country a regional trade hub.

Western Asia: Jordanian economic expansion accelerated in 2014, amid regional instability

In Jordan, the Department of Statistics published fourth-quarter and annual GDP data for 2014, showing that the economy expanded by 3.7 per cent in the fourth quarter of 2014 and 3.1 per cent for the whole year of 2014. This is an improvement, compared with 2013, but it is still below the longer-term historical GDP growth average, which was above 6 per cent between 2000 and 2010. Mining and quarrying, and to a lesser extent agriculture, forestry and fishing, were the main drivers of GDP growth in 2014. In Bahrain, GDP grew 4 per cent in the final quarter of 2014, bringing the overall GDP growth for 2014 to 4.5 per cent. The main contributors to growth in 2014 were oil and gas, manufacturing and finance, followed closely by construction. Oman is expected to benefit from a Saudi grant totalling US$ 181.2m, to finance two structural projects in the fishing sector. Given the decline in oil prices and the limited fiscal space, this is good news for the Omani Government. This is part of an aid package pledged in 2011 by other GCC members. According to data published by the Central Bureau of Statistics on April 21st, Israel posted a trade deficit of US$ 705m in the first quarter of 2015, less than onethird of the deficit recorded in the first quarter of 2014. The narrowing trade deficit was driven by the sharp decline in import costs, which fell by 14.7 per cent in the first quarter. This highlights the strongly positive net impact for Israel of the recent collapse in oil prices and the sharp falls in other commodity prices.

Latin America and the Caribbean: Brazilian labour market affected by economic slump

In recent years, the Brazilian economy slowed down noticeably, but at the same time reached record lows on unemployment rates. This apparent paradox was commonly explained by an ageing workforce and an increase in the number of retirees. However, the worsening economic situation has recently started to have visible effects on labour market indicators, amid tighter monetary and fiscal conditions. In March, the unemployment rate was 6.2 per cent, 0.3 percentage points higher than the previous month and 1.2 percentage points higher than a year ago. This trend is explained by a combination of faster labour force growth and a decline in employment, particularly in the formal sector. As a result, the employment rate decreased to 52.1 per cent in March 2015, from 53.0 per cent in March 2014. For example, there has been a substantial rise in layoffs in the construction sector, which has been rattled by corruption problems in the large semi-public company Petrobras. In the industrial sector, the number of salaried employees declined by 0.5 per cent in February, in comparison to the previous month, leading to an annual decline of 4.5 per cent. Meanwhile, wages are also showing signs of serious weaknesses. In February, workers' real earnings decreased by 2.8 per cent on average, the largest fall in a decade. This lead to a 3.0 per cent fall, partly reflecting recent inflation rises. The gradual deterioration of the Brazilian labour market indicators is expected to continue throughout 2015.

Welcome to the United Nations

Welcome to the United Nations