Publications

Displaying 101 - 110 of 195

United States household incomes rise sharply in 2015

The Nigerian economy contracts at a faster pace amid significant macroeconomic challenges

Services trade as a potential source of global growth

Growth moderation in India amid a contraction of investment activity

? The weak global economy restrains remittance flows

? China?s GDP growth stabilizes

?

Prolonged weak global growth poses a challenge to sustainable development

India further liberalizes its FDI regime

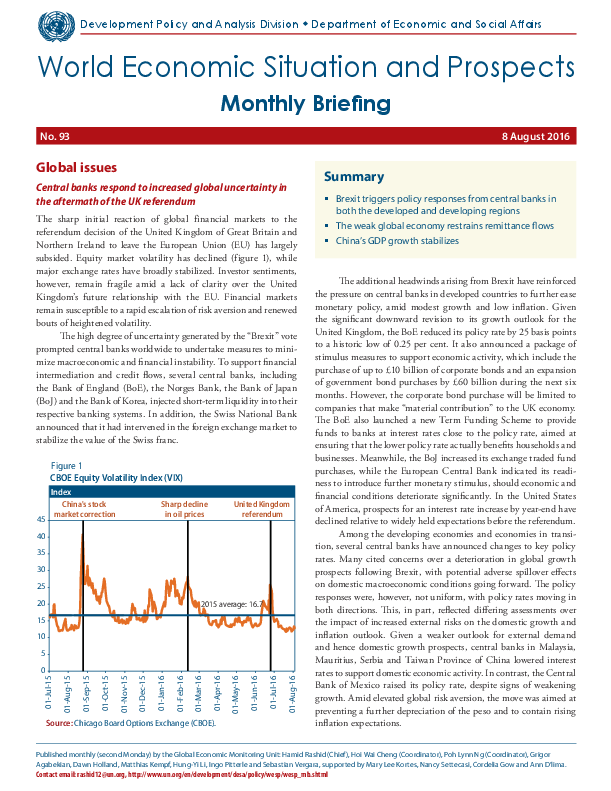

Forthcoming referendum on EU membership has increased financial market volatility in the United Kingdom

Ongoing fiscal adjustment in Africa, the CIS, Latin America and Western Asia continues to constrain prospects

Deflationary trends remain a concern in euro area and Japan

GDP growth in China in line with government target, but United States and Republic of Korea fall short of expectations

Further improvement in labour market conditions in Europe and the United States

Monetary stance eases in the CIS but tightens in Africa

EU-wide strategy to address refugee crisis remains elusive

Drought leads to a spike in food prices in Africa and Latin America

China emphasized the need to improve productivity through policies on the supply side of the economy

Bank of Japan adopts a negative interest rate

IMF includes Chinese renminbi in the SDR basket

Monetary tightening in Western Asia and Latin America in response to Fed's first rate hike in seven years

Welcome to the United Nations

Welcome to the United Nations