Publications

Displaying 361 - 370 of 1089

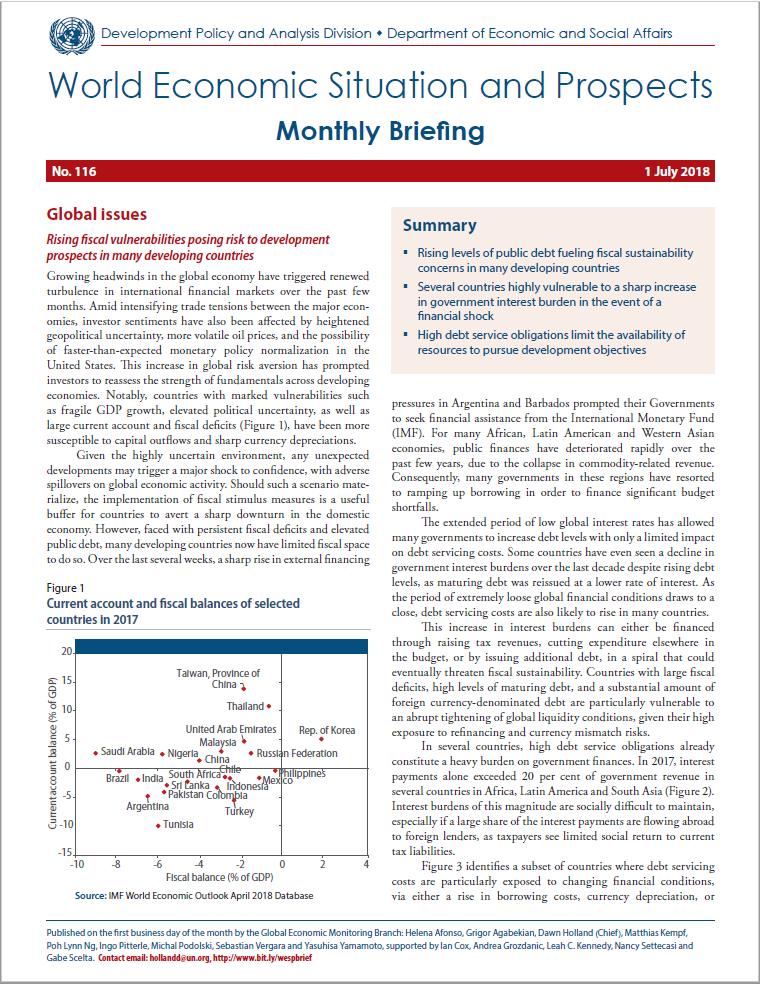

Several countries highly vulnerable to a sharp increase in government interest burden in the event of a financial shock

High debt service obligations limit the availability of resources to pursue development objectives

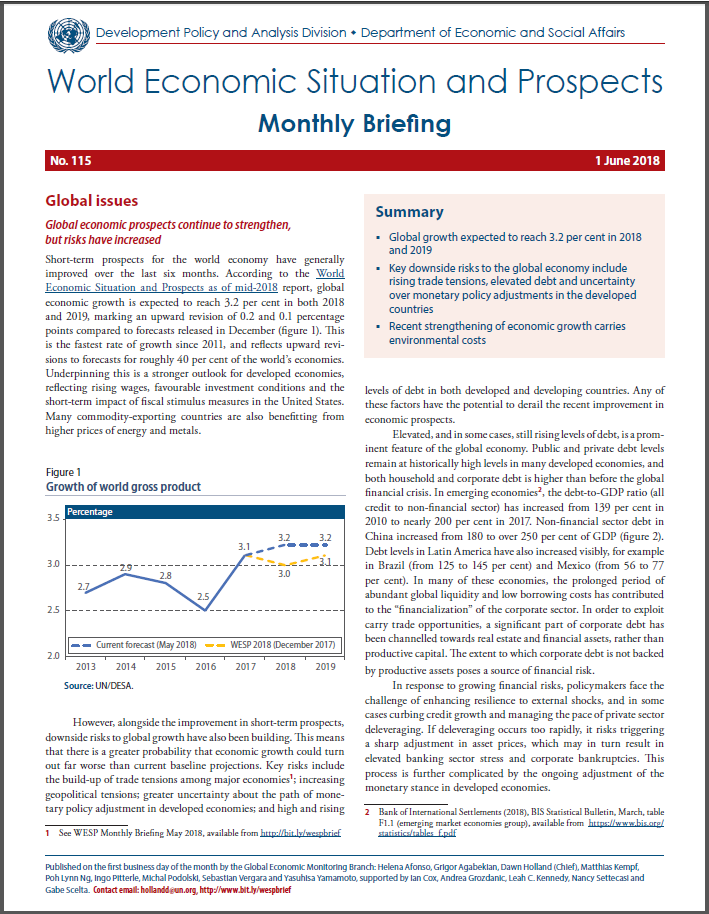

Key downside risks to the global economy include rising trade tensions, elevated debt and uncertainty over monetary policy adjustments in the developed countries

Recent strengthening of economic growth carries environmental costs

Welcome to the United Nations

Welcome to the United Nations