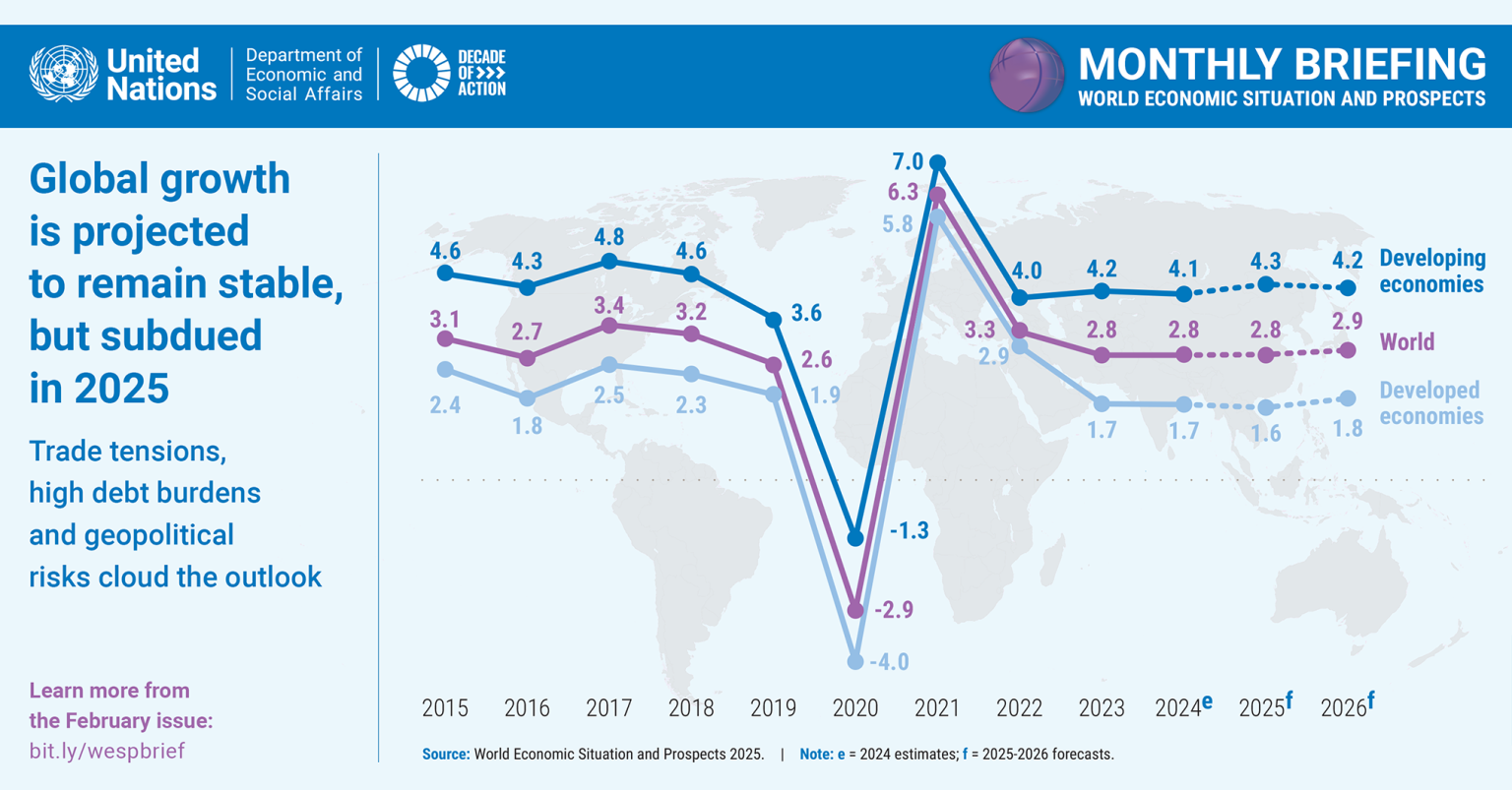

The world economy has shown resilience despite multiple shocks, but the outlook remains uncertain due to ongoing conflicts, geopolitical and trade tensions, climate risks, and mounting fiscal pressures.

Monthly Briefing on the World Economic Situation and Prospects

Economic growth in landlocked developing countries (LLDCs) is expected to be steady in the near term but remains well below the average in the pre-pandemic decade. Substantial downside risks remain, including commodity price volatility, debt challenges, climate disasters and geopolitical tensions.

The global automotive market is experiencing transformative shifts, with China emerging as a leading force in electric vehicle (EV) production and exports. In contrast, traditional powerhouses like Germany, Japan, the Republic of Korea, and the United States are facing stiff competitiveness challenges.

After seeing near-zero interest rates in major economies in the aftermath of COVID-19, the world economy has experienced rapid monetary tightening since early-2022 (UNDESA, 2024a). Persistent inflationary pressures during the second half of 2021 due to stronger-than-expected recovery in demand, and supply shortages brought along the most aggressive monetary tightening in decades.

On 1 May 2004, eight countries from Eastern Europe – the Czech Republic, Estonia, Hungary, Latvia, Lithuania, Poland, Slovakia and Slovenia – the group often referred to as EU-8, along with Cyprus and Malta, became full-fledged members of the European Union (EU). This event is often called the “Big Bang” enlargement of the EU, with the set of pre-existing members being referred to as the EU-15.

Climate change has emerged as a source of supply shocks and a key risk to the global economy. While localized supply shocks may have a limited impact, multiple severe events – such as those associated with climate change- can push inflation up.

The majority of central banks kept their policy rates unchanged in the first quarter of 2024, closely watching the decisions of the United States Federal Reserve and the European Central Bank.

Industrial and innovation policies are gaining additional traction, becoming crucial aspects of many governments? toolkits to support innovation, build resilience, and accelerate the green energy transition. There are, however, enormous disparities across economies in their capacity to implement industrial policies, particularly those to support science, technology and innovation.

Despite persistent monetary tightening by major central banks, labour market conditions in most developed economies remained robust in 2023. Low unemployment and high economic activity are accompanied with continuing, albeit moderating, labour shortages.

Welcome to the United Nations

Welcome to the United Nations