Publications

Displaying 1 - 10 of 33

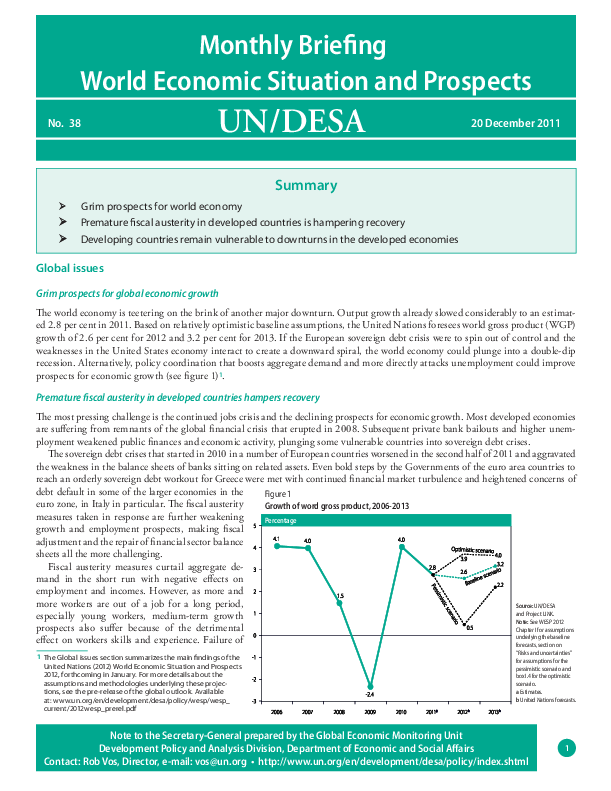

Summary: Grim prospects for world economy

Premature fiscal austerity in developed countries is hampering recovery

Developing countries remain vulnerable to downturns in the developed economie

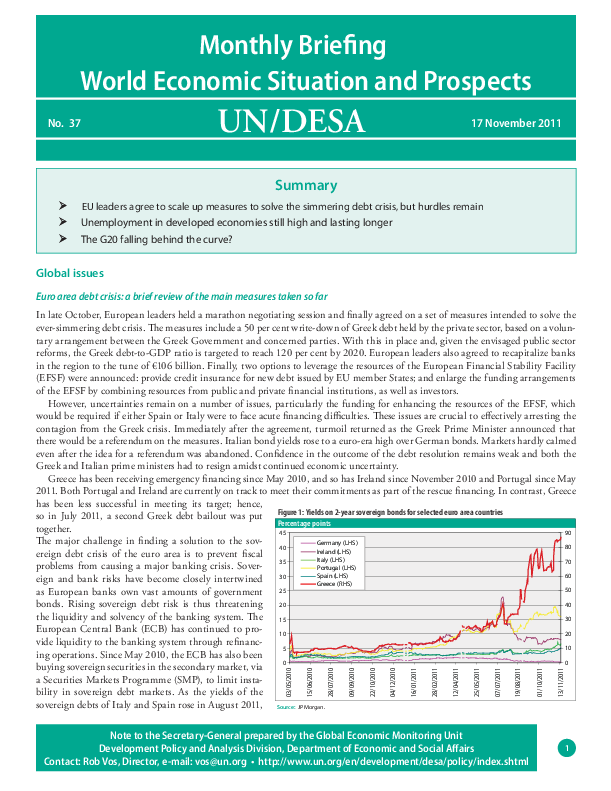

Summary: EU leaders agree to scale up measures to solve the simmering debt crisis, but hurdles remain

Unemployment in developed economies still high and lasting longer

Is the G20 fallin

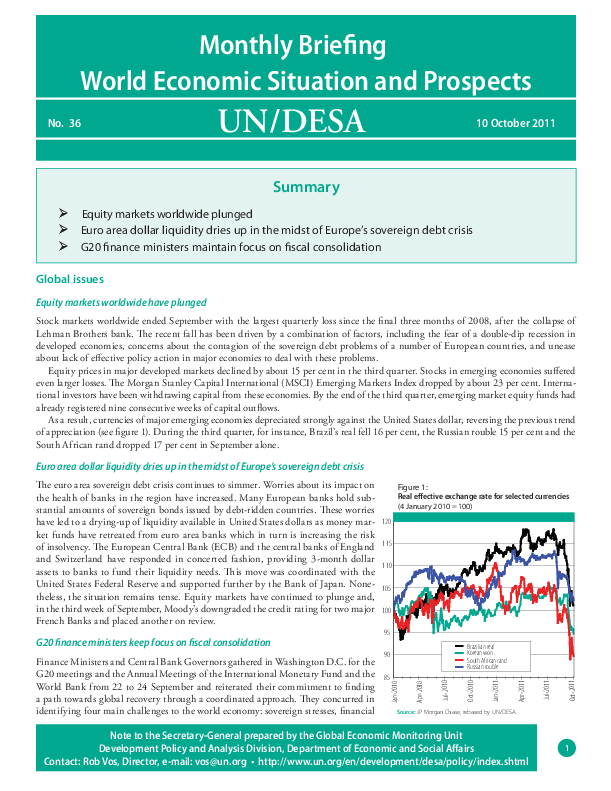

Summary: Equity markets worldwide plunged

Euro area dollar liquidity dries up in the midst of Europe?s sovereign debt crisis

G20 finance ministers maintain focus on fiscal consolidation

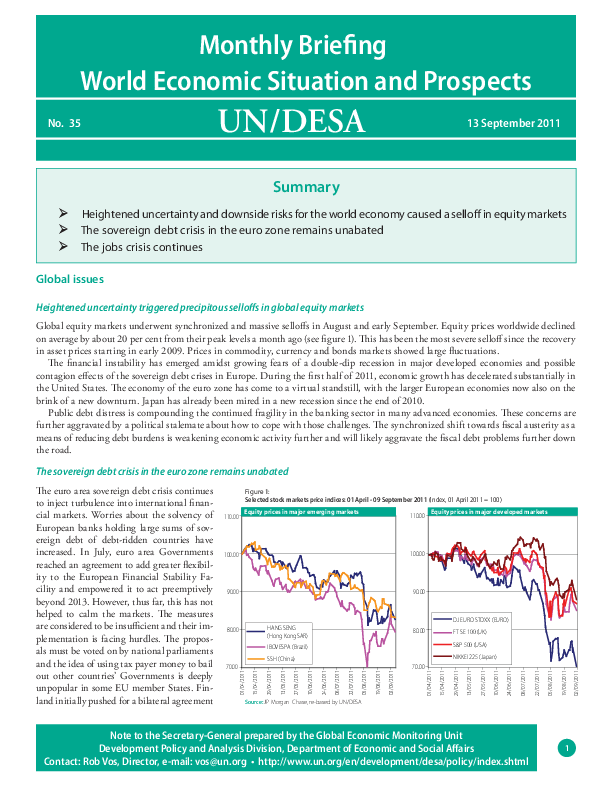

Summary: Heightened uncertainty and downside risks for the world economy caused a sell-off in equity markets

The sovereign debt crisis in the euro zone remains unabated

The jobs crisis

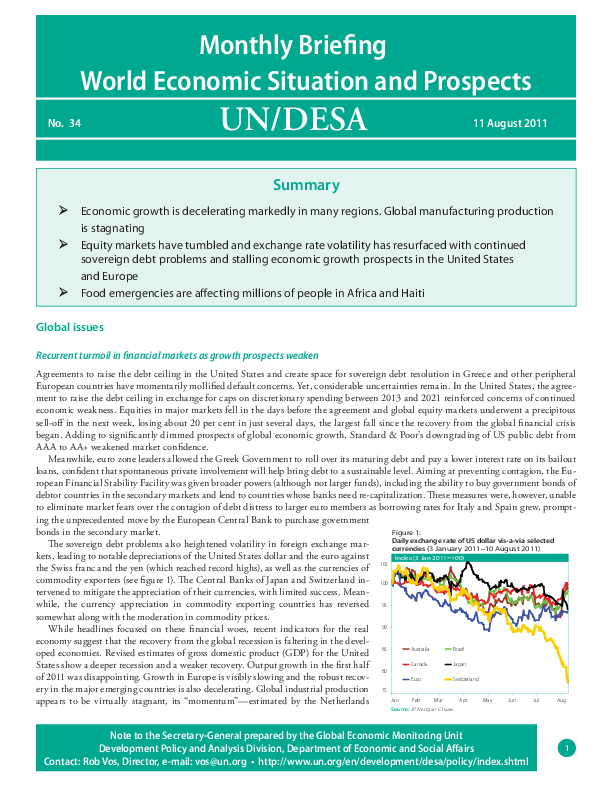

Summary: Economic growth is decelerating markedly in many regions; global manufacturing production?is stagnating

Equity markets have tumbled and exchange rate volatility has resurfaced with contin

Welcome to the United Nations

Welcome to the United Nations