Following the unprecedented changes in the trade policy of the United States, LDCs must contend simultaneously with significantly higher bilateral tariffs, policy uncertainty, lower growth prospects in many importing countries, a potential re-alignment of supply chains, and a disruption to the existing

multilateral order.

Monthly Briefing on the World Economic Situation and Prospects

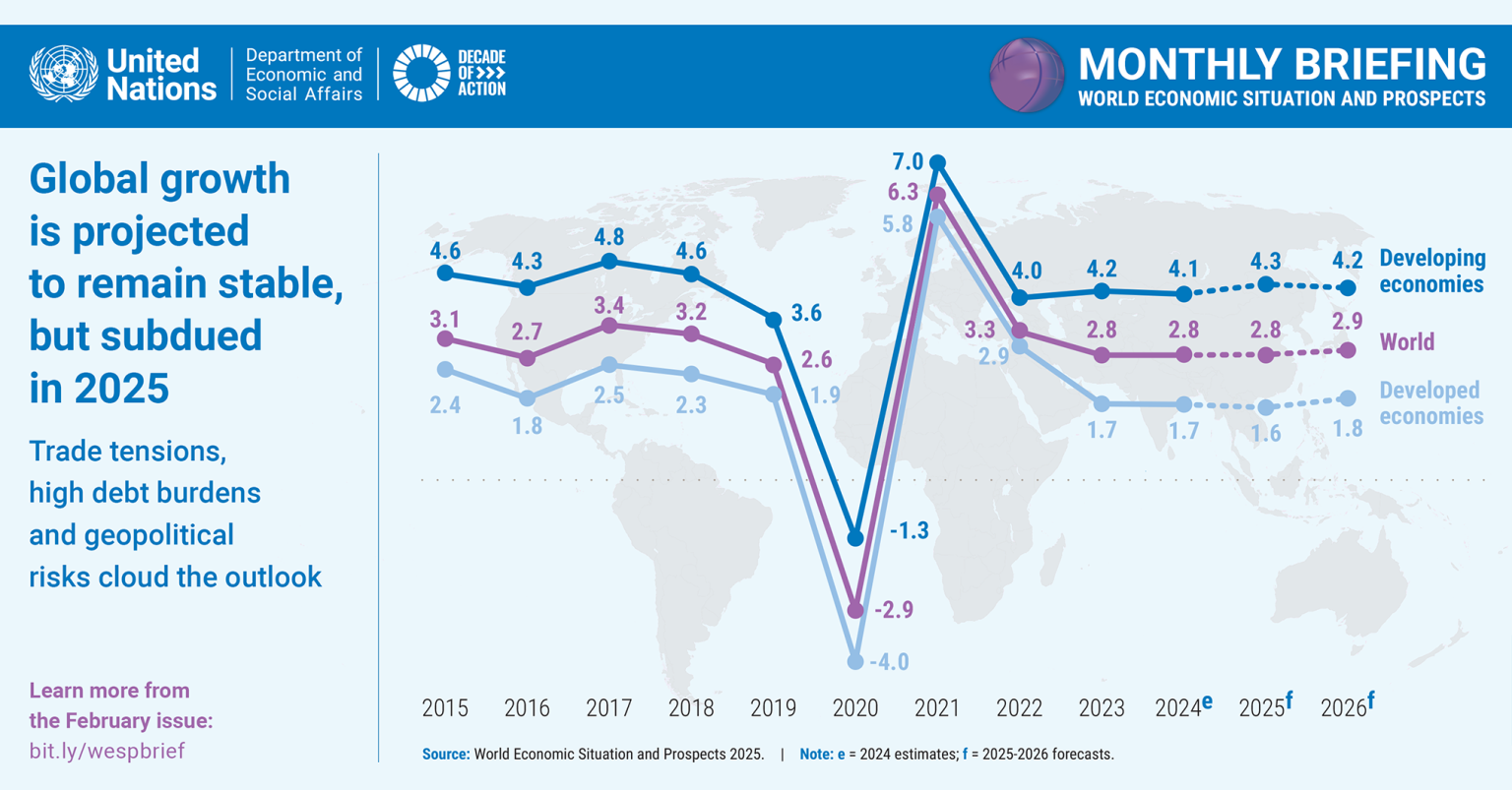

The global economic outlook as of mid-2025 has deteriorated notably, according to the latest World Economic Situation and Prospects (WESP) update. Global growth is now forecast to slow to 2.4 per cent in 2025, down from 2.9 per cent in 2024 and 0.4 percentage points below the January forecast.

Geopolitical fragmentation, trade barriers, and climate change portend recurrent supply-side shocks, fuelling unpredictable inflationary pressures. These disruptions are increasing uncertainty and volatility, which complicate investment decisions and economic policymaking.

The near-term global trade outlook is fraught with uncertainties amid new tariffs and other trade restrictions. While recent history demonstrates that the global trading system is resilient, often adapting by finding alternative channels for sustaining commerce, policy uncertainty could hinder this process by discouraging necessary investments.

The world economy has shown resilience despite multiple shocks, but the outlook remains uncertain due to ongoing conflicts, geopolitical and trade tensions, climate risks, and mounting fiscal pressures.

Economic growth in landlocked developing countries (LLDCs) is expected to be steady in the near term but remains well below the average in the pre-pandemic decade. Substantial downside risks remain, including commodity price volatility, debt challenges, climate disasters and geopolitical tensions.

Climate change has emerged as a source of supply shocks and a key risk to the global economy. While localized supply shocks may have a limited impact, multiple severe events – such as those associated with climate change- can push inflation up.

The majority of central banks kept their policy rates unchanged in the first quarter of 2024, closely watching the decisions of the United States Federal Reserve and the European Central Bank.

Industrial and innovation policies are gaining additional traction, becoming crucial aspects of many governments? toolkits to support innovation, build resilience, and accelerate the green energy transition. There are, however, enormous disparities across economies in their capacity to implement industrial policies, particularly those to support science, technology and innovation.

Welcome to the United Nations

Welcome to the United Nations