Publications

Displaying 1 - 10 of 296

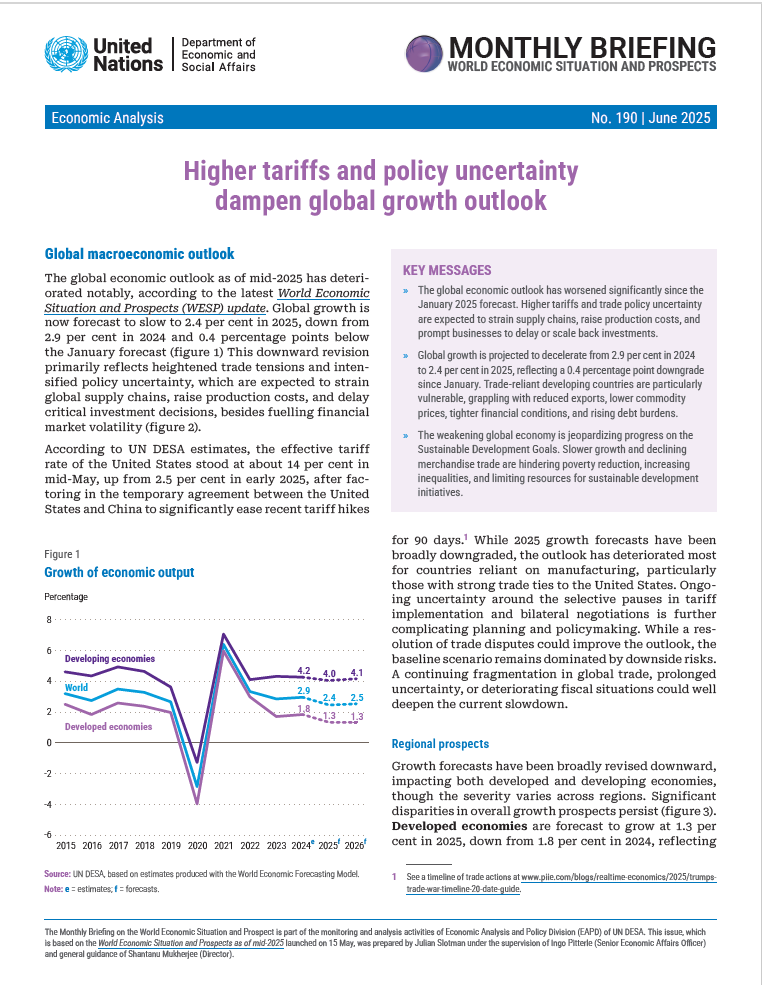

Global macroeconomic outlook The global economic outlook as of mid-2025 has deteriorated notably, according to the latest World Economic Situation and Prospects (WESP) update. Global growth is now forecast to slow to 2.4 per cent in 2025, down from 2.9 per cent in 2024 and 0.4 percentage points below the January forecast (figure 1) This downward revision primarily reflects heightened trade tensions and intensified policy uncertainty, which are expected to strain global supply chains, raise production costs, and delay critical investment decisions, besides fuelling financial market volatility (figure 2). According to UN DESA estimates, the effective tariff rate of the United…

Two decades of Eastern Europe’s membership in the EU On 1 May 2004, eight countries from Eastern Europe – the Czech Republic, Estonia, Hungary, Latvia, Lithuania, Poland, Slovakia and Slovenia – the group often referred to as EU-8, along with Cyprus and Malta, became full-fledged members of the European Union (EU). This event is often called the “Big Bang” enlargement of the EU, with the set of pre-existing members being referred to as the EU-15. To be admitted to the EU, these eight Eastern European countries introduced widespread structural changes, aligned their domestic institutions with the EU’s common market rules and regulations, adopted EU’s acquis communautaire and reoriented…

Welcome to the United Nations

Welcome to the United Nations