Publications

Displaying 1 - 10 of 54

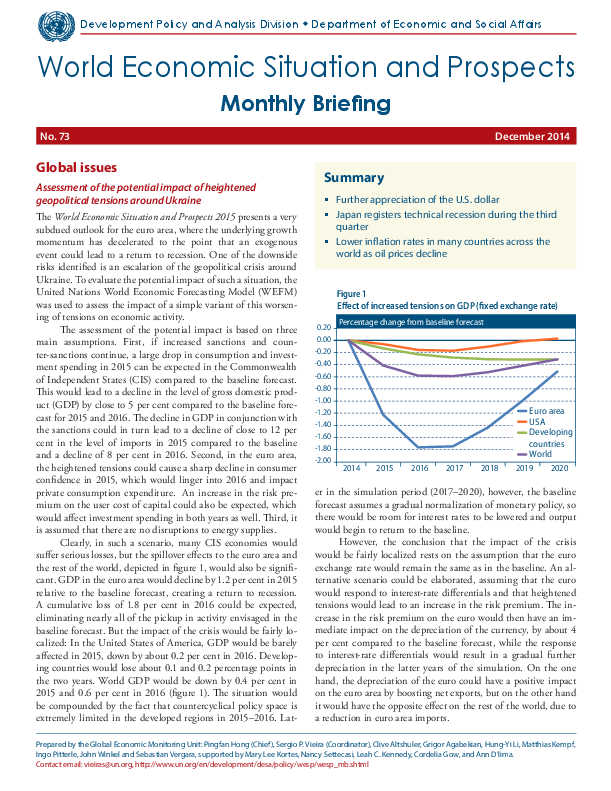

December 2014 Summary ?? Further appreciation of the U.S. dollar

Japan registers technical recession during the third quarter

Lower

Low inflation in Europe remains a concern

Diverging monetary policies in developed economies

Western European economy continues to struggle

Ebola takes severe tolls in West Africa

Report on the sixteenth session of the Committee for Development Policy, 24-28 March, 2014 (E/2014/33, Supplement No. 13)

Welcome to the United Nations

Welcome to the United Nations